This version of the form is not currently in use and is provided for reference only. Download this version of

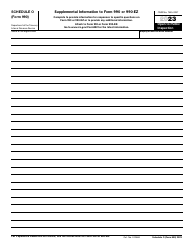

IRS Form 990 (990-EZ) Schedule G

for the current year.

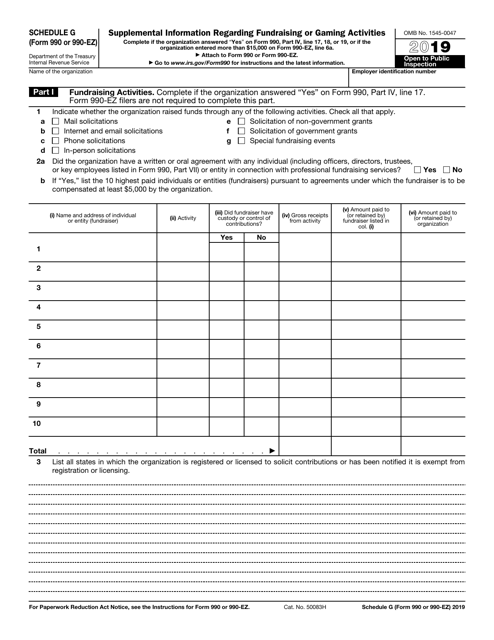

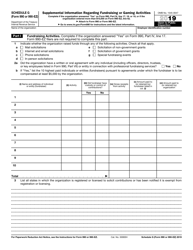

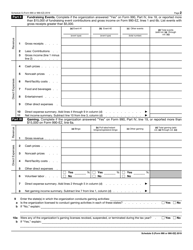

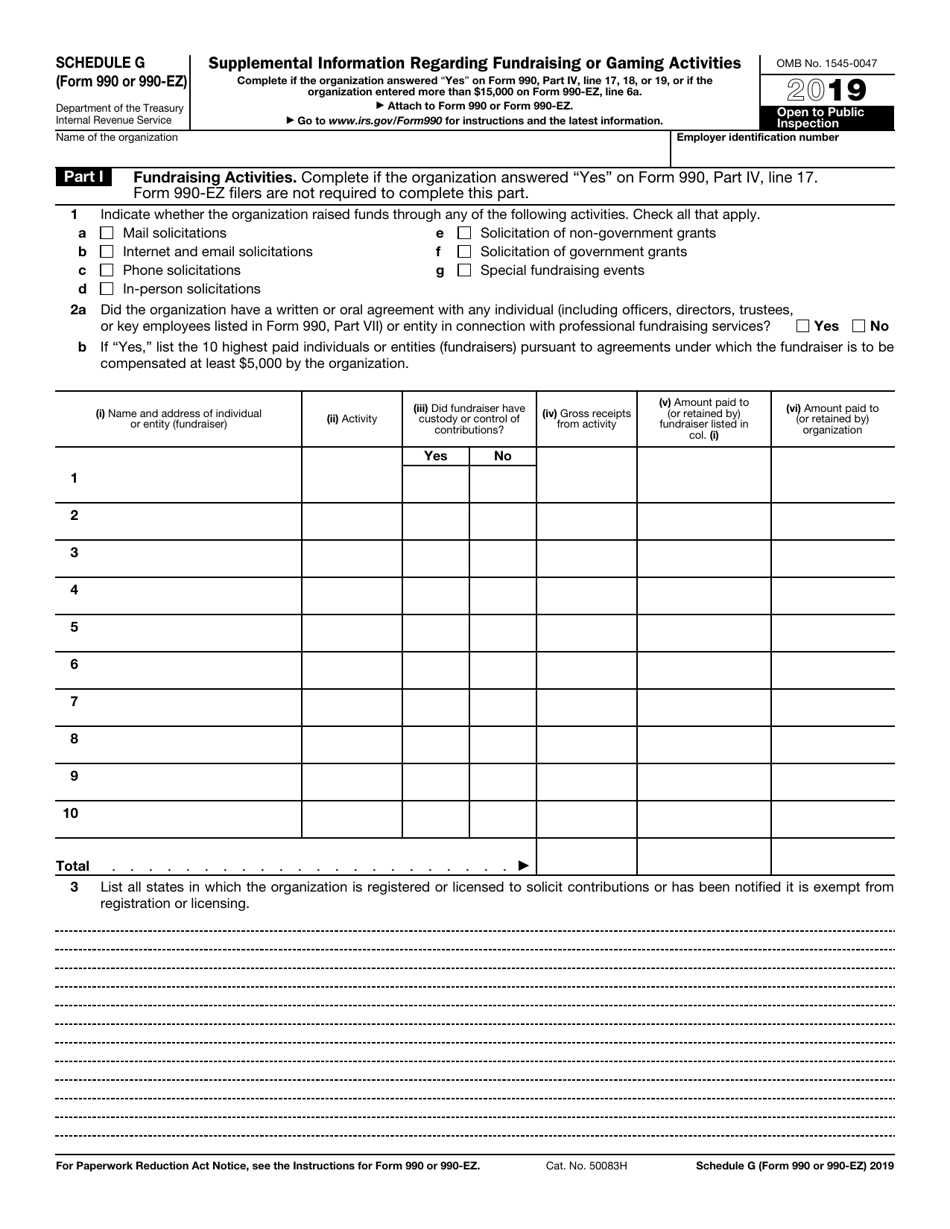

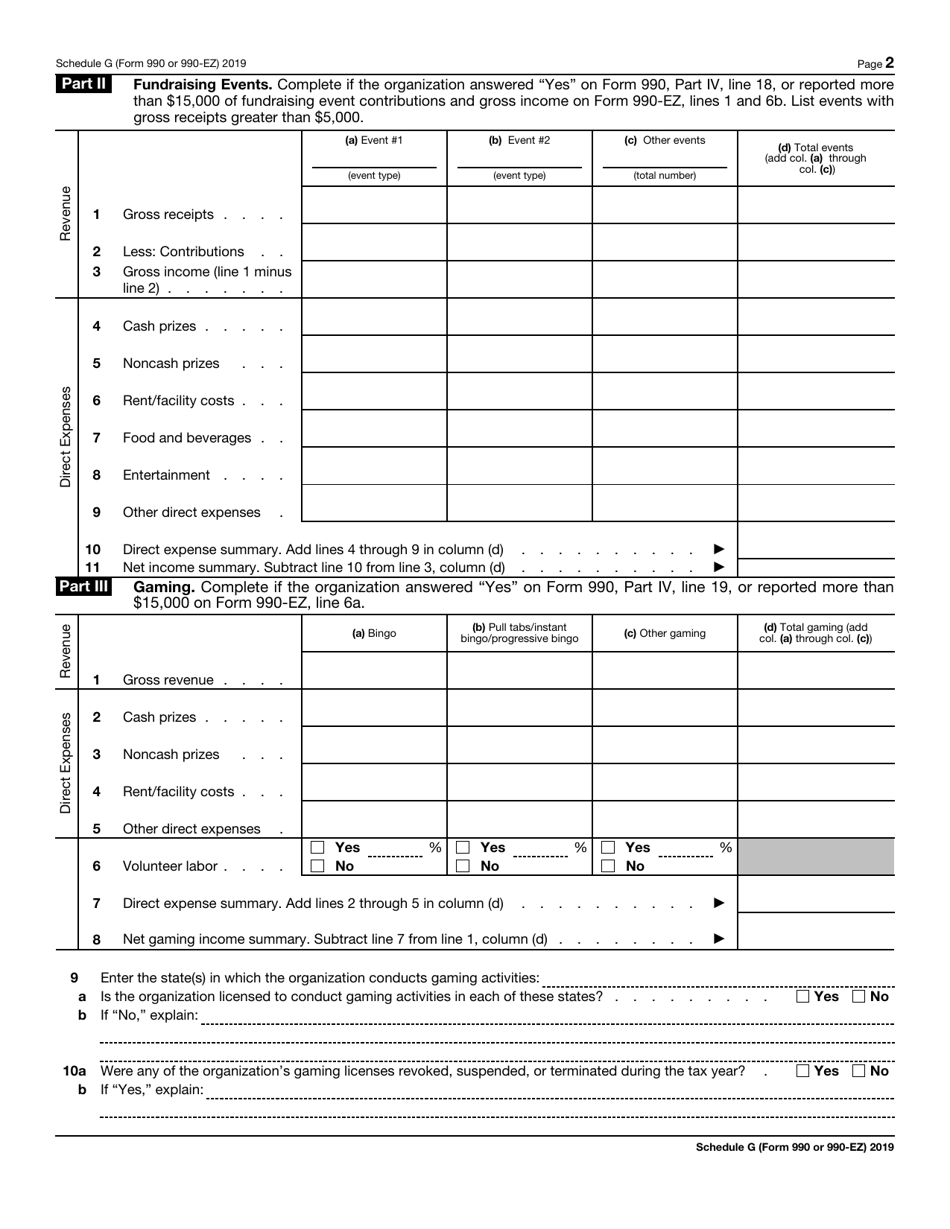

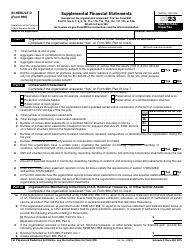

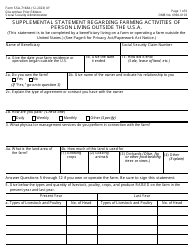

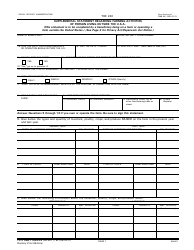

IRS Form 990 (990-EZ) Schedule G Supplemental Information Regarding Fundraising or Gaming Activities

What Is IRS Form 990 (990-EZ) Schedule G?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. The document is a supplement to IRS Form 990, and IRS Form 990-EZ. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 990 (990-EZ) Schedule G?

