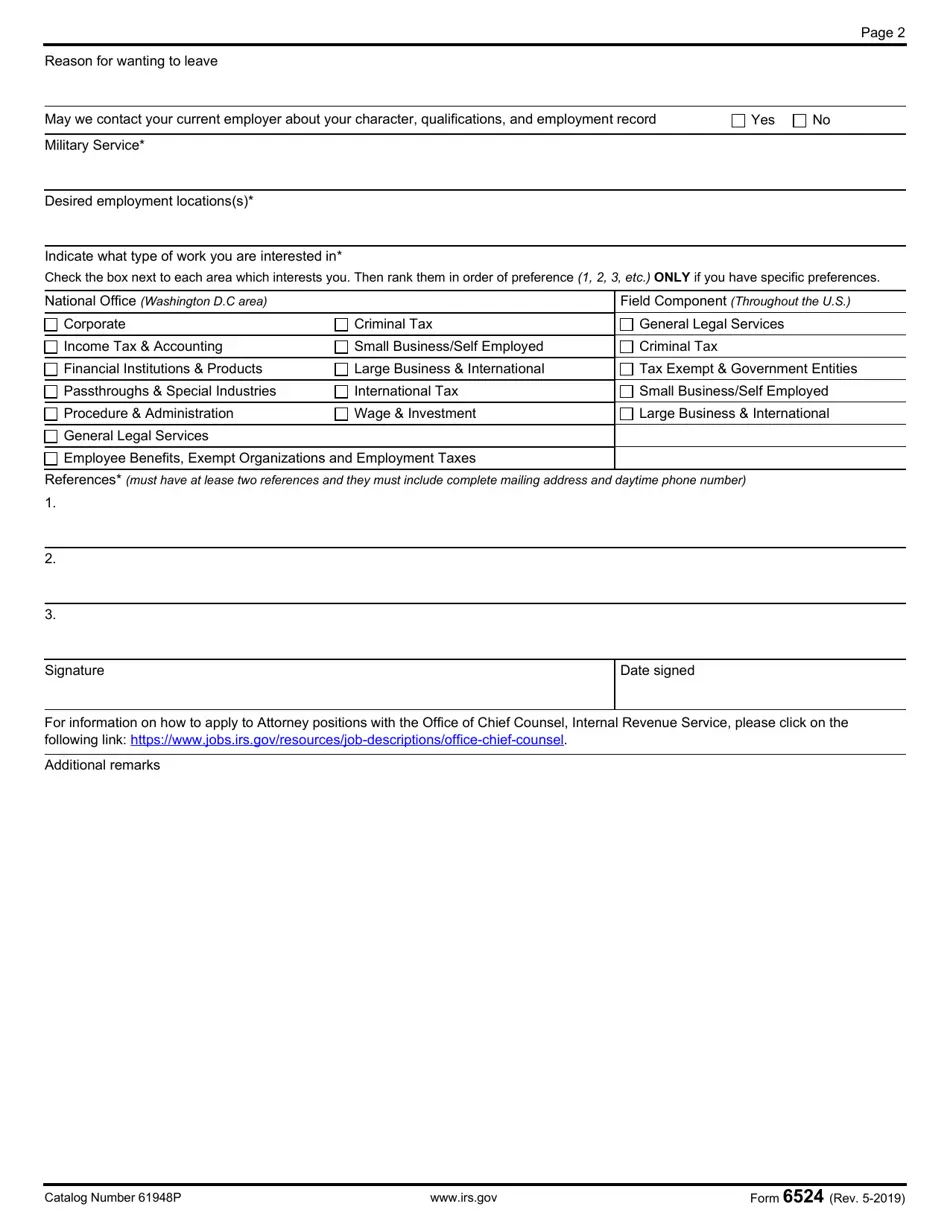

This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 6524

for the current year.

