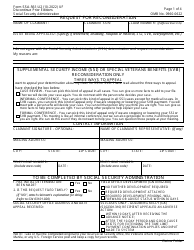

This version of the form is not currently in use and is provided for reference only. Download this version of

Form SSA-634

for the current year.

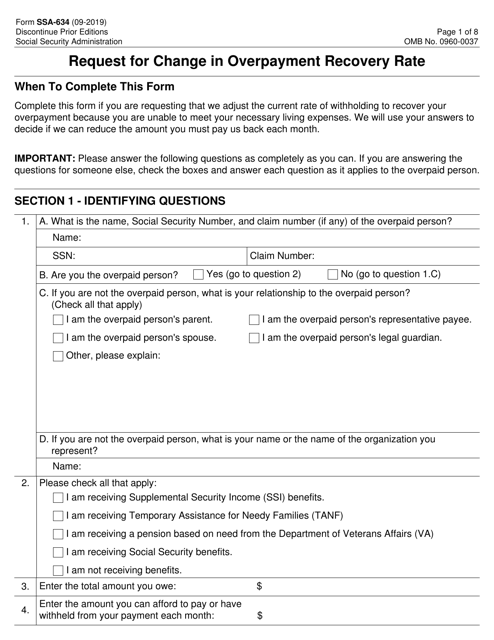

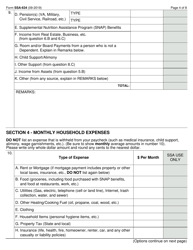

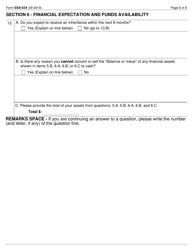

