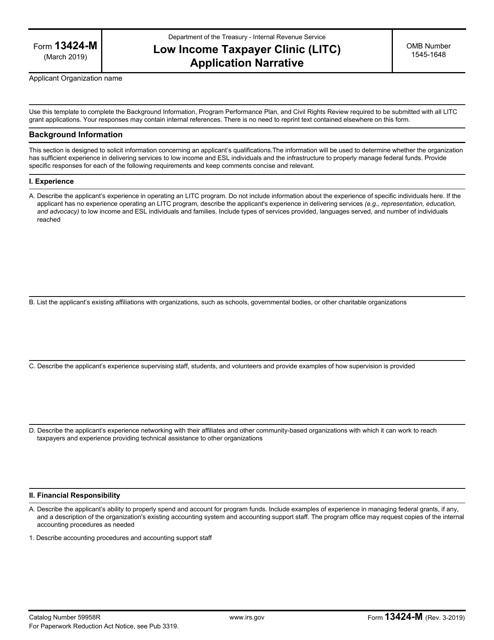

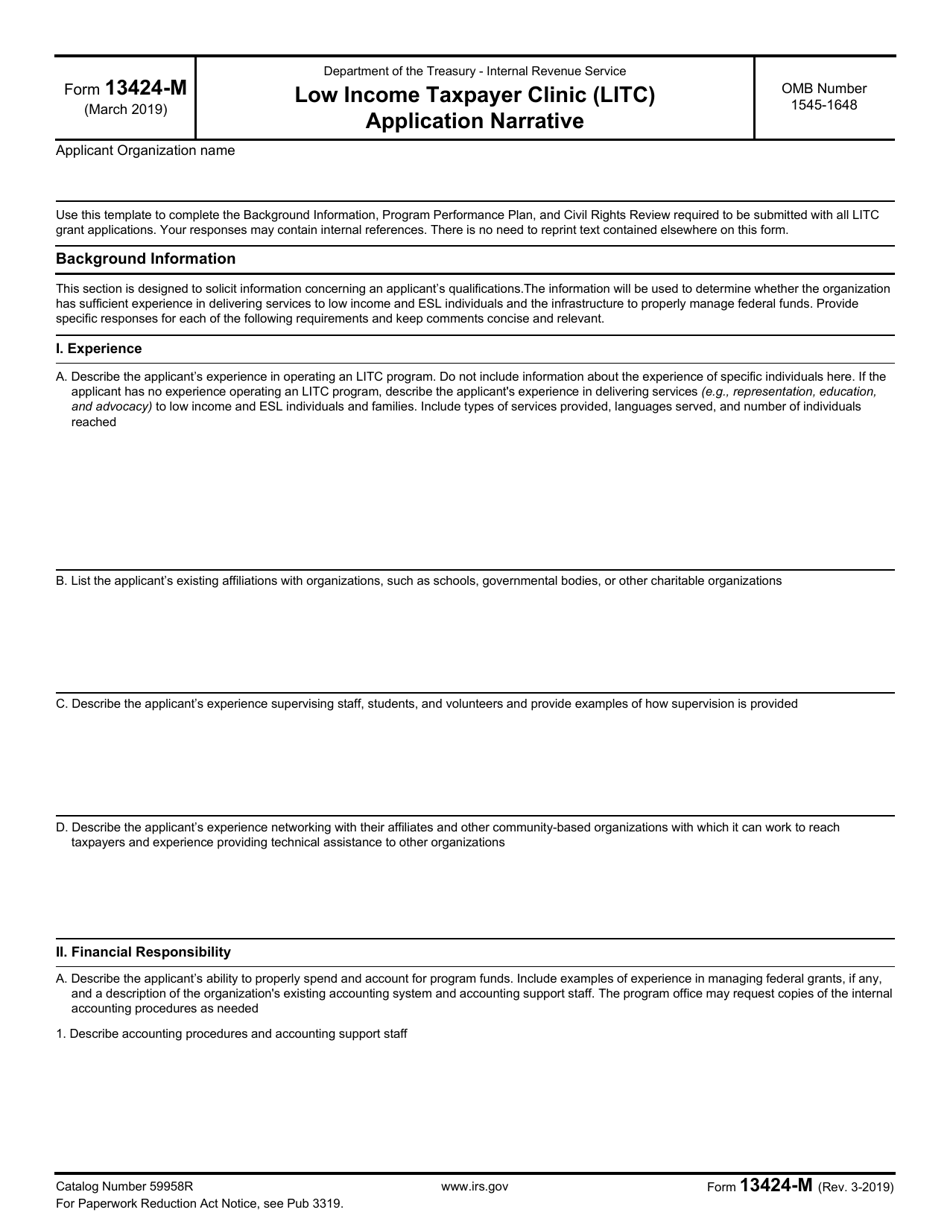

IRS Form 13424-M Low Income Taxpayer Clinic (Litc) Application Narrative

What Is IRS Form 13424-M?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on March 1, 2019. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is Form 13424-M?

