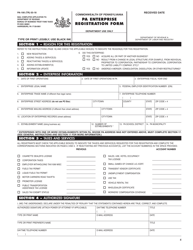

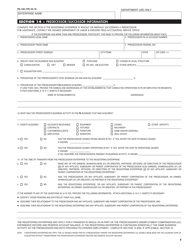

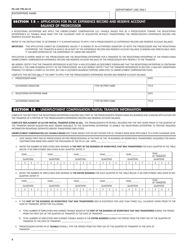

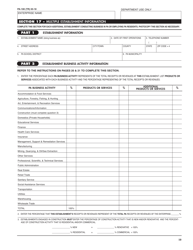

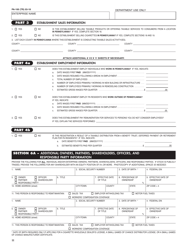

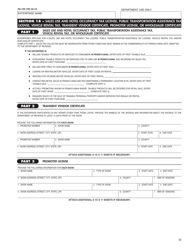

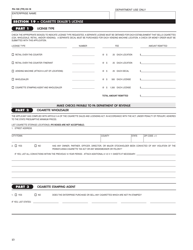

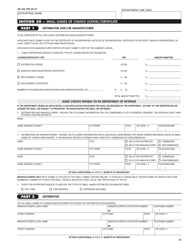

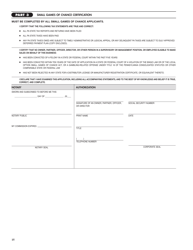

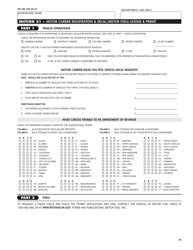

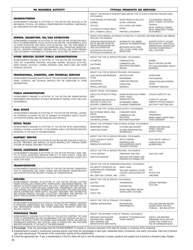

