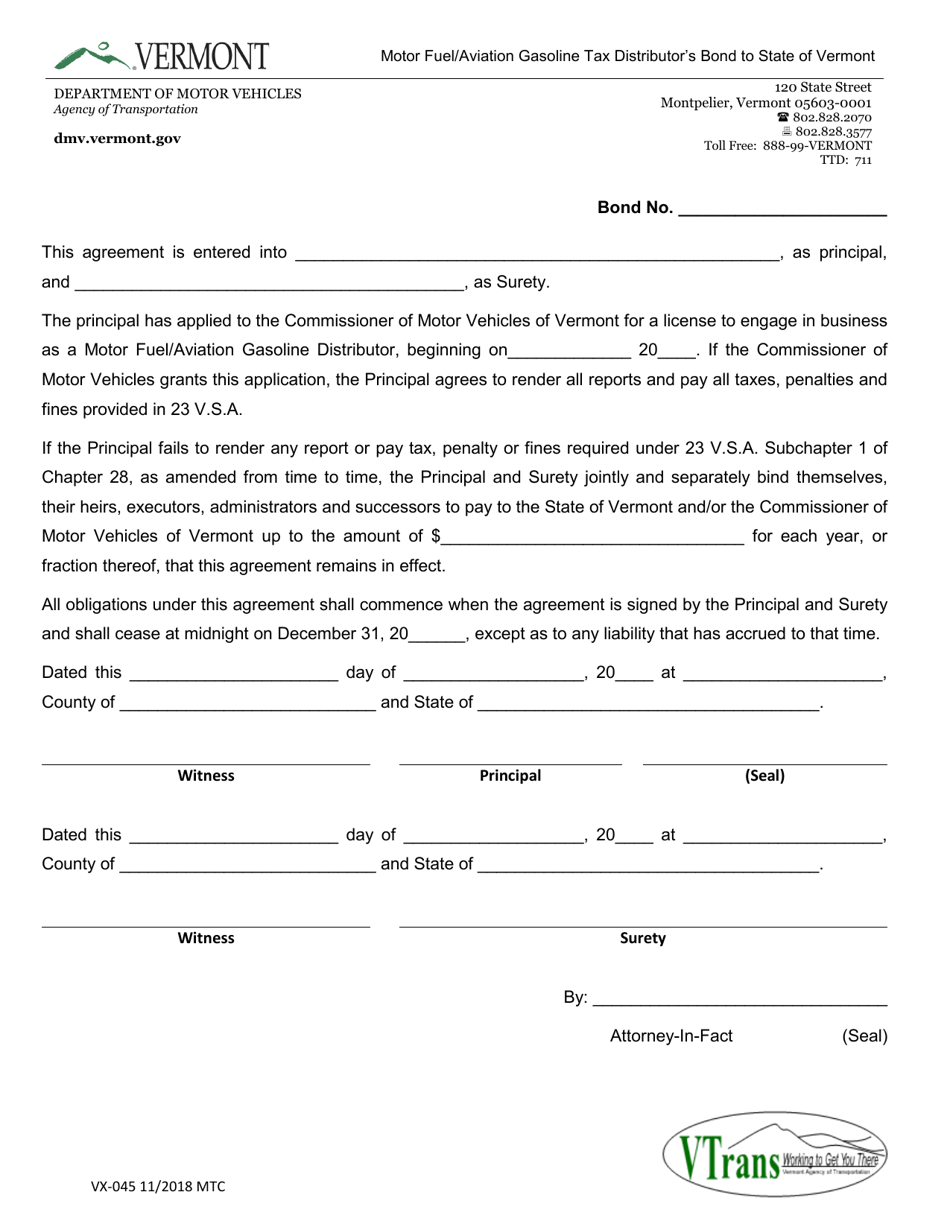

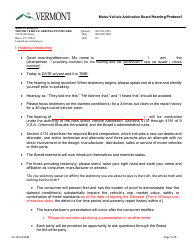

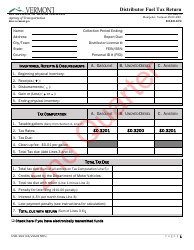

Form VX-045 Motor Fuel / Aviation Gasoline Tax Distributor's Bond to State of Vermont - Vermont

What Is Form VX-045?

This is a legal form that was released by the Vermont Department of Motor Vehicles - a government authority operating within Vermont. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form VX-045?

A: Form VX-045 is the Motor Fuel/Aviation Gasoline Tax Distributor's Bond to the State of Vermont.

Q: Who needs to file Form VX-045?

A: Motor fuel and aviation gasoline distributors in Vermont need to file Form VX-045.

Q: What is the purpose of Form VX-045?

