This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 656

for the current year.

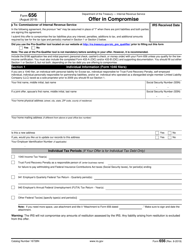

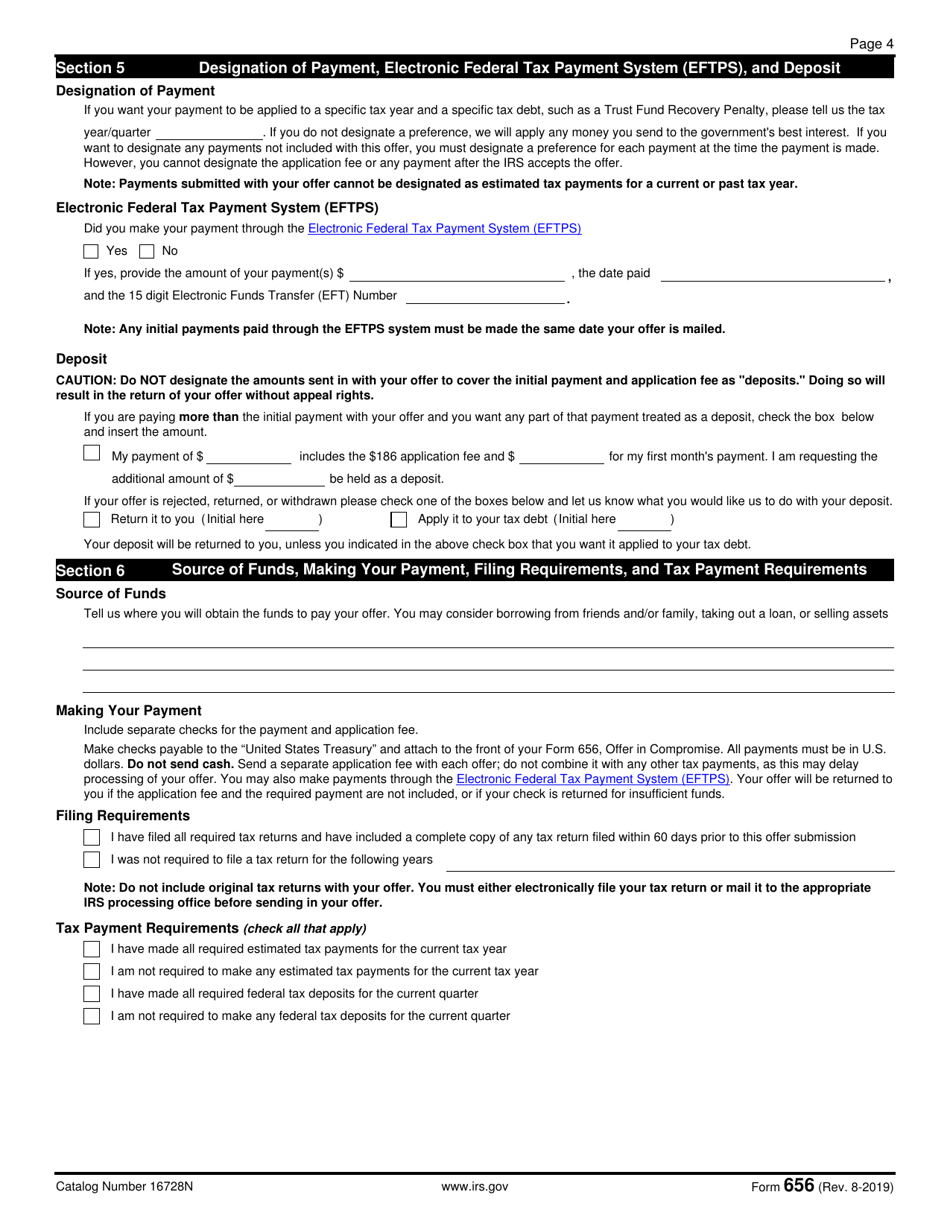

IRS Form 656 Offer in Compromise

What Is IRS Form 656?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on August 1, 2019. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

