This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 990 Schedule K

for the current year.

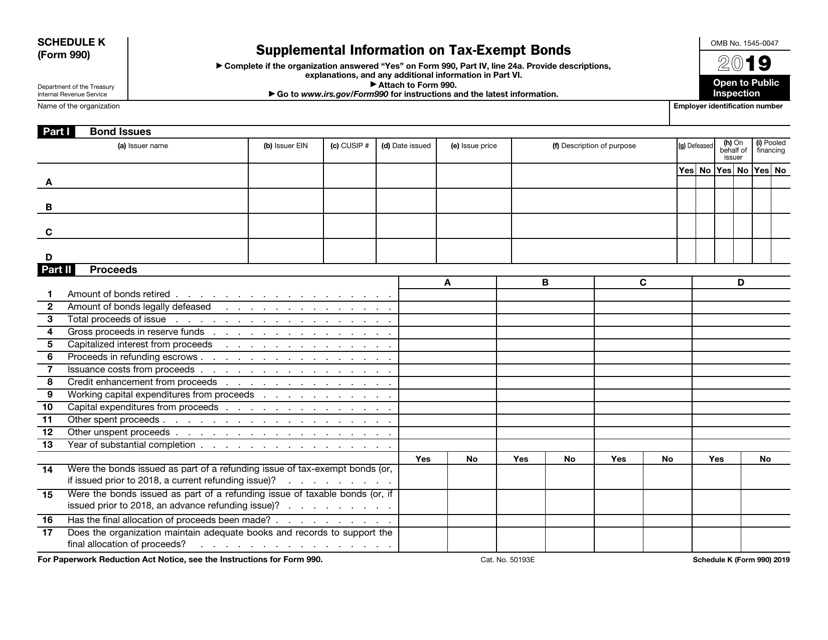

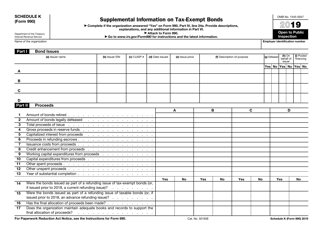

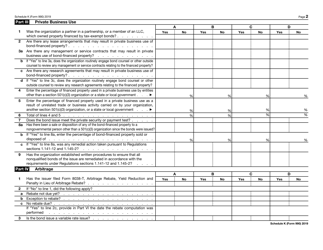

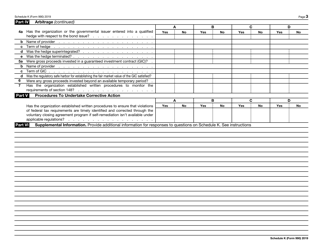

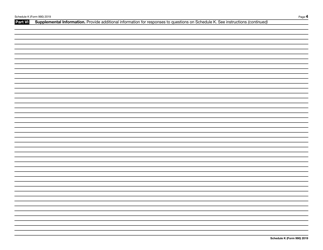

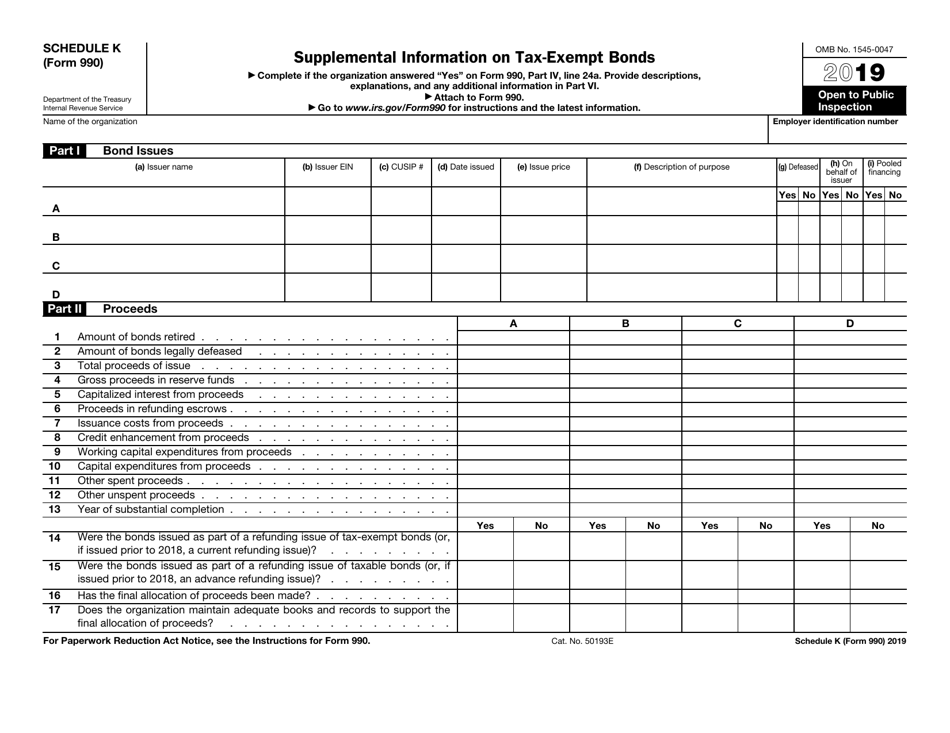

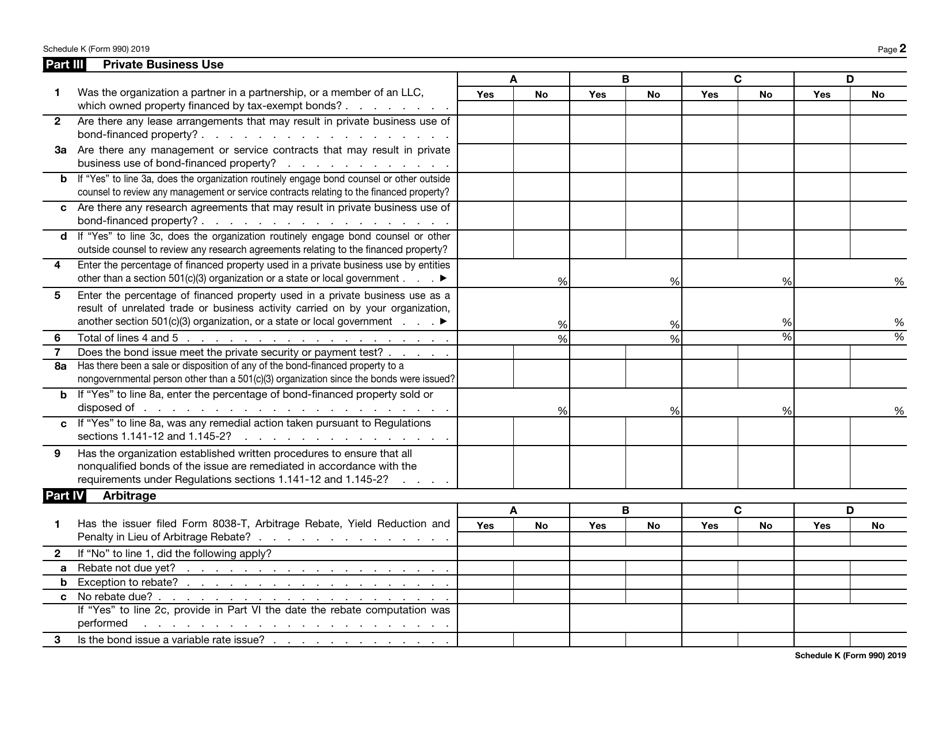

IRS Form 990 Schedule K Supplemental Information on Tax-Exempt Bonds

What Is IRS Form 990 Schedule K?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. The document is a supplement to IRS Form 990, Return of Organization Exempt From Income Tax. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 990 Schedule K?

A: IRS Form 990 Schedule K is a supplemental form that provides information about tax-exempt bonds that a tax-exempt organization may have issued or used.

Q: Who needs to file IRS Form 990 Schedule K?

A: Tax-exempt organizations that have issued or used tax-exempt bonds need to file IRS Form 990 Schedule K.

Q: What information does IRS Form 990 Schedule K require?

A: IRS Form 990 Schedule K requires information about the tax-exempt bonds, such as the bond issuer, bond issue date, bond purpose, and bond proceeds.

Q: Is IRS Form 990 Schedule K publicly available?

A: Yes, IRS Form 990 Schedule K is a public document and can be accessed by anyone who wishes to review it.

Q: Are there any penalties for not filing IRS Form 990 Schedule K?

A: Yes, there may be penalties for not filing IRS Form 990 Schedule K. It is important for tax-exempt organizations to comply with all IRS filing requirements to avoid potential penalties.

Form Details:

- A 4-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 990 Schedule K through the link below or browse more documents in our library of IRS Forms.