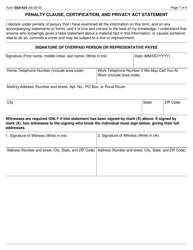

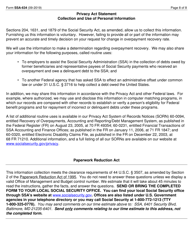

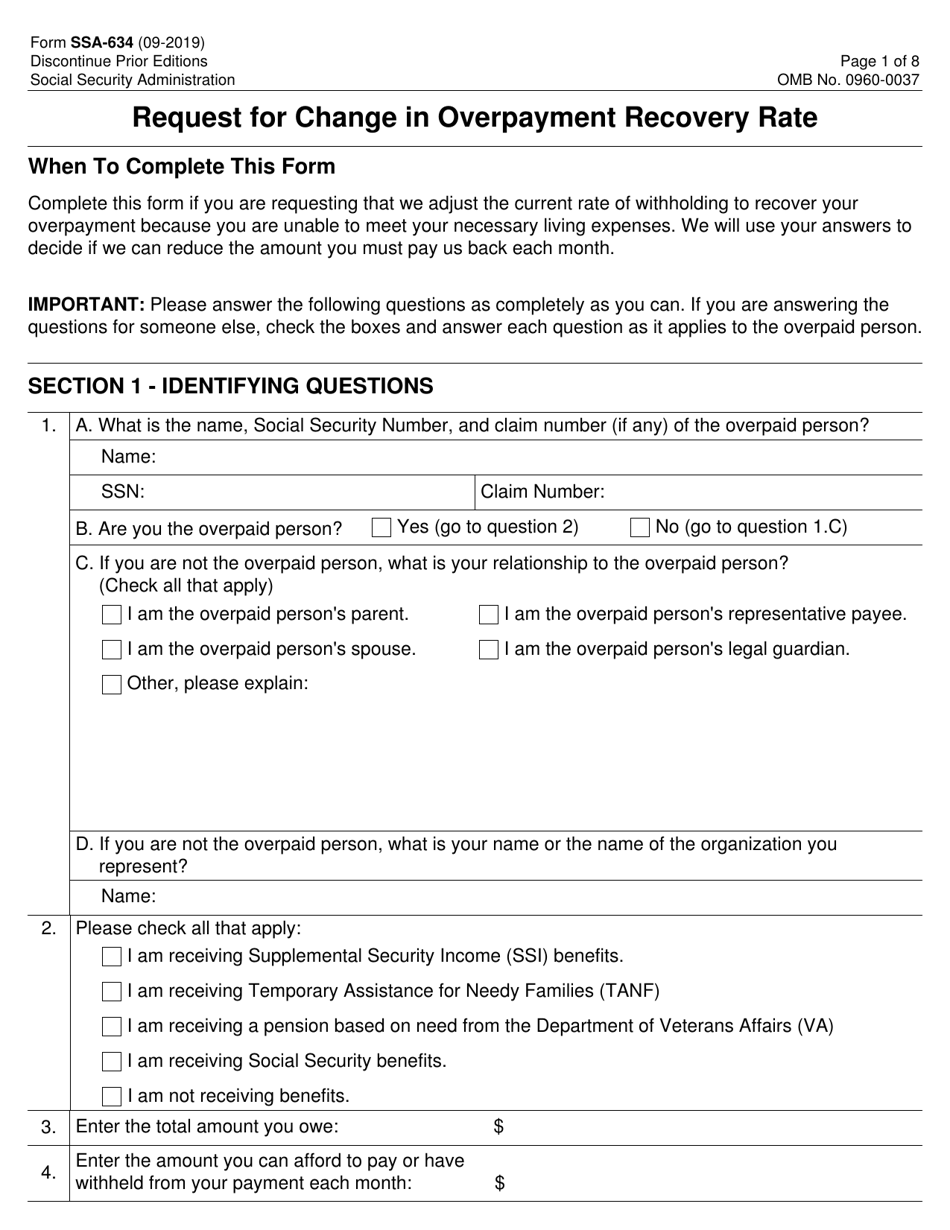

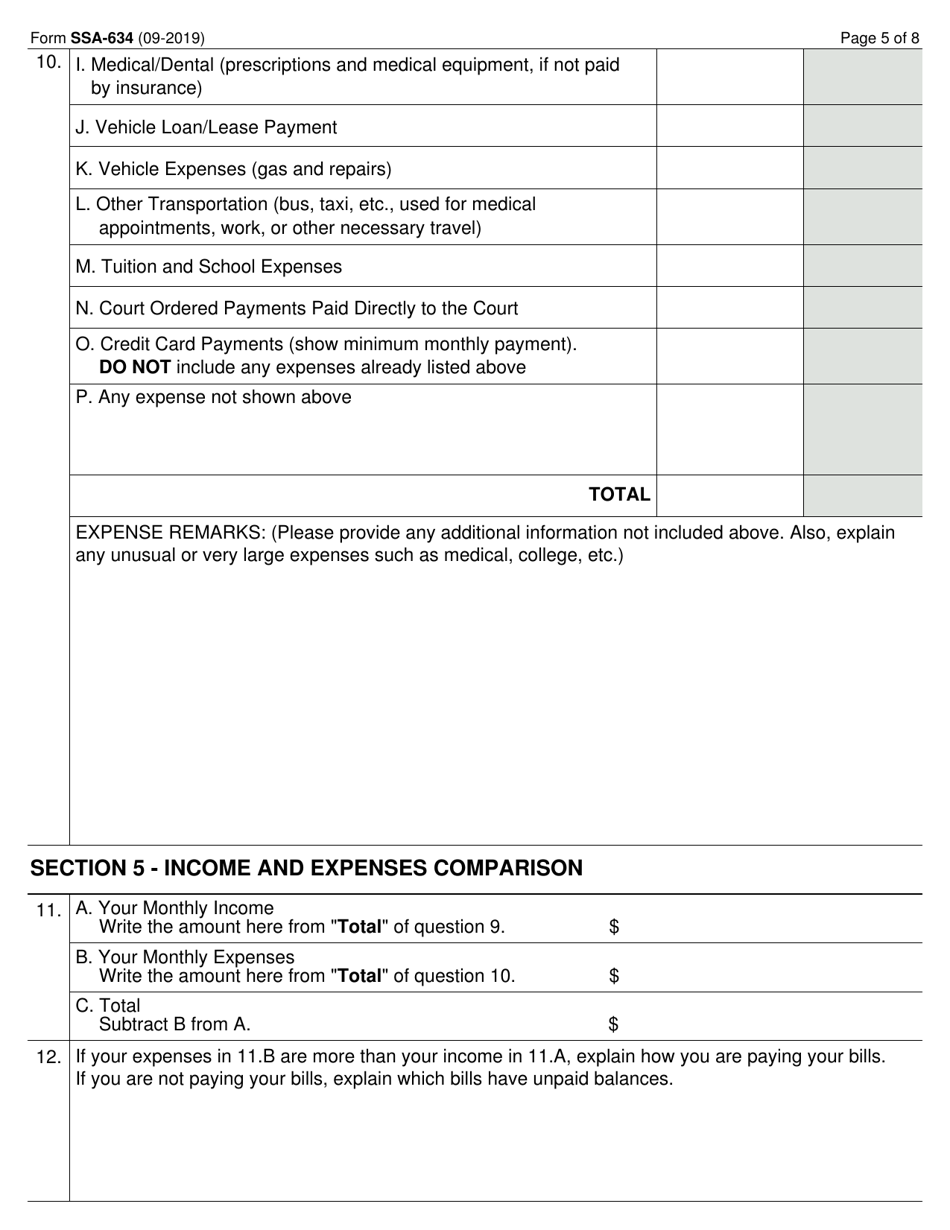

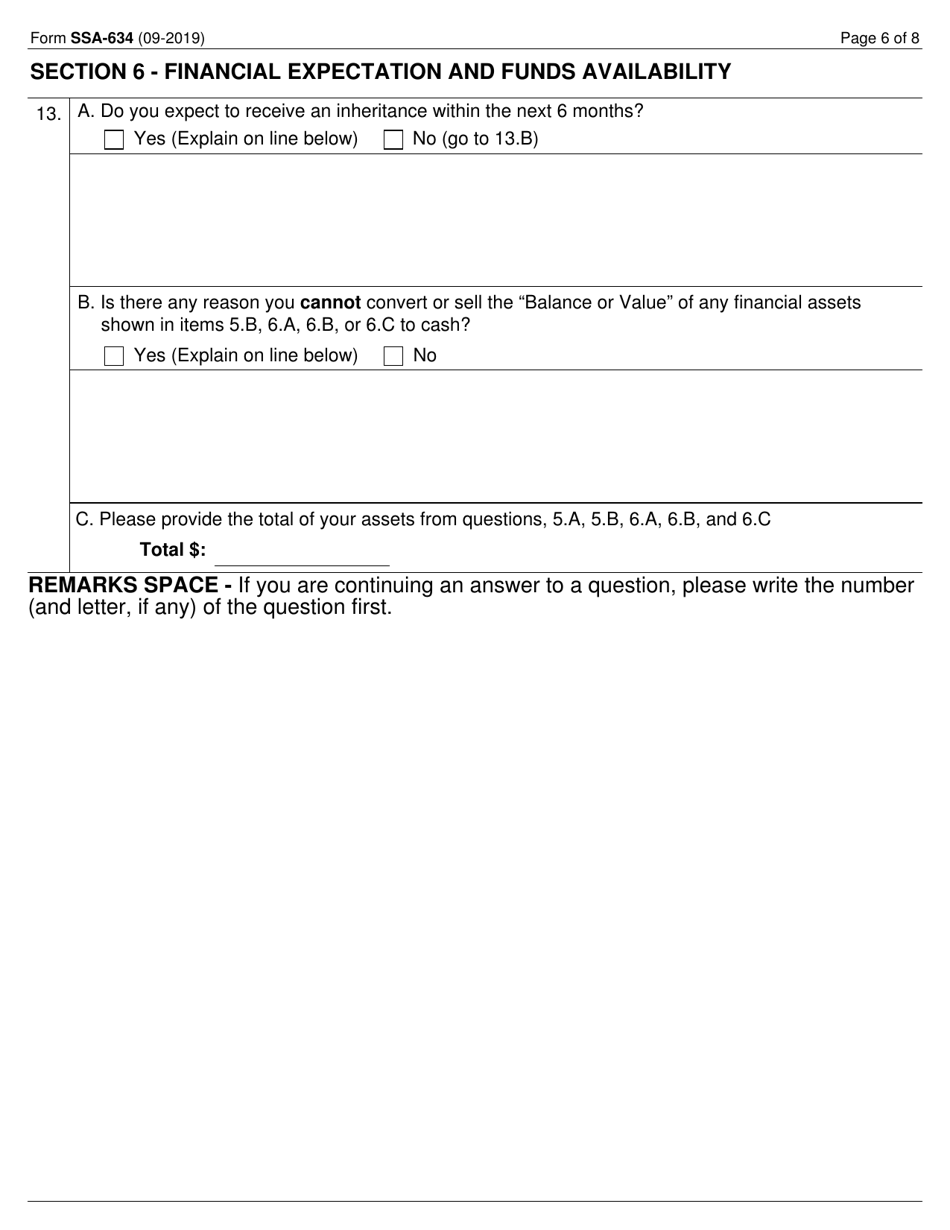

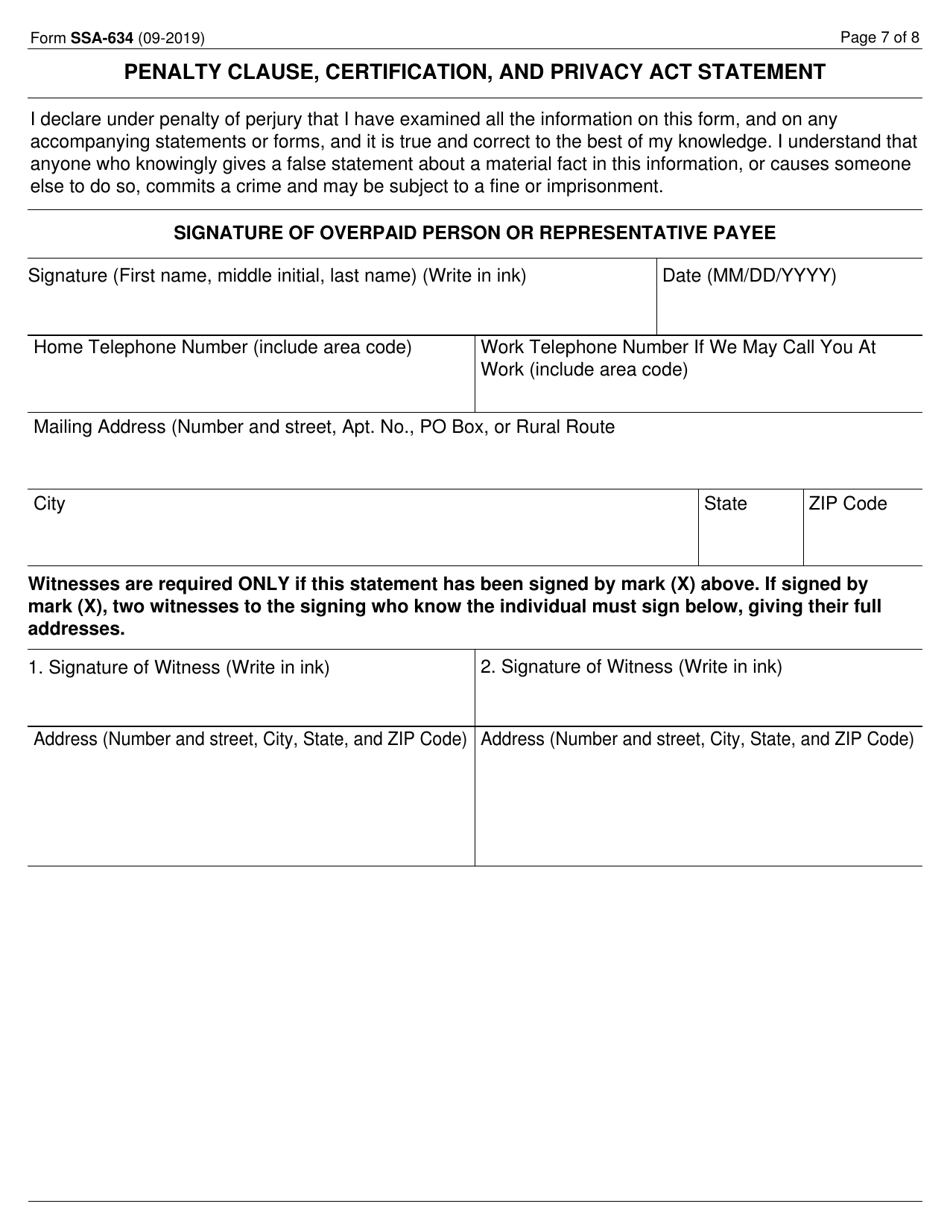

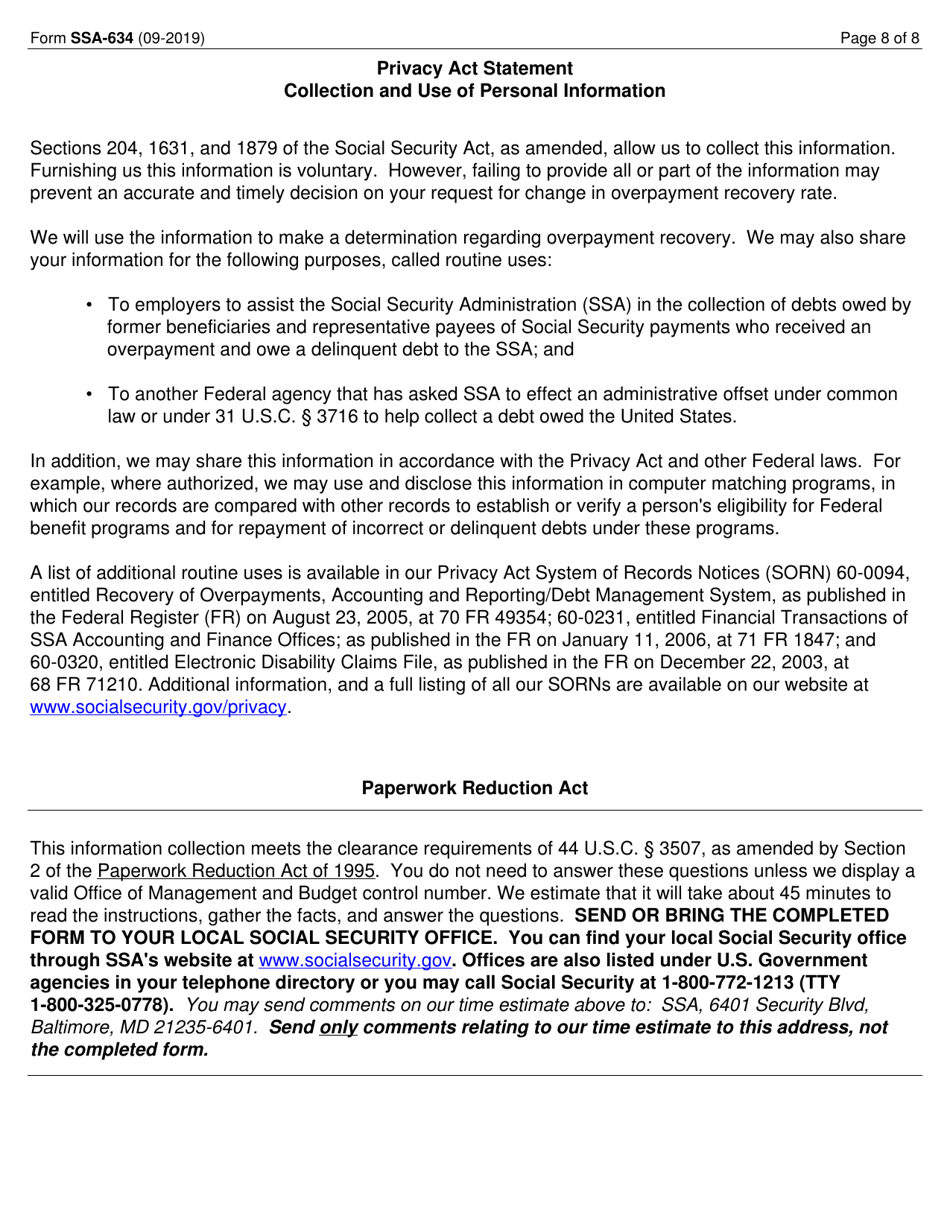

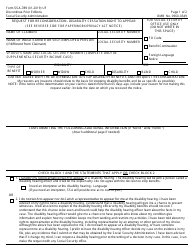

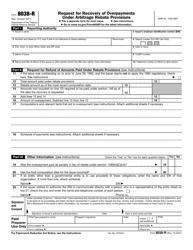

Form SSA-634 Request for Change in Overpayment Recovery Rate

What Is Form SSA-634?

This is a legal form that was released by the U.S. Social Security Administration on September 1, 2019 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

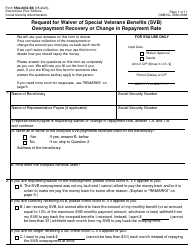

Q: What is Form SSA-634?

A: Form SSA-634 is a form used to request a change in the rate of overpayment recovery.

Q: Who can use Form SSA-634?

A: Anyone who is repaying an overpayment to the Social Security Administration can use Form SSA-634 to request a change in the recovery rate.

Q: What is an overpayment recovery rate?

A: The overpayment recovery rate is the percentage of your monthly Social Security benefits that is being used to repay an overpayment.

Q: Why would someone want to request a change in the overpayment recovery rate?

