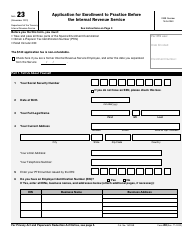

This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 14457

for the current year.

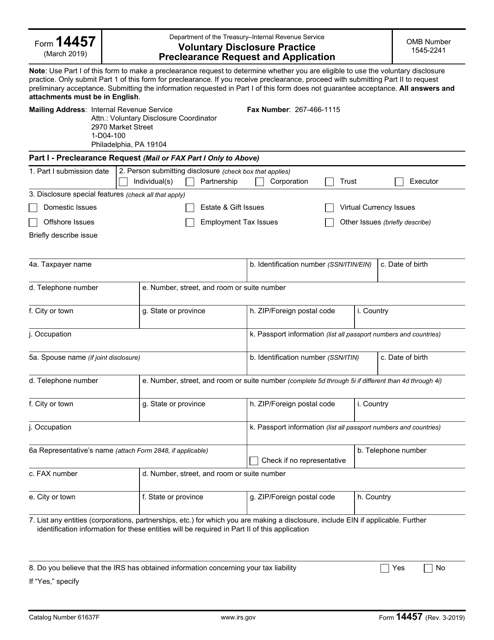

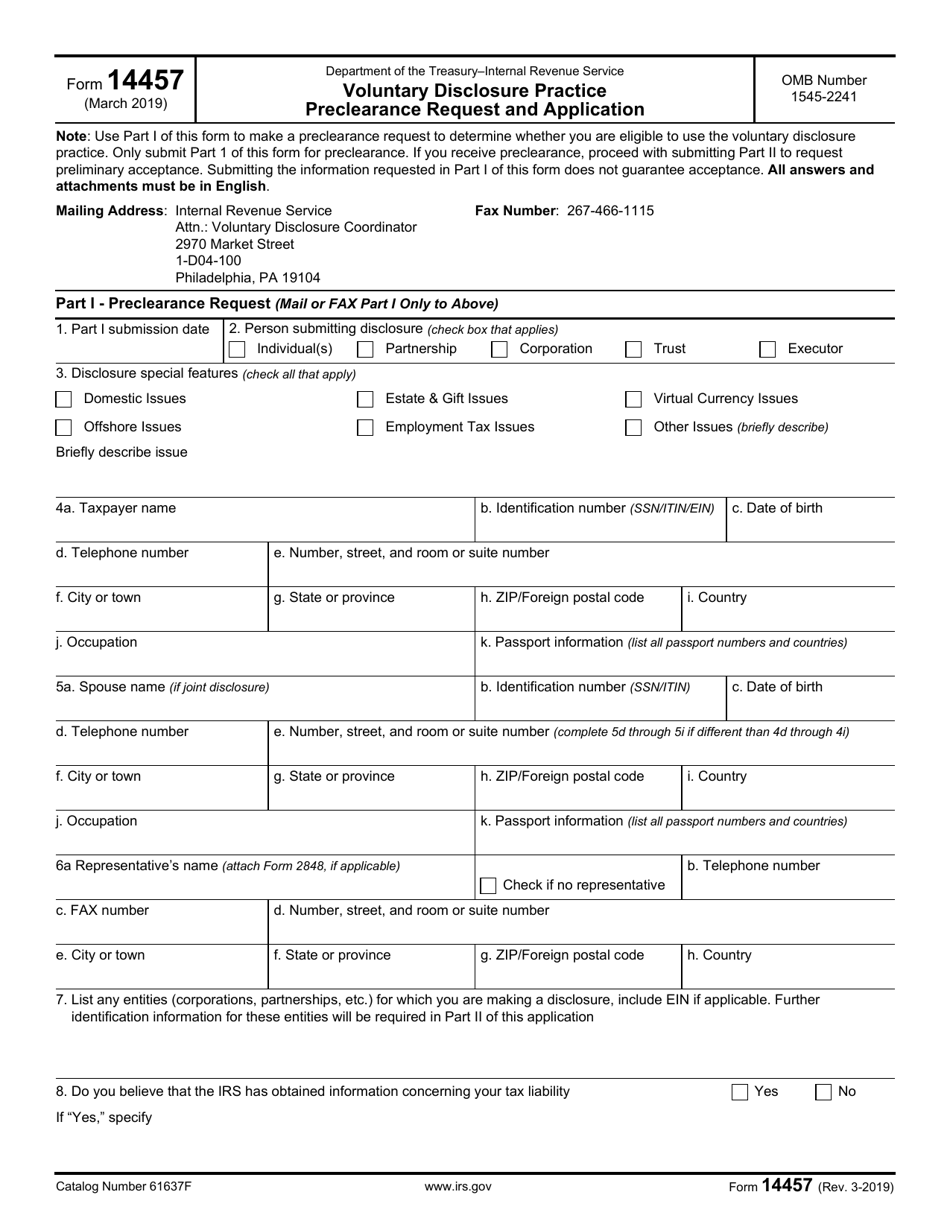

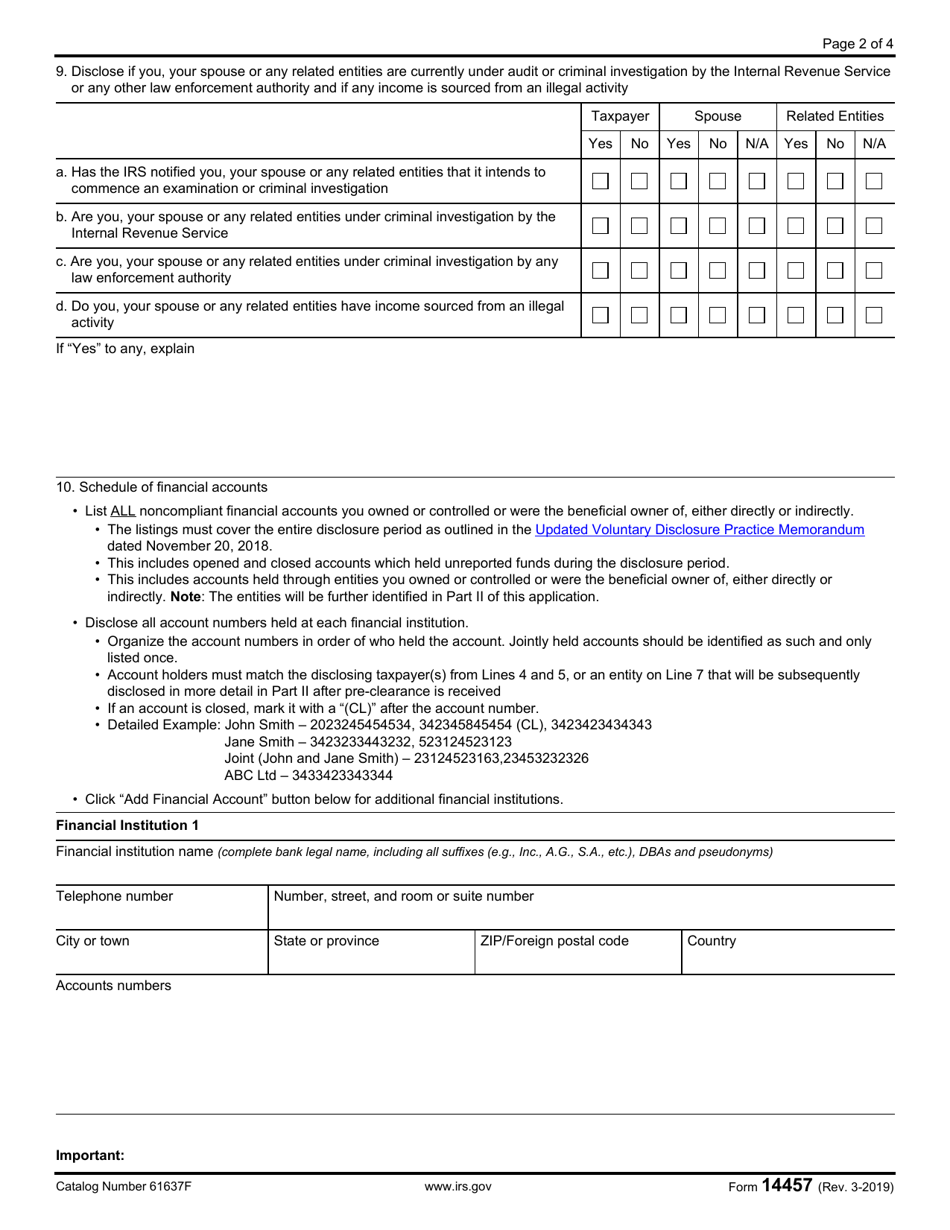

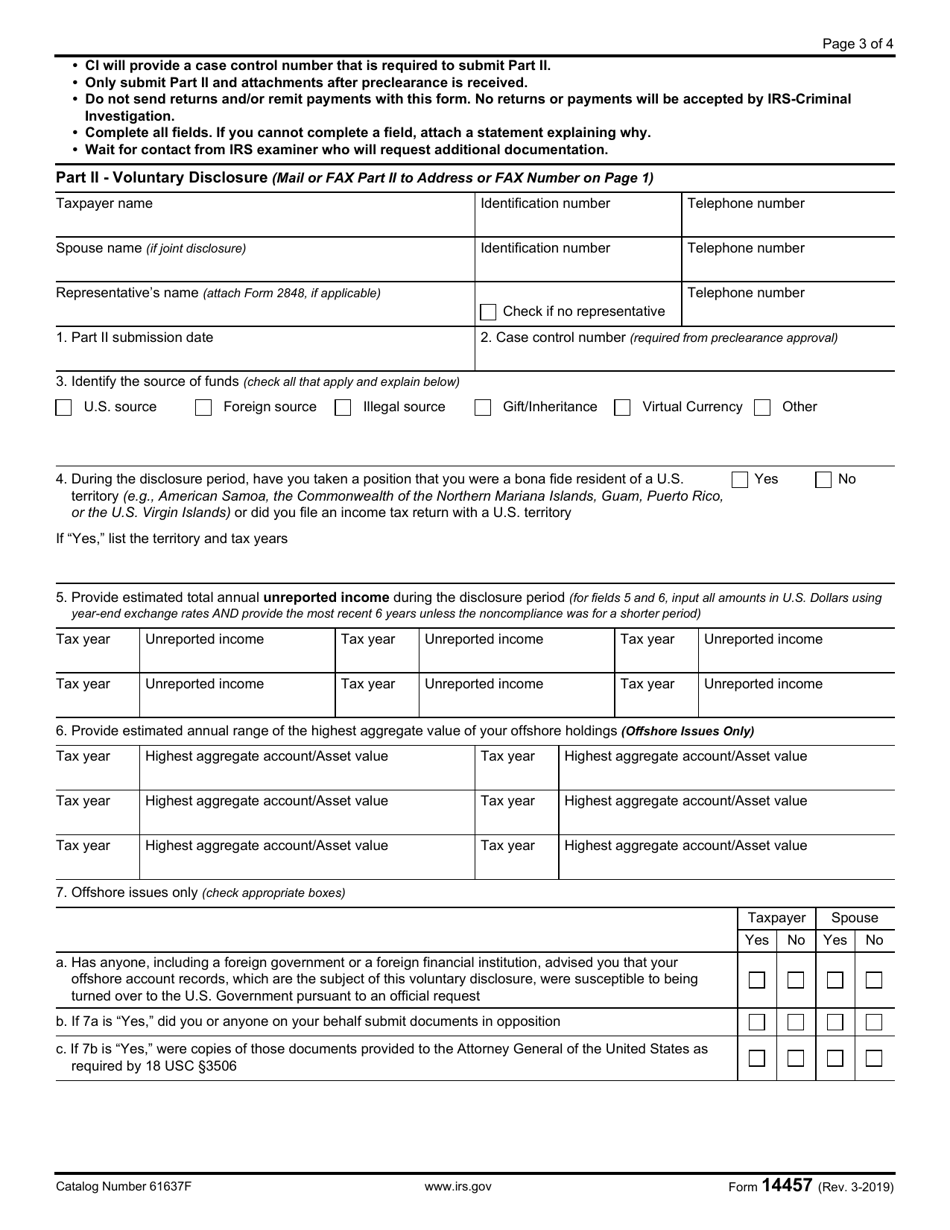

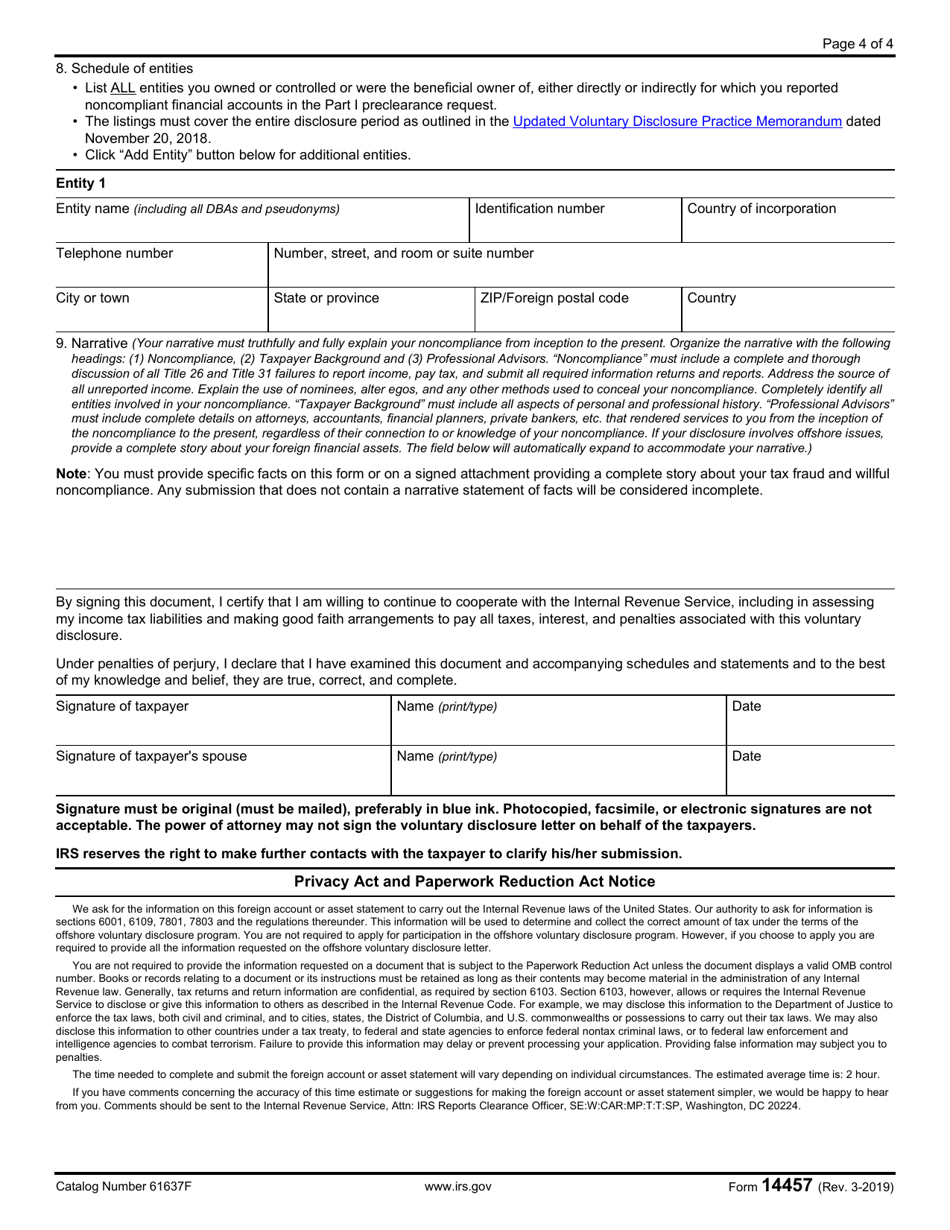

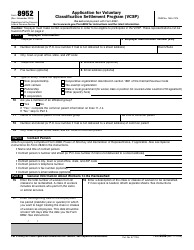

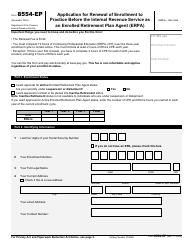

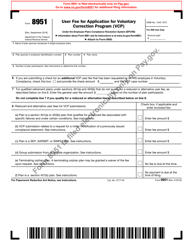

IRS Form 14457 Voluntary Disclosure Practice Preclearance Request and Application

What Is IRS Form 14457?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on March 1, 2019. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 14457?