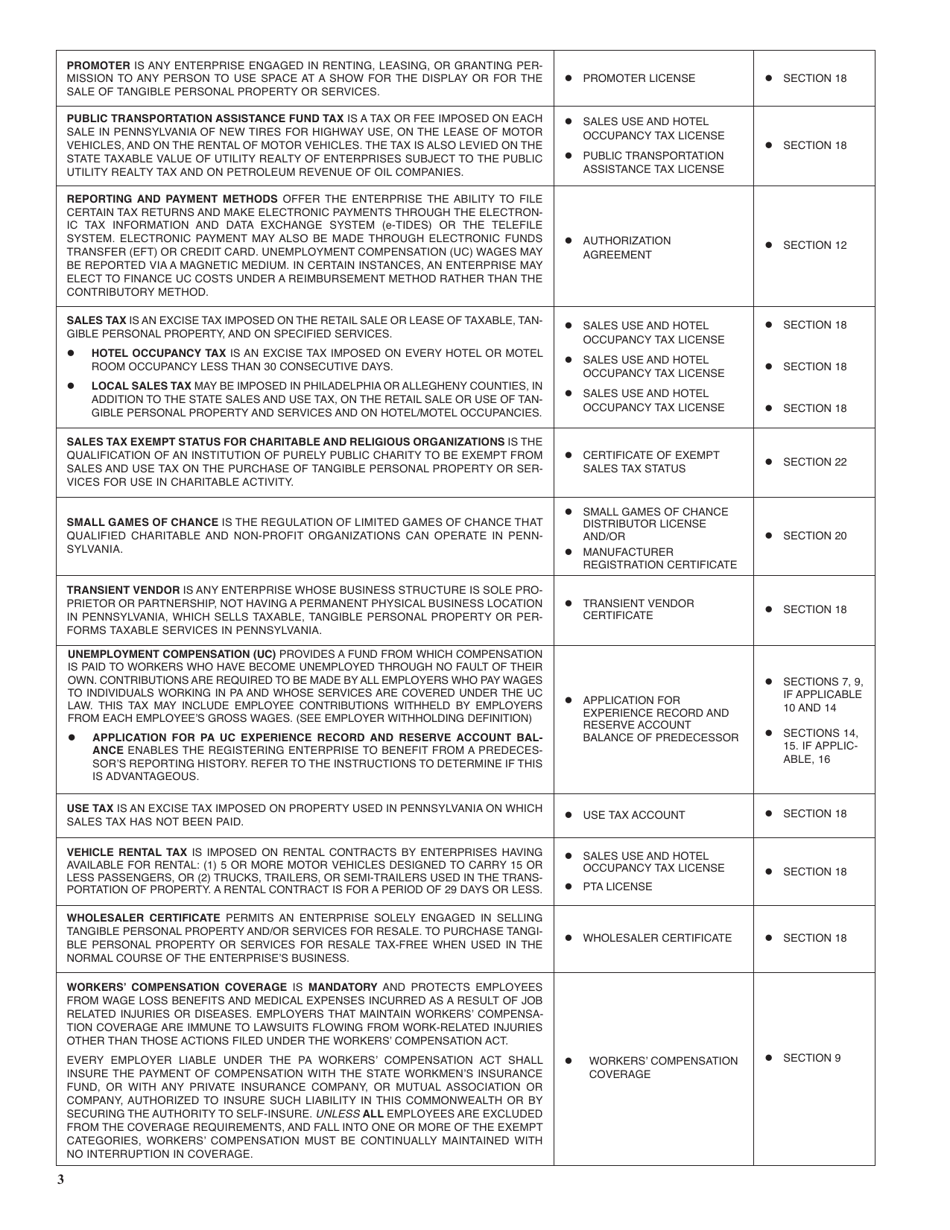

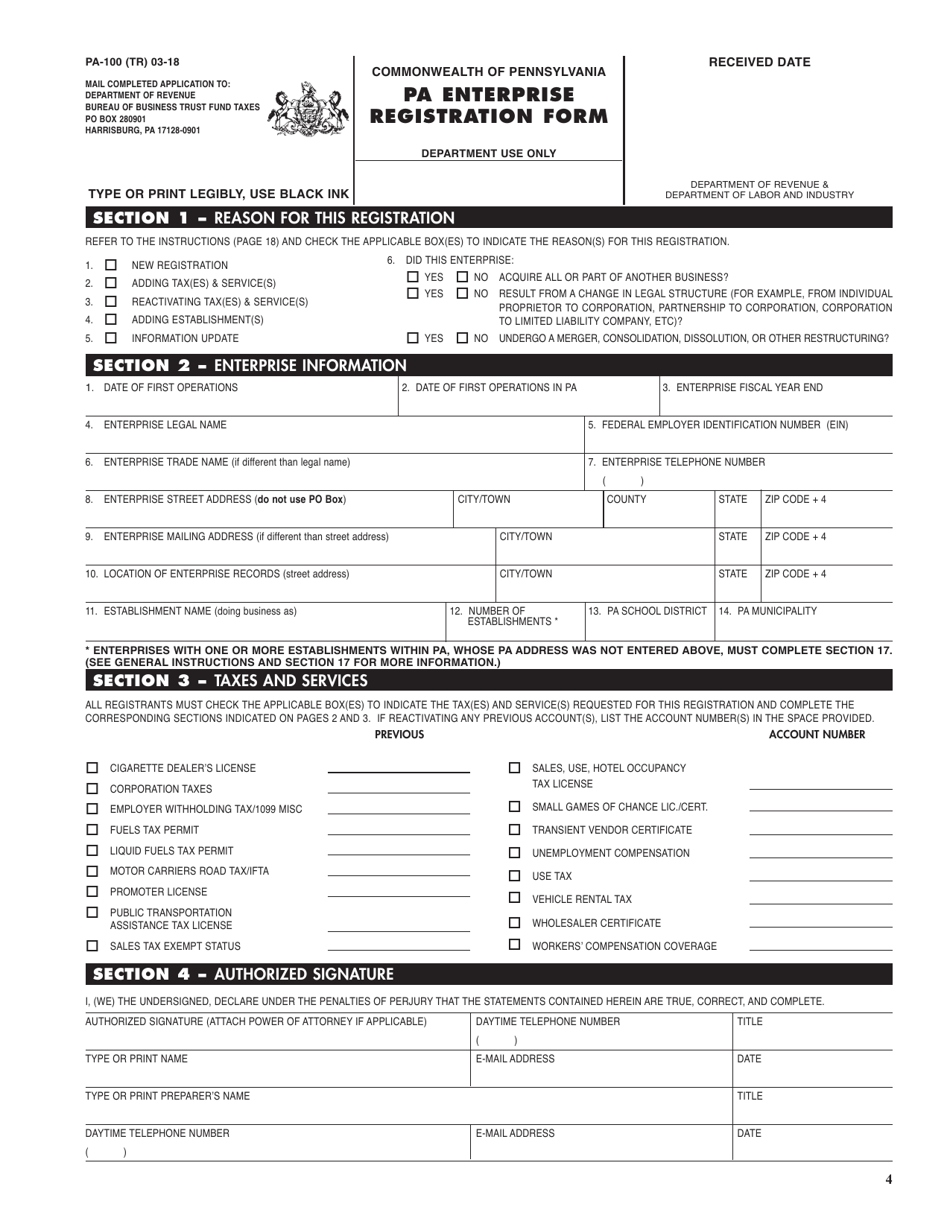

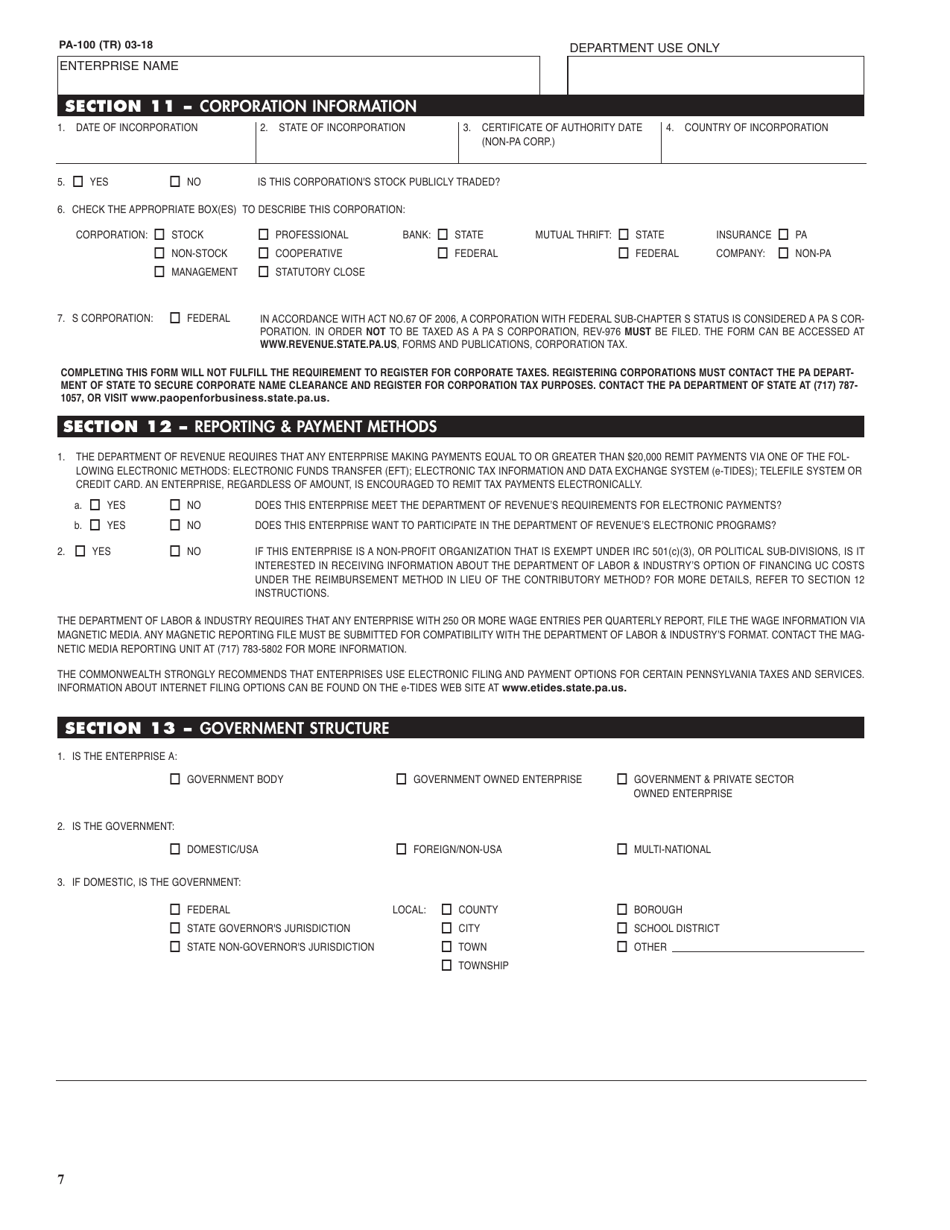

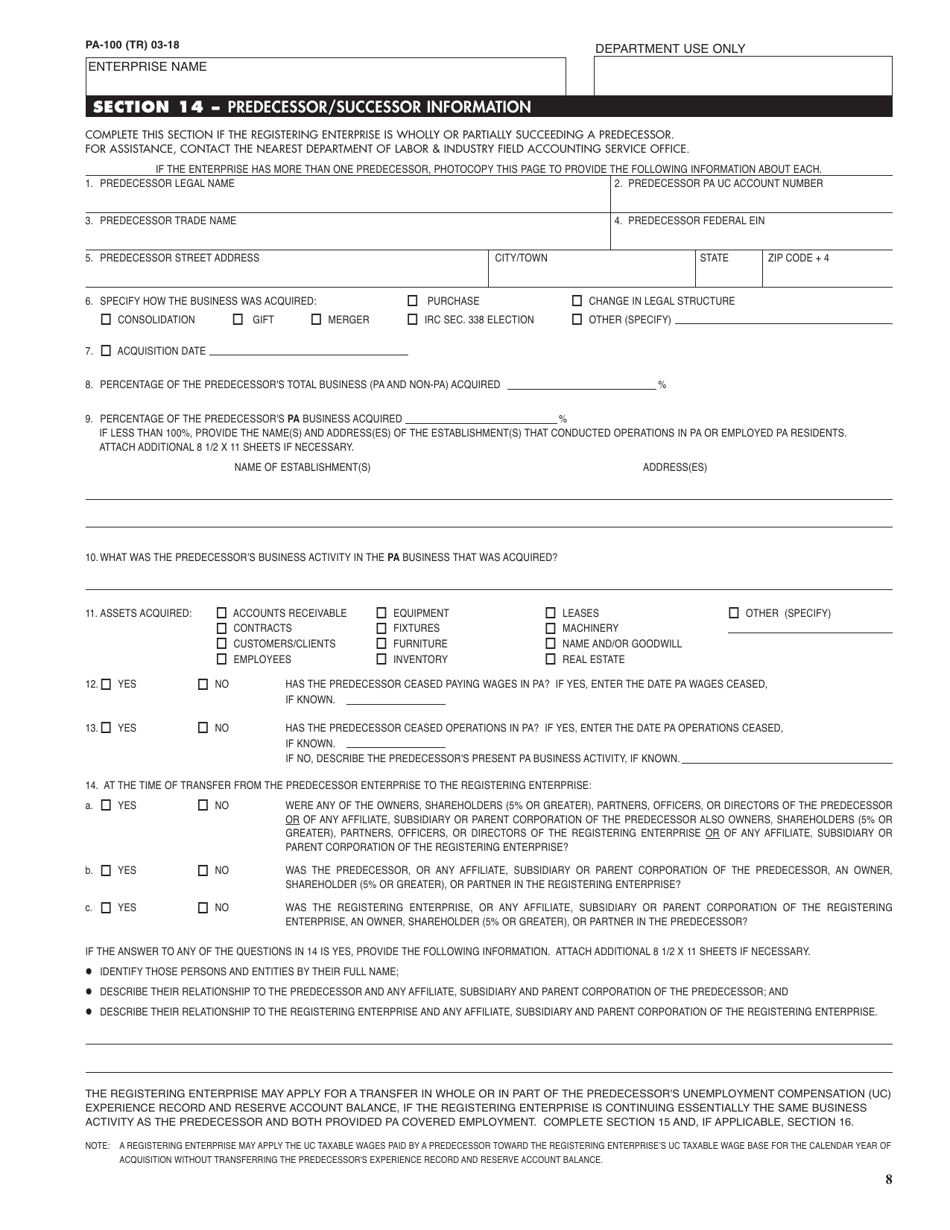

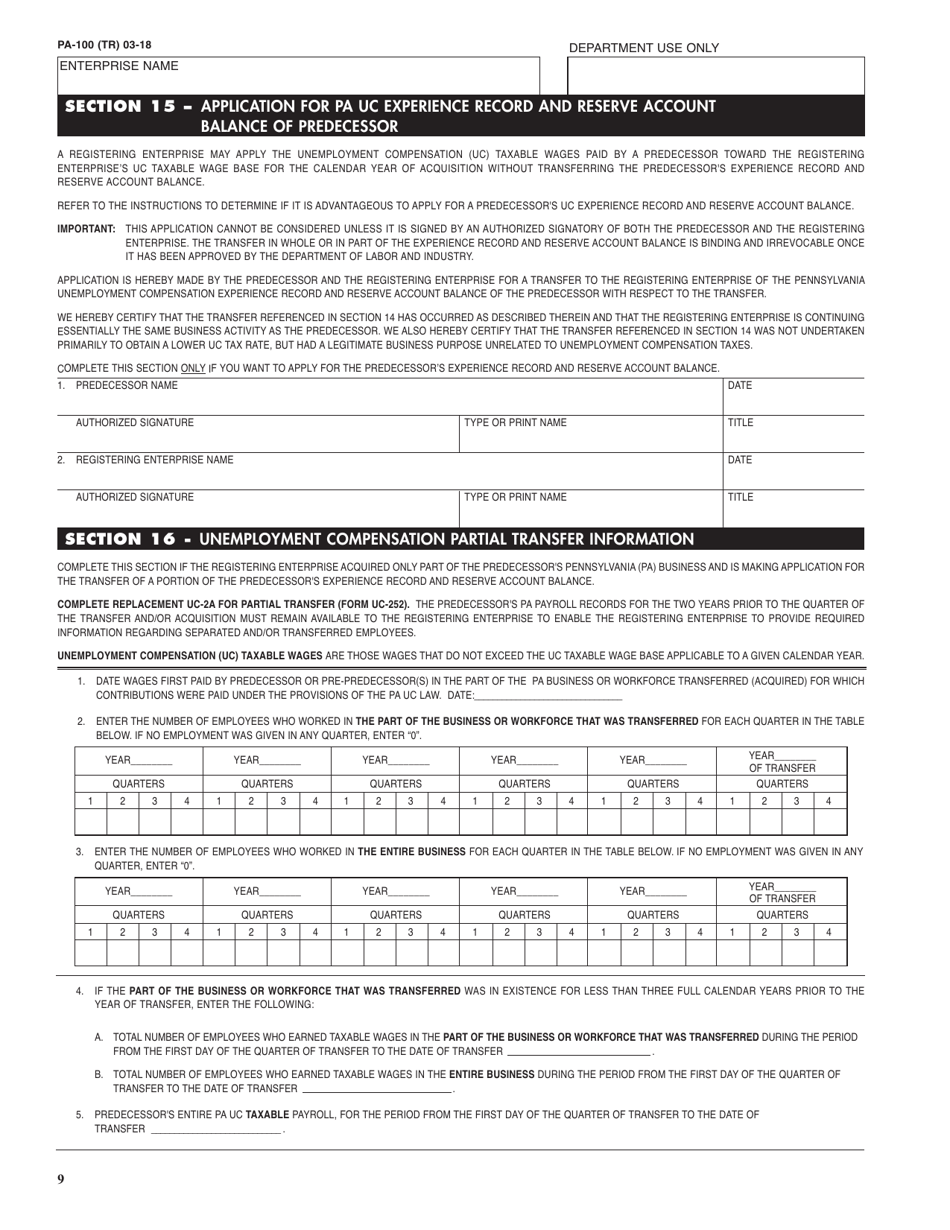