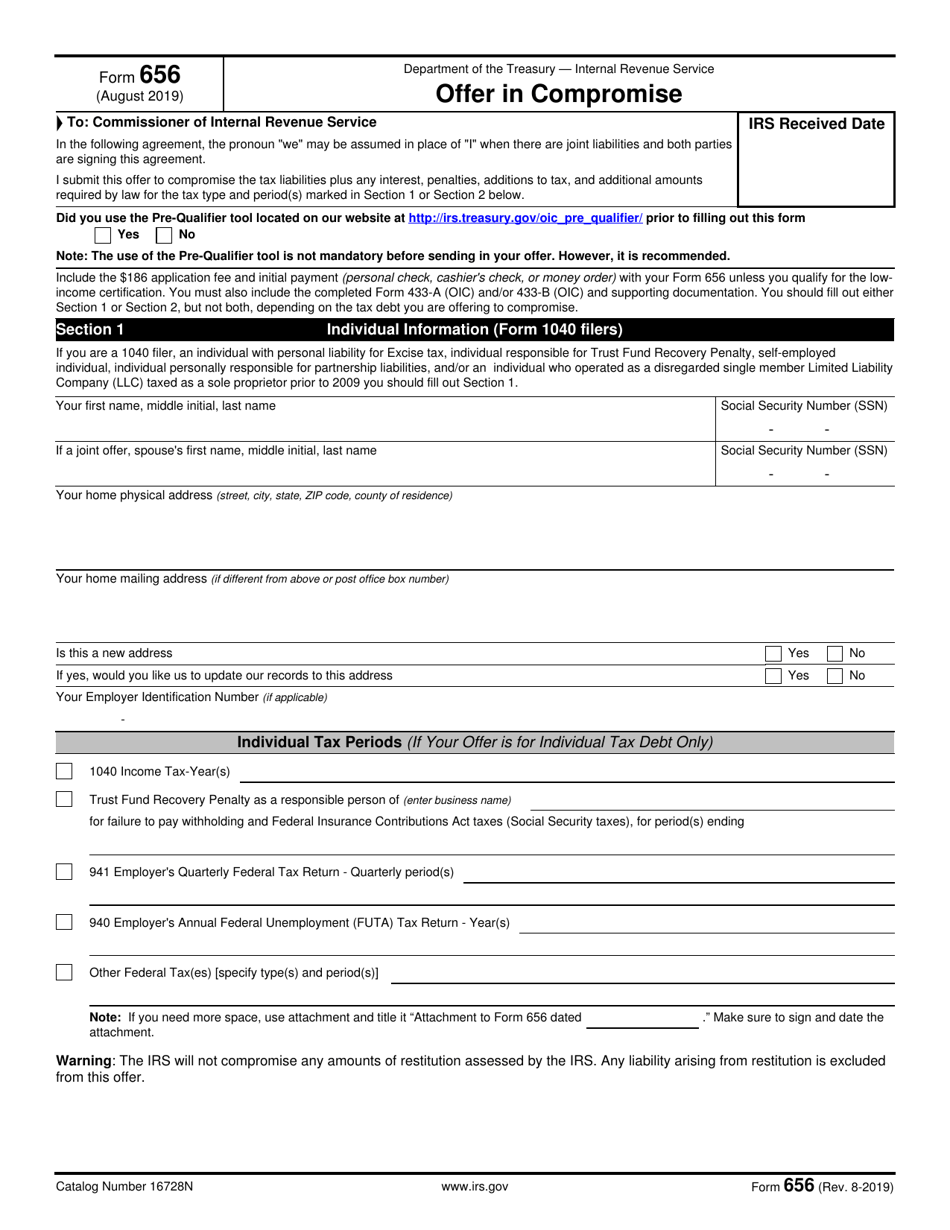

Q: What is IRS Form 656?

A: IRS Form 656 is a document used to propose an Offer in Compromise (OIC) to the Internal Revenue Service (IRS).

Q: What is an Offer in Compromise (OIC)?

A: An Offer in Compromise (OIC) is a program offered by the IRS that allows taxpayers to settle their tax debt for less than the full amount owed.

Q: Who is eligible to submit an Offer in Compromise?

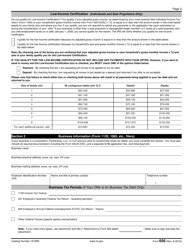

A: Individuals or businesses who are unable to pay their tax debt in full and can demonstrate that the offered amount is the most they can reasonably pay.

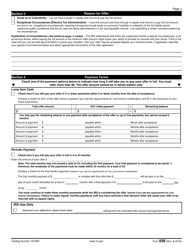

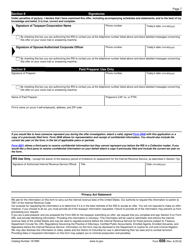

Q: What information is required on IRS Form 656?