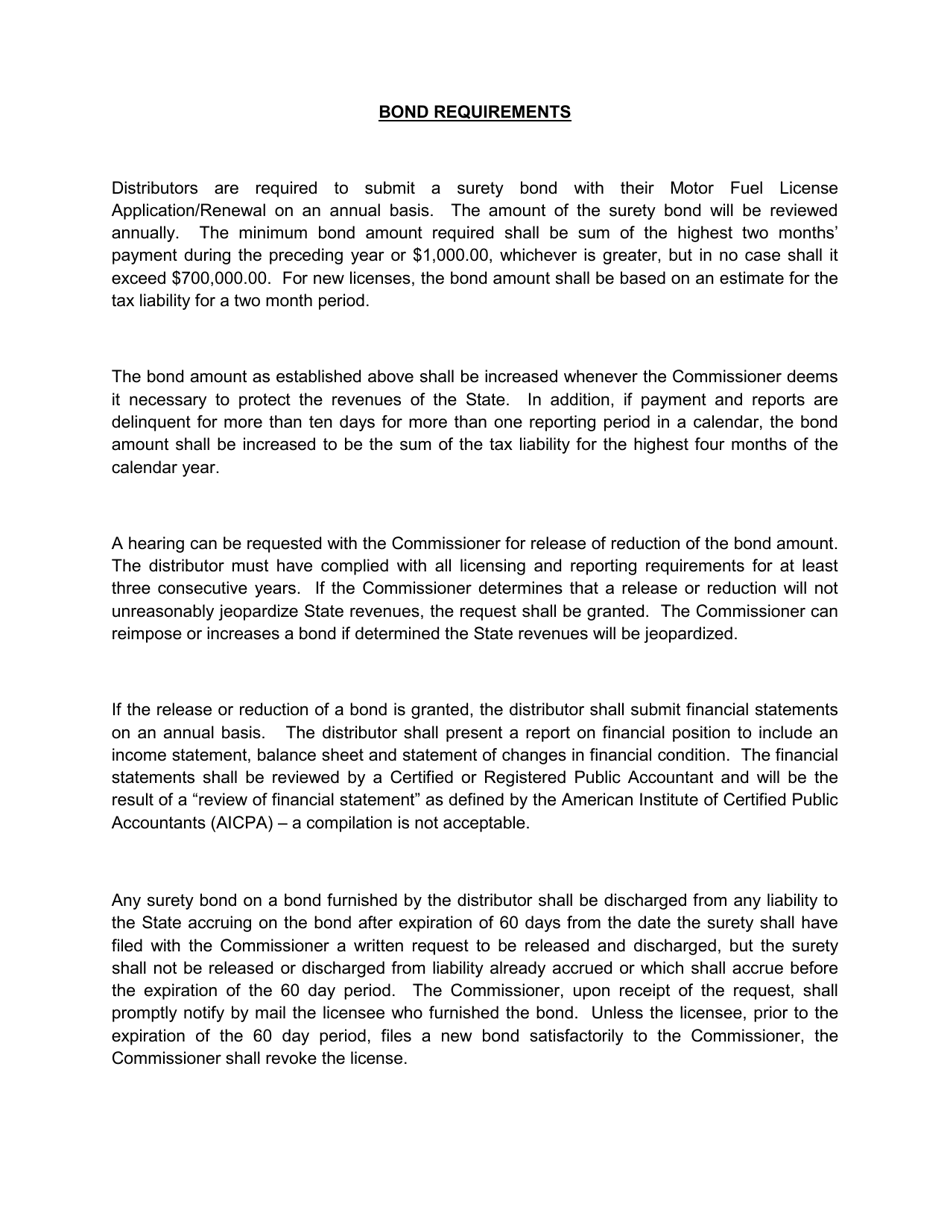

A: Form VX-045 is used to provide a bond as security for the payment of motor fuel and aviation gasoline tax liabilities.

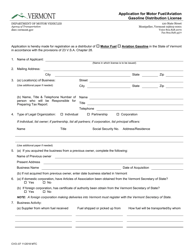

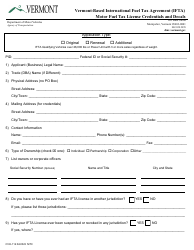

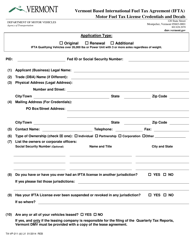

Q: What information is required on Form VX-045?

A: Form VX-045 requires information such as the distributor's name, contact information, business activity, tax periods covered, and bond amount.

Q: When is Form VX-045 due?

A: Form VX-045 is due on or before the 25th day of the month following the end of the tax period.

Q: Are there any penalties for late filing of Form VX-045?

A: Yes, a penalty may be imposed for late filing of Form VX-045.

Q: Is Form VX-045 specific to Vermont?

A: Yes, Form VX-045 is specific to the State of Vermont and is used for motor fuel and aviation gasoline tax purposes in Vermont.

Q: Can I use Form VX-045 for other types of taxes?

A: No, Form VX-045 is specifically for motor fuel and aviation gasoline tax liabilities in Vermont.

Form Details:

- Released on November 1, 2018;

- The latest edition provided by the Vermont Department of Motor Vehicles;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form VX-045 by clicking the link below or browse more documents and templates provided by the Vermont Department of Motor Vehicles.