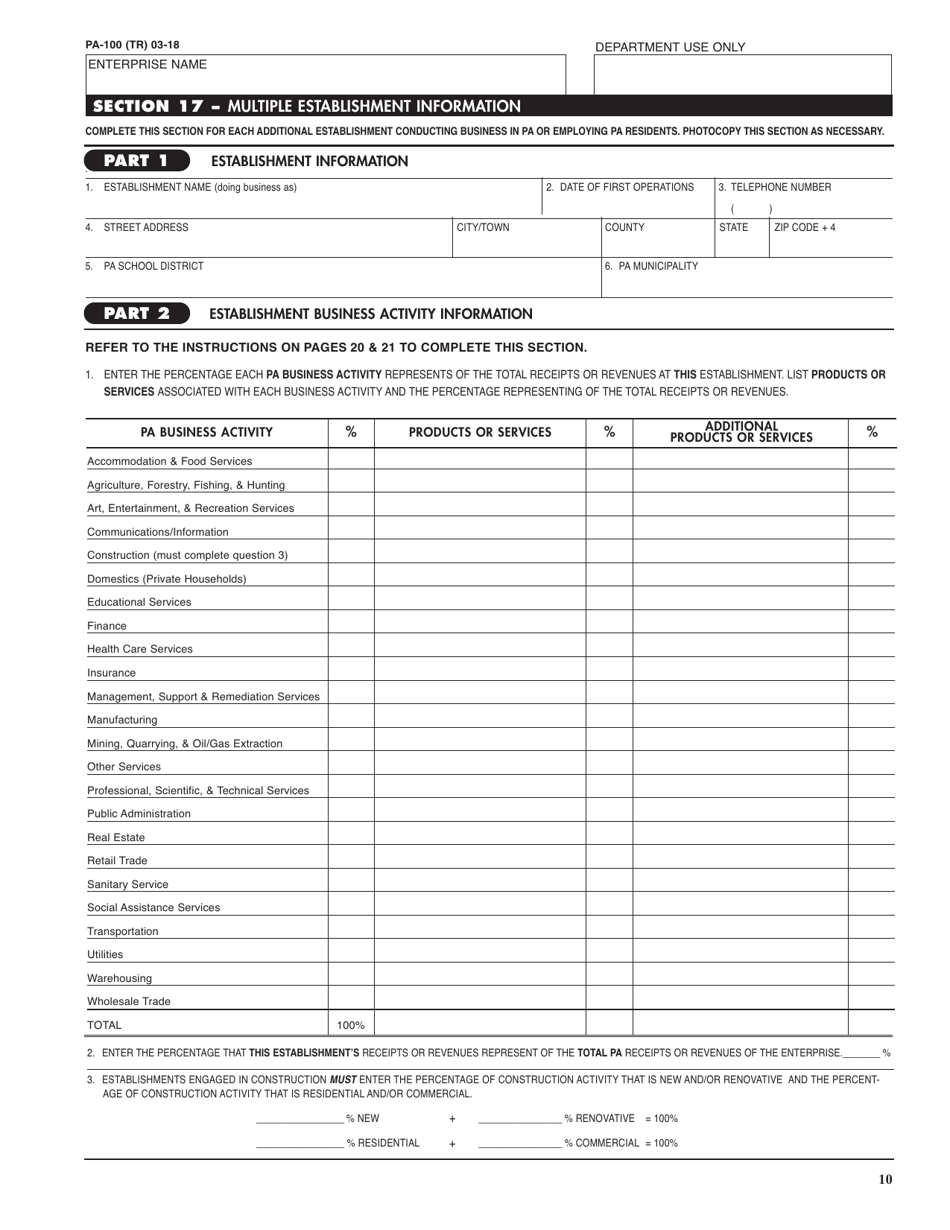

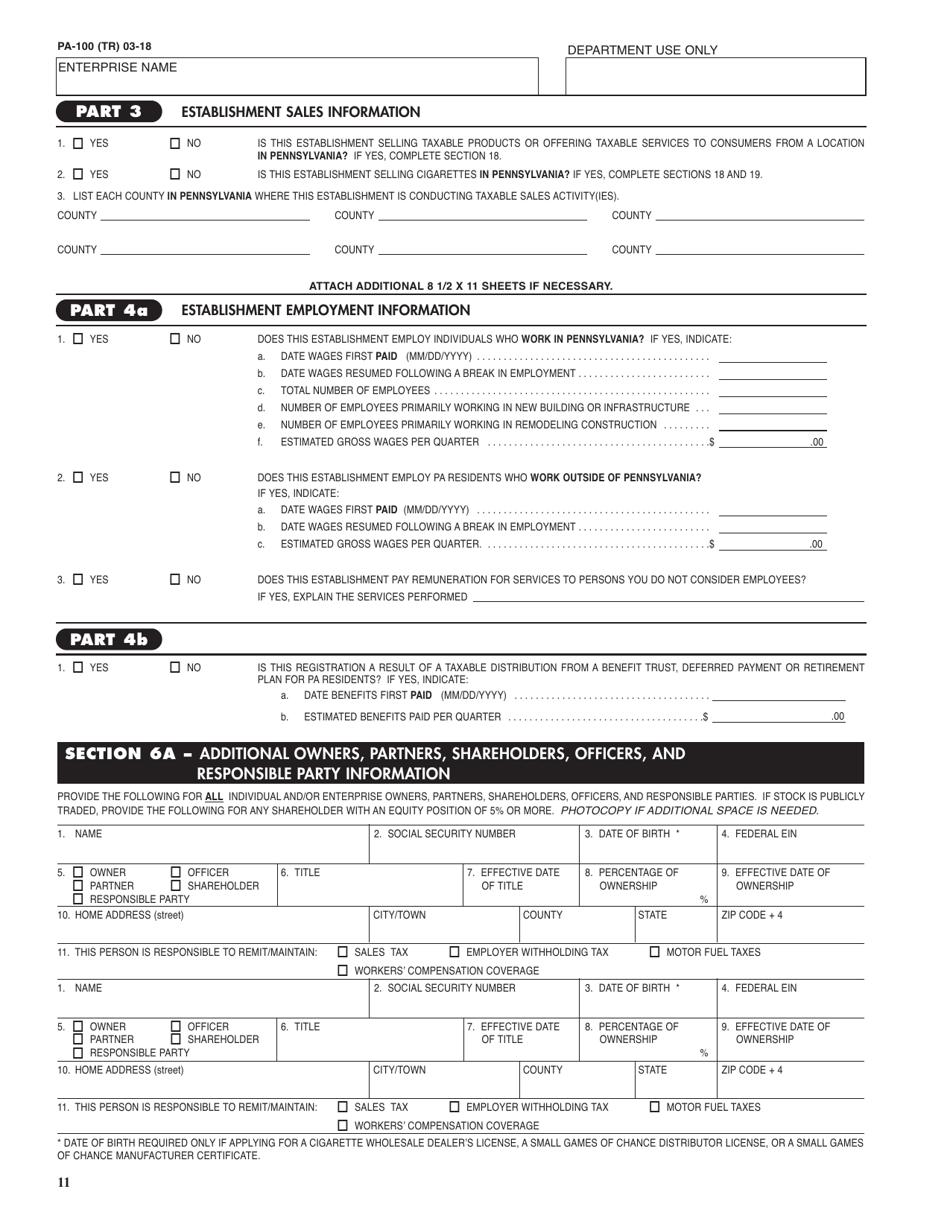

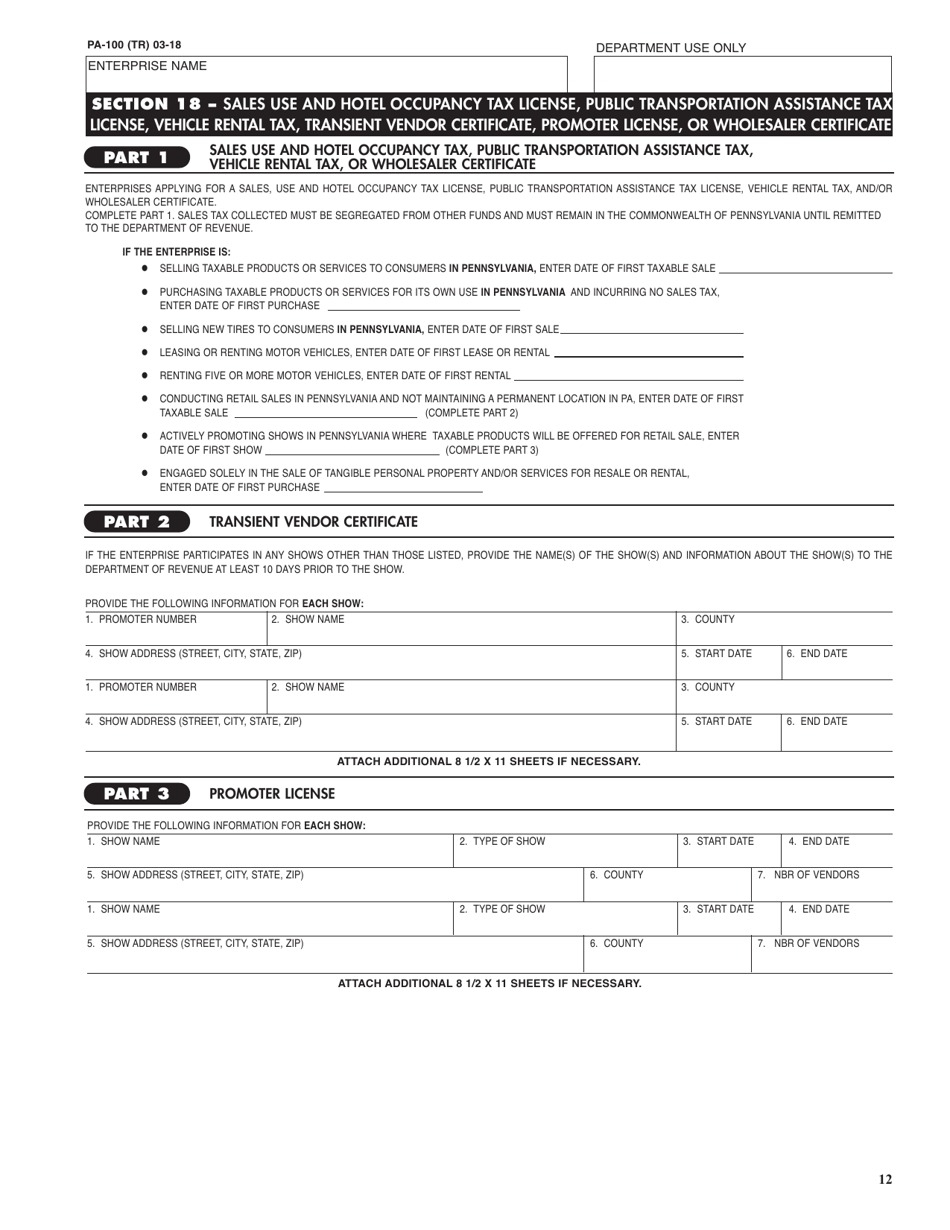

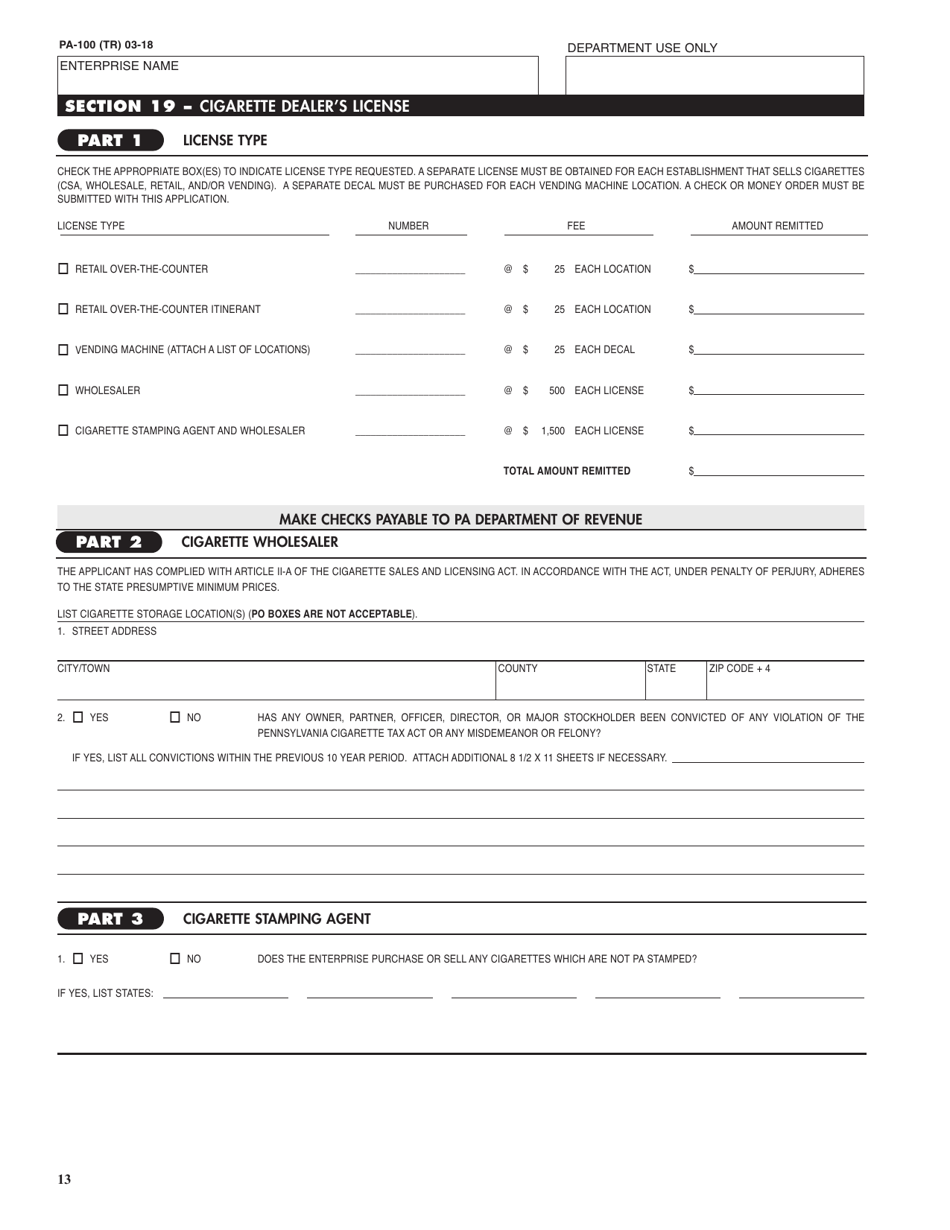

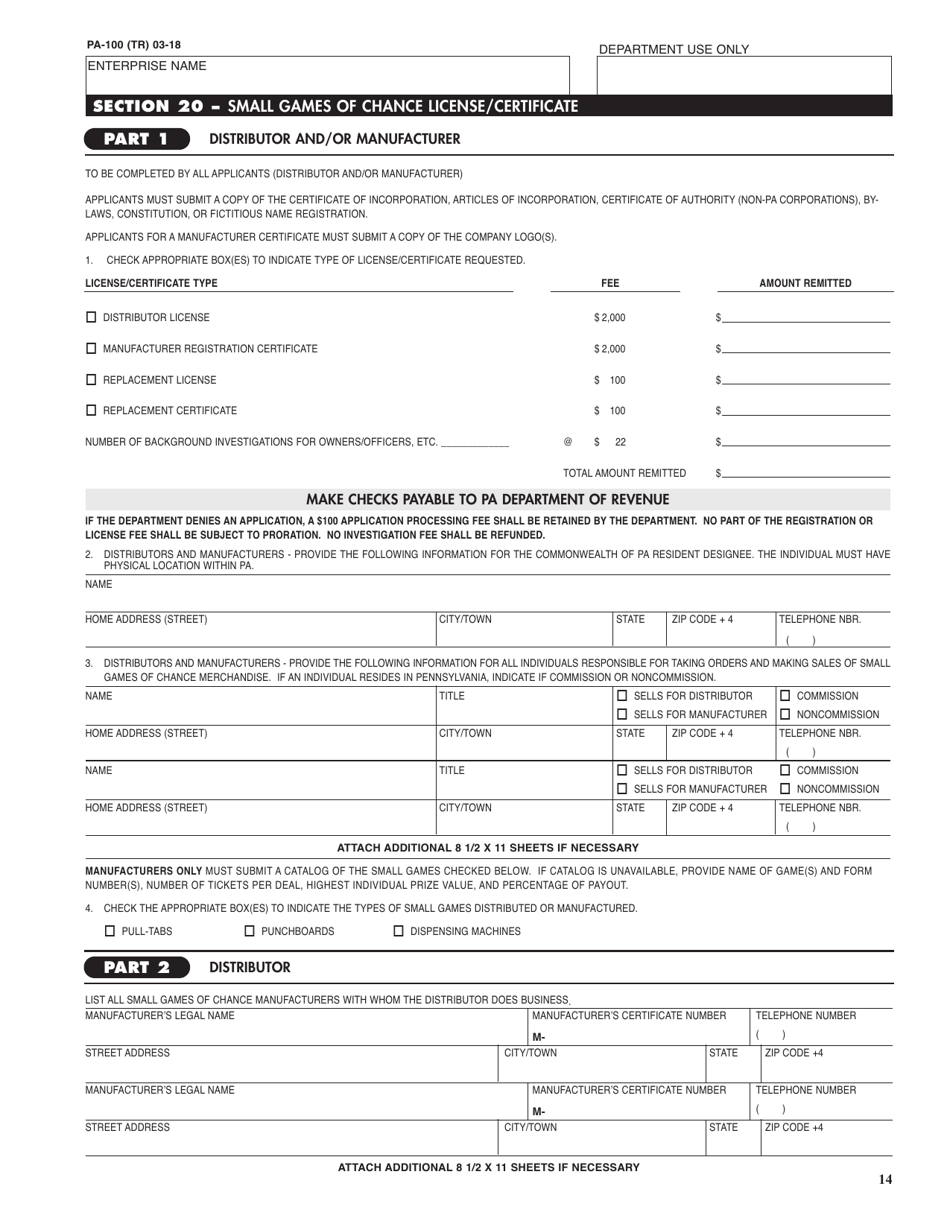

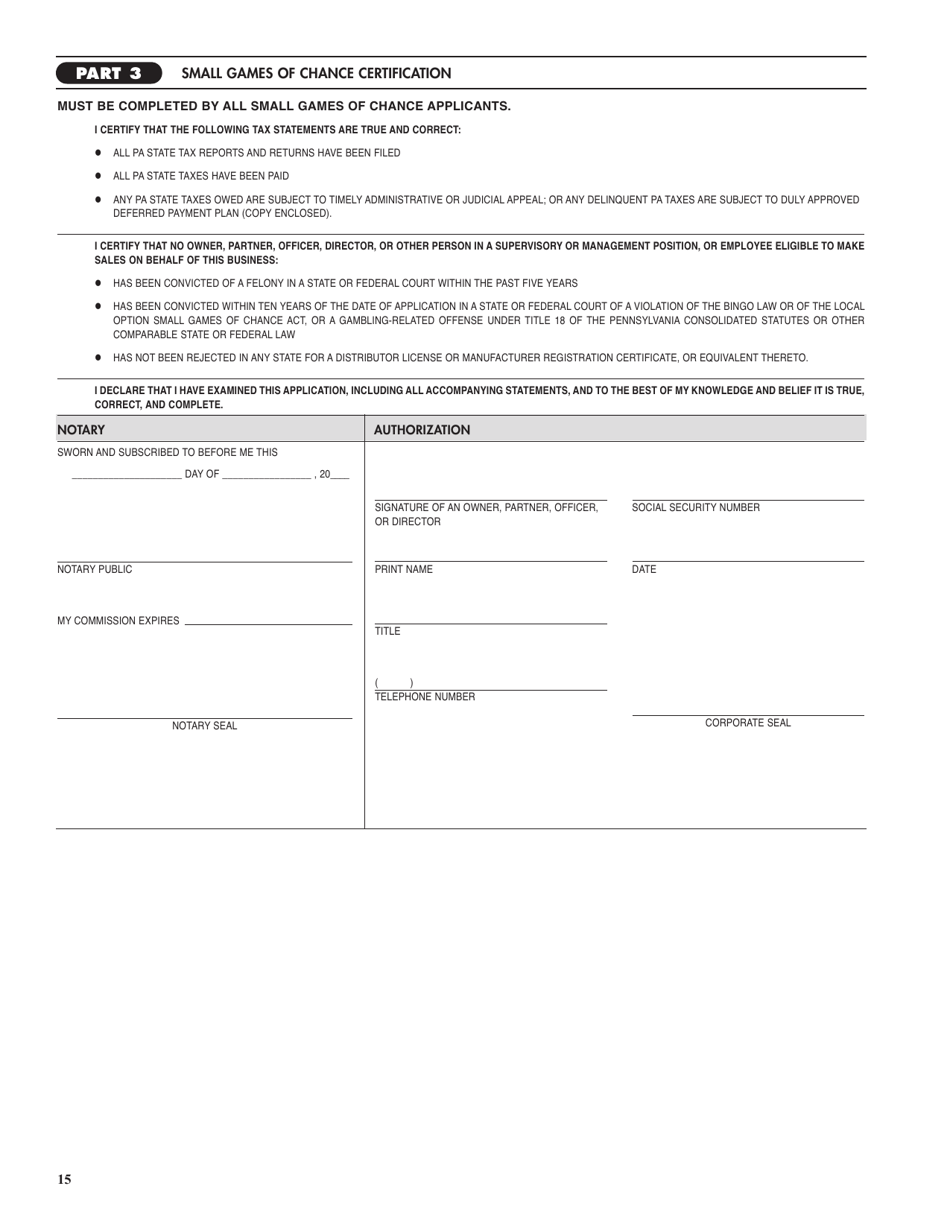

