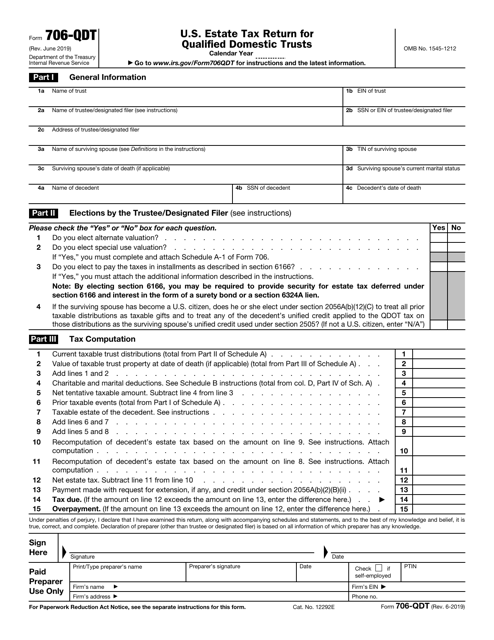

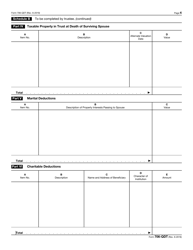

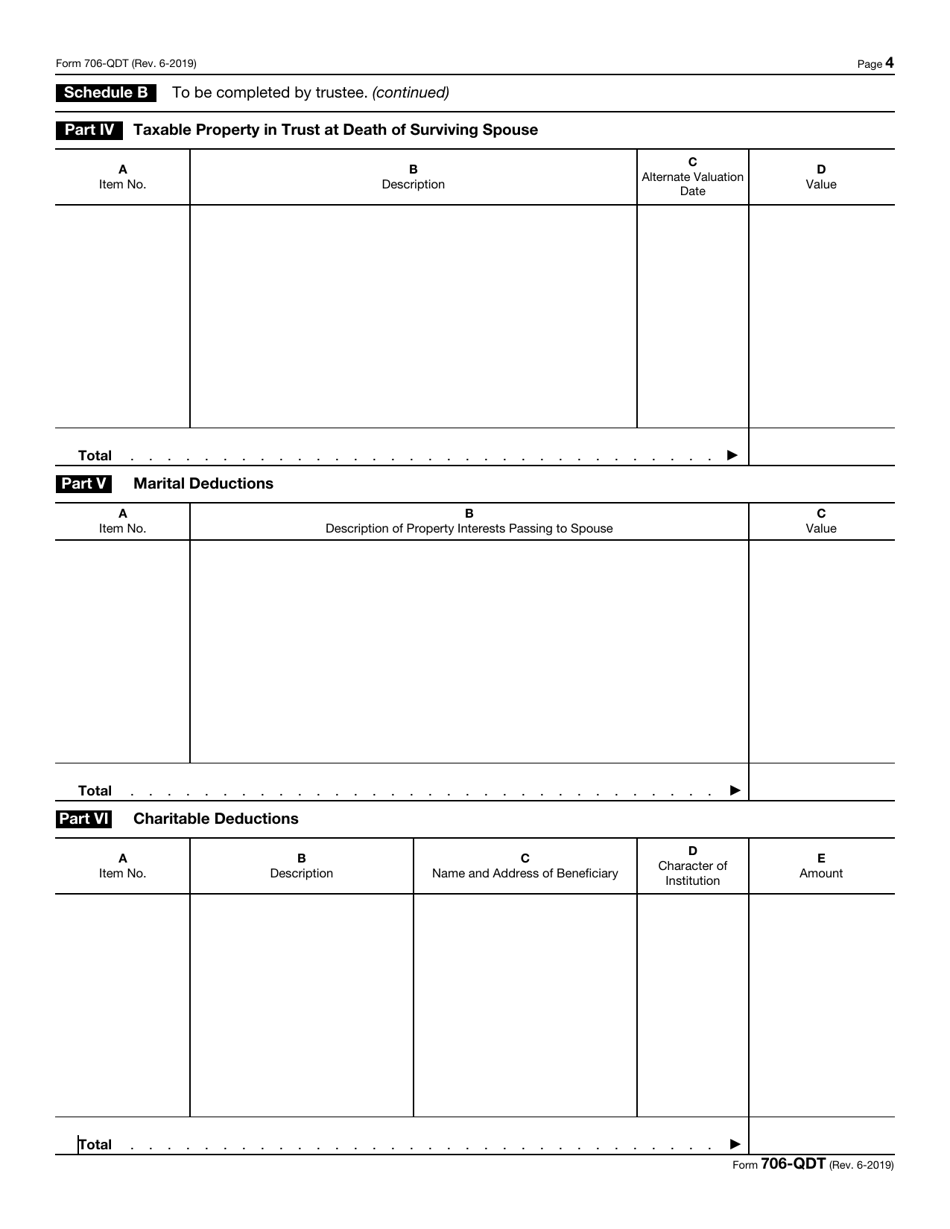

IRS Form 706-QDT U.S. Estate Tax Return for Qualified Domestic Trusts

What Is IRS Form 706-QDT?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on June 1, 2019. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 706-QDT?

