This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 1095-A

for the current year.

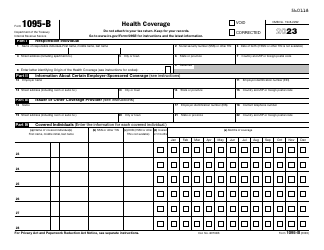

Instructions for IRS Form 1095-A Health Insurance Marketplace Statement

This document contains official instructions for IRS Form 1095-A , Health Insurance Marketplace Statement - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 1095-A is available for download through this link.

FAQ

Q: What is IRS Form 1095-A?

A: IRS Form 1095-A is a Health Insurance Marketplace Statement.

Q: Why do I need IRS Form 1095-A?

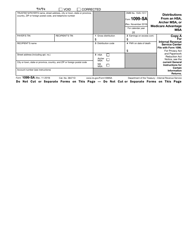

A: You need IRS Form 1095-A to reconcile any advance payments of the premium tax credit and to claim the premium tax credit on your tax return.

Q: What information does IRS Form 1095-A contain?

A: IRS Form 1095-A contains information about your Marketplace coverage, premium amounts, and any advance payments of the premium tax credit.

Q: Do I have to attach IRS Form 1095-A to my tax return?

A: No, you do not have to attach IRS Form 1095-A to your tax return, but you should keep it for your records.

Instruction Details:

- This 3-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.