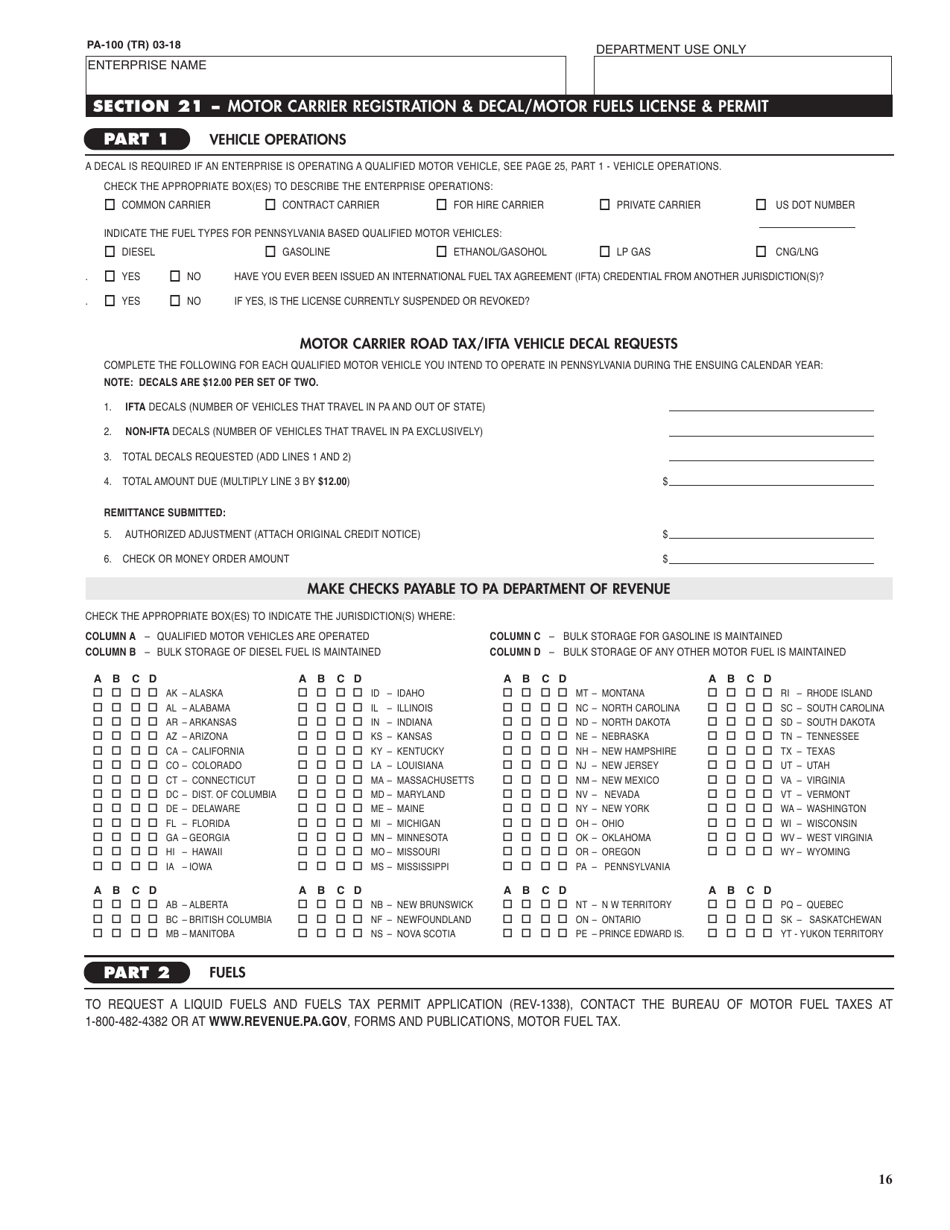

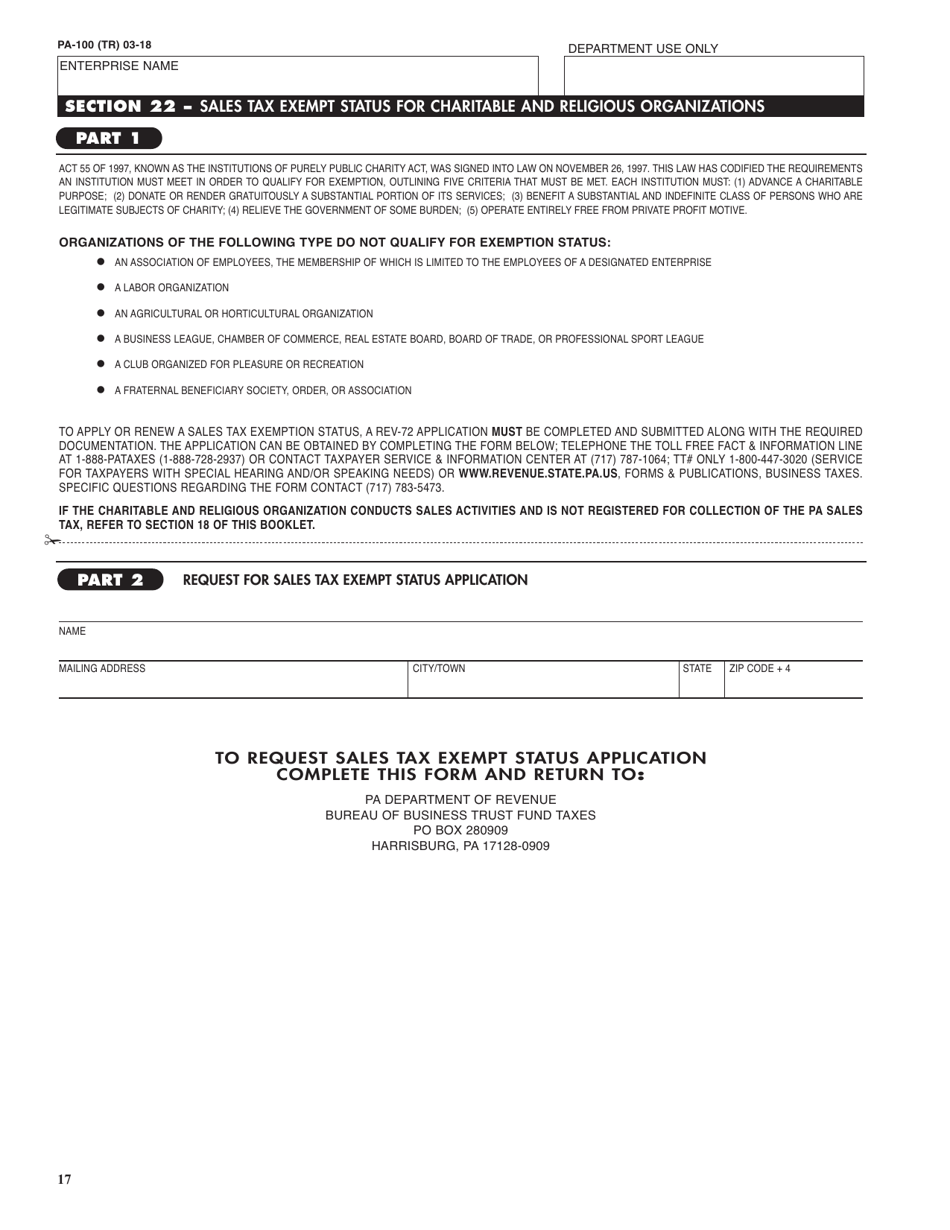

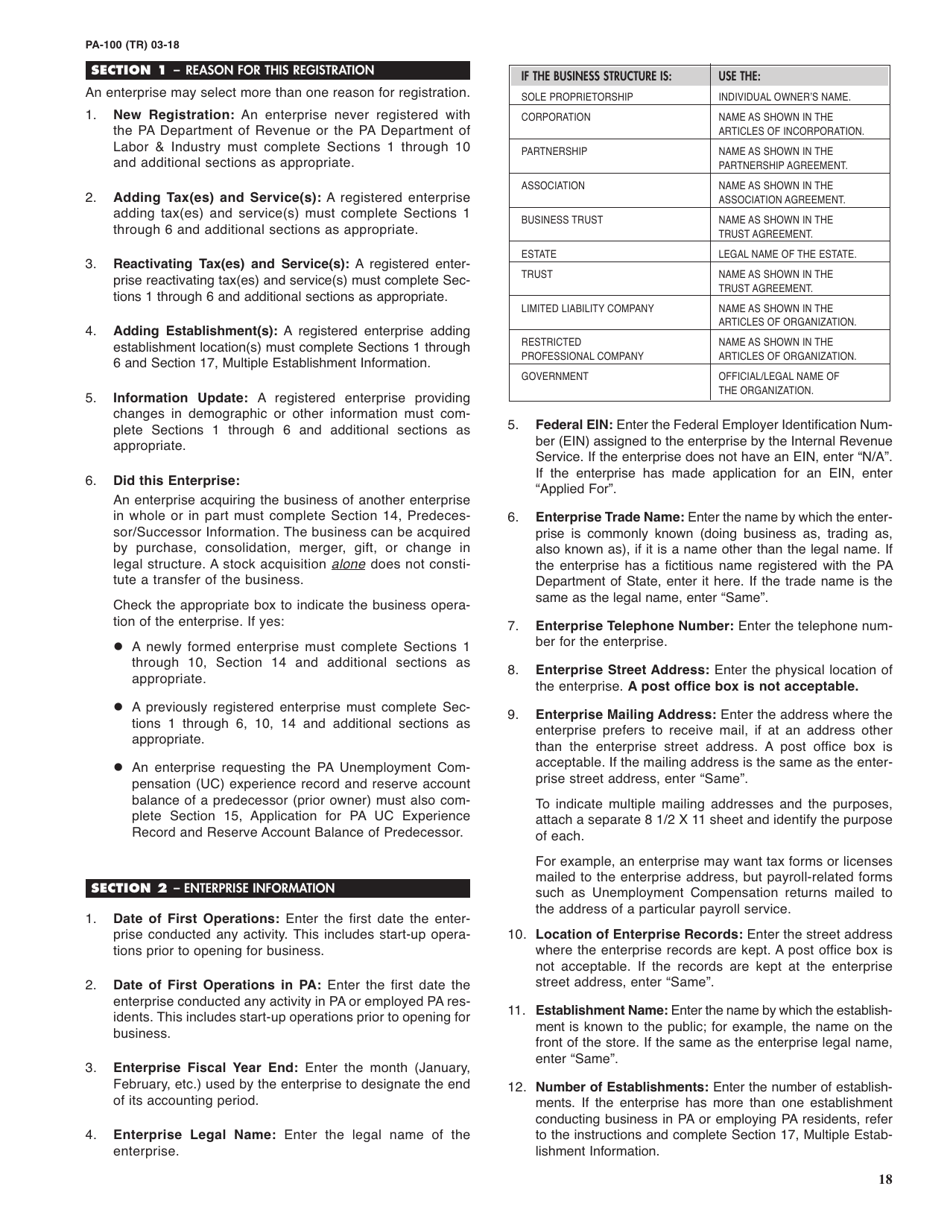

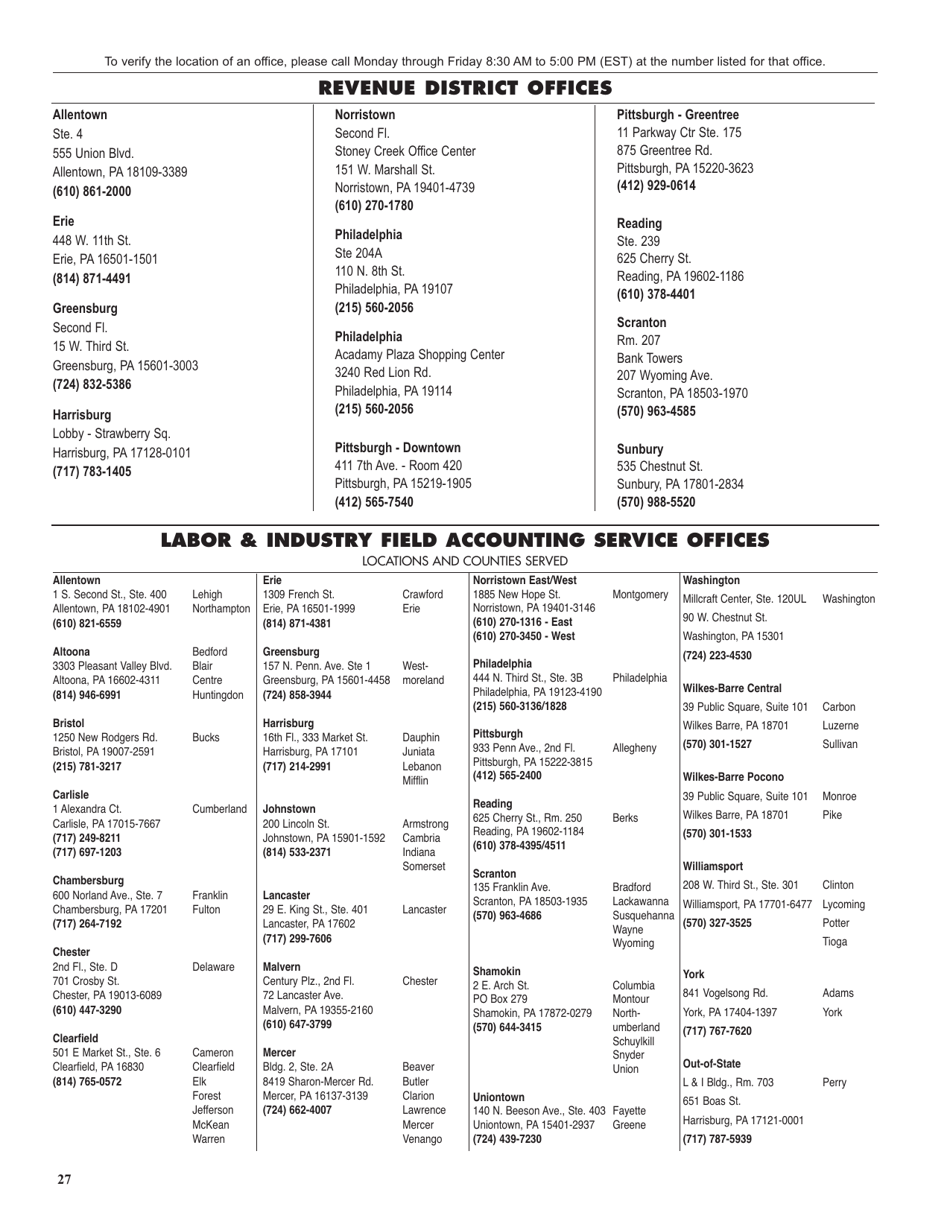

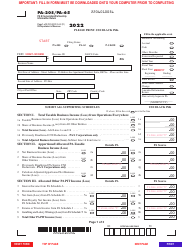

