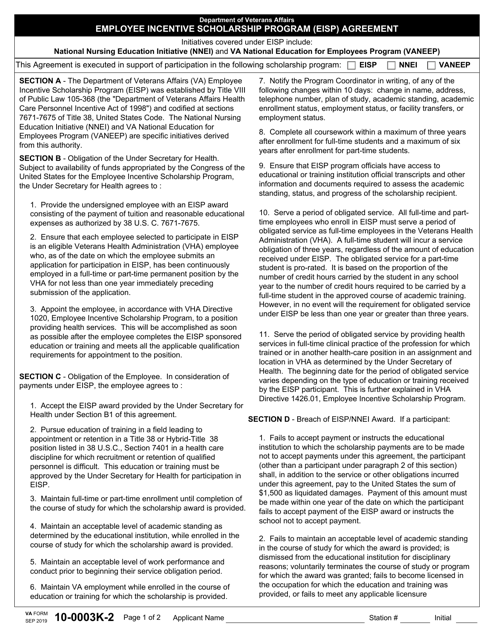

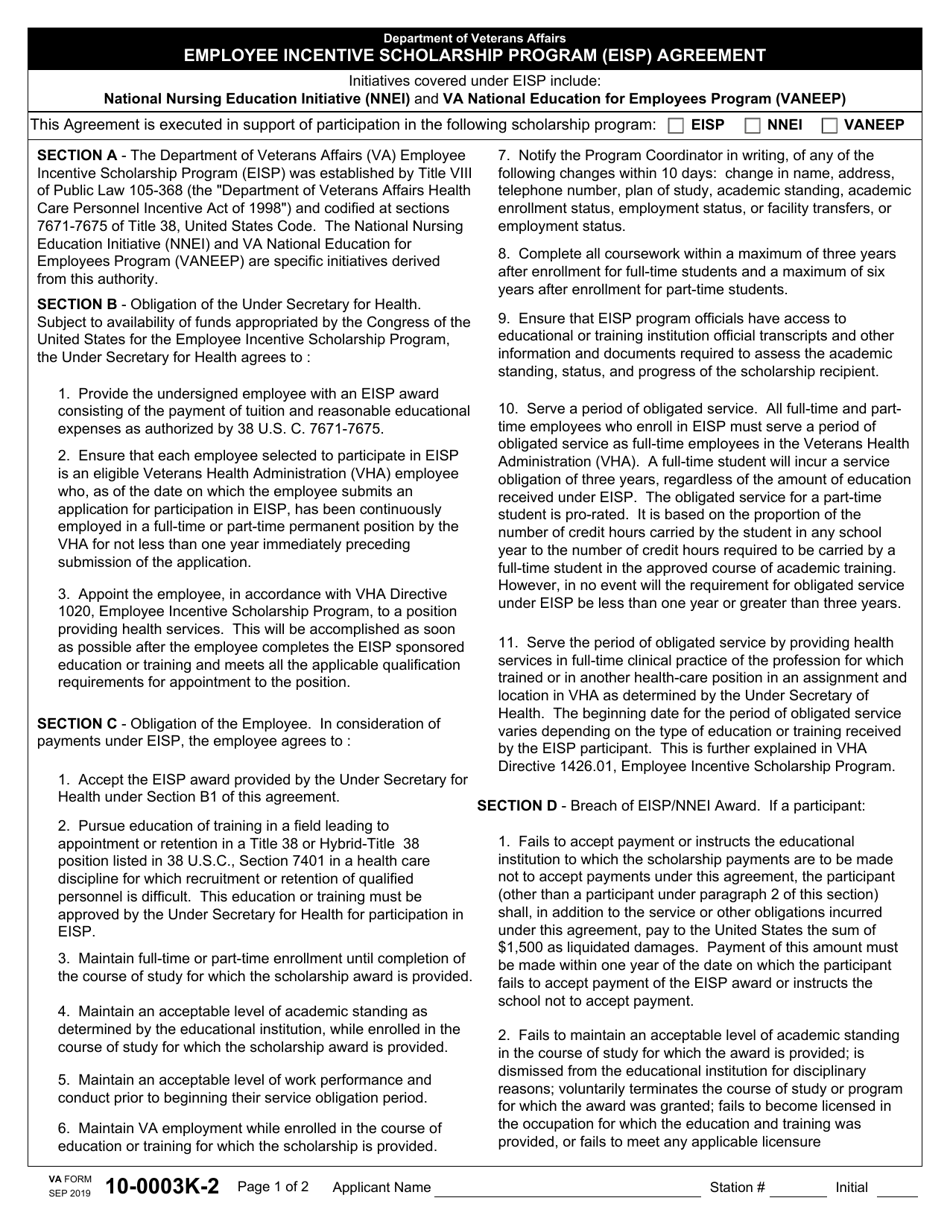

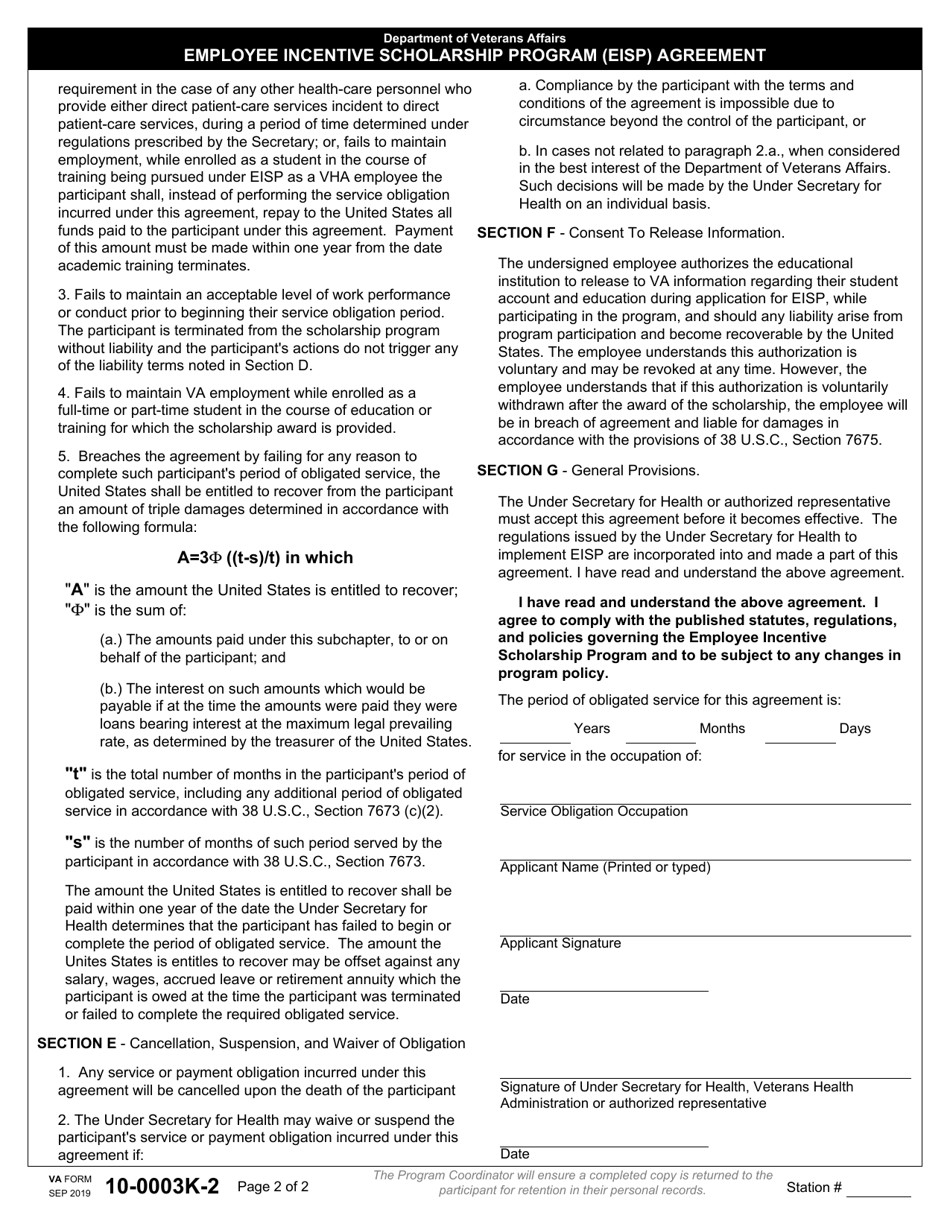

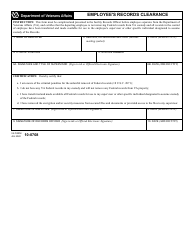

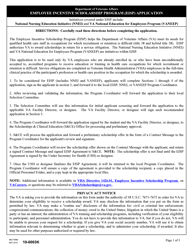

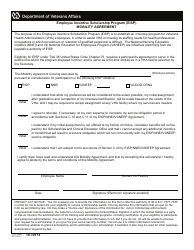

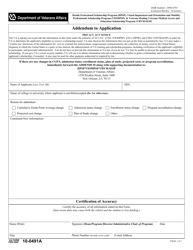

VA Form 10-0003K-2 Employee Incentive Scholarship Program (Eisp) Agreement

What Is VA Form 10-0003K-2?

