This version of the form is not currently in use and is provided for reference only. Download this version of

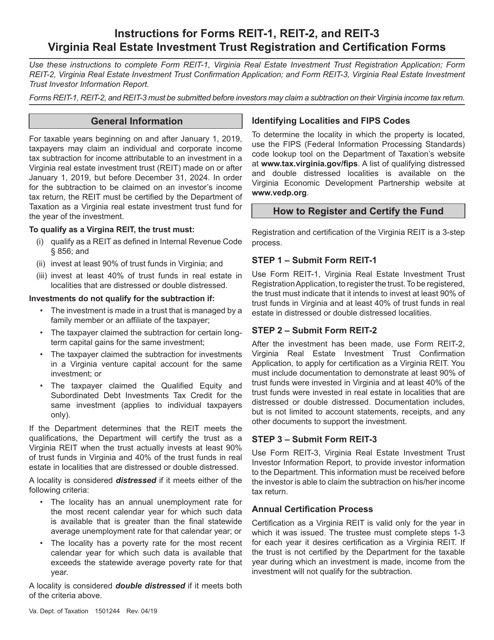

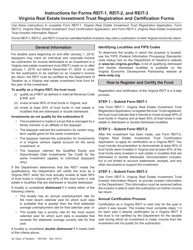

Instructions for Form REIT-1, REIT-2, REIT-3

for the current year.

