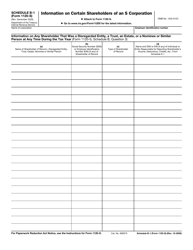

This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 1099-G

for the current year.

Instructions for IRS Form 1099-G Certain Government Payments

This document contains official instructions for IRS Form 1099-G , Certain Government Payments - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 1099-G is available for download through this link.

FAQ

Q: What is IRS Form 1099-G?

A: IRS Form 1099-G is used to report certain government payments you may have received during the tax year.

Q: What kind of payments are reported on IRS Form 1099-G?

A: IRS Form 1099-G is used to report payments such as unemployment compensation, state or local income tax refunds, or certain other government payments.

Q: Do I need to report the amounts listed on IRS Form 1099-G on my tax return?

A: Yes, you generally need to report the amounts listed on IRS Form 1099-G on your tax return as taxable income.

Q: What should I do if there is an error on my IRS Form 1099-G?

A: If you believe there is an error on your IRS Form 1099-G, you should contact the government agency that issued the form to request a corrected version.

Instruction Details:

- This 2-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.