This version of the form is not currently in use and is provided for reference only. Download this version of

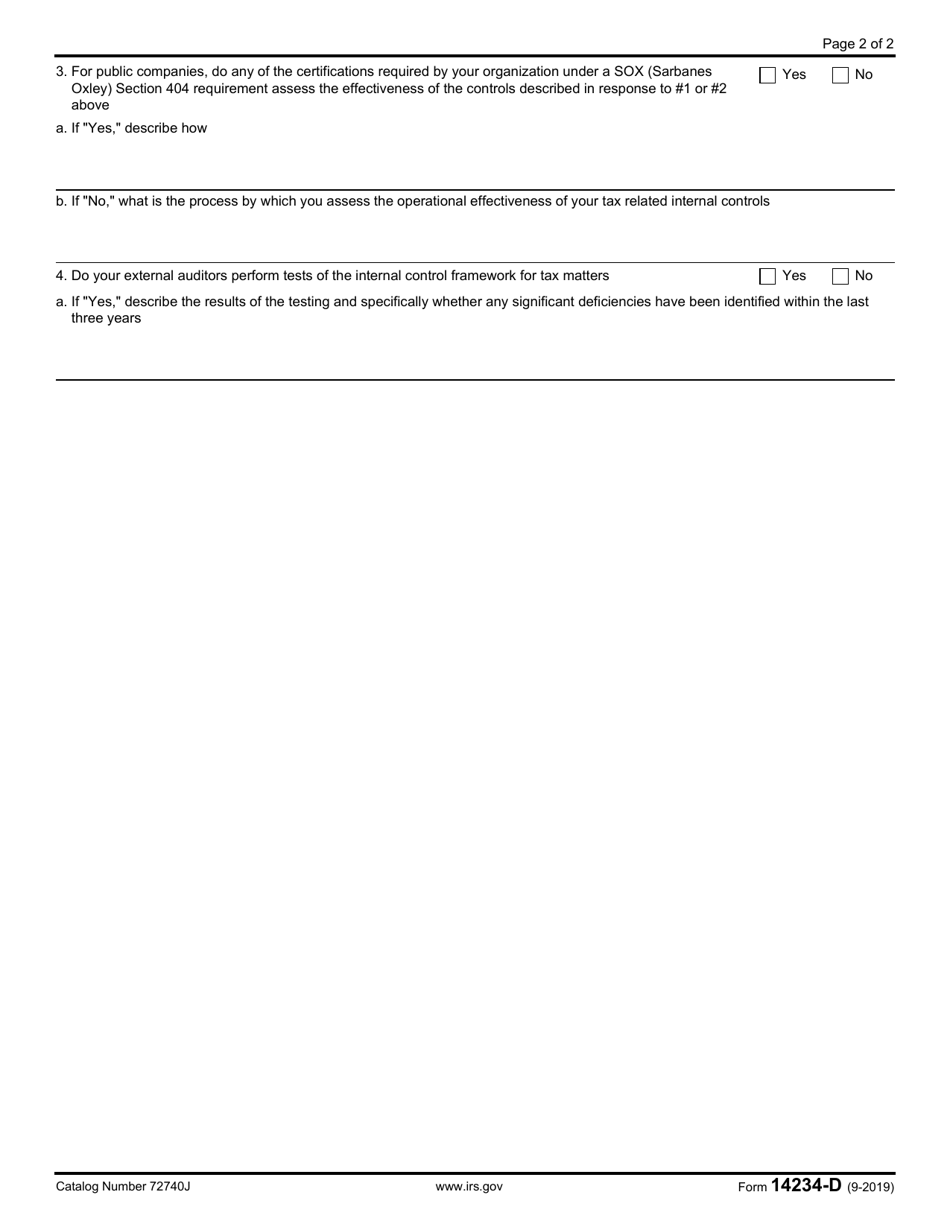

IRS Form 14234-D

for the current year.

