This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 8975 Schedule A

for the current year.

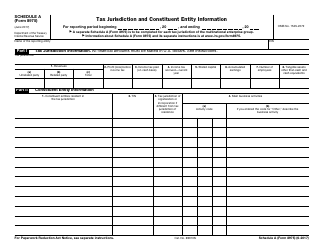

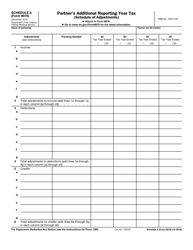

Instructions for IRS Form 8975 Schedule A Country-By-Country Report

This document contains official instructions for IRS Form 8975 Schedule A, Country-By-Country Report - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury.

FAQ

Q: What is IRS Form 8975 Schedule A?

A: IRS Form 8975 Schedule A is a report used for the Country-by-Country (CbC) reporting requirements.

Q: What is Country-by-Country reporting?

A: Country-by-Country reporting is a reporting requirement for multinational corporations to provide information about their global operations and tax payments.

Q: Who needs to file IRS Form 8975 Schedule A?

A: Multinational corporations that meet the CbC reporting threshold and have ultimate parent entities in the United States are required to file IRS Form 8975 Schedule A.

Q: What information is required to be reported on IRS Form 8975 Schedule A?

A: IRS Form 8975 Schedule A requires the reporting of specific financial and tax information about the multinational corporation and its subsidiaries in different jurisdictions.

Q: How often does IRS Form 8975 Schedule A need to be filed?

A: IRS Form 8975 Schedule A is filed annually, along with the multinational corporation's income tax return.

Q: What are the penalties for not filing IRS Form 8975 Schedule A?

A: Failure to file IRS Form 8975 Schedule A or providing inaccurate information can result in significant penalties imposed by the IRS.

Q: Can the information reported on IRS Form 8975 Schedule A be shared with other countries?

A: Yes, the information reported on IRS Form 8975 Schedule A may be shared with tax authorities of other countries, as part of international tax transparency efforts.

Instruction Details:

- This 6-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.