This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 1040 (1040-SR) Schedule R

for the current year.

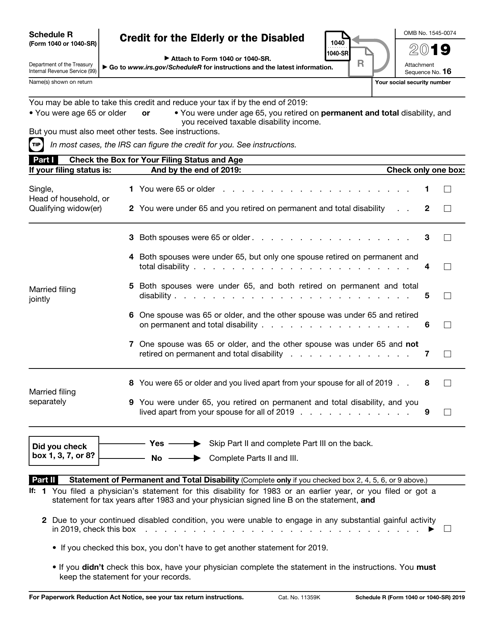

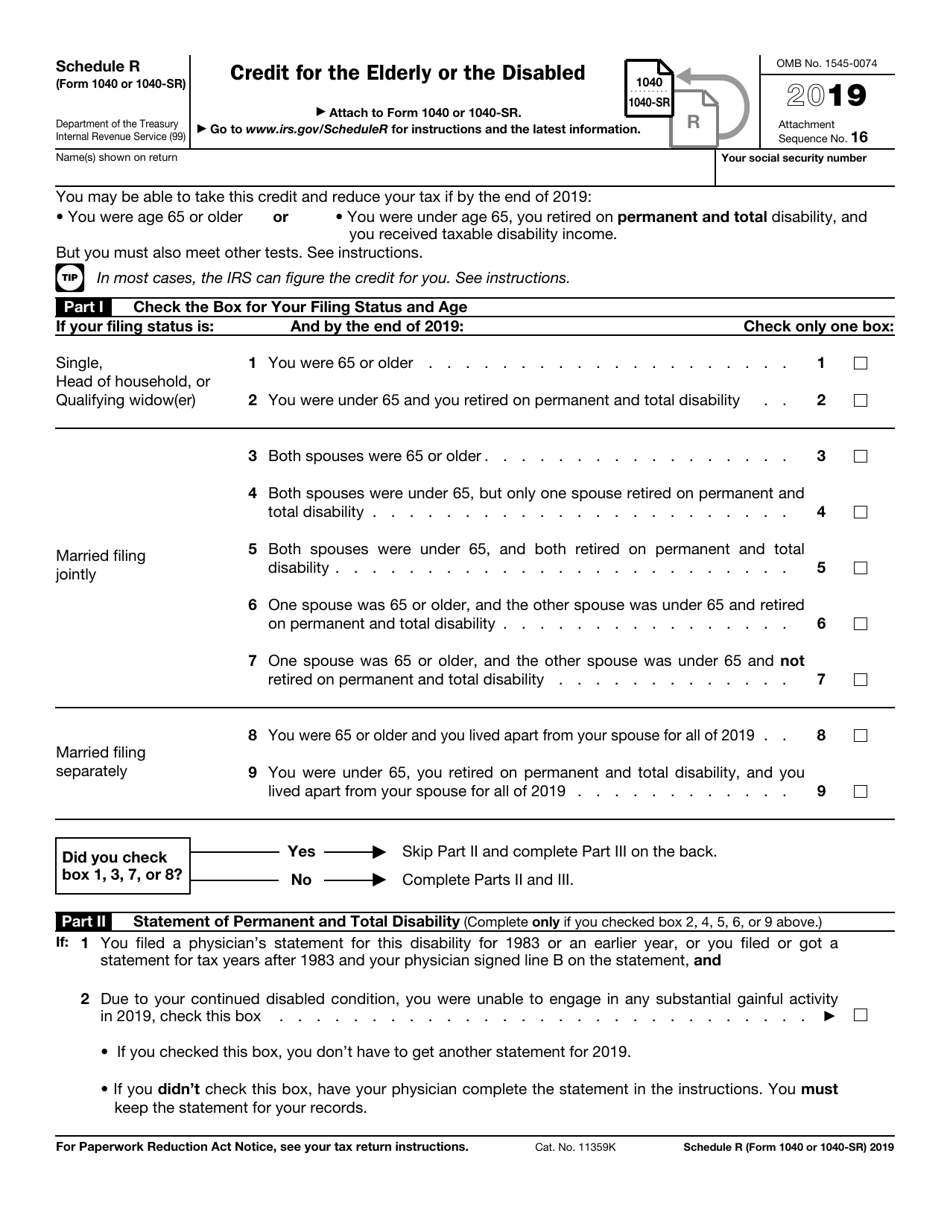

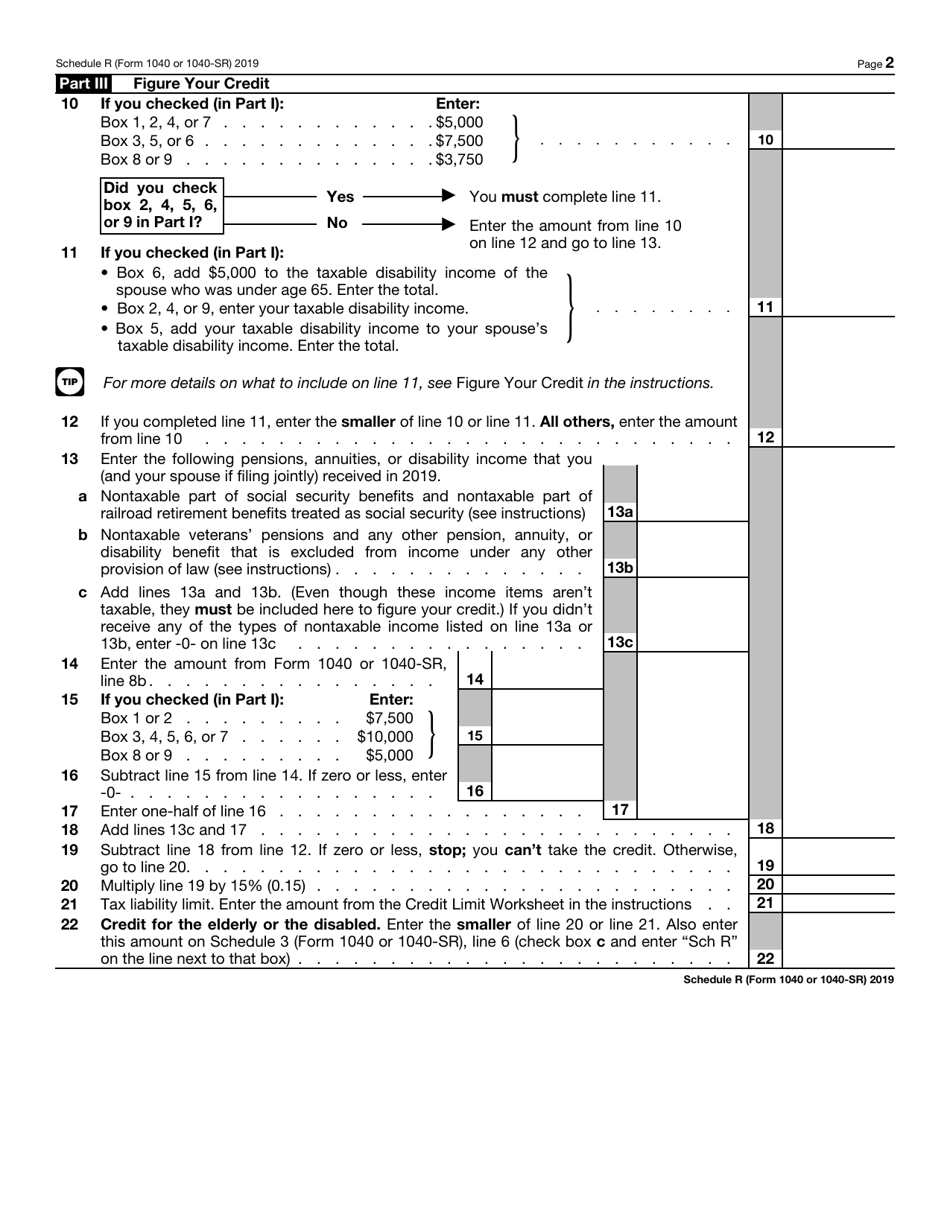

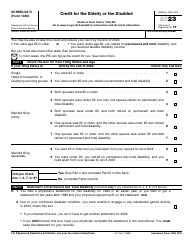

IRS Form 1040 (1040-SR) Schedule R Credit for the Elderly or the Disabled

What Is IRS Form 1040 (1040-SR) Schedule R?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. The document is a supplement to IRS Form 1040, and IRS Form 1040-SR. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 1040?

A: IRS Form 1040 is an individual income tax return form used by taxpayers to report their income and determine their tax liability.

Q: What is IRS Form 1040-SR?

A: IRS Form 1040-SR is a simplified version of Form 1040 specifically designed for taxpayers who are 65 years or older.

Q: What is Schedule R?

A: Schedule R is a form that is used to claim the Credit for the Elderly or the Disabled. It is filed along with either Form 1040 or 1040-SR.

Q: Who is eligible for the Credit for the Elderly or the Disabled?

A: Taxpayers who are either 65 years or older, or permanently and totally disabled may be eligible for this credit.

Q: What expenses are considered for this credit?

A: Qualified expenses include in-home care expenses, medical expenses, and certain retirement home expenses.

Q: How much is the credit?

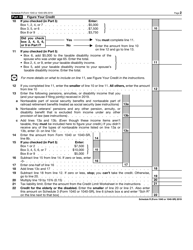

A: The credit amount varies based on the individual's income, filing status, and other factors. It is calculated using a specific formula provided by the IRS.

Q: How do I claim the credit?

A: To claim the credit, you need to complete and attach Schedule R to your Form 1040 or 1040-SR. You will also need to meet certain eligibility criteria.

Q: Can I claim this credit for someone else?

A: No, the credit can only be claimed by the taxpayer who meets the eligibility requirements.

Form Details:

- A 2-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1040 (1040-SR) Schedule R through the link below or browse more documents in our library of IRS Forms.