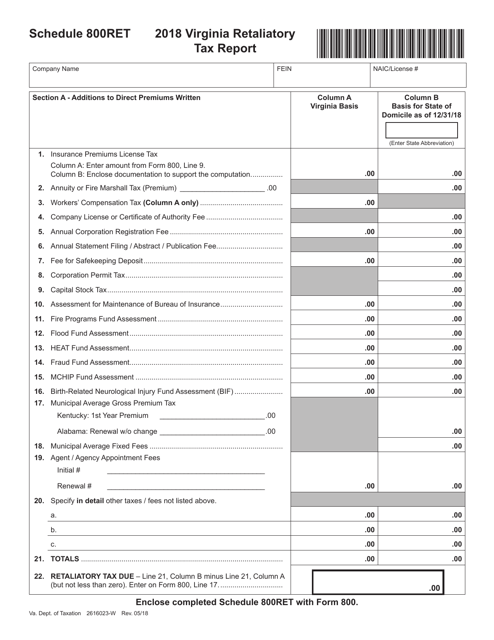

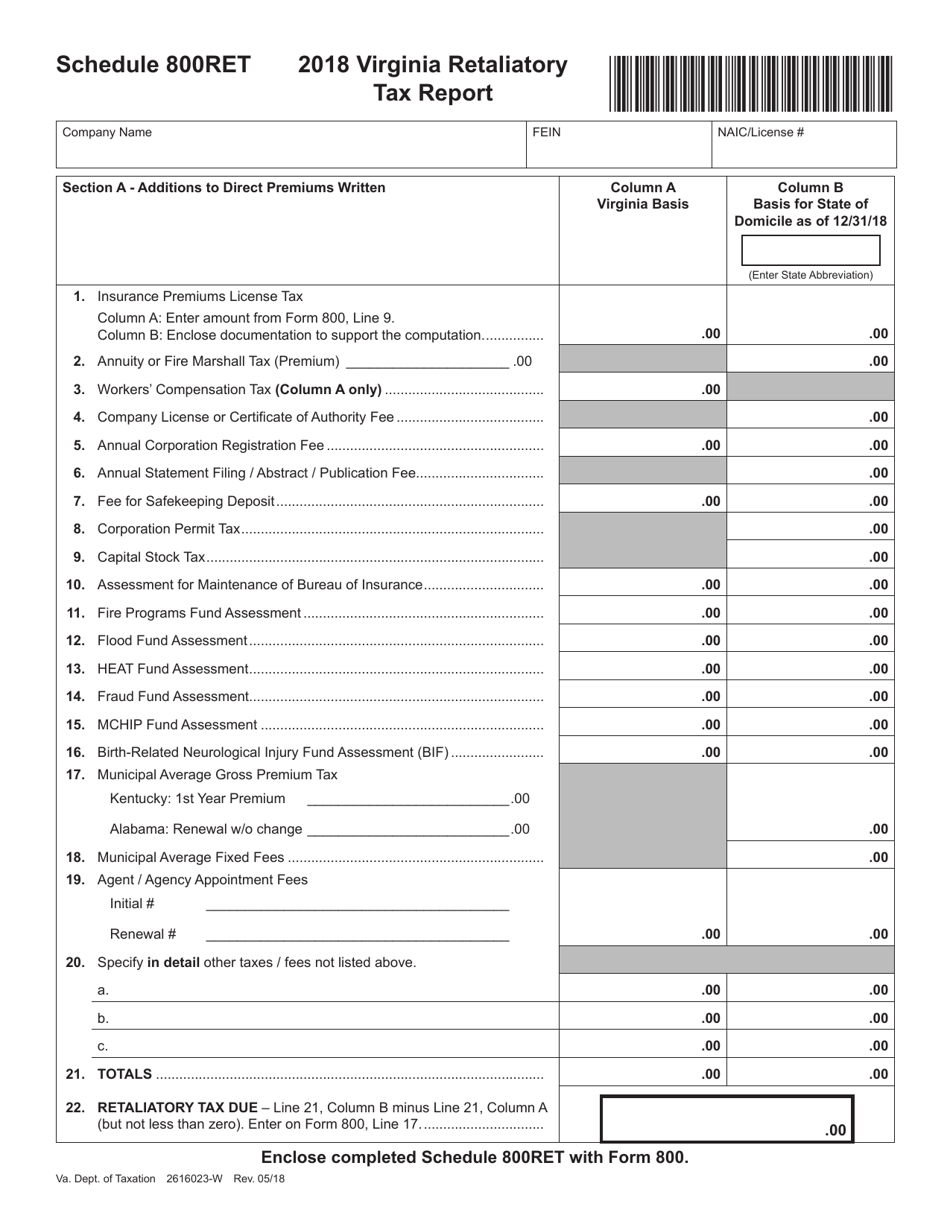

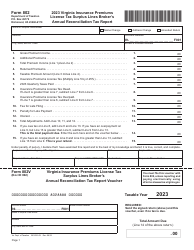

Form 800 Schedule 800RET Virginia Retaliatory Tax Report - Virginia

What Is Form 800 Schedule 800RET?

This is a legal form that was released by the Virginia Department of Taxation - a government authority operating within Virginia.The document is a supplement to Form 800, Insurance Premiums License Tax Return. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 800 Schedule 800RET?

A: Form 800 Schedule 800RET is the Virginia Retaliatory Tax Report.

Q: Who needs to file Form 800 Schedule 800RET?

A: Any business entity that is subject to retaliatory taxes in Virginia needs to file Form 800 Schedule 800RET.

Q: What are retaliatory taxes?

A: Retaliatory taxes are taxes that a state imposes on businesses from other states, based on the taxes those businesses impose on similar businesses from the imposing state.

Q: When is Form 800 Schedule 800RET due?

A: Form 800 Schedule 800RET is due on or before the 15th day of the 4th month following the end of the taxable year.

Q: Is Form 800 Schedule 800RET required for all businesses?

A: No, Form 800 Schedule 800RET is only required for businesses that are subject to retaliatory taxes in Virginia.

Q: What information do I need to complete Form 800 Schedule 800RET?

A: You will need information such as your business entity's name, federal identification number, and details of your retaliatory tax liability.

Q: Are there any penalties for late filing of Form 800 Schedule 800RET?

A: Yes, there are penalties for late filing of Form 800 Schedule 800RET, so it is important to submit it on time.

Form Details:

- Released on May 1, 2018;

- The latest edition provided by the Virginia Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 800 Schedule 800RET by clicking the link below or browse more documents and templates provided by the Virginia Department of Taxation.