A: IRS Form 656 requires detailed financial information, including assets, income, and expenses, to determine the taxpayer's ability to pay.

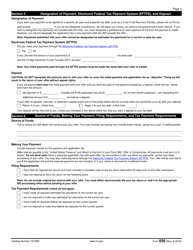

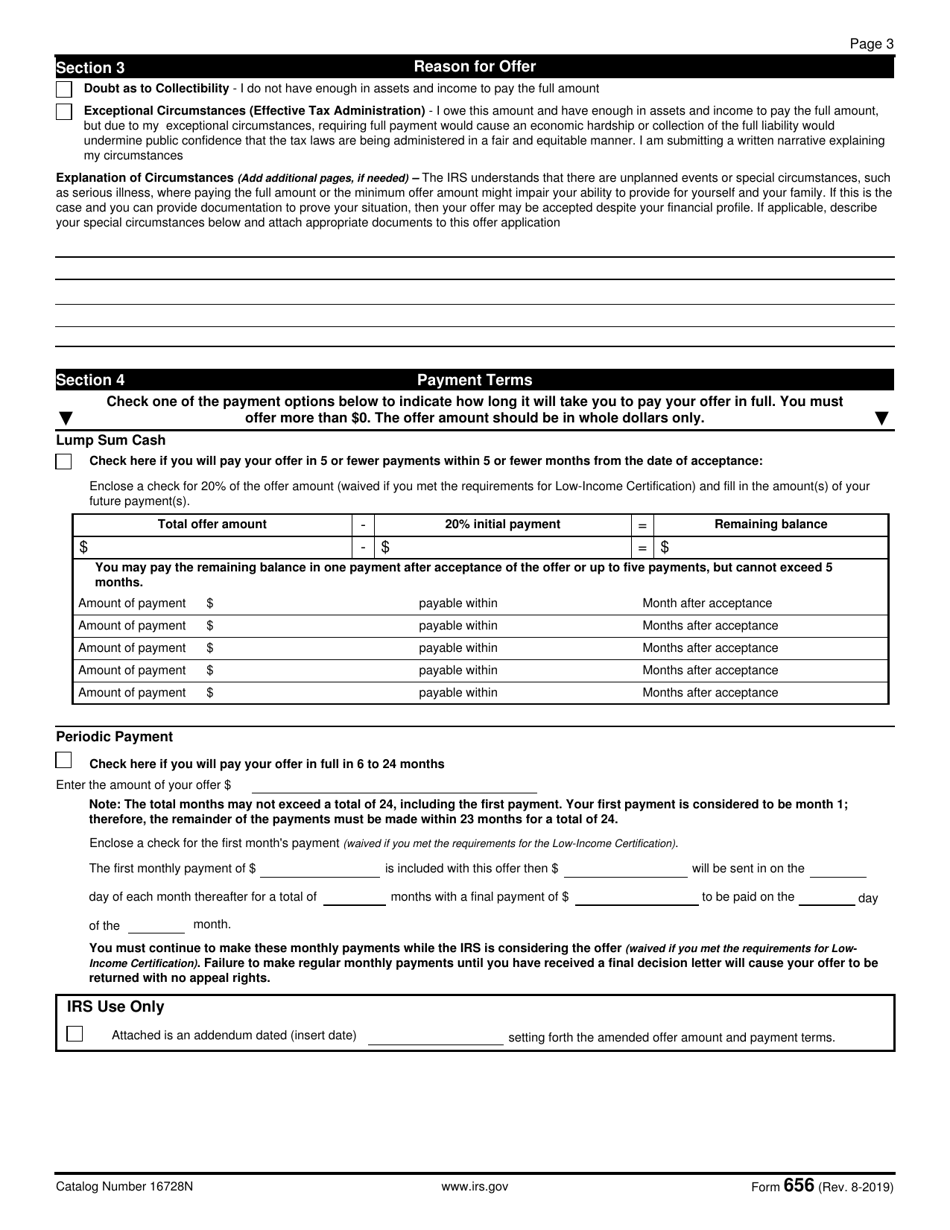

Q: What is the process to submit an Offer in Compromise?

A: The process includes completing IRS Form 656, providing supporting documentation, and paying a non-refundable fee. The IRS will evaluate the offer based on the taxpayer's financial situation.