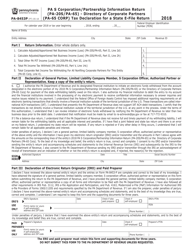

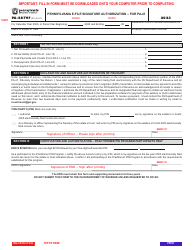

Form PA-100 Pa Enterprise Registration Form - Pennsylvania

What Is Form PA-100?

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

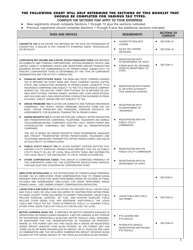

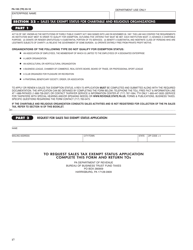

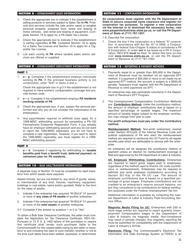

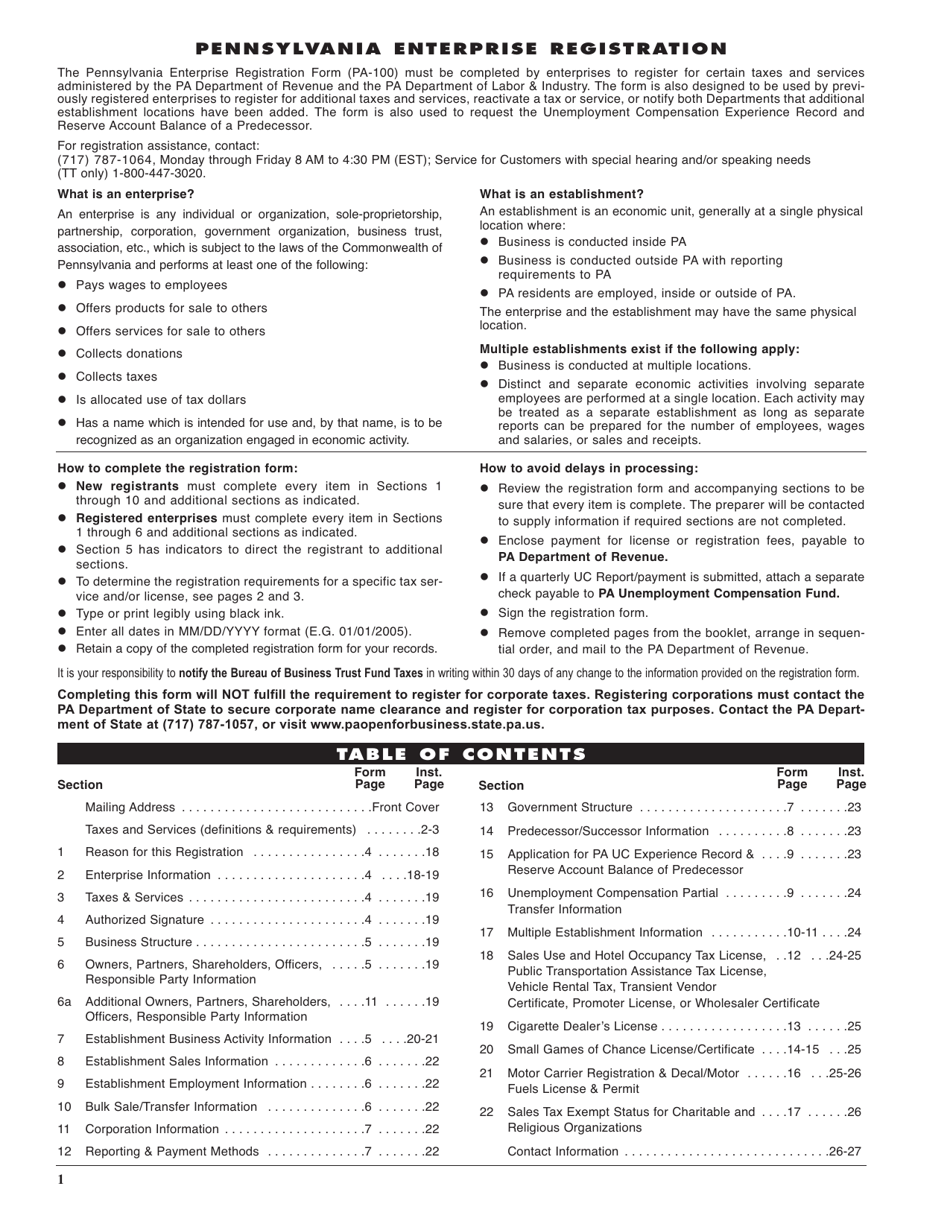

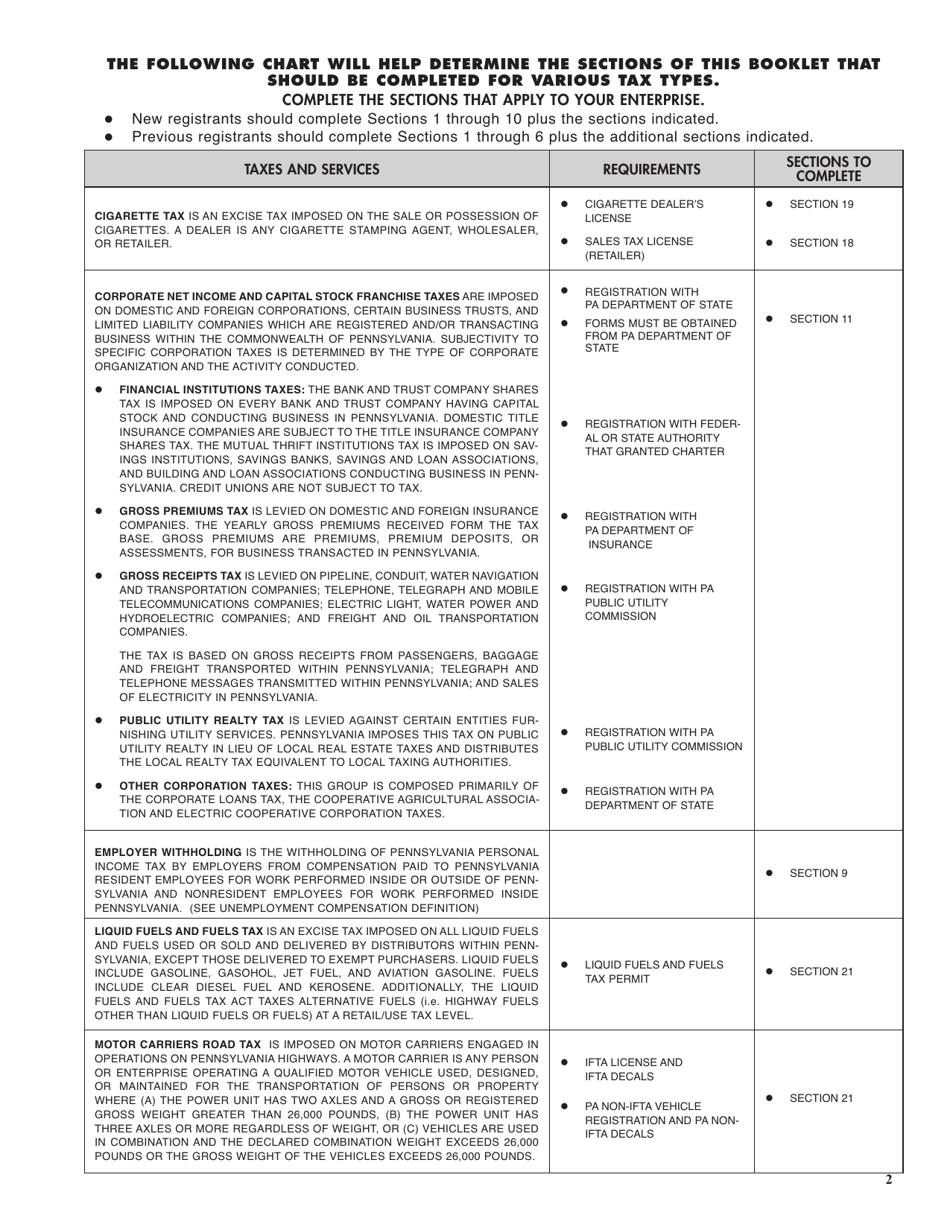

Q: What is the purpose of Form PA-100?

