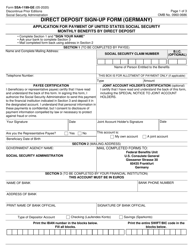

This version of the form is not currently in use and is provided for reference only. Download this version of

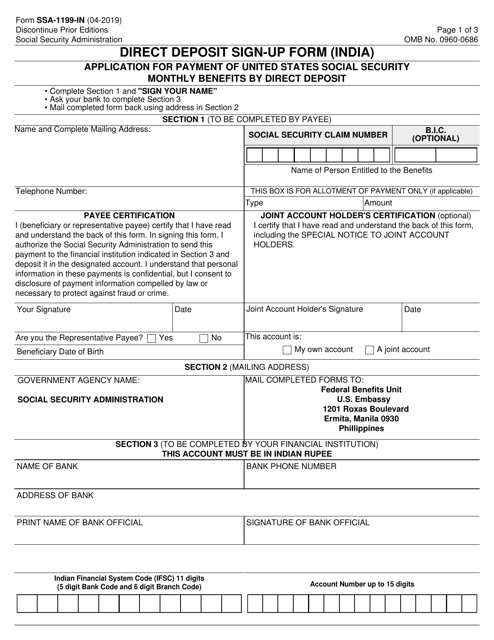

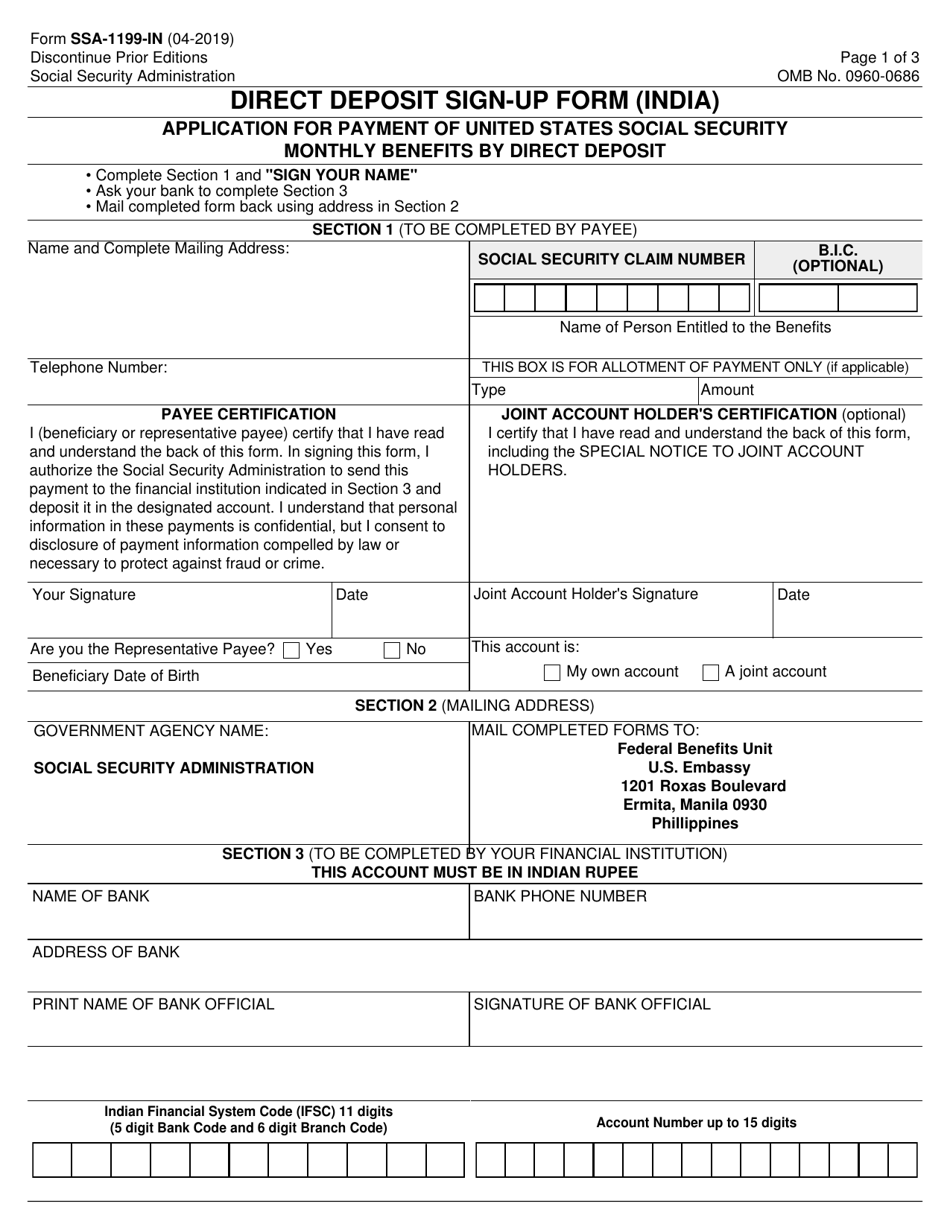

Form SSA-1199-IN

for the current year.

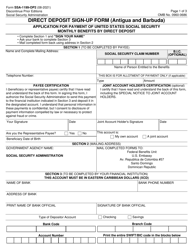

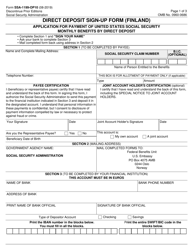

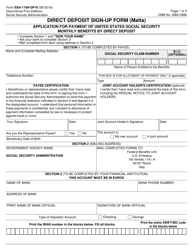

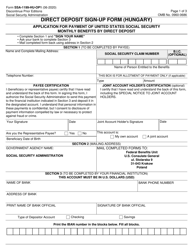

Form SSA-1199-IN Direct Deposit Sign-Up Form (India)

What Is Form SSA-1199-IN?

This is a legal form that was released by the U.S. Social Security Administration on April 1, 2019 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form SSA-1199-IN?

A: Form SSA-1199-IN is the Direct Deposit Sign-Up Form for individuals residing in India.

Q: What is the purpose of Form SSA-1199-IN?

A: The purpose of Form SSA-1199-IN is to sign up for direct deposit of Social Security or Supplemental Security Income (SSI) payments for individuals residing in India.

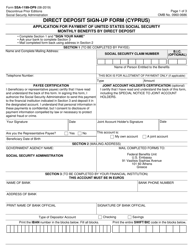

Q: Who can use Form SSA-1199-IN?

A: Form SSA-1199-IN is specifically for individuals residing in India who receive Social Security or SSI payments.

Q: Is Form SSA-1199-IN available in languages other than English?

A: No, Form SSA-1199-IN is only available in English.

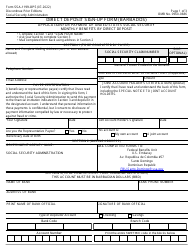

Q: Are there any fees associated with using Form SSA-1199-IN?

A: No, there are no fees associated with using Form SSA-1199-IN.