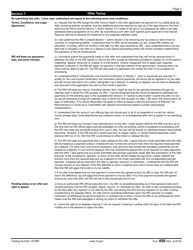

Q: What happens after submitting an Offer in Compromise?

A: After submitting an Offer in Compromise, the IRS will review the proposal and either accept, reject, or make a counteroffer. It is important to continue making payments during the review process.

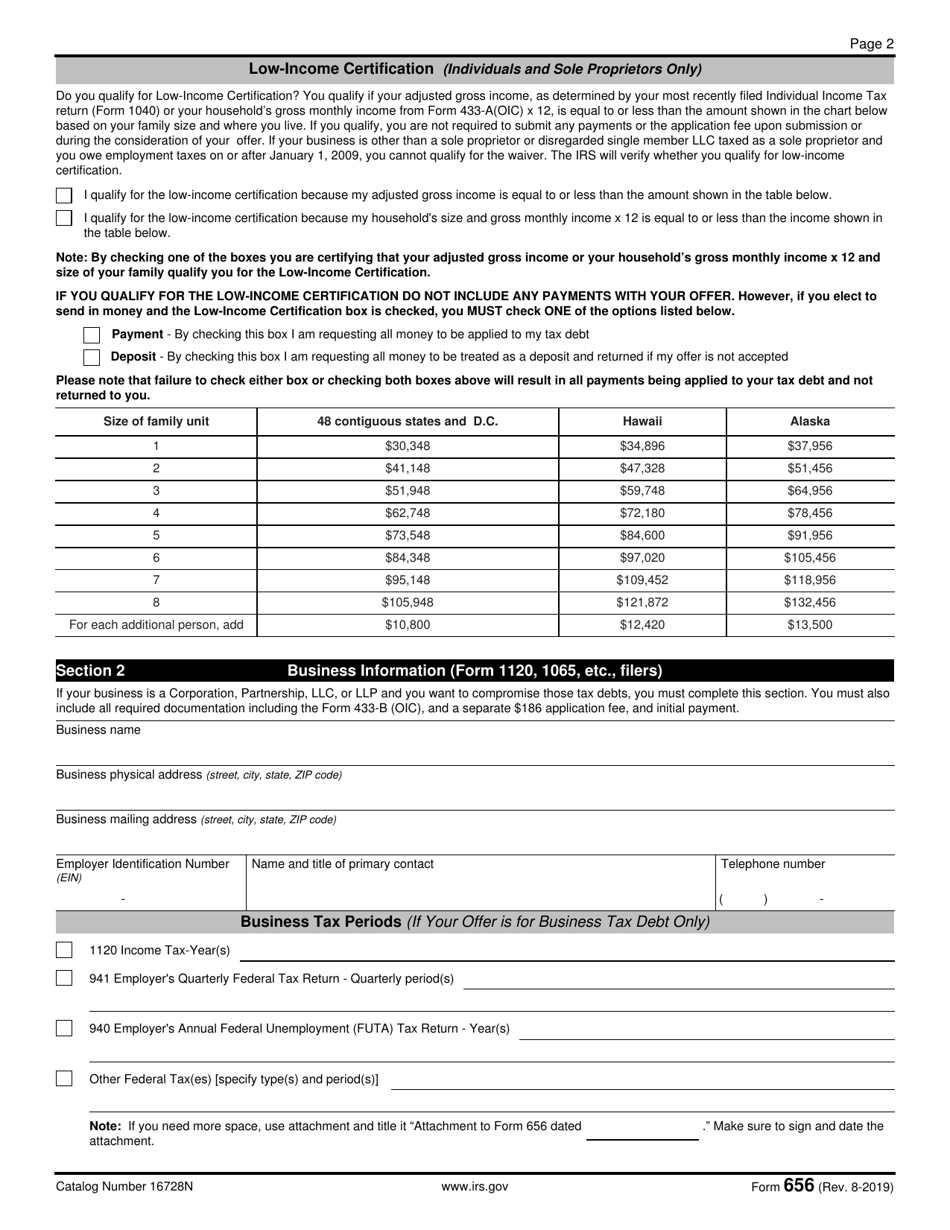

Q: Are there any fees associated with submitting an Offer in Compromise?

A: Yes, there is a non-refundable application fee and an initial payment required with the offer. Low-income taxpayers may qualify for a reduced fee.

Form Details:

- A 8-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- A Spanish version of IRS Form 656 is available for spanish-speaking filers;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 656 through the link below or browse more documents in our library of IRS Forms.