A: IRS Form 14457 is the Voluntary Disclosure Practice Preclearance Request and Application form.

Q: What is the purpose of Form 14457?

A: The purpose of Form 14457 is to request preclearance from the IRS to participate in the Voluntary Disclosure Practice.

Q: What is the Voluntary Disclosure Practice?

A: The Voluntary Disclosure Practice is a program offered by the IRS that allows taxpayers to come forward and disclose previously undisclosed offshore accounts or assets.

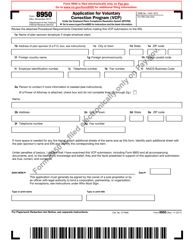

Q: Who should use Form 14457?

A: Taxpayers who wish to participate in the Voluntary Disclosure Practice should use Form 14457 to request preclearance from the IRS.

Q: Is the use of Form 14457 mandatory for voluntary disclosure?

A: Yes, taxpayers must submit Form 14457 to the IRS in order to request preclearance for participation in the Voluntary Disclosure Practice.

Q: Are there any fees associated with submitting Form 14457?

A: No, there are no fees associated with submitting Form 14457.

Q: Is legal representation required for participation in the Voluntary Disclosure Practice?

A: While legal representation is not required, it is highly recommended to seek the assistance of a tax professional or attorney familiar with the program.

Q: What happens after submitting Form 14457?

A: After submitting Form 14457, the IRS will review the request for preclearance and provide a response to the taxpayer.

Q: Can the IRS reject a preclearance request?

A: Yes, the IRS has the discretion to reject a preclearance request based on various factors.

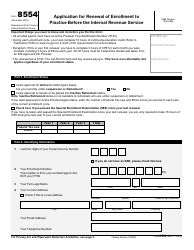

Form Details:

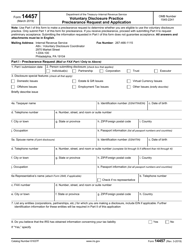

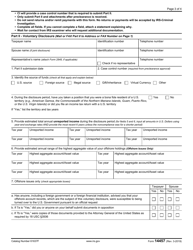

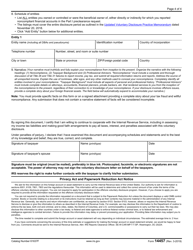

- A 4-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 14457 through the link below or browse more documents in our library of IRS Forms.