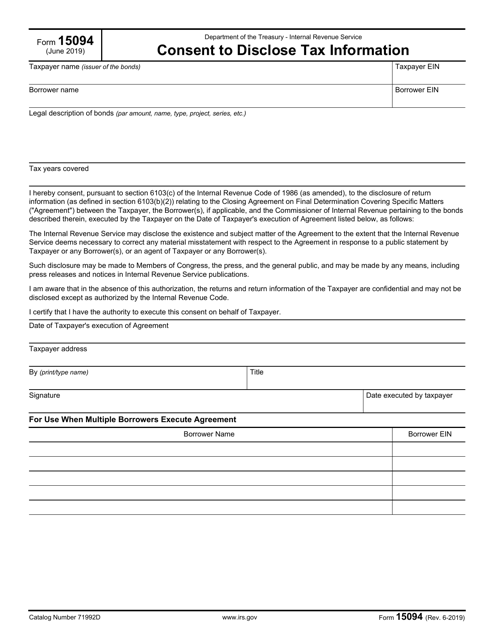

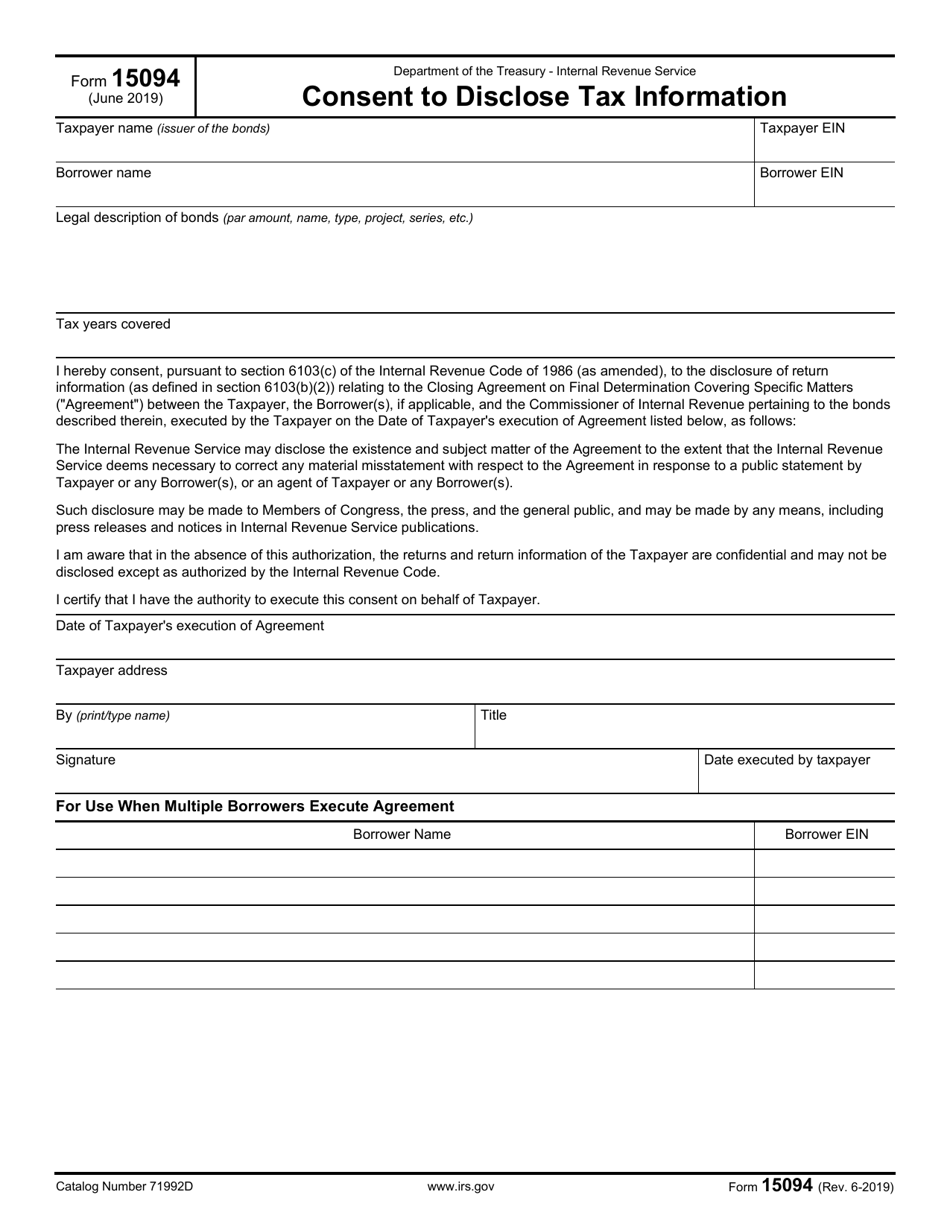

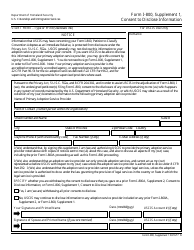

IRS Form 15094 Consent to Disclose Tax Information

What Is IRS Form 15094?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on June 1, 2019. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 15094?

A: IRS Form 15094 is a form used to give consent to disclose tax information to a third party.

Q: Why would I need to fill out IRS Form 15094?

A: You might need to fill out IRS Form 15094 if you want to authorize someone else, like a tax professional, to access and discuss your tax information with the IRS.

Q: Who can I authorize with IRS Form 15094?

A: You can authorize any individual or organization to access and discuss your tax information with the IRS using IRS Form 15094.

Q: Is there a fee for submitting IRS Form 15094?

A: No, there is no fee for submitting IRS Form 15094.

Q: How should I fill out IRS Form 15094?

A: You should carefully follow the instructions provided with the form to accurately fill out IRS Form 15094.

Q: Can I submit IRS Form 15094 electronically?

A: No, IRS Form 15094 cannot be submitted electronically. You need to submit a paper copy to the IRS.

Q: Is IRS Form 15094 available for both individuals and businesses?

A: Yes, both individuals and businesses can use IRS Form 15094 to authorize the disclosure of tax information.

Q: How long does it take for the IRS to process a submitted IRS Form 15094?

A: The processing time for IRS Form 15094 can vary, but it generally takes a few weeks for the IRS to process the form.

Form Details:

- A 1-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 15094 through the link below or browse more documents in our library of IRS Forms.