Instructions for Form REIT-1, REIT-2, REIT-3 - Virginia

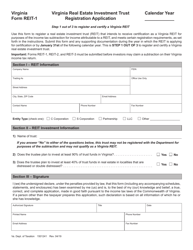

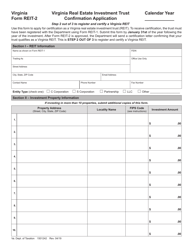

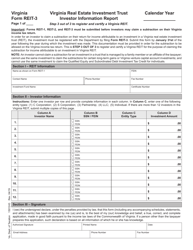

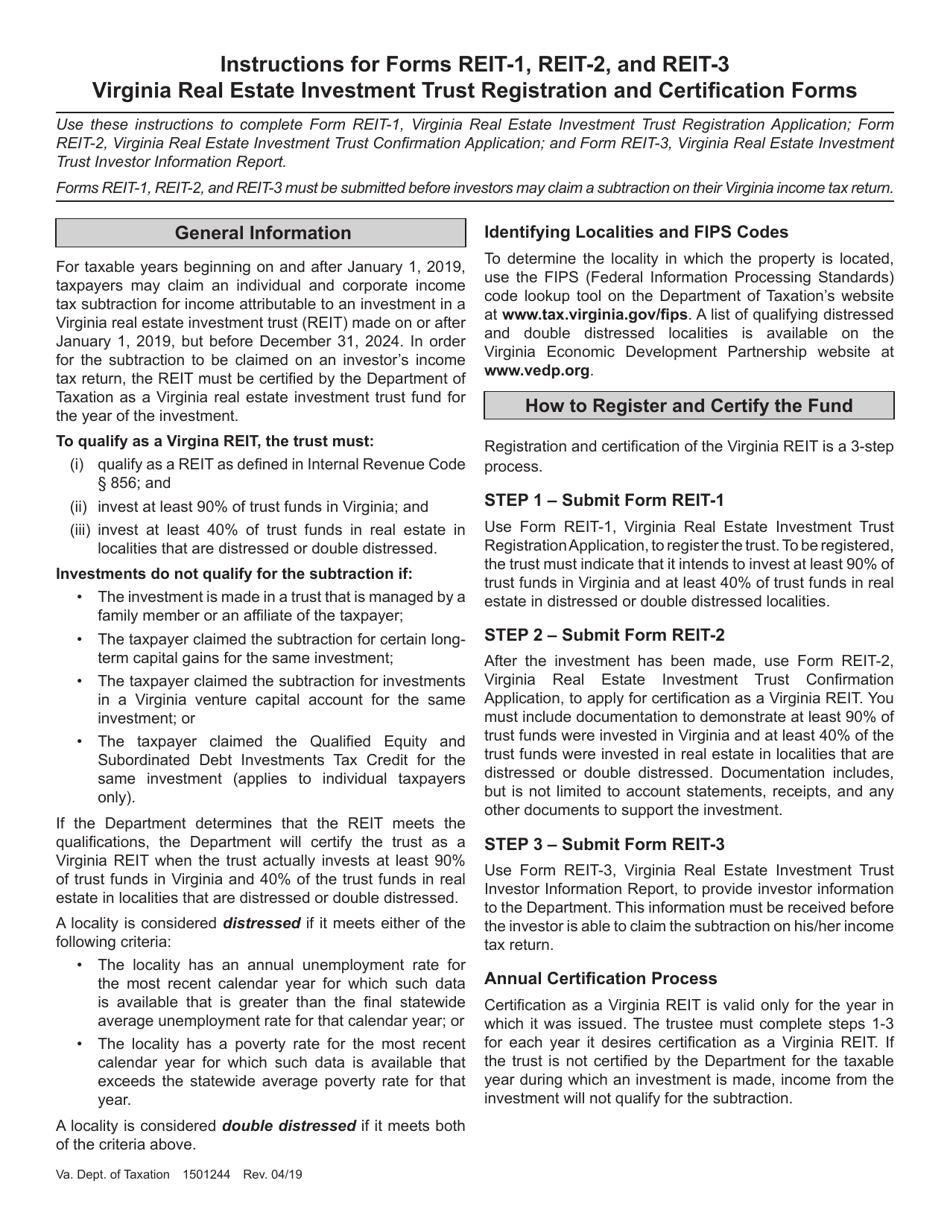

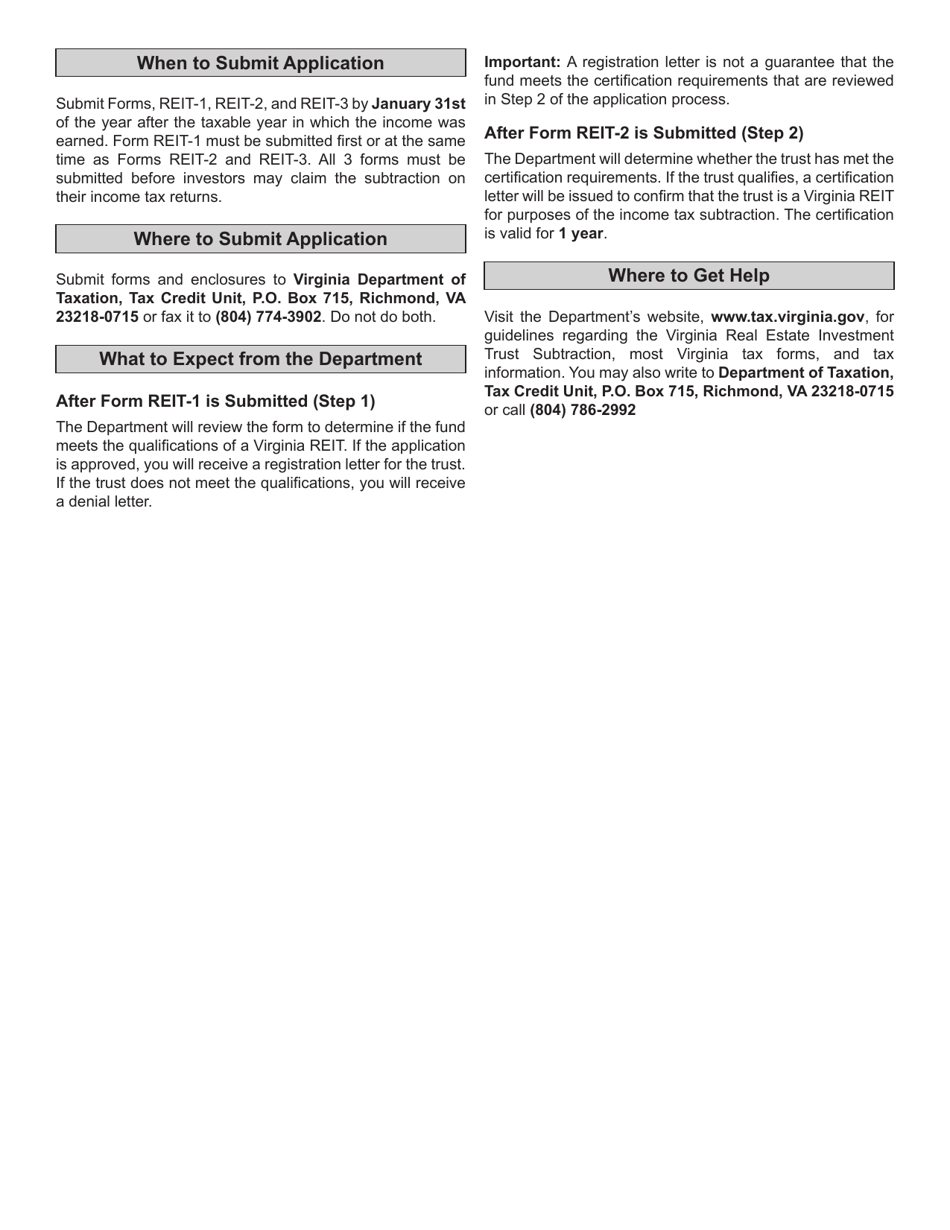

This document contains official instructions for Form REIT-1 , Form REIT-2 , and Form REIT-3 . All forms are released and collected by the Virginia Department of Taxation. An up-to-date fillable Form REIT-1 is available for download through this link. The latest available Form REIT-2 can be downloaded through this link. Form REIT-3 can be found here.

FAQ

Q: What are Form REIT-1, REIT-2, and REIT-3?

A: Form REIT-1, REIT-2, and REIT-3 are specific tax forms used in Virginia for the reporting of real estate investment trust (REIT) activities.

Q: Who needs to file Form REIT-1, REIT-2, and REIT-3?

A: Real estate investment trusts operating in Virginia need to file these forms to report their activities and comply with state tax regulations.

Q: What is the purpose of Form REIT-1?

A: Form REIT-1 is used to report the initial registration of a real estate investment trust in Virginia.

Q: What is the purpose of Form REIT-2?

A: Form REIT-2 is used to report the annual registration and updates of a real estate investment trust in Virginia.

Q: What is the purpose of Form REIT-3?

A: Form REIT-3 is used to report changes, amendments, or updates to previously filed forms REIT-1 or REIT-2.

Q: What happens if I don't file Form REIT-1, REIT-2, and REIT-3?

A: Failure to file these forms or comply with the reporting requirements may result in penalties, fines, or other legal consequences as determined by the Virginia Department of Taxation.

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Virginia Department of Taxation.