This is a legal form that was released by the U.S. Department of Veterans Affairs on September 1, 2019 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is VA Form 10-0003K-2?

A: VA Form 10-0003K-2 is the form used for the Employee IncentiveScholarship Program (EISP) Agreement.

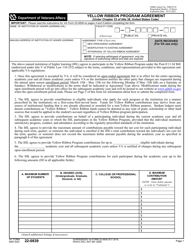

Q: What is the Employee Incentive Scholarship Program (EISP)?

A: The Employee Incentive Scholarship Program (EISP) is a program designed to provide educational assistance to employees.

Q: Who is eligible for the Employee Incentive Scholarship Program (EISP)?

A: Eligibility for the Employee Incentive Scholarship Program (EISP) is typically limited to employees of the organization offering the program.

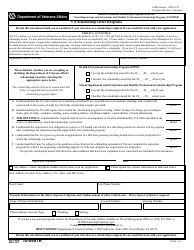

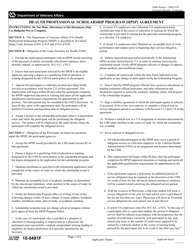

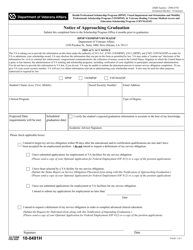

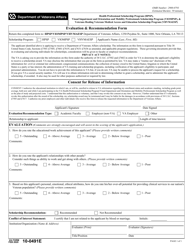

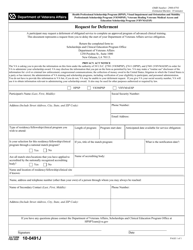

Q: What does the VA Form 10-0003K-2 Employee Incentive Scholarship Program (EISP) Agreement entail?

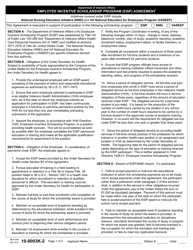

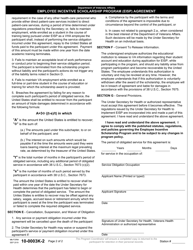

A: The VA Form 10-0003K-2 Employee Incentive Scholarship Program (EISP) Agreement is a document that outlines the terms and conditions of the EISP, including the obligations of both the employee and the organization.

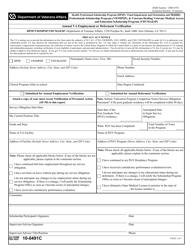

Q: Are there any deadlines associated with VA Form 10-0003K-2?

A: Specific deadlines may vary, but generally, the Employee Incentive Scholarship Program (EISP) Agreement must be completed and submitted before the designated deadline.

Q: What should I do if I have questions about VA Form 10-0003K-2?

A: If you have questions about VA Form 10-0003K-2 or the Employee Incentive Scholarship Program (EISP), you should reach out to the HR department or the designated personnel for assistance.

Q: Can I make changes to VA Form 10-0003K-2 once it is submitted?

A: Once the Employee Incentive Scholarship Program (EISP) Agreement is submitted, changes might be difficult to make, so it is important to review the form carefully before submission.

Q: What happens if I breach the terms of the VA Form 10-0003K-2 Employee Incentive Scholarship Program (EISP) Agreement?

A: Breach of the Employee Incentive Scholarship Program (EISP) Agreement may result in consequences, such as repayment obligations or loss of scholarship benefits.

Q: Is the Employee Incentive Scholarship Program (EISP) taxable?

A: The taxability of the Employee Incentive Scholarship Program (EISP) may vary depending on the specific circumstances, so it is advisable to consult with a tax professional or refer to IRS guidelines.

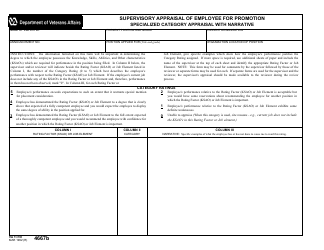

Form Details:

- Released on September 1, 2019;

- The latest available edition released by the U.S. Department of Veterans Affairs;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of VA Form 10-0003K-2 by clicking the link below or browse more documents and templates provided by the U.S. Department of Veterans Affairs.