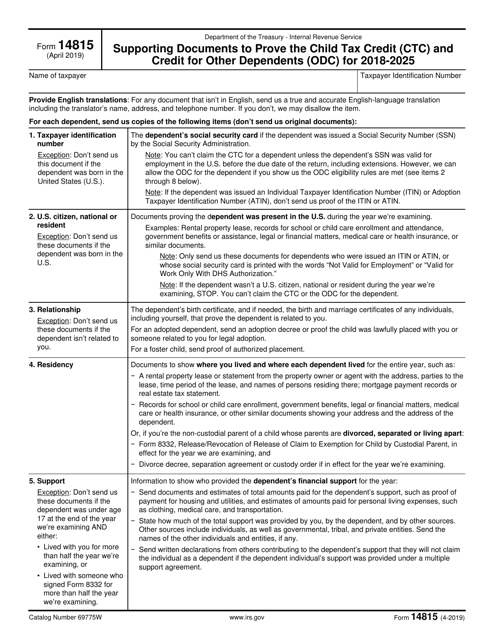

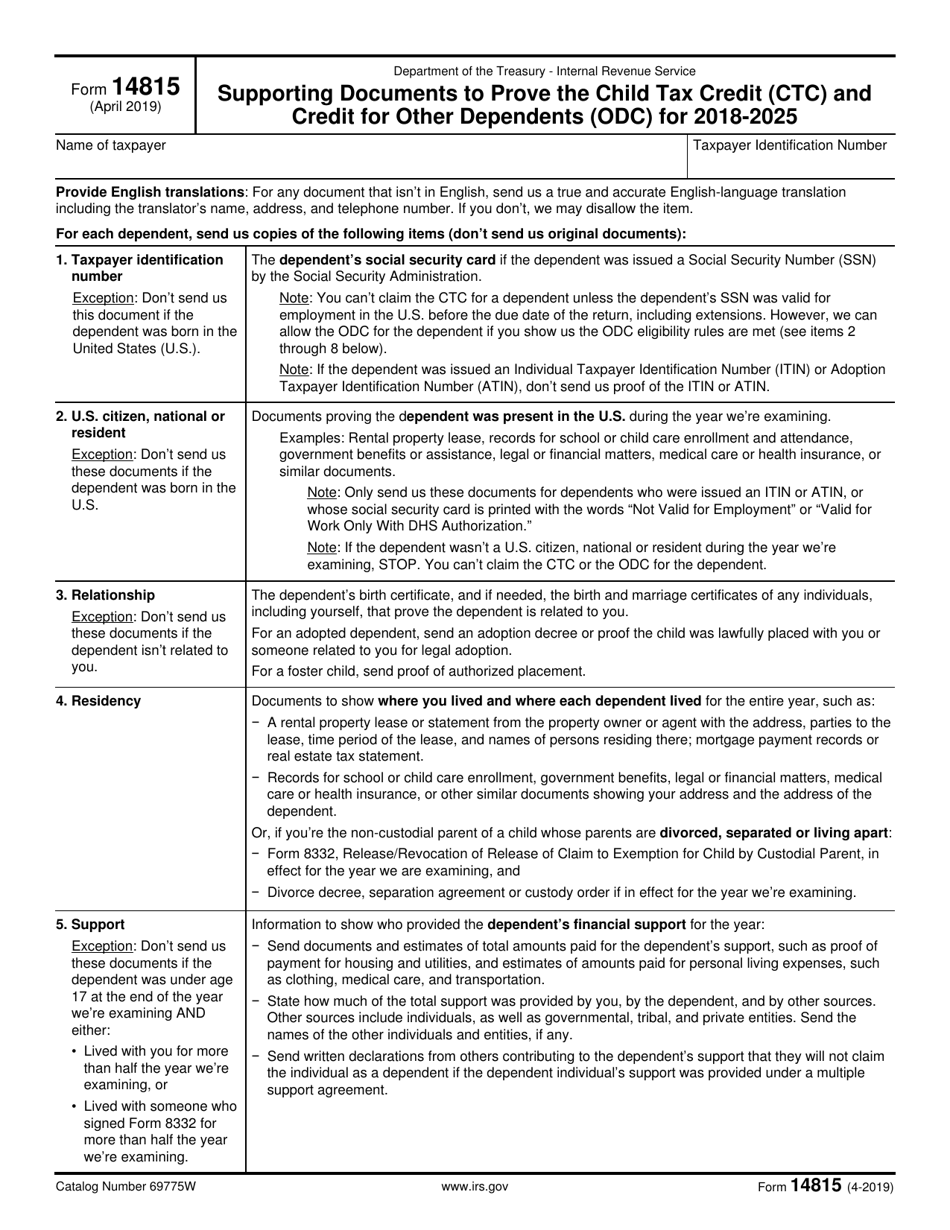

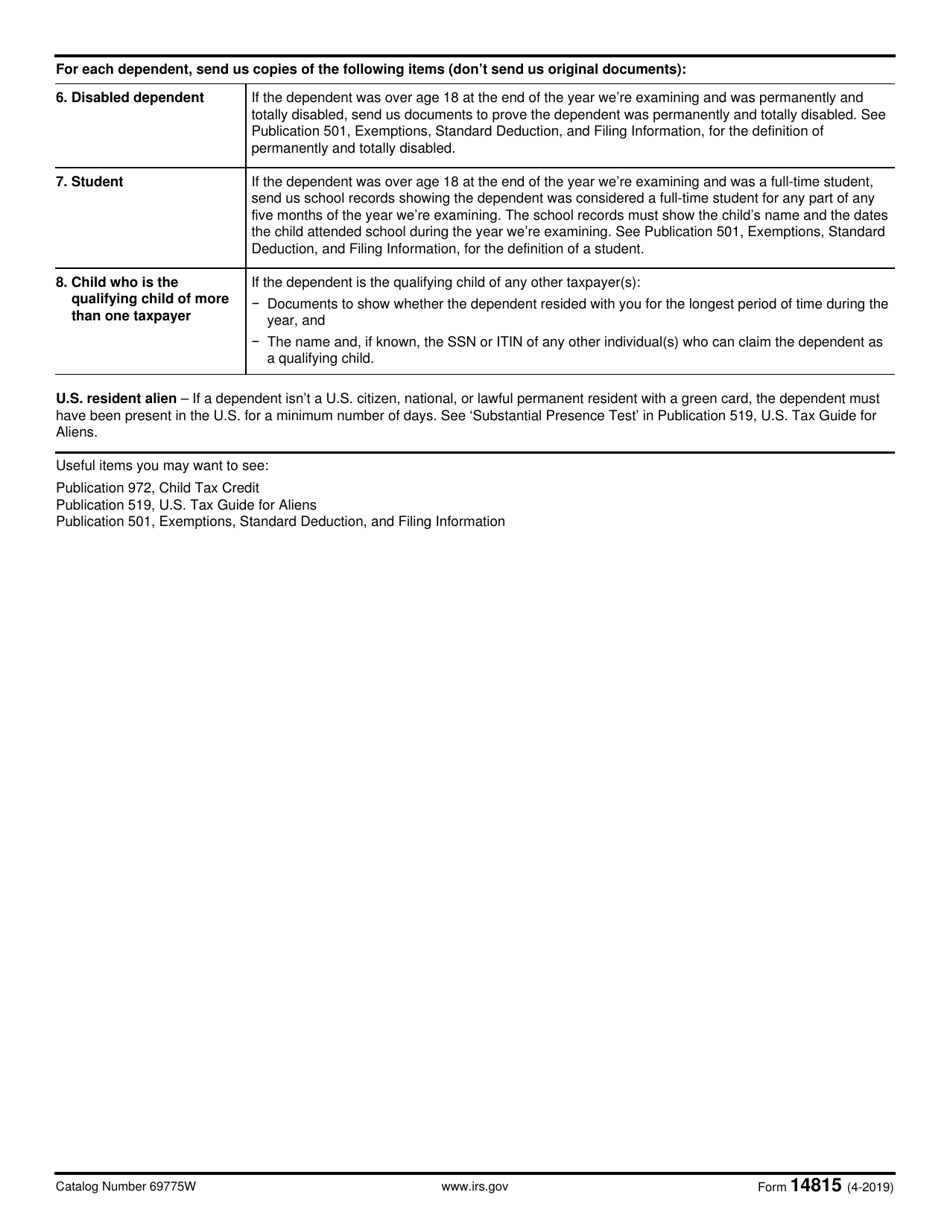

IRS Form 14815 Supporting Documents to Prove the Child Tax Credit (Ctc) and Credit for Other Dependents (Odc)

What Is IRS Form 14815?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on April 1, 2019. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 14815?

A: IRS Form 14815 is a form used to submit supporting documents to prove eligibility for the Child Tax Credit (CTC) and Credit for Other Dependents (ODC).

Q: What are the Child Tax Credit (CTC) and Credit for Other Dependents (ODC)?

A: The Child Tax Credit (CTC) and Credit for Other Dependents (ODC) are tax credits provided by the IRS to help taxpayers offset the cost of raising children and caring for dependents.

Q: When do I need to submit supporting documents using IRS Form 14815?

A: You need to submit supporting documents using IRS Form 14815 if you are claiming the Child Tax Credit (CTC) or Credit for Other Dependents (ODC) on your tax return.

Q: What kind of supporting documents do I need to submit with IRS Form 14815?

A: You may need to submit documents such as birth certificates, social security cards, or adoption records to prove the eligibility of the child or dependent.

Q: What happens if I don't submit supporting documents for the Child Tax Credit (CTC) or Credit for Other Dependents (ODC)?

A: If you don't submit the required supporting documents, your claim for the Child Tax Credit (CTC) or Credit for Other Dependents (ODC) may be denied or delayed by the IRS.

Q: Can I submit copies of documents or do they need to be original?

A: In most cases, copies of documents are acceptable as long as they are legible and show all relevant information.

Q: Is there a deadline for submitting supporting documents using IRS Form 14815?

A: The deadline for submitting supporting documents depends on the tax year you are filing for. It is best to check the instructions for IRS Form 14815 or consult a tax professional for specific deadlines.

Q: What should I do if I have questions about IRS Form 14815?

A: If you have questions about IRS Form 14815 or the Child Tax Credit (CTC) and Credit for Other Dependents (ODC), you can contact the Internal Revenue Service (IRS) or seek assistance from a tax professional.

Form Details:

- A 2-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 14815 through the link below or browse more documents in our library of IRS Forms.