This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 1116

for the current year.

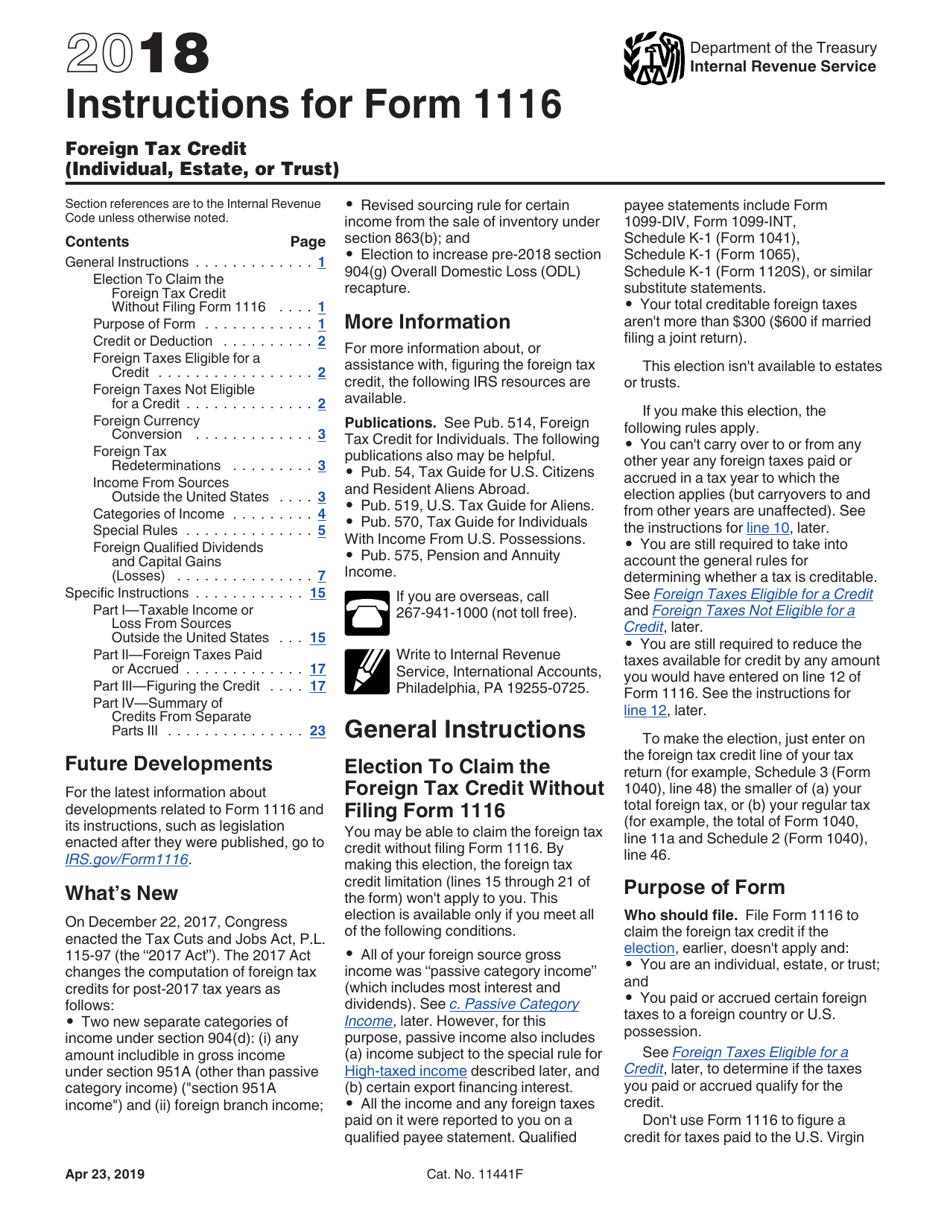

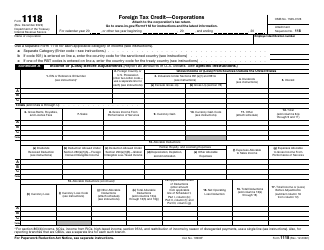

Instructions for IRS Form 1116 Foreign Tax Credit (Individual, Estate, or Trust)

This document contains official instructions for IRS Form 1116 , Foreign Tax Credit (Individual, Estate, or Trust) - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 1116 is available for download through this link.

FAQ

Q: What is IRS Form 1116?

A: IRS Form 1116 is used to claim the Foreign Tax Credit.

Q: Who needs to file IRS Form 1116?

A: Individuals, estates, or trusts who paid foreign taxes and want to claim a credit for those taxes on their US tax return.

Q: What is the Foreign Tax Credit?

A: The Foreign Tax Credit is a tax benefit that allows you to offset the taxes you paid to a foreign country against your US tax liability.

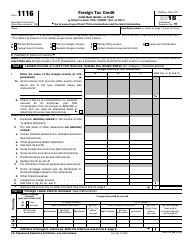

Q: What information do I need to complete Form 1116?

A: You will need information on the foreign taxes paid, foreign source income, and the foreign tax credit limitation.

Q: How do I calculate the foreign tax credit?

A: The foreign tax credit is calculated by multiplying the foreign taxes paid or accrued by the foreign source income, and then dividing that amount by your total taxable income.

Q: Are there any limitations to the Foreign Tax Credit?

A: Yes, there are certain limitations based on your US tax liability and the foreign tax credit limitation.

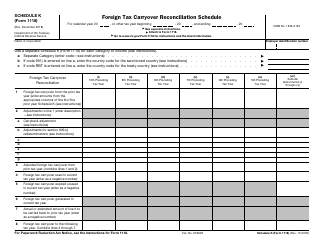

Q: Can the unused foreign tax credit be carried forward?

A: Yes, if you are unable to use the full amount of your foreign tax credit in a given year, you can carry it forward to future years.

Instruction Details:

- This 24-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.