This version of the form is not currently in use and is provided for reference only. Download this version of

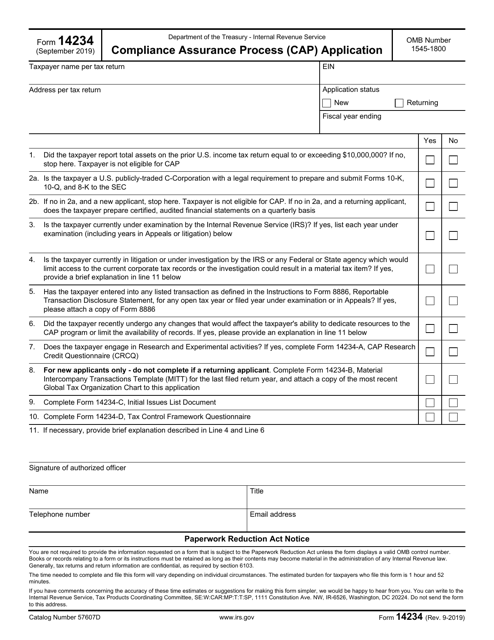

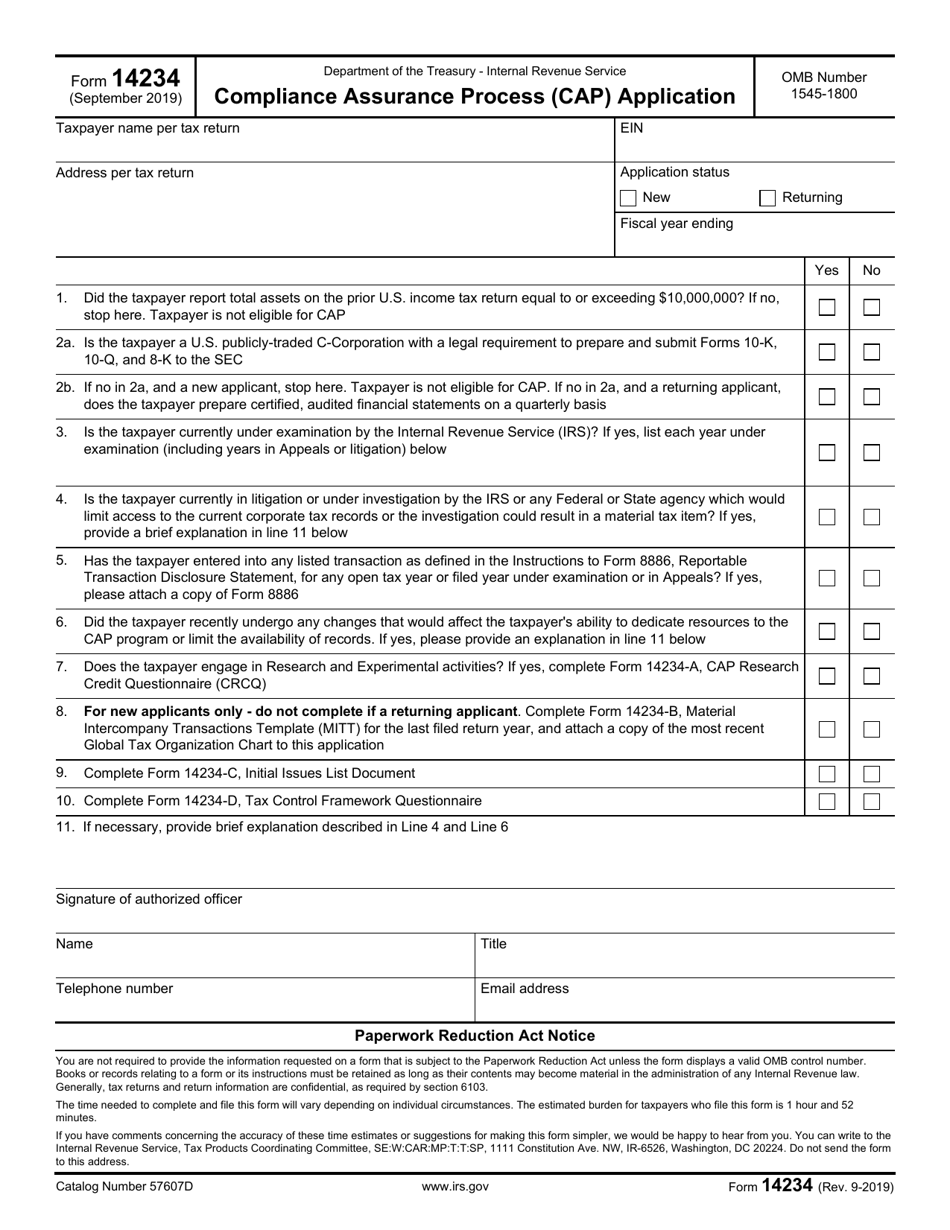

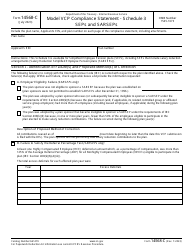

IRS Form 14234

for the current year.

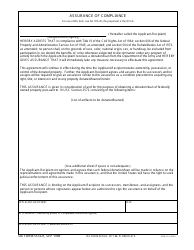

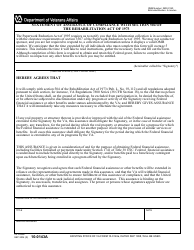

IRS Form 14234 Compliance Assurance Process (CAP) Application

What Is IRS Form 14234?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on September 1, 2019. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 14234?

A: IRS Form 14234 is the Compliance Assurance Process (CAP) Application form.

Q: What is the Compliance Assurance Process (CAP)?

A: The Compliance Assurance Process (CAP) is a program that allows businesses to proactively work with the IRS to identify and resolve potential compliance issues.

Q: Who can use IRS Form 14234?

A: Businesses that meet certain criteria can use IRS Form 14234 to apply for participation in the Compliance Assurance Process (CAP).

Q: What is the purpose of the CAP application?

A: The purpose of the CAP application is to provide the IRS with information about the business's tax compliance practices and to demonstrate their commitment to cooperative compliance.

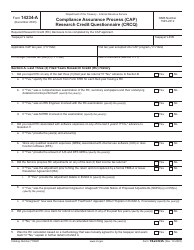

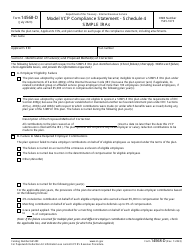

Q: What information is required on IRS Form 14234?

A: IRS Form 14234 requires information such as the business's contact details, tax return information, and details about their compliance systems and processes.

Q: Is participation in the CAP program mandatory?

A: Participation in the CAP program is voluntary. Businesses can choose whether or not to apply for participation.

Q: What are the benefits of participating in the CAP program?

A: Participating in the CAP program can provide businesses with increased certainty regarding their tax compliance and may result in a reduced scope of IRS audits.

Form Details:

- A 1-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 14234 through the link below or browse more documents in our library of IRS Forms.