A: Form 13424-M is the application narrative for the Low Income Taxpayer Clinic (LITC) program.

Q: What is the Low Income Taxpayer Clinic (LITC) program?

A: The Low Income Taxpayer Clinic (LITC) program provides assistance to low-income taxpayers in resolving tax problems with the IRS.

Q: Who can apply for the LITC program?

A: Non-profit organizations, clinical programs at accredited law, business, or accounting schools, and organizations sponsored by state or local governments can apply for the LITC program.

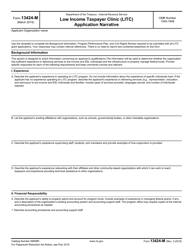

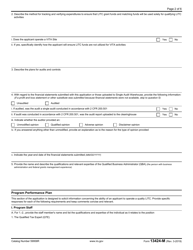

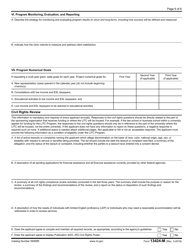

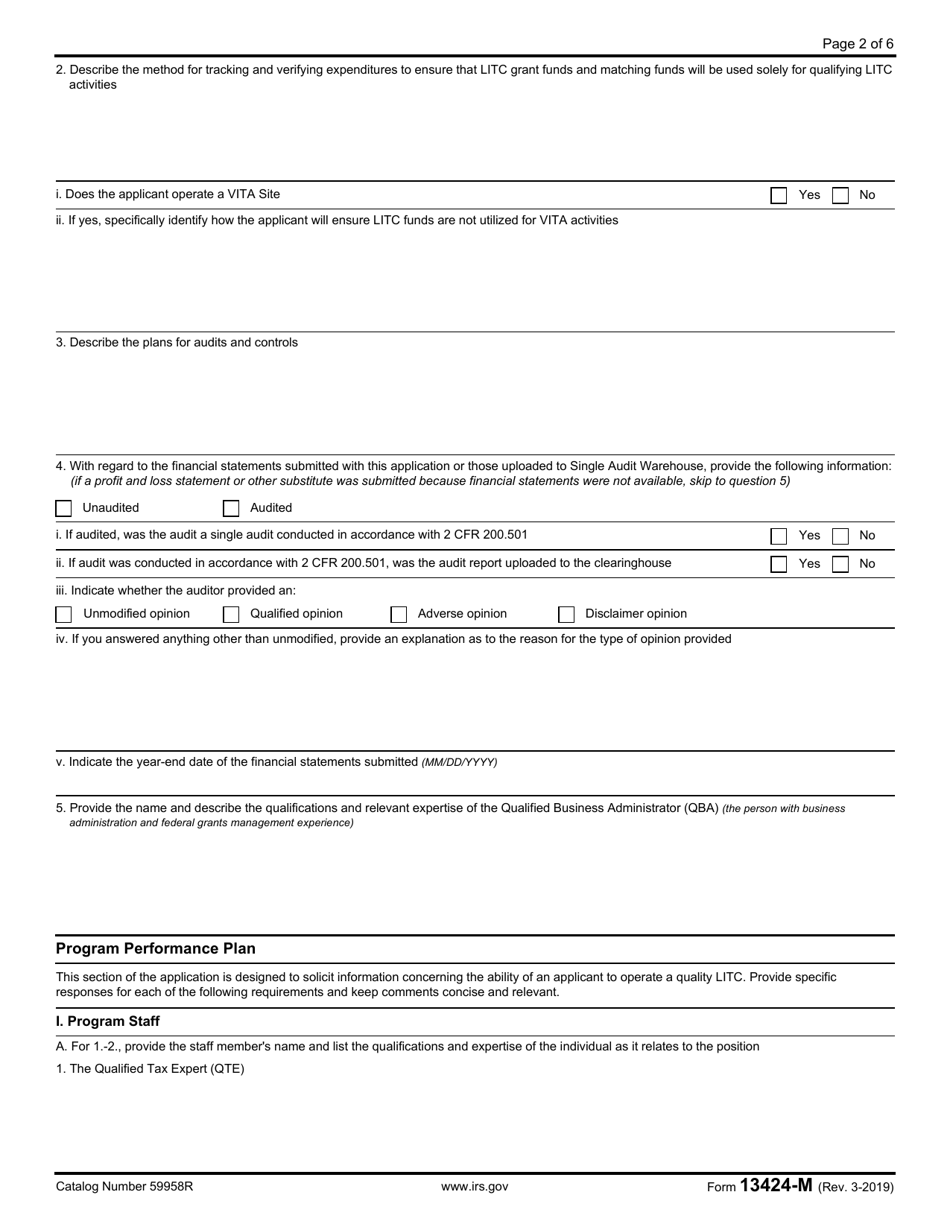

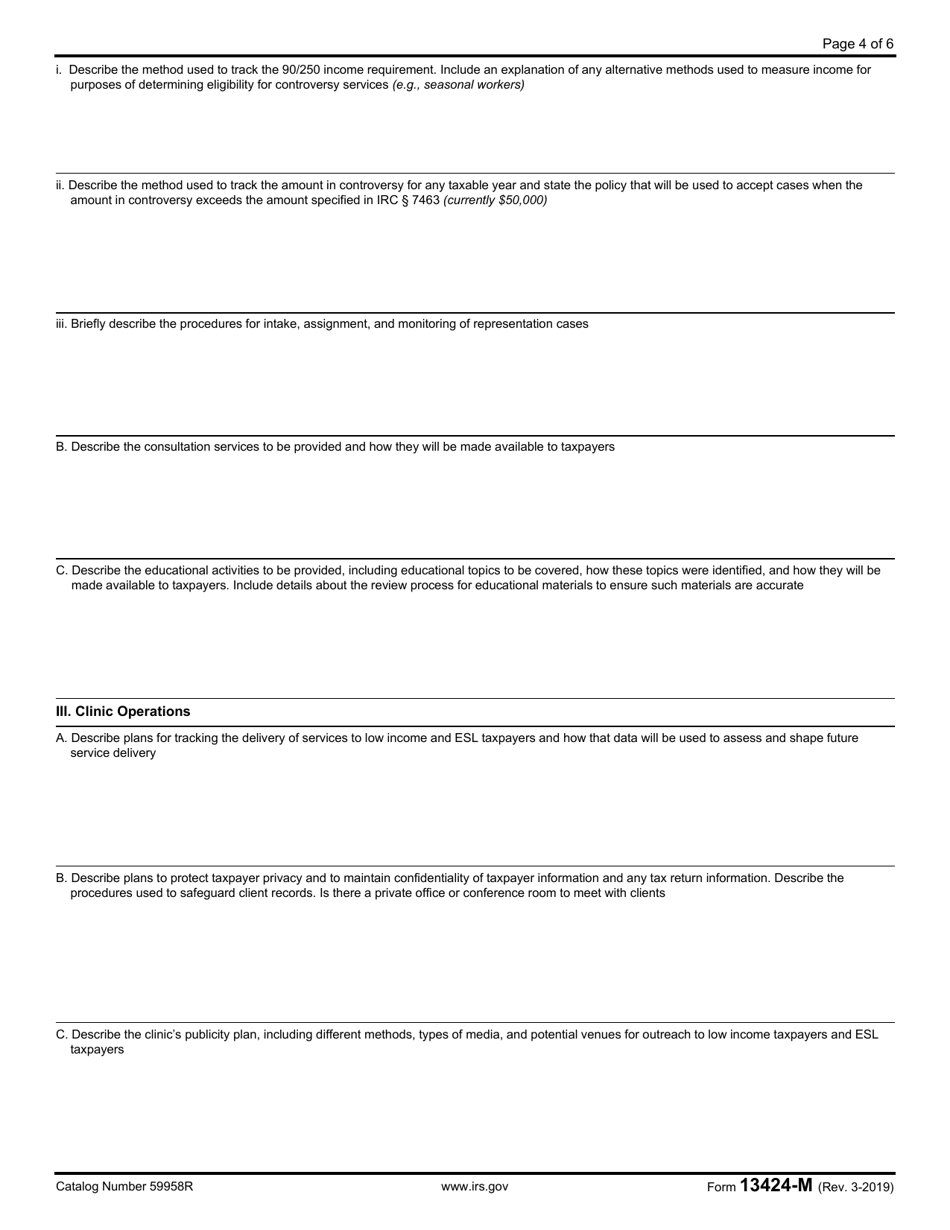

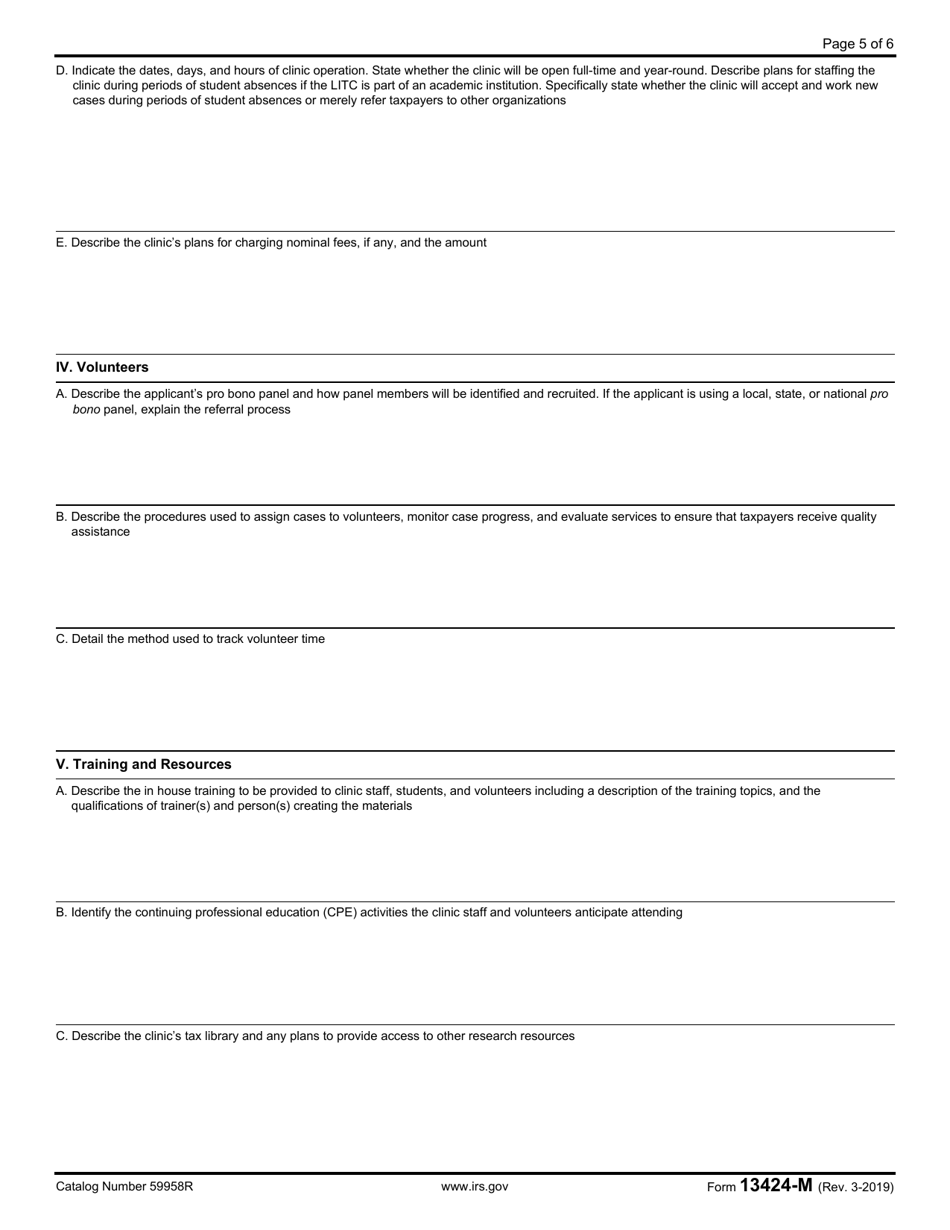

Q: What information is required in the application narrative?

A: The application narrative for Form 13424-M requires information about the organization's qualifications, proposed services, staffing, and budget.

Form Details:

- A 6-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 13424-M through the link below or browse more documents in our library of IRS Forms.