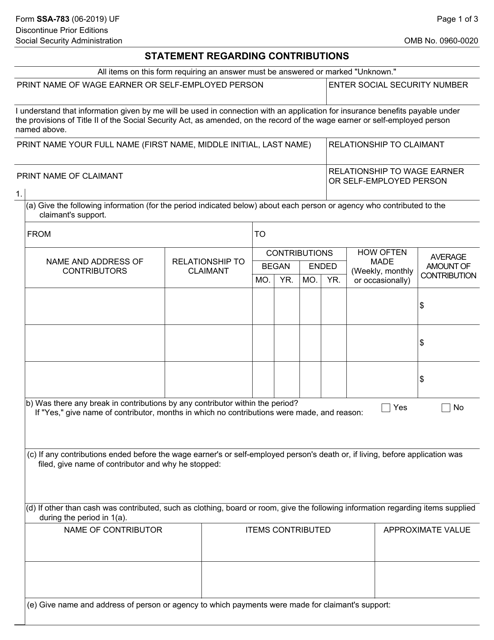

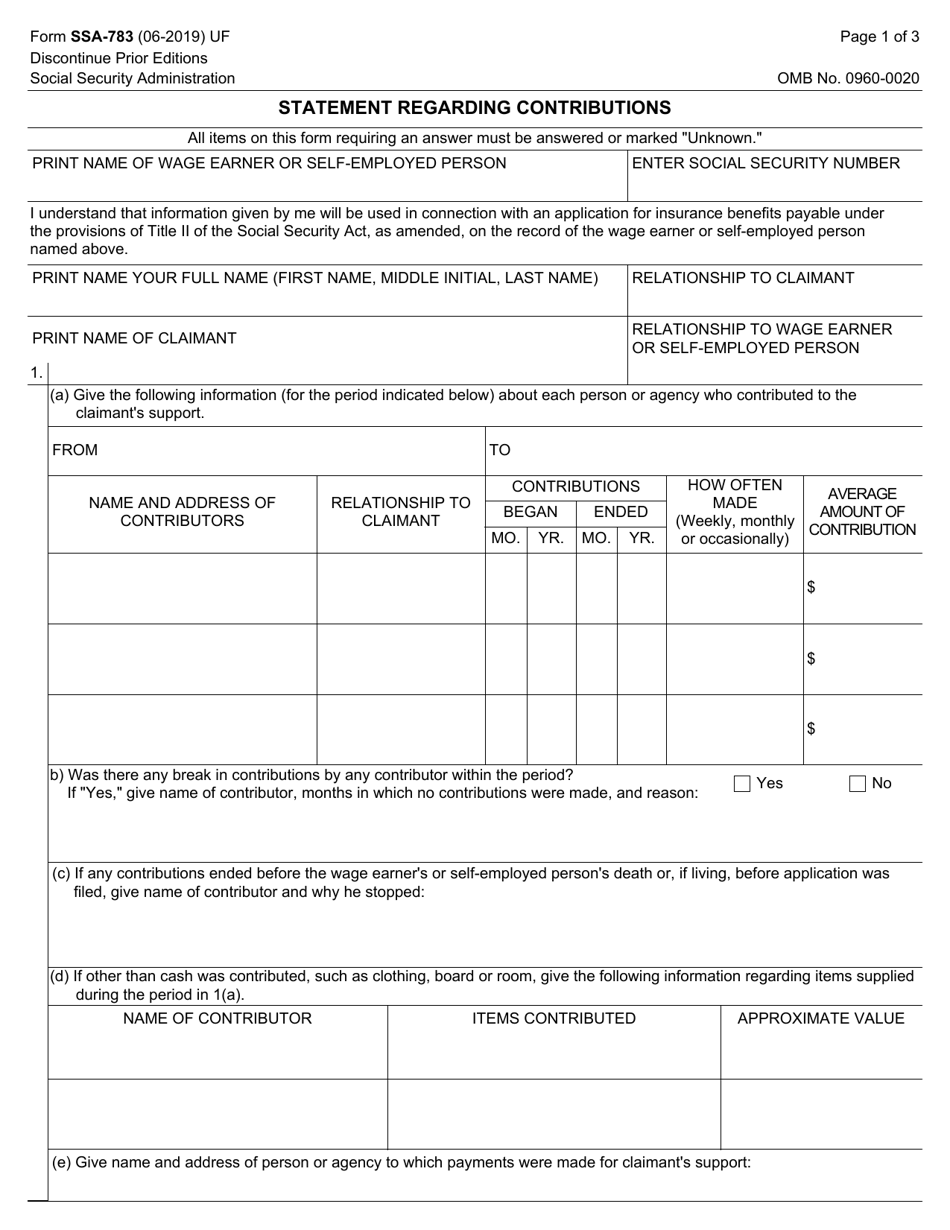

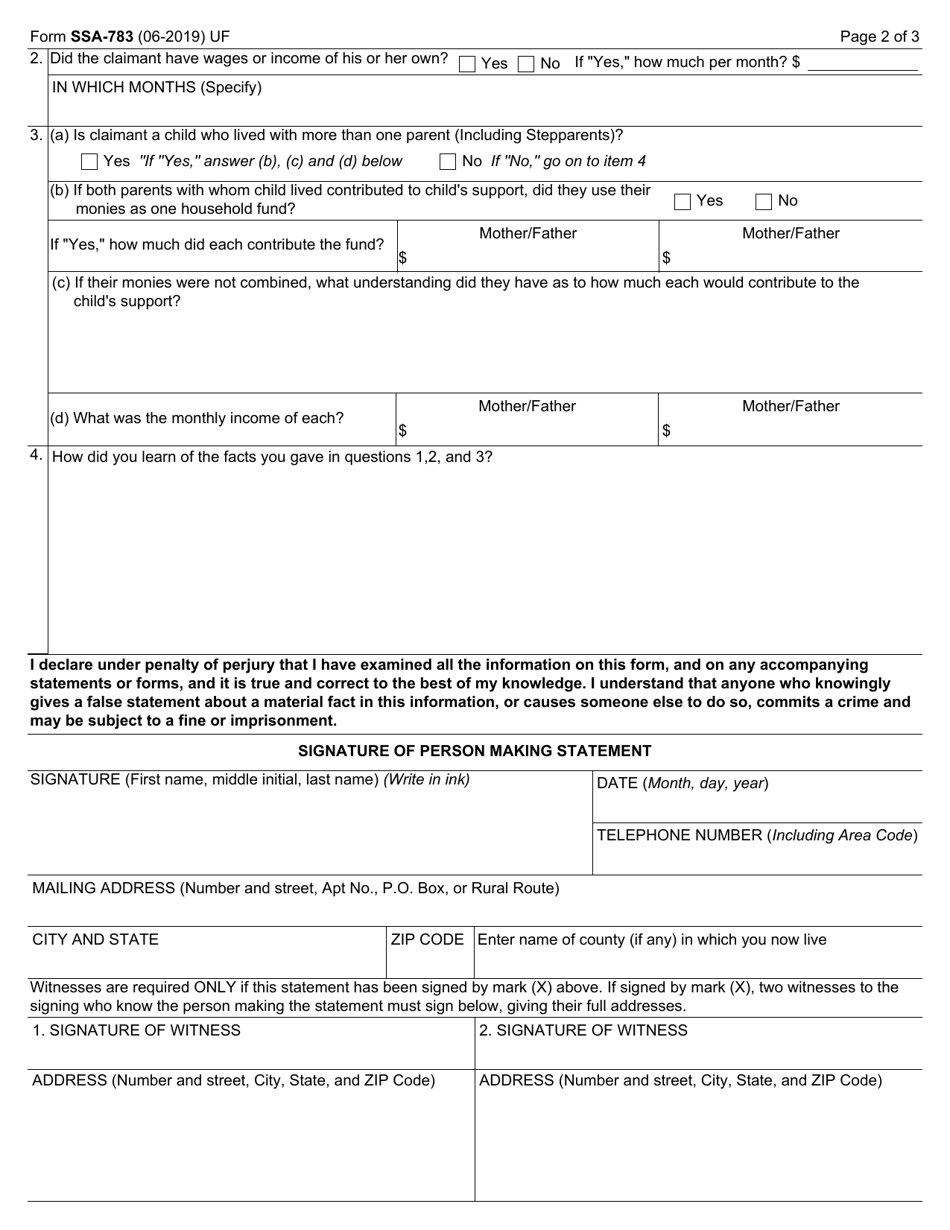

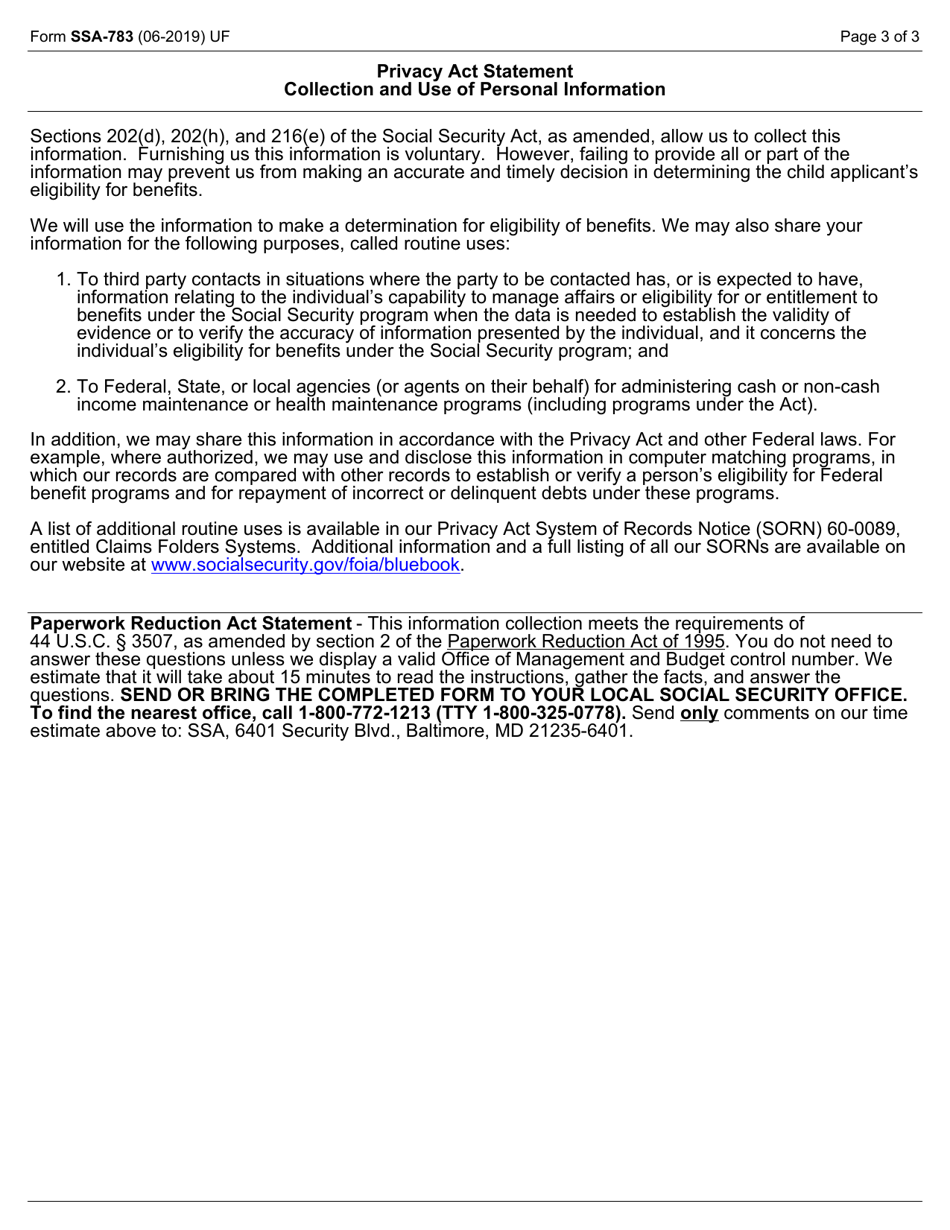

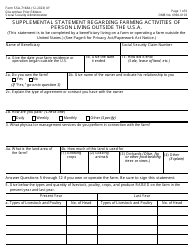

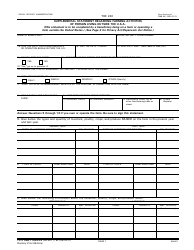

Form SSA-783 Statement Regarding Contributions

What Is Form SSA-783?

This is a legal form that was released by the U.S. Social Security Administration on June 1, 2019 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form SSA-783?

A: Form SSA-783 is a Statement Regarding Contributions form.

Q: What is the purpose of Form SSA-783?

A: The purpose of Form SSA-783 is to provide information about an individual's contributions to Social Security.

Q: Who needs to fill out Form SSA-783?

A: Form SSA-783 needs to be filled out by individuals who need to report their contributions to Social Security.

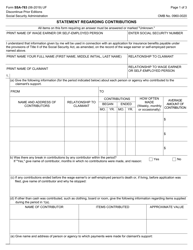

Q: What information is required on Form SSA-783?

A: Form SSA-783 requires information such as the individual's name, Social Security number, and details about their contributions.

Q: Is Form SSA-783 mandatory?

A: Filling out Form SSA-783 is mandatory if you want to report your contributions to Social Security.

Q: Can I submit Form SSA-783 electronically?

A: No, Form SSA-783 cannot be submitted electronically. It must be completed and submitted by mail or in person.

Q: Are there any fees associated with Form SSA-783?

A: No, there are no fees associated with submitting Form SSA-783.

Q: What should I do if I have additional questions about Form SSA-783?

A: If you have additional questions about Form SSA-783, you can contact the Social Security Administration for assistance.

Form Details:

- Released on June 1, 2019;

- The latest available edition released by the U.S. Social Security Administration;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form SSA-783 by clicking the link below or browse more documents and templates provided by the U.S. Social Security Administration.