This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 1041 Schedule D

for the current year.

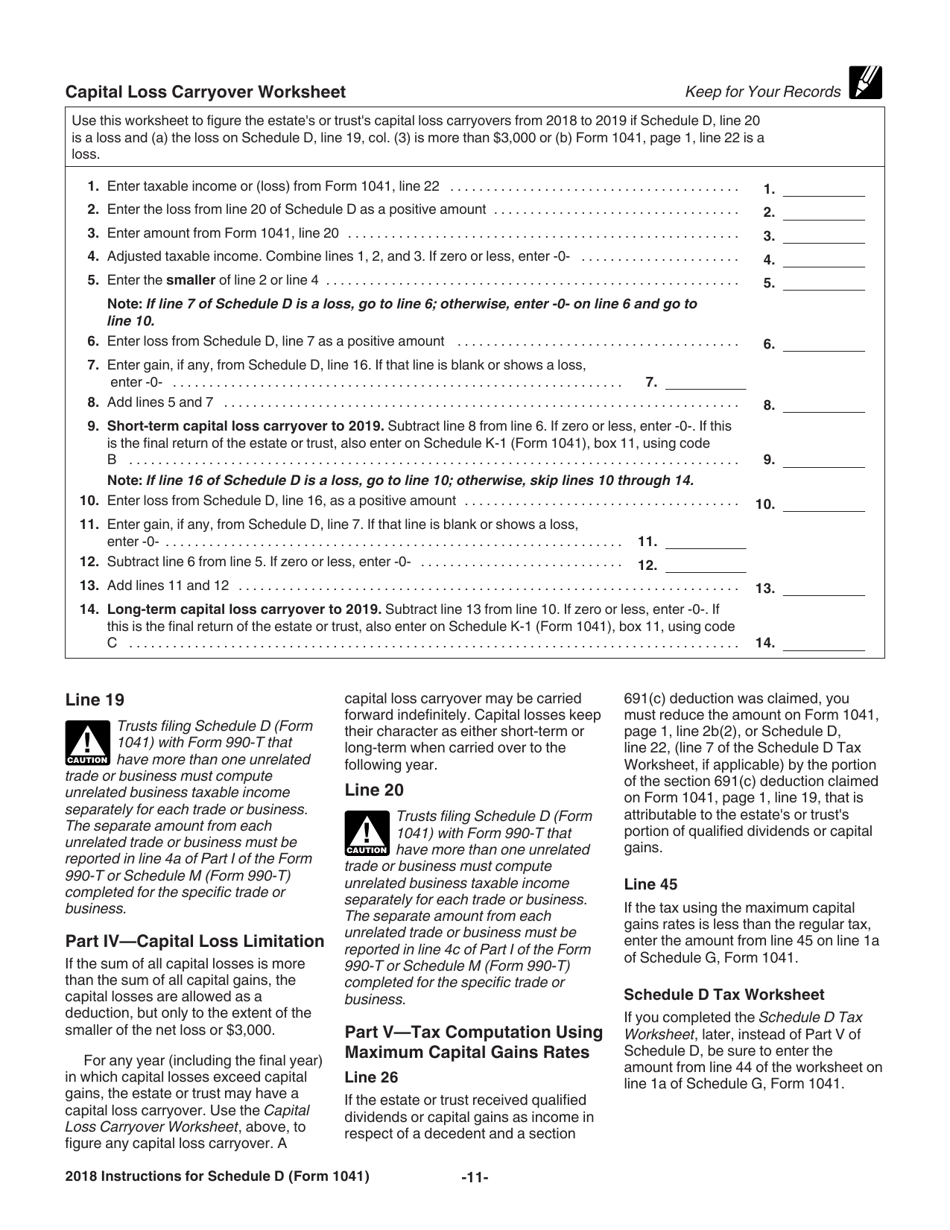

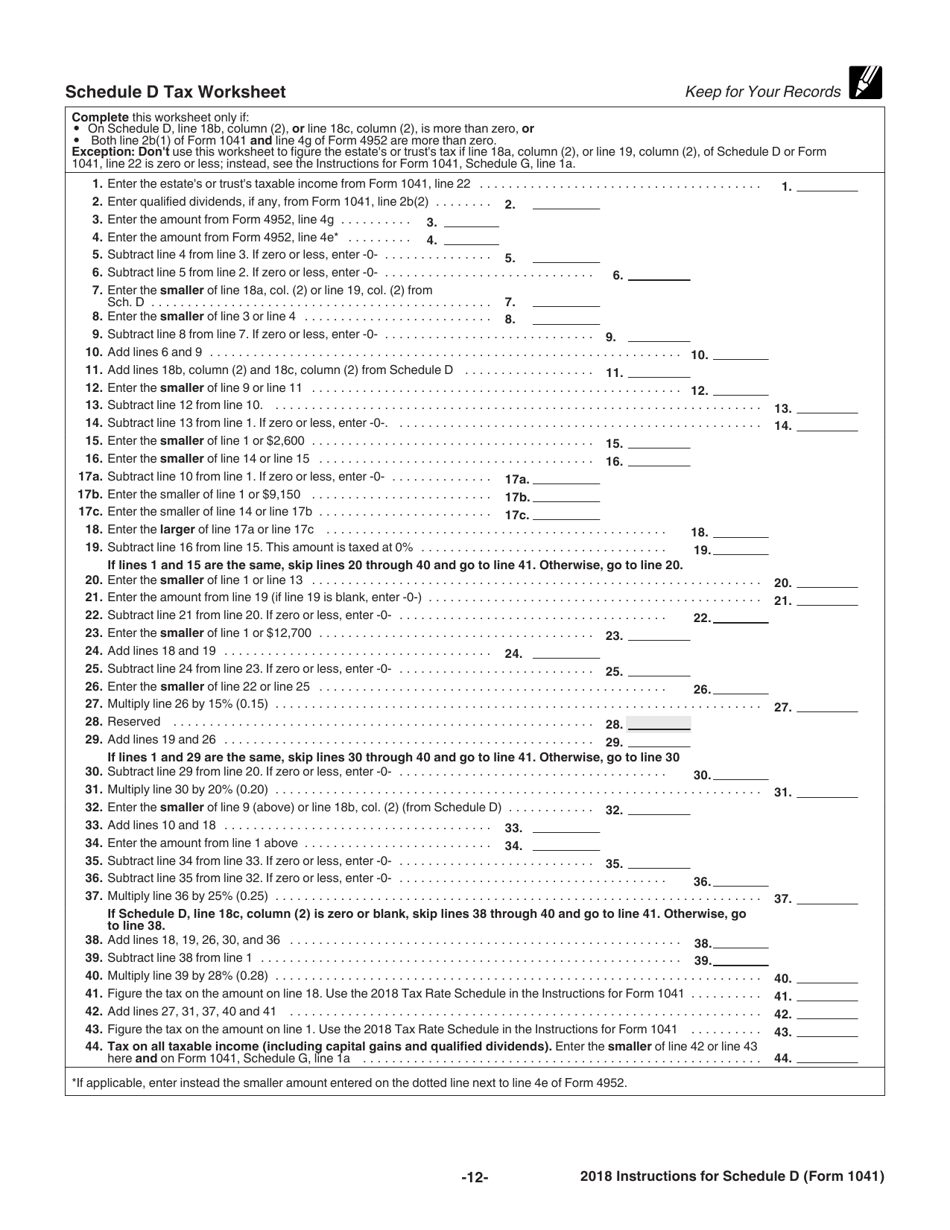

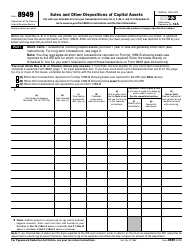

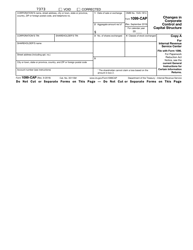

Instructions for IRS Form 1041 Schedule D Capital Gains and Losses

This document contains official instructions for IRS Form 1041 Schedule D, Capital Gains and Losses - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 1041 Schedule D is available for download through this link.

FAQ

Q: What is IRS Form 1041 Schedule D?

A: IRS Form 1041 Schedule D is a tax form used to report capital gains and losses for estates and trusts.

Q: Who needs to file IRS Form 1041 Schedule D?

A: Estates and trusts that have capital gains or losses need to file IRS Form 1041 Schedule D.

Q: What is considered a capital gain or loss?

A: A capital gain is the profit from the sale of an asset, while a capital loss is the loss from the sale of an asset.

Q: What information is required to complete IRS Form 1041 Schedule D?

A: To complete IRS Form 1041 Schedule D, you will need information on the assets bought and sold, the purchase and sale dates, and the cost basis.

Q: How do I report capital gains and losses on IRS Form 1041 Schedule D?

A: You report capital gains and losses on IRS Form 1041 Schedule D by listing each transaction separately and calculating the total gains or losses.

Q: When is the deadline to file IRS Form 1041 Schedule D?

A: The deadline to file IRS Form 1041 Schedule D is generally the same as the deadline for filing the estate or trust's tax return, which is April 15th.

Q: Can I e-file IRS Form 1041 Schedule D?

A: No, IRS Form 1041 Schedule D cannot be e-filed and must be mailed to the IRS along with the estate or trust's tax return.

Q: Are there any penalties for not filing IRS Form 1041 Schedule D?

A: Yes, failure to file IRS Form 1041 Schedule D or reporting inaccurate information can result in penalties and interest charges.

Q: Do I need to keep a copy of IRS Form 1041 Schedule D for my records?

A: Yes, it is important to keep a copy of IRS Form 1041 Schedule D for your records in case of future audits or inquiries.

Instruction Details:

- This 12-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.