This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 990 Schedule M

for the current year.

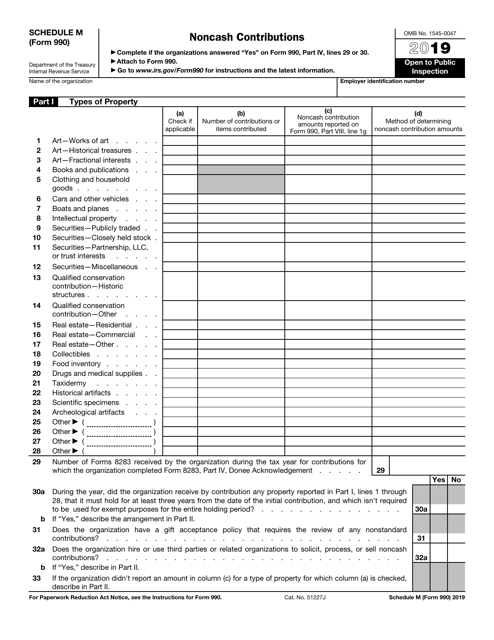

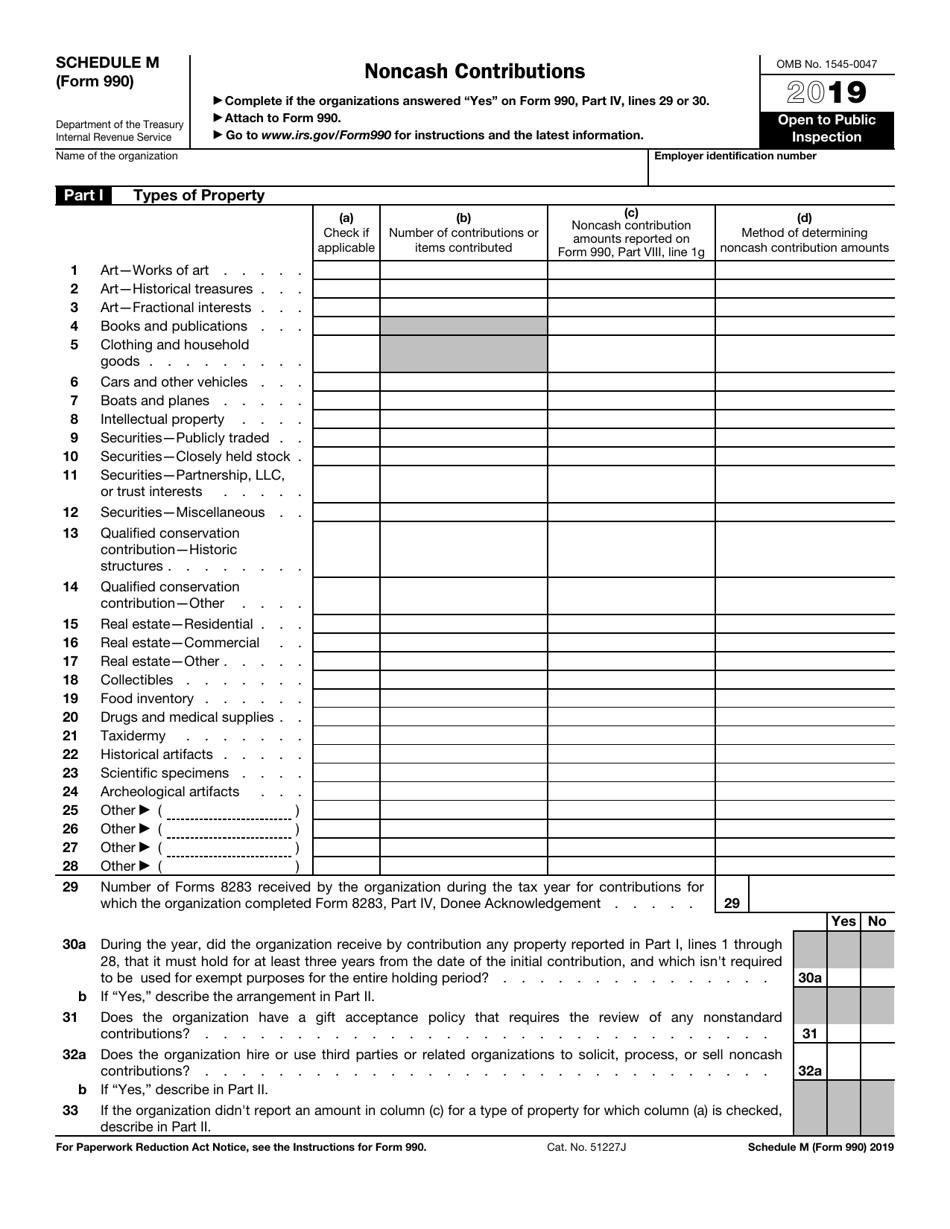

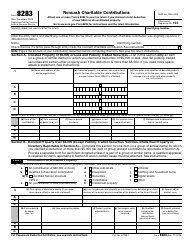

IRS Form 990 Schedule M Noncash Contributions

What Is IRS Form 990 Schedule M?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. The document is a supplement to IRS Form 990, Return of Organization Exempt From Income Tax. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 990 Schedule M?

A: IRS Form 990 Schedule M is a tax form used by tax-exempt organizations to report noncash contributions they receive.

Q: Who needs to file IRS Form 990 Schedule M?

A: Tax-exempt organizations that receive noncash contributions totaling $5,000 or more during the tax year need to file IRS Form 990 Schedule M.

Q: What are noncash contributions?

A: Noncash contributions are donations made in the form of property or assets, rather than money.

Q: What information is required to fill out IRS Form 990 Schedule M?

A: IRS Form 990 Schedule M requires organizations to provide details about the noncash contributions they received, including a description of the property, its fair market value, how it was used by the organization, and the method used to determine its value.

Q: When is IRS Form 990 Schedule M due?

A: IRS Form 990 Schedule M is typically due along with the organization's annual Form 990 filing, which is due on the 15th day of the 5th month after the end of the organization's tax year.

Form Details:

- A 5-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 990 Schedule M through the link below or browse more documents in our library of IRS Forms.