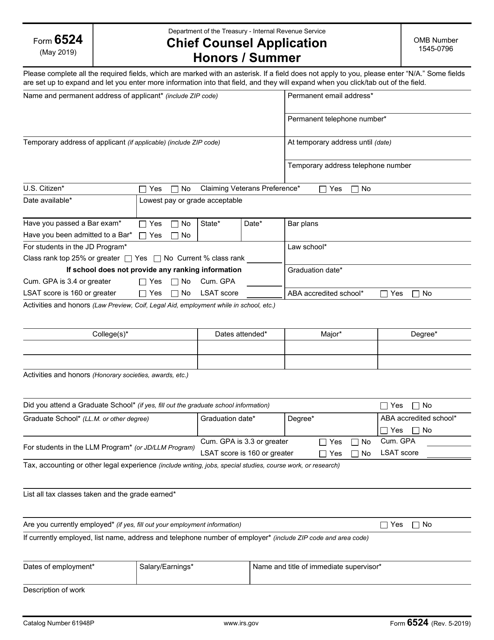

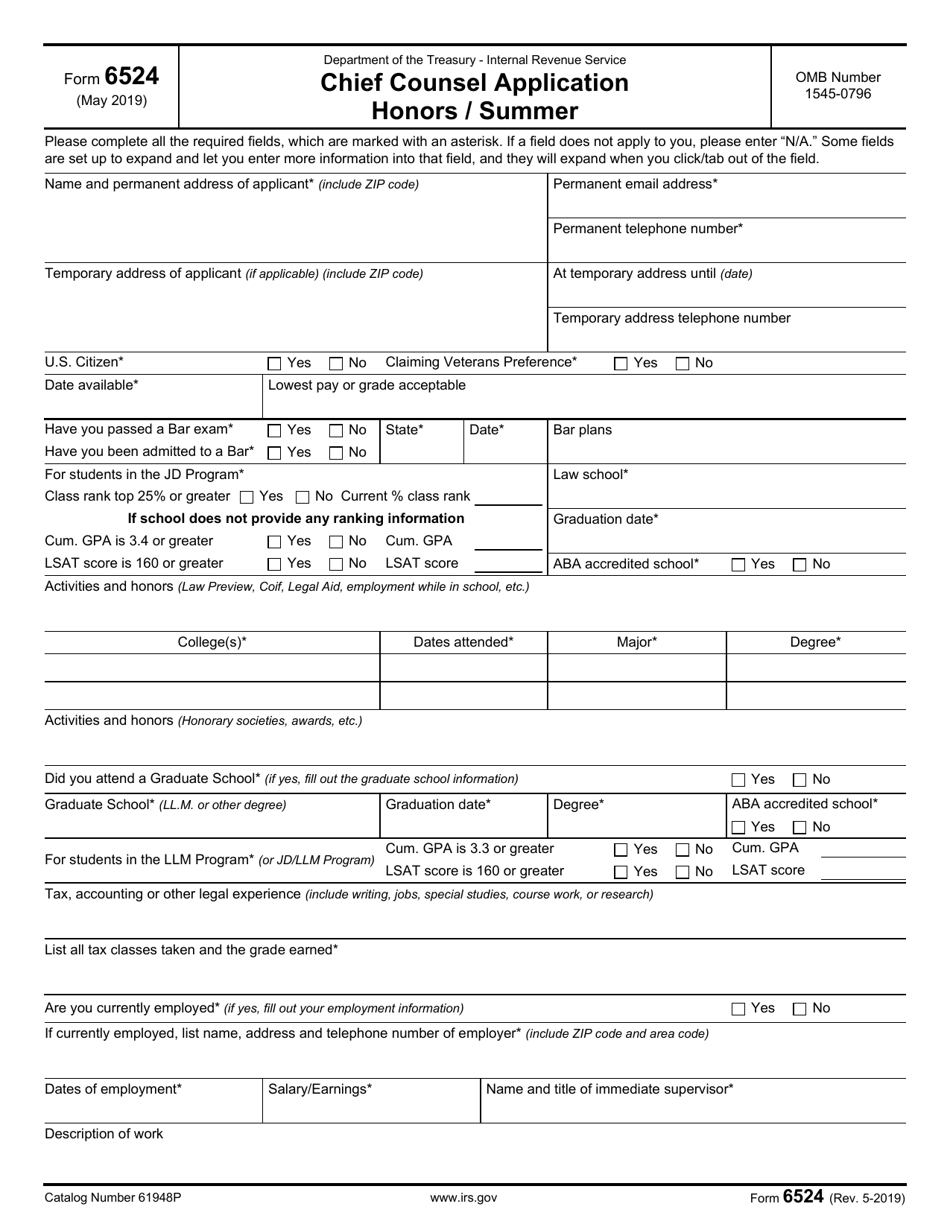

IRS Form 6524 Chief Counsel Application Honors / Summer

What Is IRS Form 6524?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on May 1, 2019. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 6524?

A: IRS Form 6524 is the Chief Counsel Application for Honors/Summer program.

Q: What is the purpose of IRS Form 6524?

A: The purpose of IRS Form 6524 is to apply for the Chief Counsel Honors/Summer program.

Q: Who can use IRS Form 6524?

A: Individuals who are interested in participating in the Chief Counsel Honors/Summer program can use IRS Form 6524.

Q: What is the Chief Counsel Honors/Summer program?

A: The Chief Counsel Honors/Summer program is a program offered by the IRS Chief Counsel's Office that provides law students with an opportunity to gain hands-on experience in tax law.

Q: Are there any eligibility requirements for the Chief Counsel Honors/Summer program?

A: Yes, there are eligibility requirements. The specific requirements can be found in the instructions for IRS Form 6524.

Q: Is there any cost associated with submitting IRS Form 6524?

A: No, there is no cost associated with submitting IRS Form 6524 for the Chief Counsel Honors/Summer program.

Q: What happens after submitting IRS Form 6524 for the Chief Counsel Honors/Summer program?

A: After submitting IRS Form 6524, applicants may be contacted for further steps in the application process, such as interviews or additional documentation.

Q: Can I apply for the Chief Counsel Honors/Summer program more than once?

A: Yes, individuals can apply for the Chief Counsel Honors/Summer program multiple times if they meet the eligibility requirements.

Form Details:

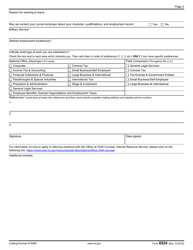

- A 3-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 6524 through the link below or browse more documents in our library of IRS Forms.