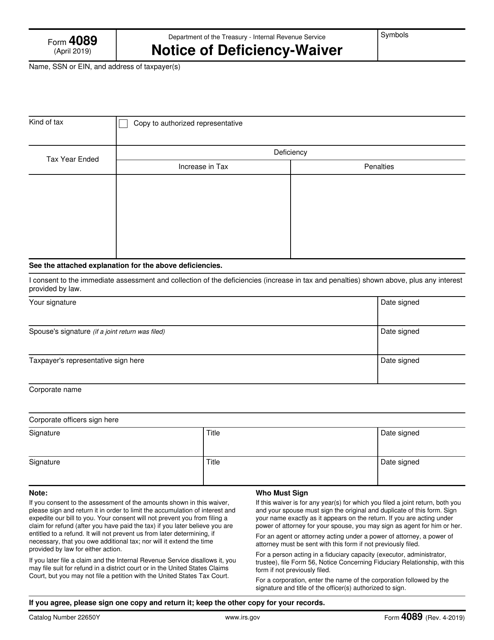

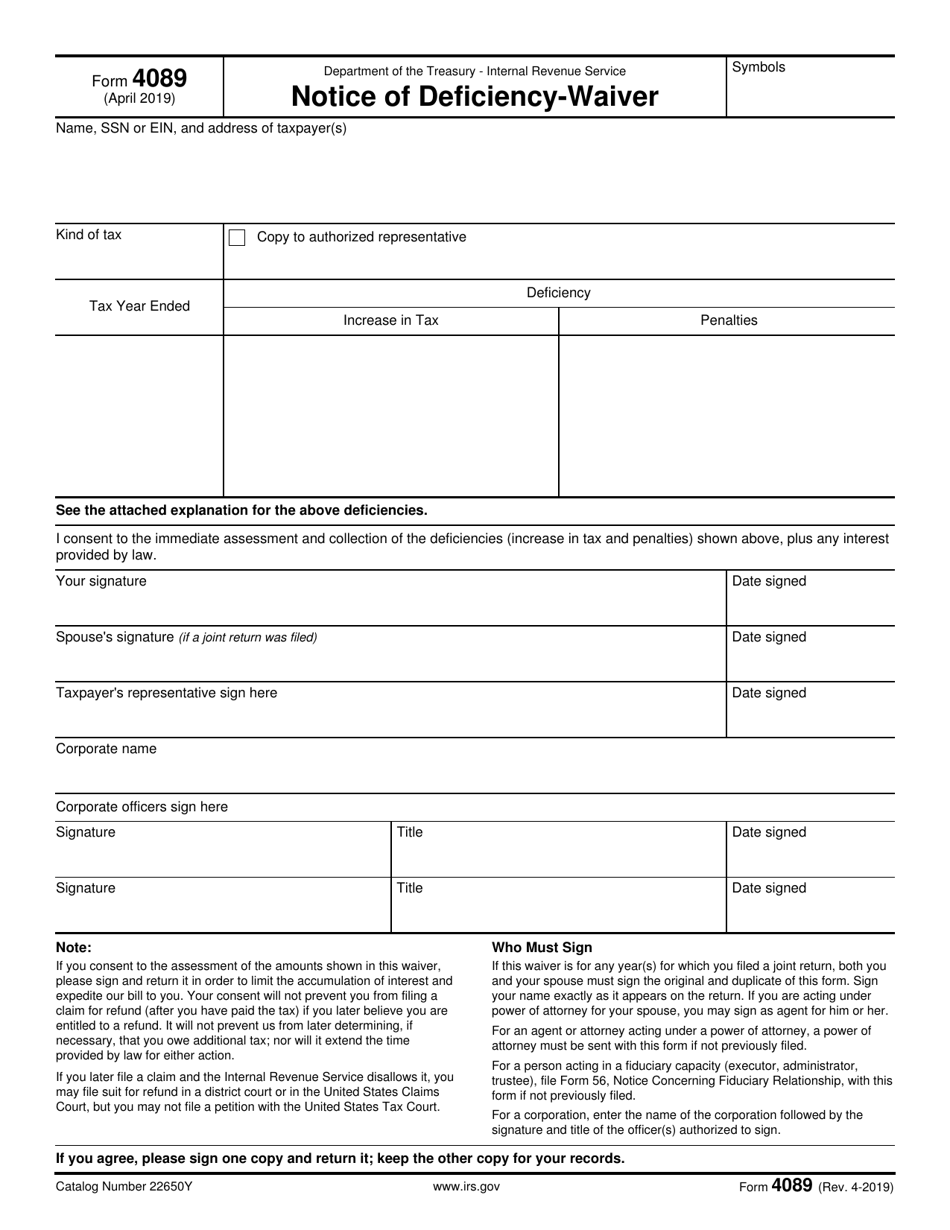

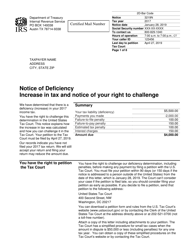

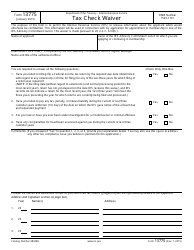

IRS Form 4089 Notice of Deficiency - Waiver

What Is IRS Form 4089?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on April 1, 2019. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 4089?

A: IRS Form 4089 is the Notice of Deficiency - Waiver form used by the Internal Revenue Service (IRS).

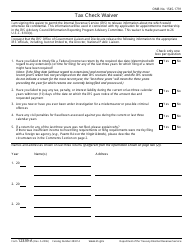

Q: What is the purpose of IRS Form 4089?

A: The purpose of IRS Form 4089 is to notify taxpayers of a deficiency in their tax return and provide an opportunity to either agree to the proposed changes or request a review.

Q: When should I expect to receive IRS Form 4089?

A: You should expect to receive IRS Form 4089 after the IRS has conducted a review of your tax return and determined that changes or adjustments are required.

Q: How do I respond to IRS Form 4089?

A: You can respond to IRS Form 4089 by signing and returning the form, indicating your agreement to the proposed changes, or by requesting a review of the proposed changes.

Q: What happens if I do not respond to IRS Form 4089?

A: If you do not respond to IRS Form 4089 within the specified timeframe, the proposed changes to your tax return will be assessed and become final.

Q: Can I appeal the changes proposed in IRS Form 4089?

A: Yes, you have the right to appeal the changes proposed in IRS Form 4089 by requesting a review within the specified timeframe.

Q: Is it possible to waive the right to receive IRS Form 4089?

A: Yes, it is possible to waive the right to receive IRS Form 4089 by signing a waiver form provided by the IRS.

Q: What should I do if I disagree with the proposed changes in IRS Form 4089?

A: If you disagree with the proposed changes in IRS Form 4089, you should request a review or seek professional assistance to address the matter.

Q: Are there any penalties for not responding to IRS Form 4089?

A: Failure to respond to IRS Form 4089 can result in the assessment of additional penalties and interest on the proposed changes.

Form Details:

- A 1-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 4089 through the link below or browse more documents in our library of IRS Forms.