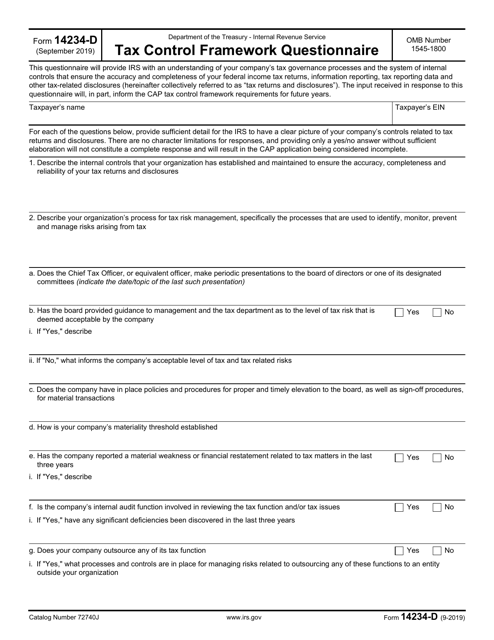

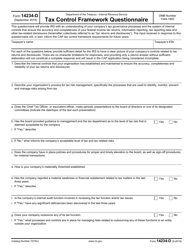

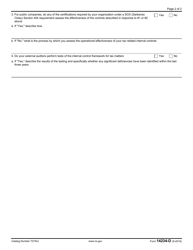

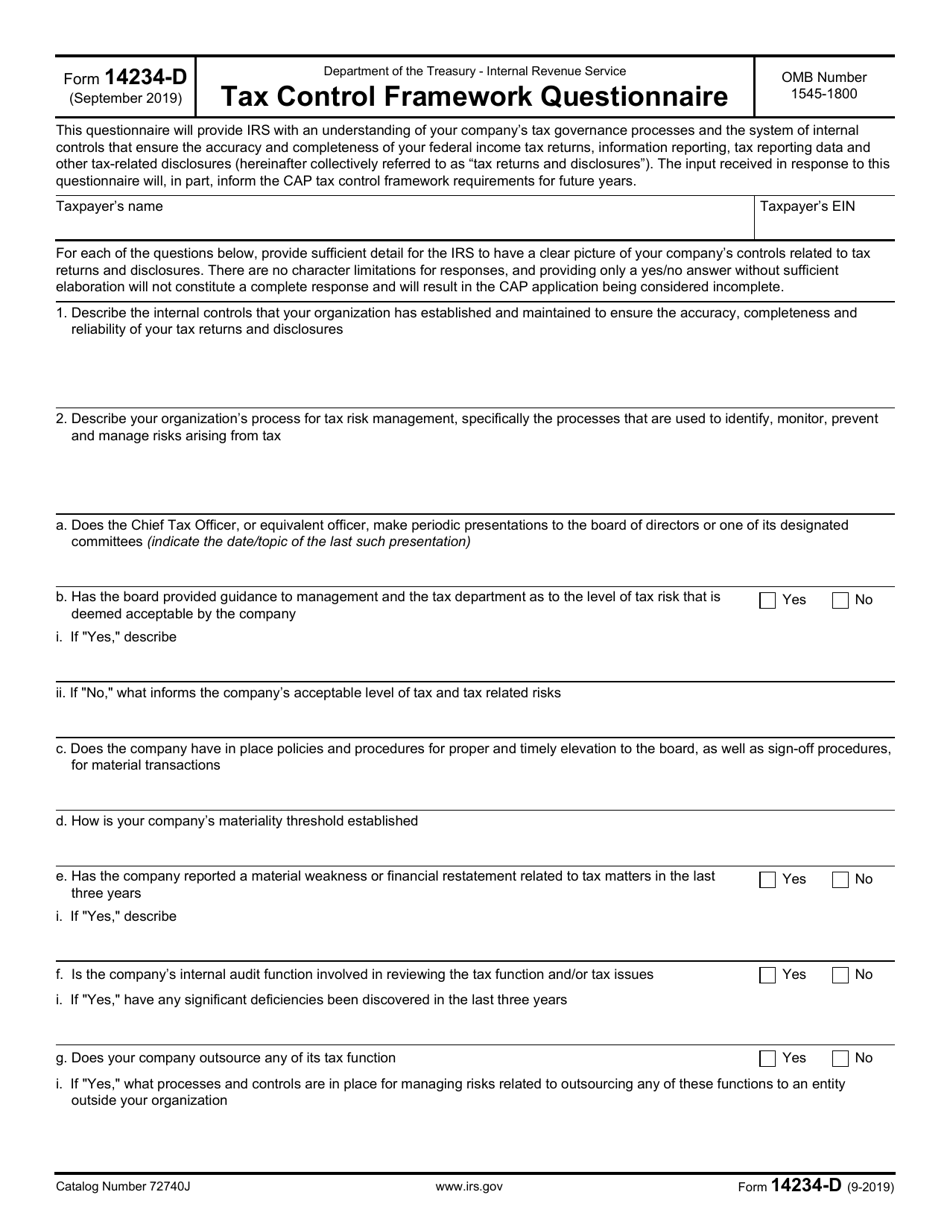

IRS Form 14234-D Tax Control Framework Questionnaire

What Is IRS Form 14234-D?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on September 1, 2019. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 14234-D?

A: IRS Form 14234-D is a Tax Control Framework Questionnaire.

Q: Who is required to fill out IRS Form 14234-D?

A: Certain taxpayers and tax-exempt organizations may be required to fill out this form.

Q: What is the purpose of IRS Form 14234-D?

A: The purpose of this form is to gather information about a taxpayer's tax control framework.

Q: What is a tax control framework?

A: A tax control framework refers to the policies, procedures, and systems that a taxpayer has in place to ensure accurate and compliant tax reporting.

Q: Who should I contact for assistance with IRS Form 14234-D?

A: You can reach out to the Internal Revenue Service (IRS) for assistance with this form.

Q: Are there any penalties for not completing IRS Form 14234-D?

A: Failure to complete this form when required may result in penalties or other consequences imposed by the IRS.

Q: Can I request an extension to fill out IRS Form 14234-D?

A: In certain circumstances, you may be able to request an extension for filing this form. Contact the IRS for more information.

Q: Is IRS Form 14234-D applicable only to individuals?

A: No, this form may be applicable to both individuals and tax-exempt organizations.

Q: When is IRS Form 14234-D due?

A: The due date for this form may vary depending on the individual or organization's circumstances. Check the form instructions or consult the IRS for the specific due date.

Form Details:

- A 2-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 14234-D through the link below or browse more documents in our library of IRS Forms.