A: IRS Form 706-QDT is the U.S. Estate Tax Return for Qualified Domestic Trusts.

Q: Who should file IRS Form 706-QDT?

A: Individuals who are the trustees of qualified domestic trusts should file IRS Form 706-QDT.

Q: What is the purpose of IRS Form 706-QDT?

A: The purpose of IRS Form 706-QDT is to calculate and report the estate tax owed by a qualified domestic trust.

Q: Is IRS Form 706-QDT required for all domestic trusts?

A: No, IRS Form 706-QDT is specifically for qualified domestic trusts.

Q: What information is required to complete IRS Form 706-QDT?

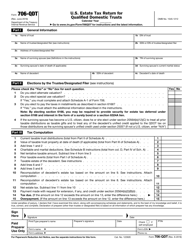

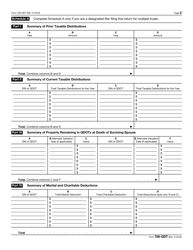

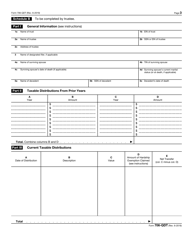

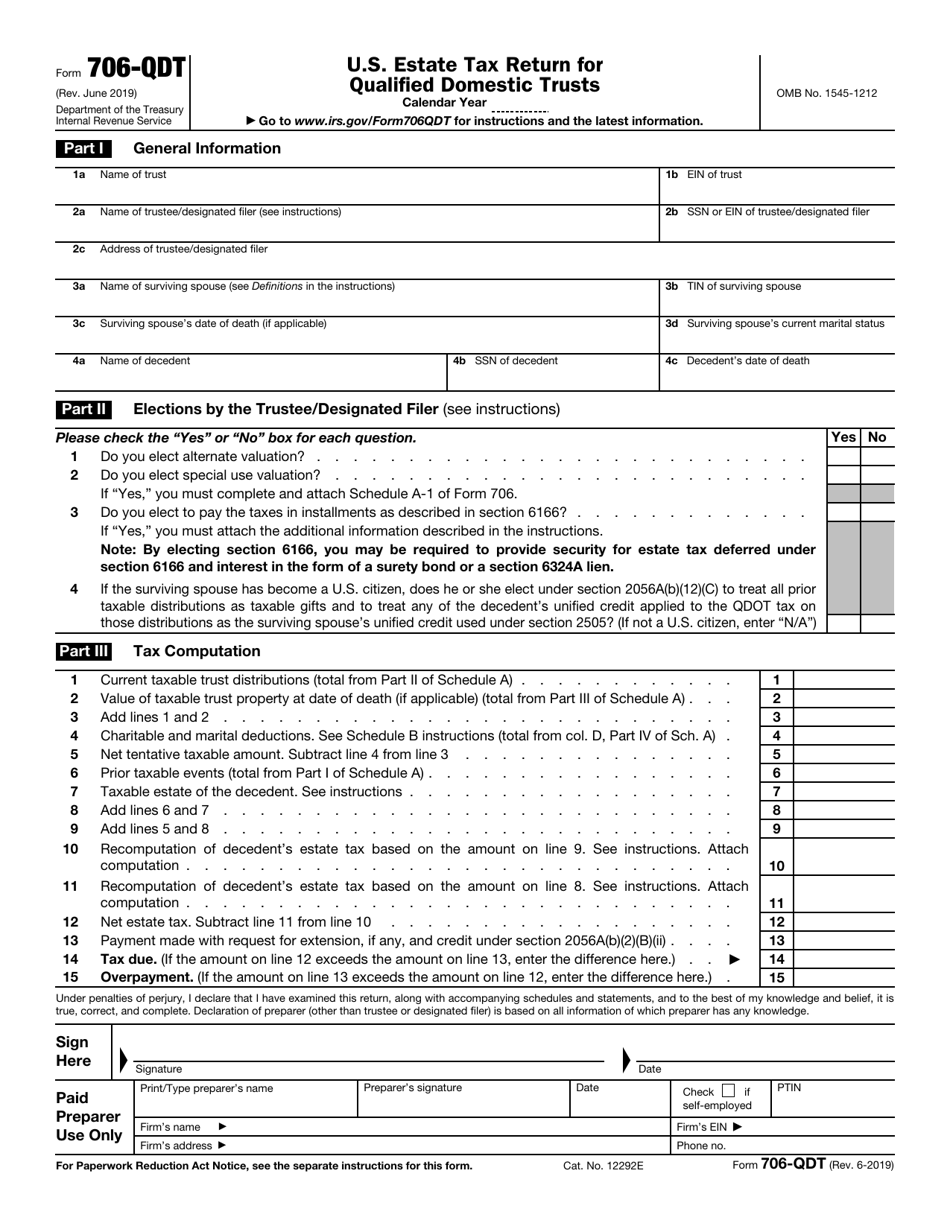

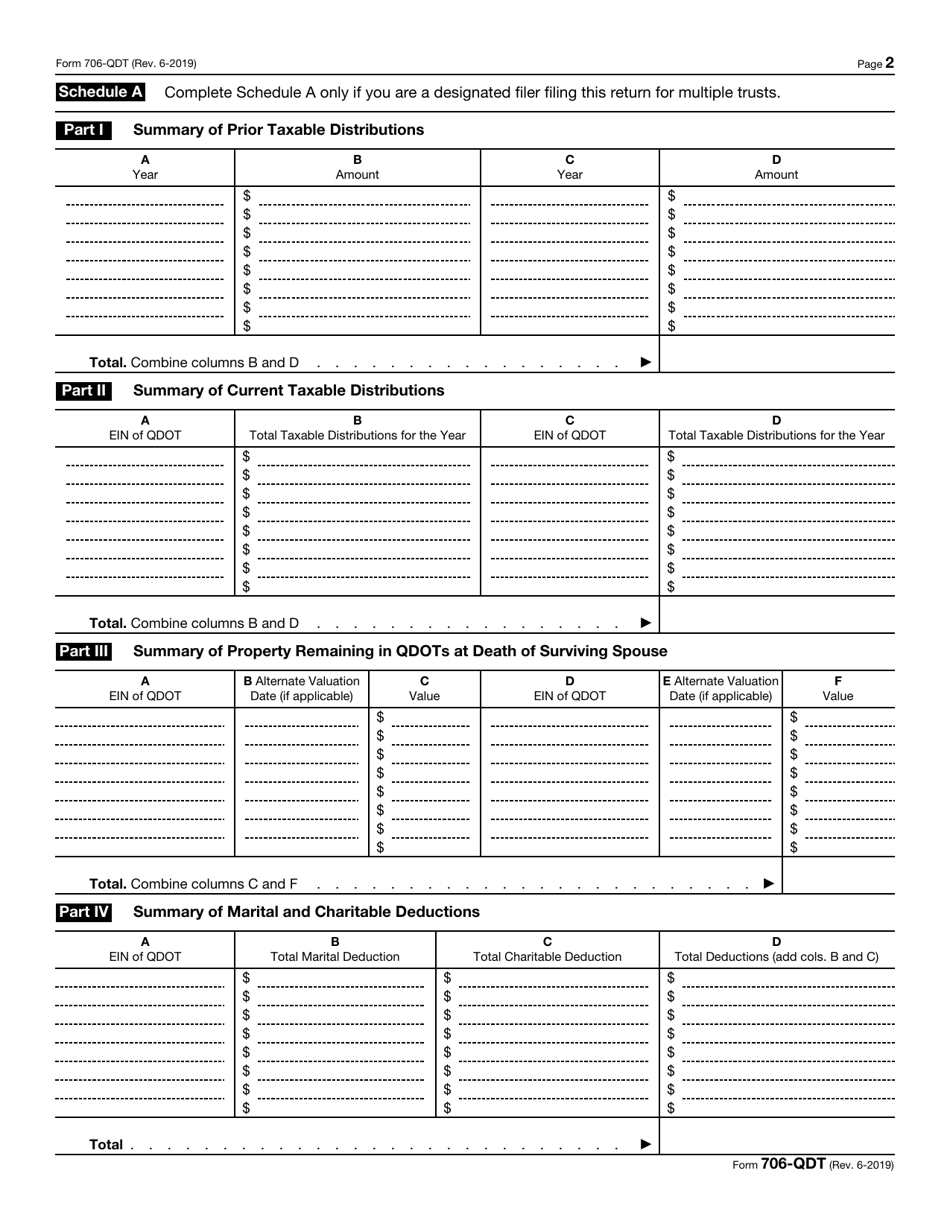

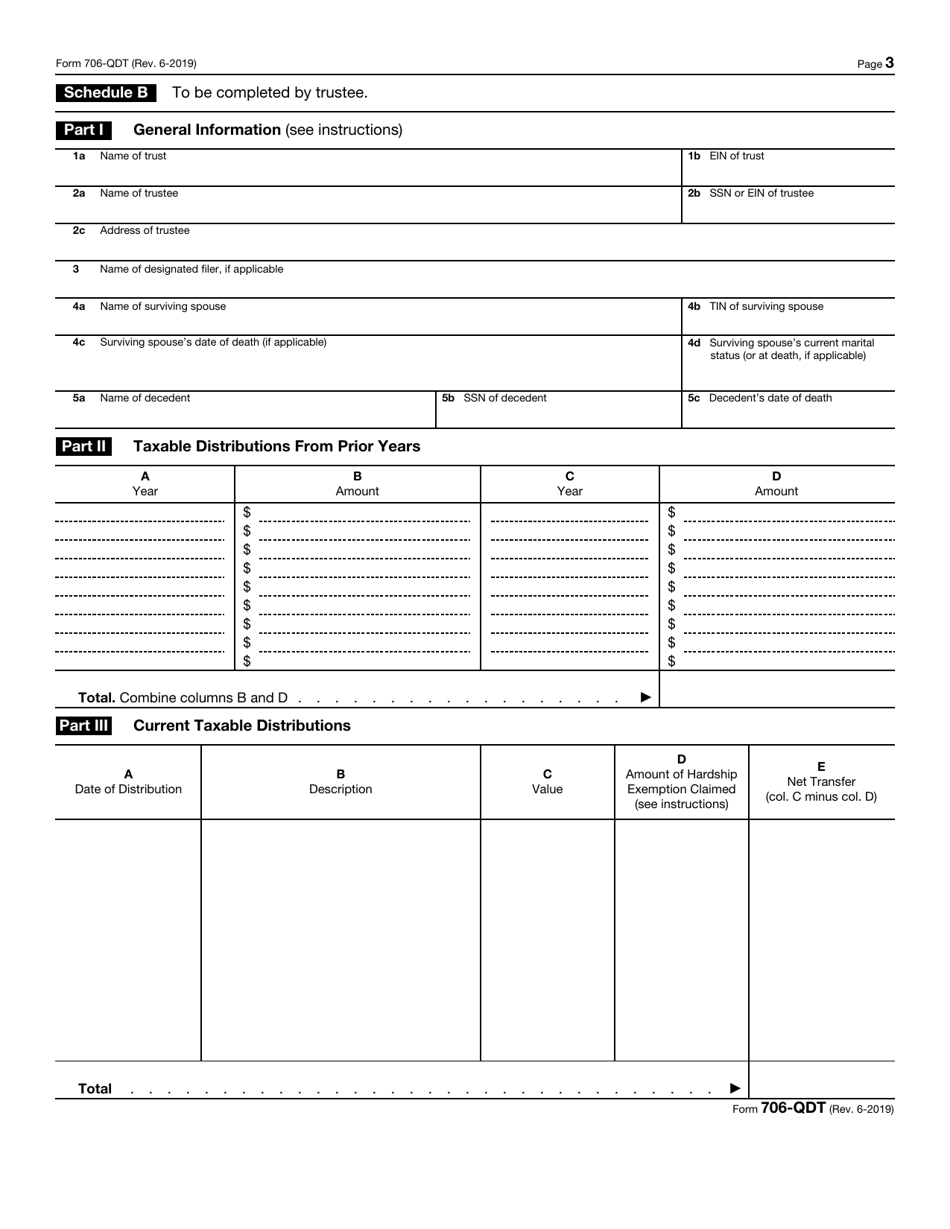

A: IRS Form 706-QDT requires information about the trust, its assets and liabilities, and any distributions made from the trust.

Q: When is the deadline to file IRS Form 706-QDT?

A: The deadline to file IRS Form 706-QDT is generally 9 months after the date of the decedent's death.

Q: Are there any penalties for late filing of IRS Form 706-QDT?

A: Yes, there are penalties for late filing of IRS Form 706-QDT, which can include interest charges and possible additional taxes.

Form Details:

- A 4-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 706-QDT through the link below or browse more documents in our library of IRS Forms.