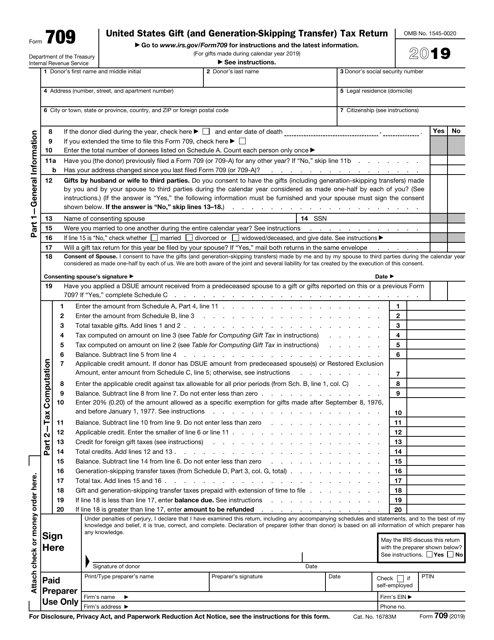

This version of the form is not currently in use and is provided for reference only. Download this version of

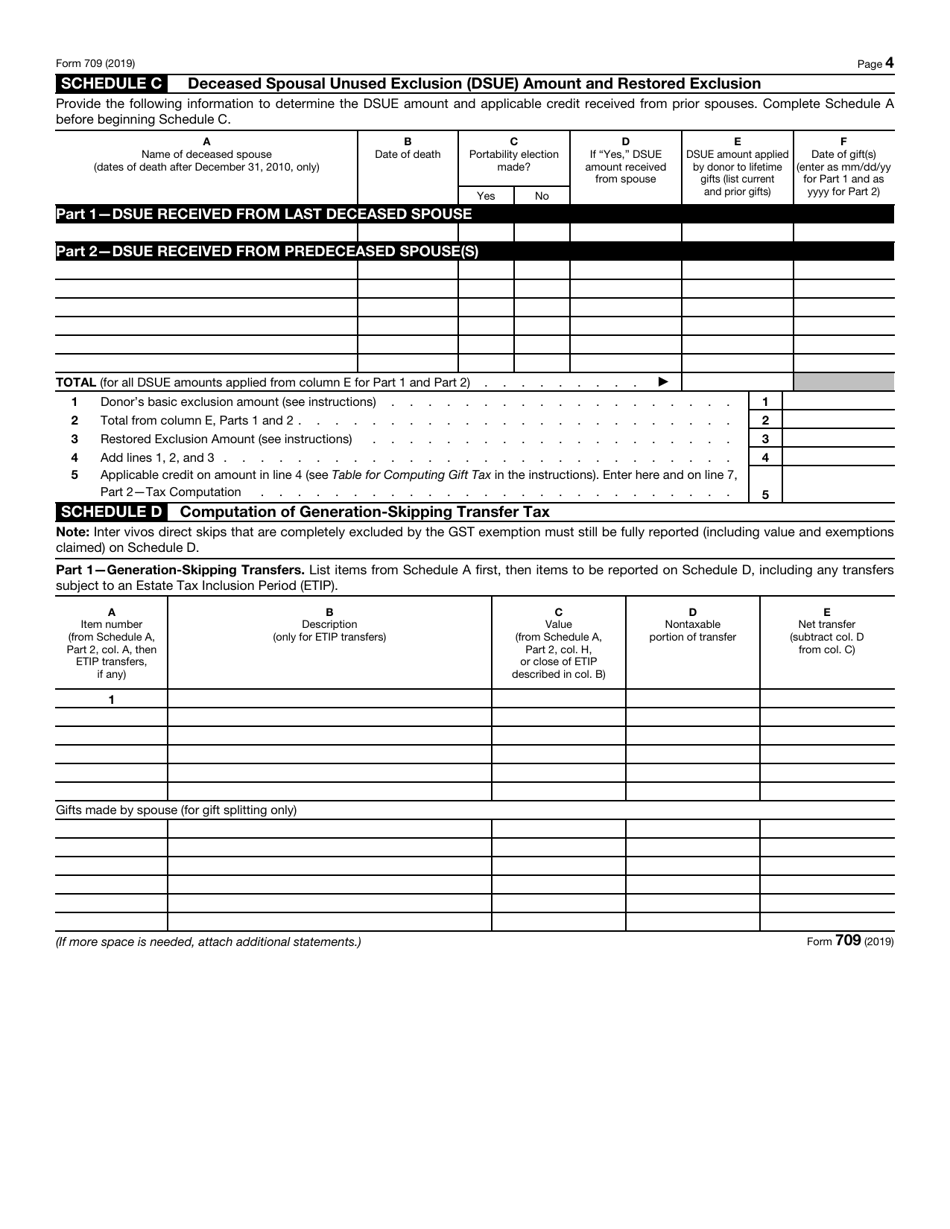

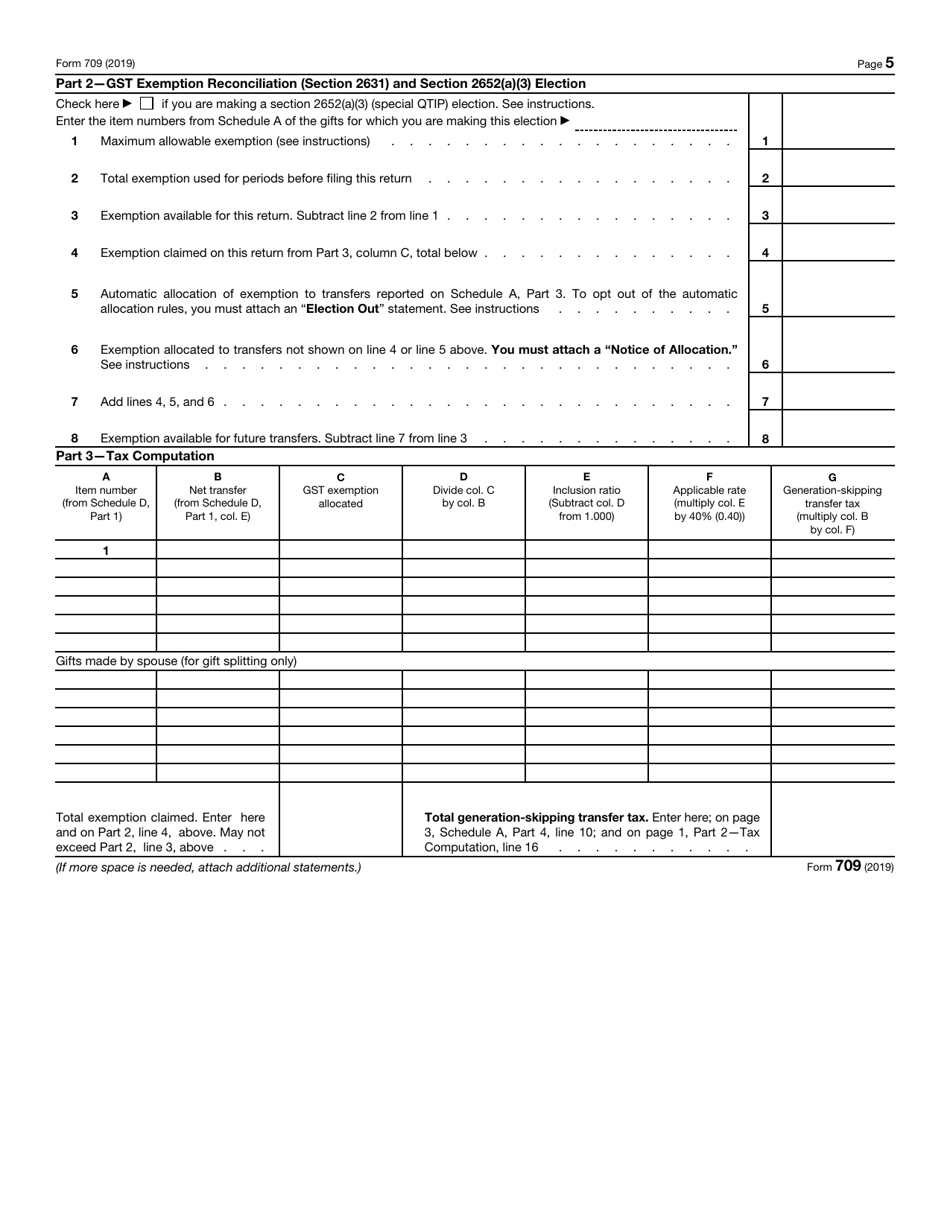

IRS Form 709

for the current year.