A: Someone may want to request a change in the overpayment recovery rate if the current rate is causing financial hardship or if they believe it is unfair.

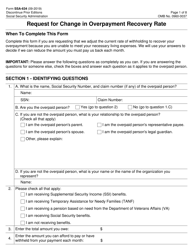

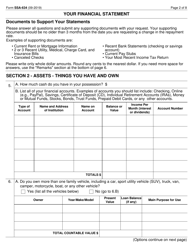

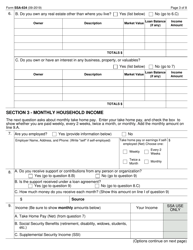

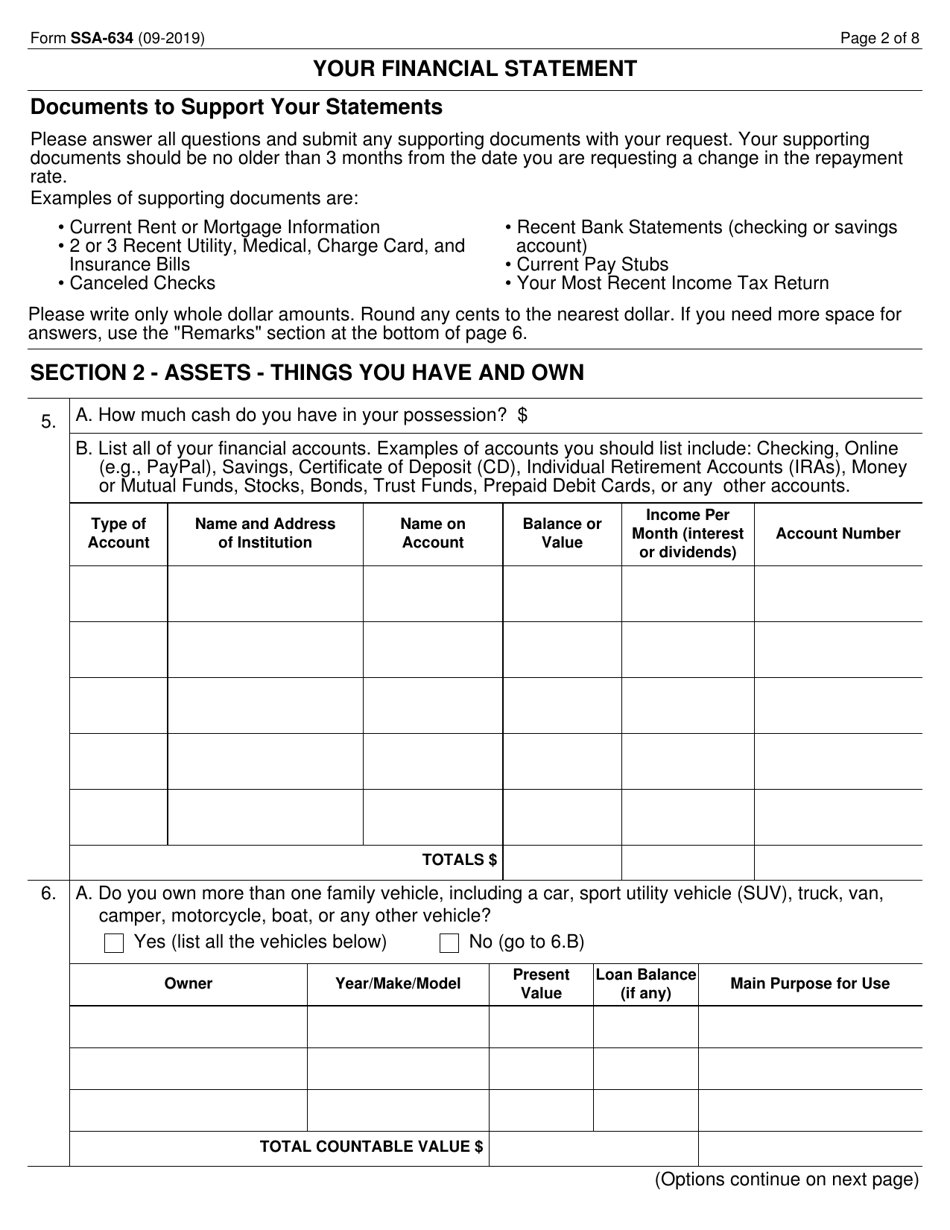

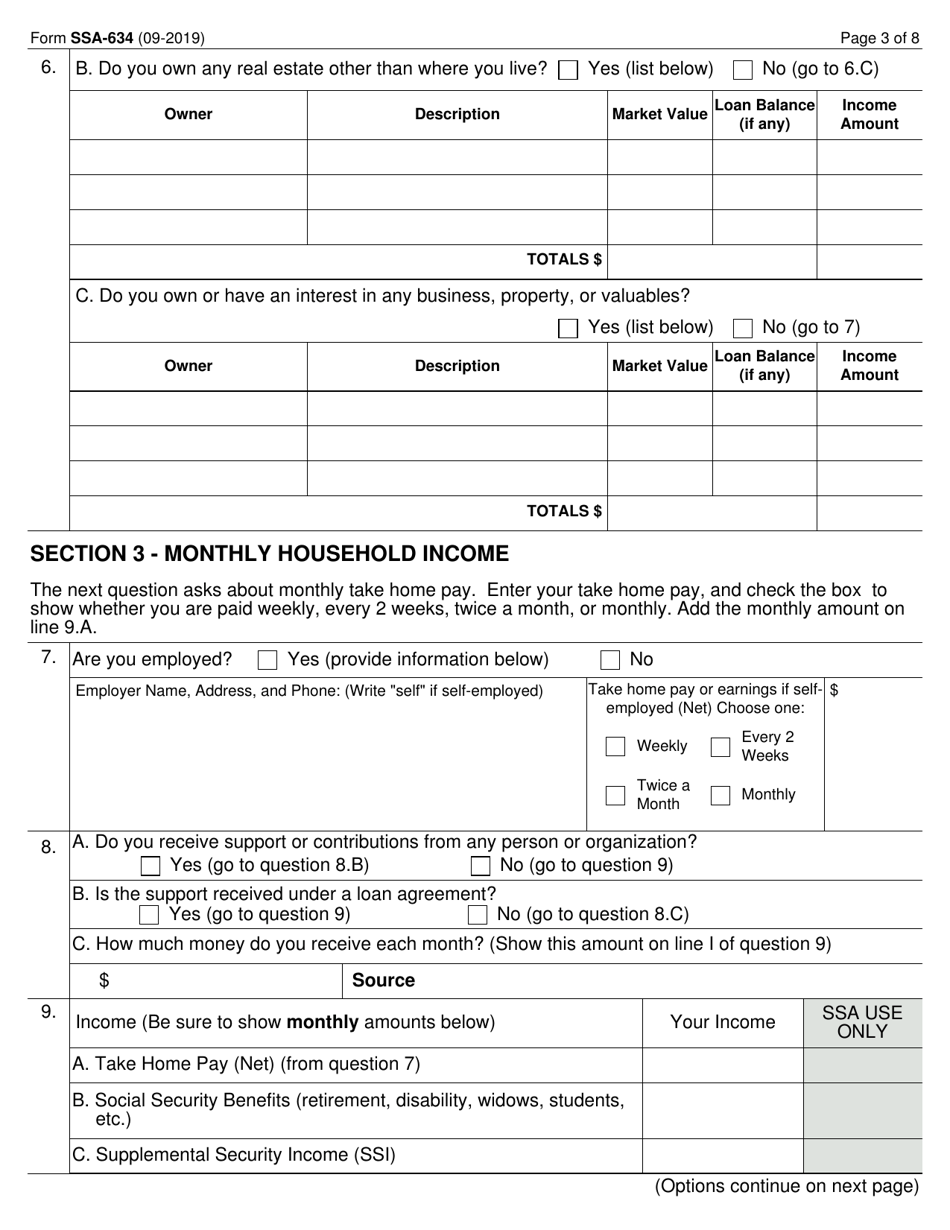

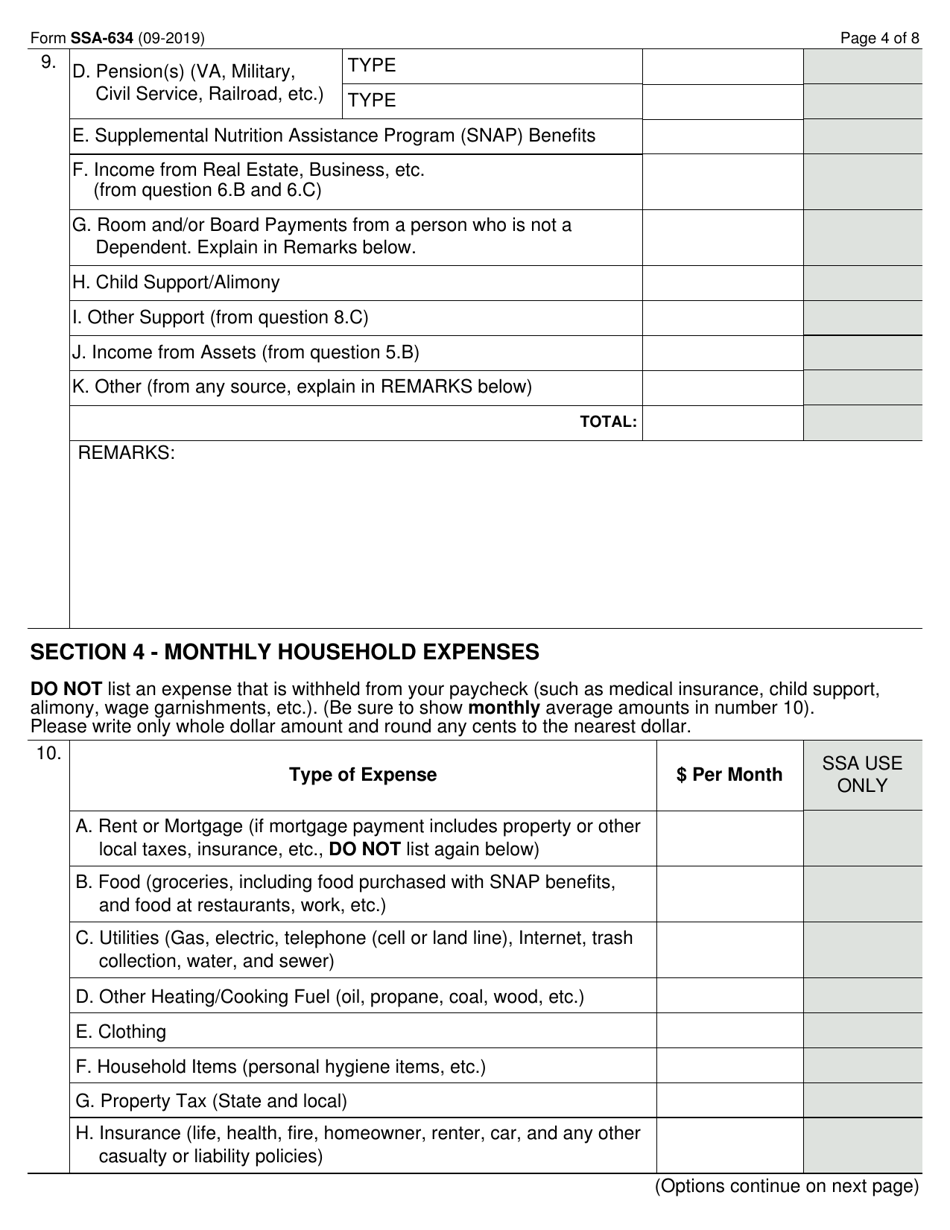

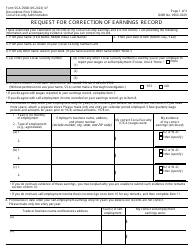

Q: What information do I need to provide on Form SSA-634?

A: You will need to provide your personal information, information about the overpayment, and the reason for requesting a change in the recovery rate.

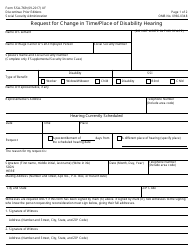

Q: Is there a deadline for submitting Form SSA-634?

A: There is no specific deadline for submitting Form SSA-634, but it is best to submit it as soon as possible.

Q: How long does it take to process a request for a change in the overpayment recovery rate?

A: The processing time can vary, but you should receive a decision within a few weeks of submitting the form.

Q: Can my request for a change in the overpayment recovery rate be denied?

A: Yes, your request can be denied if the Social Security Administration determines that there is no valid reason for changing the recovery rate.

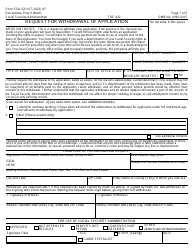

Form Details:

- Released on September 1, 2019;

- The latest available edition released by the U.S. Social Security Administration;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form SSA-634 by clicking the link below or browse more documents and templates provided by the U.S. Social Security Administration.