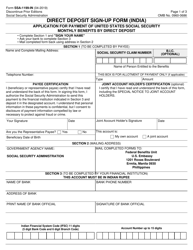

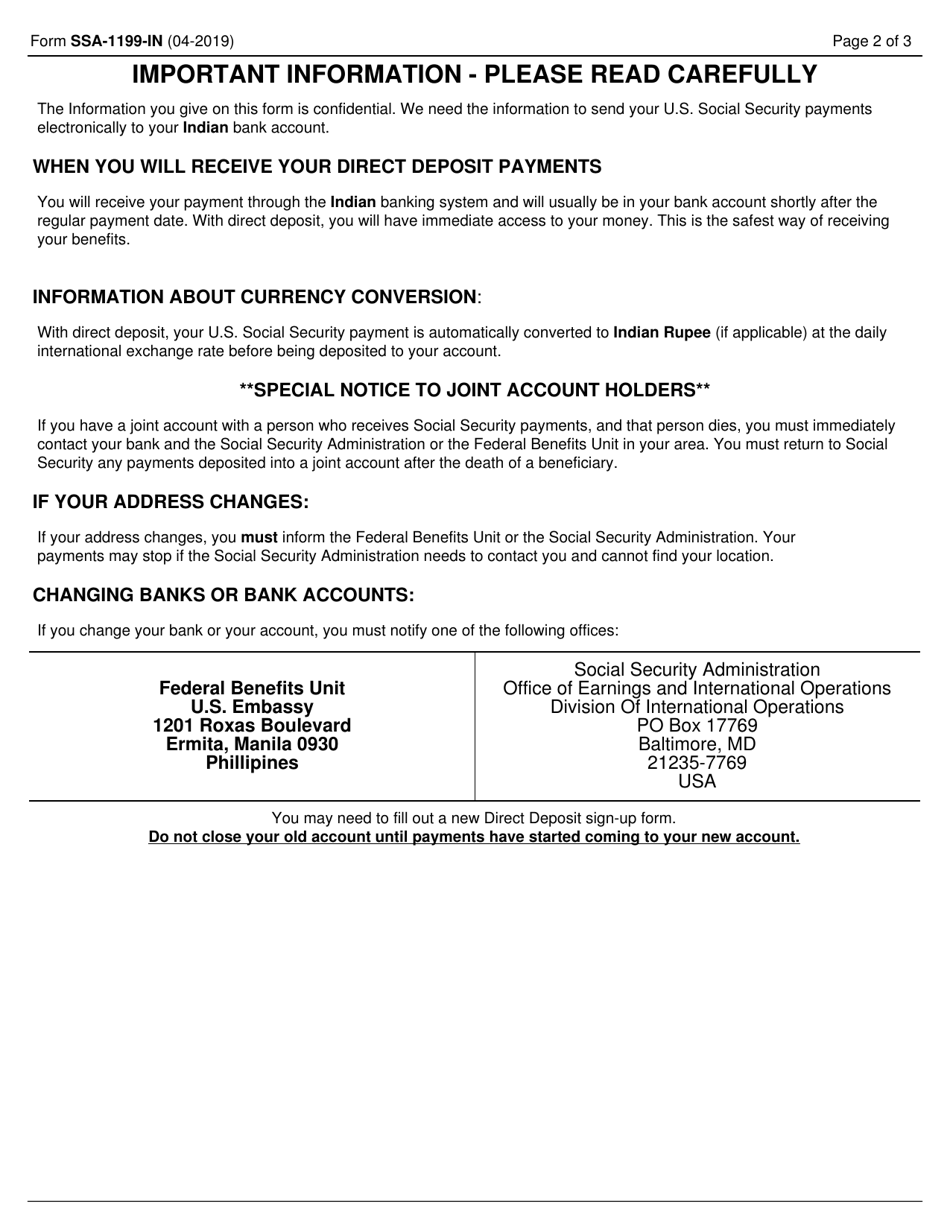

Q: How long does it take for direct deposit to become effective after submitting Form SSA-1199-IN?

A: It typically takes about one to three months for direct deposit to become effective after submitting Form SSA-1199-IN.

Q: Can I cancel or change my direct deposit information after submitting Form SSA-1199-IN?

A: Yes, you can cancel or change your direct deposit information by contacting the SSA.

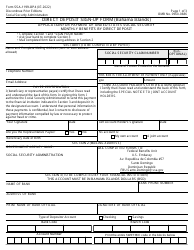

Form Details:

- Released on April 1, 2019;

- The latest available edition released by the U.S. Social Security Administration;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form SSA-1199-IN by clicking the link below or browse more documents and templates provided by the U.S. Social Security Administration.