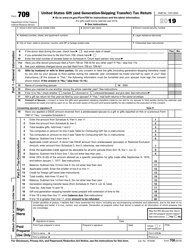

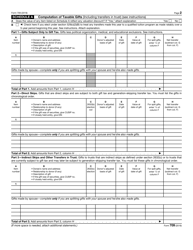

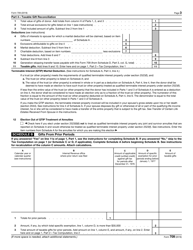

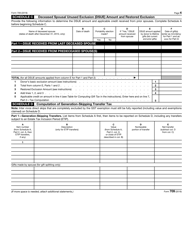

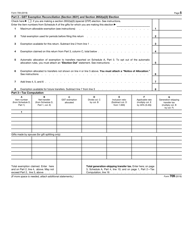

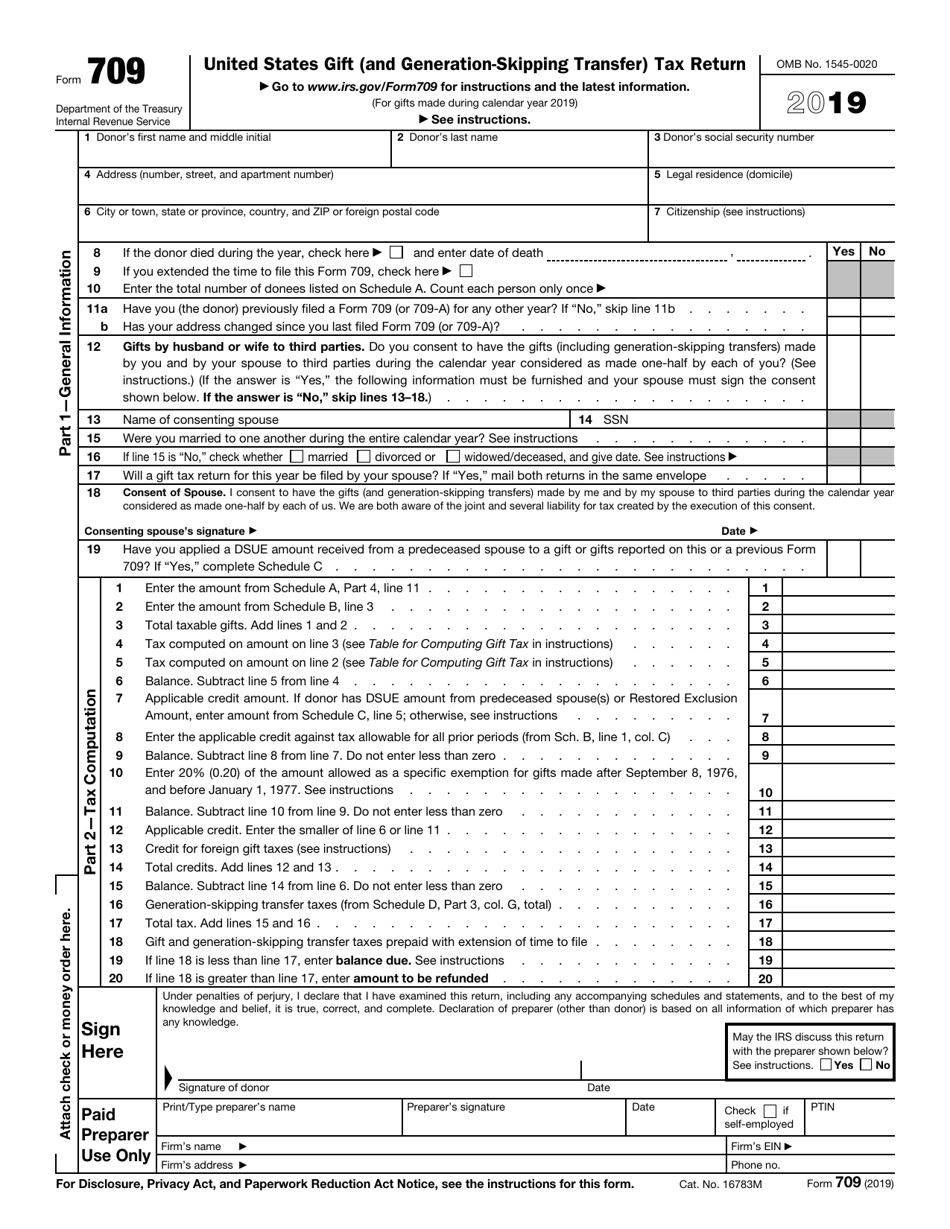

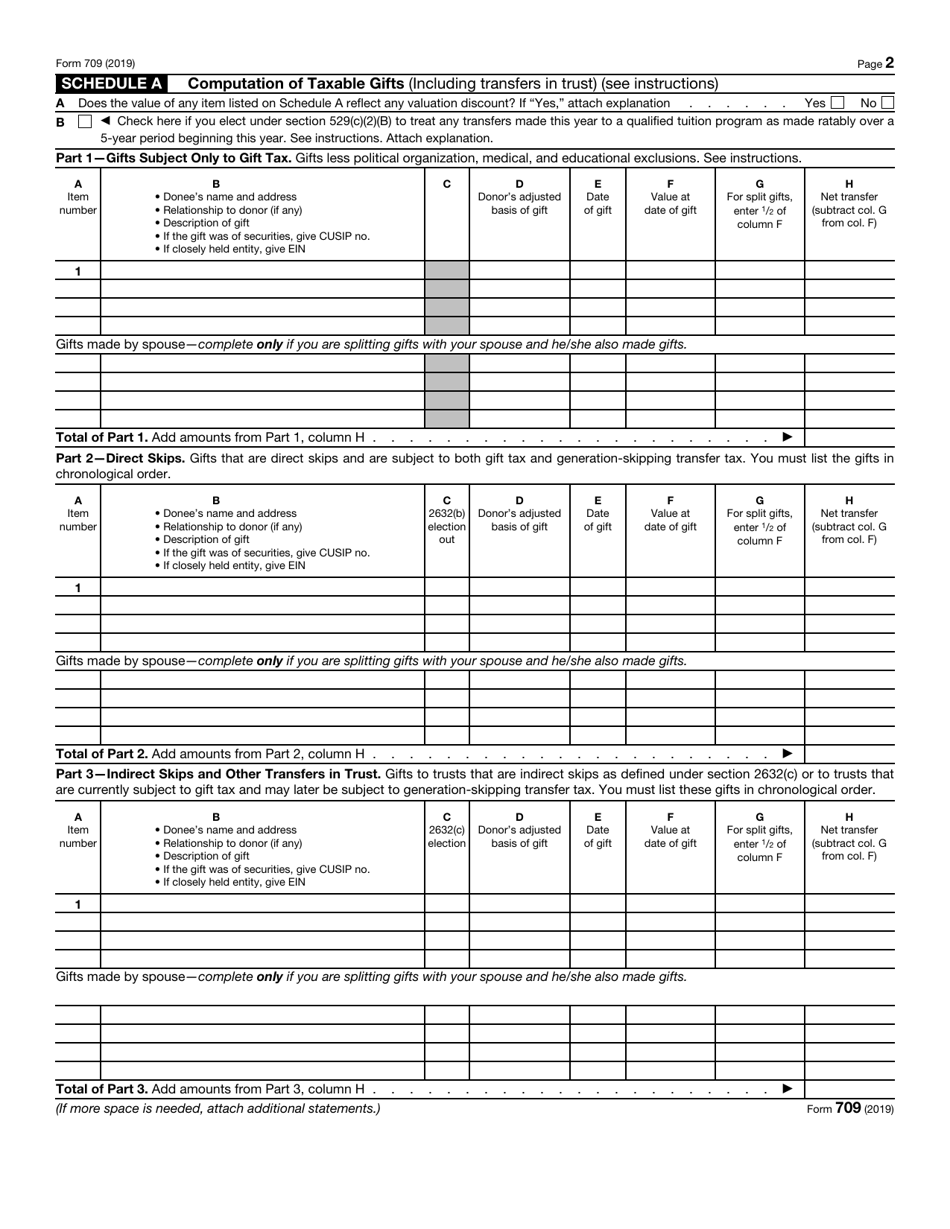

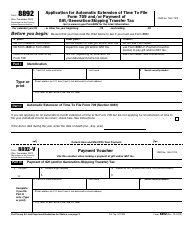

IRS Form 709 United States Gift (And Generation-Skipping Transfer) Tax Return

What Is IRS Form 709?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 709?

A: IRS Form 709 is the United States Gift (And Generation-Skipping Transfer) Tax Return.

Q: Who needs to file IRS Form 709?

A: You need to file IRS Form 709 if you made gifts during the tax year that exceed the annual exclusion amount.

Q: What is the purpose of IRS Form 709?

A: The purpose of IRS Form 709 is to report gifts made during the tax year that exceed the annual exclusion amount and calculate any gift tax liability.

Q: What is the annual exclusion amount for gifts?

A: The annual exclusion amount for gifts is the maximum value of gifts that can be given to an individual each year without incurring gift tax. The current annual exclusion amount is $15,000 per recipient.

Q: Are all gifts subject to gift tax?

A: No, not all gifts are subject to gift tax. Gifts that are below the annual exclusion amount are generally not subject to gift tax.

Q: Is there a lifetime exemption for gift tax?

A: Yes, there is a lifetime exemption for gift tax. The lifetime exemption allows you to give a certain amount in gifts over your lifetime without incurring gift tax. The current lifetime exemption is $11.7 million.

Form Details:

- A 5-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 709 through the link below or browse more documents in our library of IRS Forms.