A: IRS Form 990 (990-EZ) Schedule G is a supplemental form that provides information regarding fundraising or gaming activities for organizations filing Form 990 or Form 990-EZ.

Q: Who needs to file IRS Form 990 (990-EZ) Schedule G?

A: Nonprofit organizations that engage in fundraising or gaming activities and are required to file Form 990 or Form 990-EZ with the IRS need to file Schedule G.

Q: Why do organizations need to file IRS Form 990 (990-EZ) Schedule G?

A: Organizations file Schedule G to provide additional details and information about their fundraising or gaming activities, including any significant events or transactions.

Q: What information is required on IRS Form 990 (990-EZ) Schedule G?

A: IRS Form 990 (990-EZ) Schedule G requires organizations to provide details about their fundraising or gaming activities, such as the types of activities conducted, revenues generated, and expenses incurred.

Q: When is IRS Form 990 (990-EZ) Schedule G due?

A: IRS Form 990 (990-EZ) Schedule G is due at the same time as the organization's Form 990 or Form 990-EZ, which is typically the 15th day of the fifth month after the end of the organization's fiscal year.

Q: Are there any penalties for not filing IRS Form 990 (990-EZ) Schedule G?

A: Yes, failure to file IRS Form 990 (990-EZ) Schedule G or providing incomplete or inaccurate information may result in penalties imposed by the IRS.

Q: Can organizations e-file IRS Form 990 (990-EZ) Schedule G?

A: Yes, organizations can e-file IRS Form 990 (990-EZ) Schedule G using the IRS Modernized e-File (MeF) system or through an authorized e-file provider.

Form Details:

- A 3-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 990 (990-EZ) Schedule G through the link below or browse more documents in our library of IRS Forms.