A: The purpose of Form PA-100 is to register a business entity in Pennsylvania.

Q: Who needs to file Form PA-100?

A: Any business entity starting or operating in Pennsylvania needs to file Form PA-100.

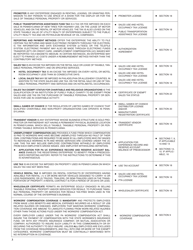

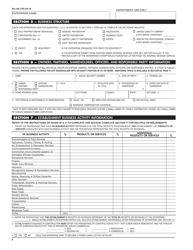

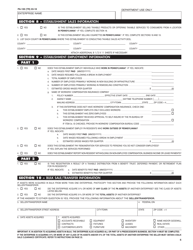

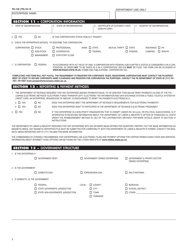

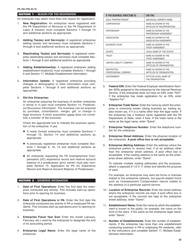

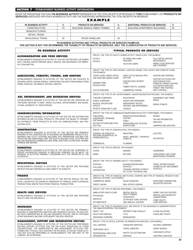

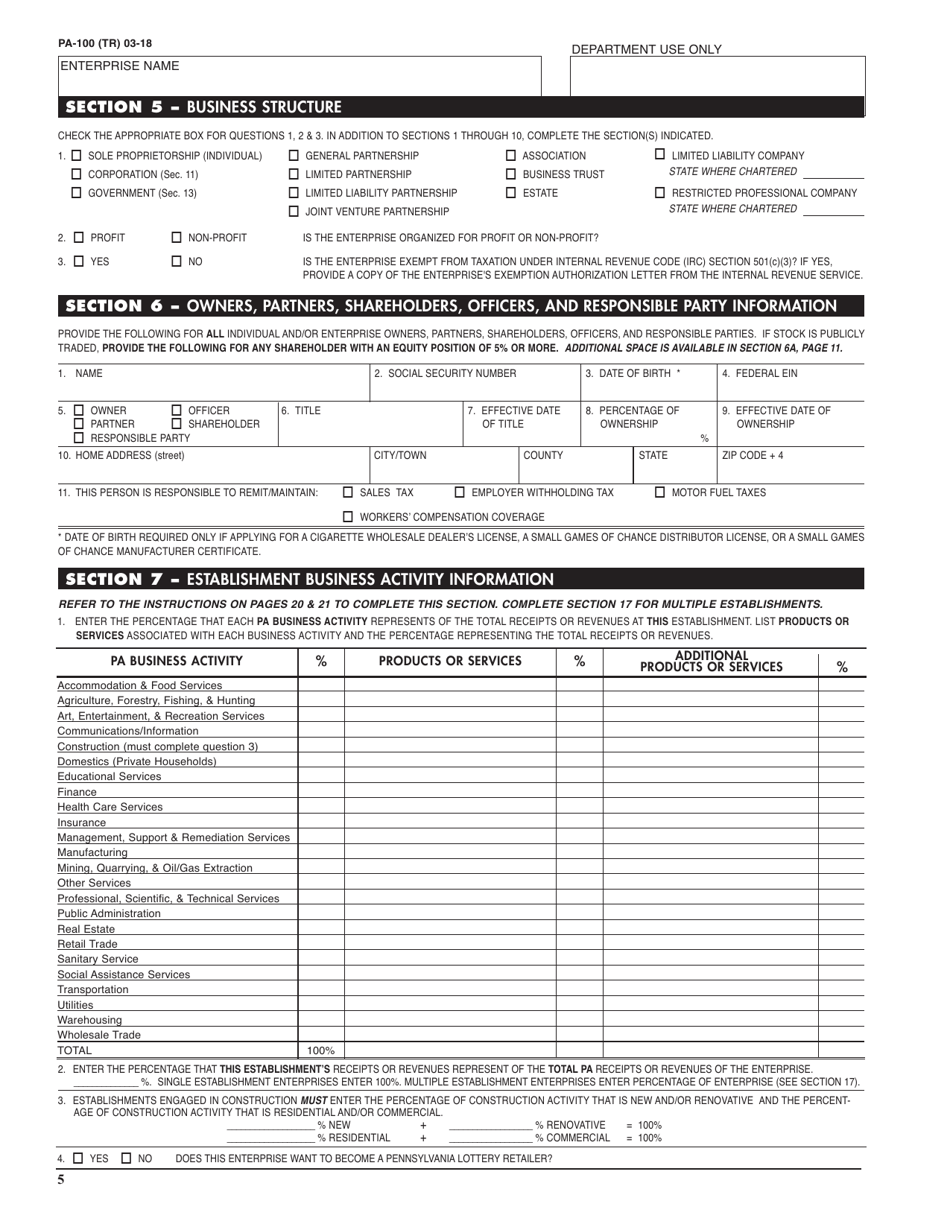

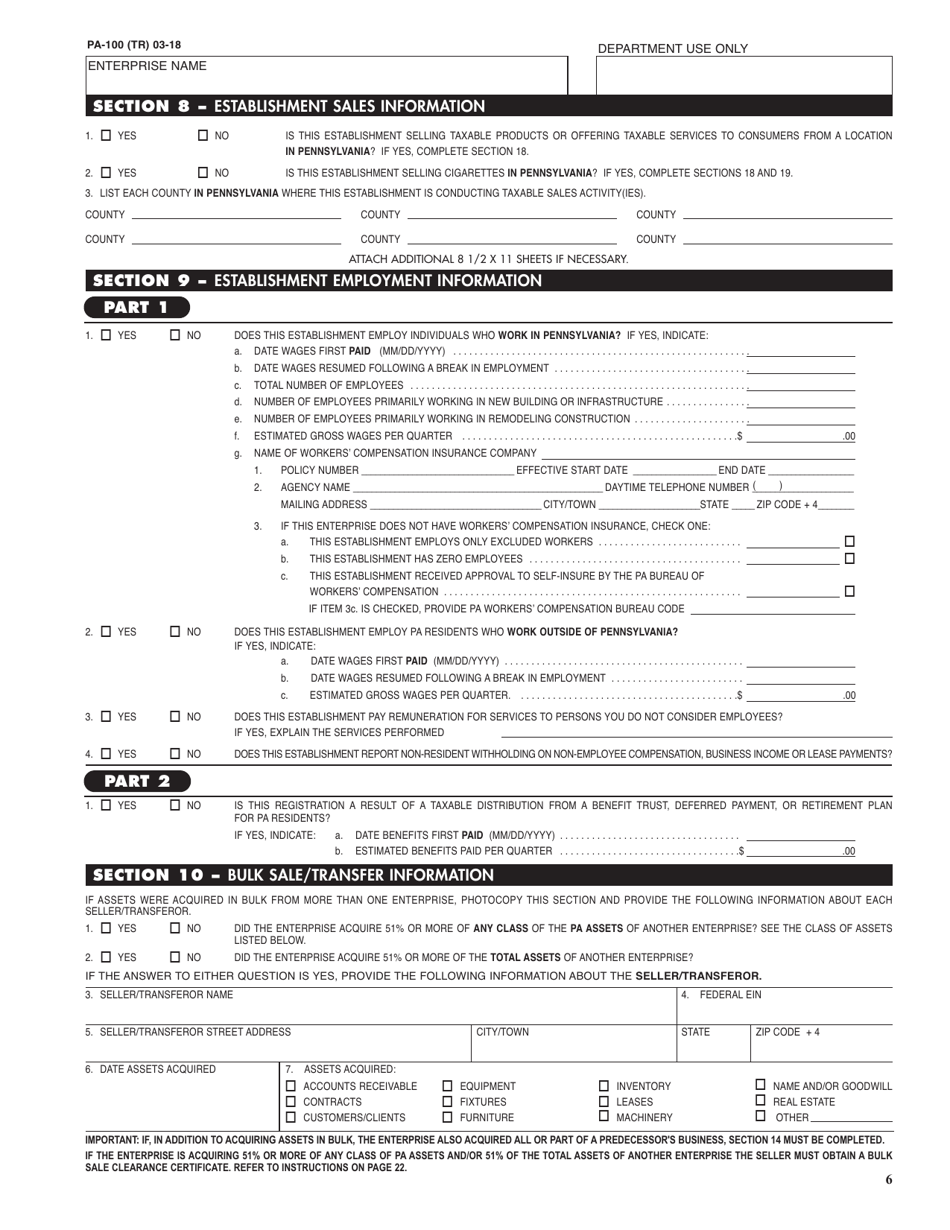

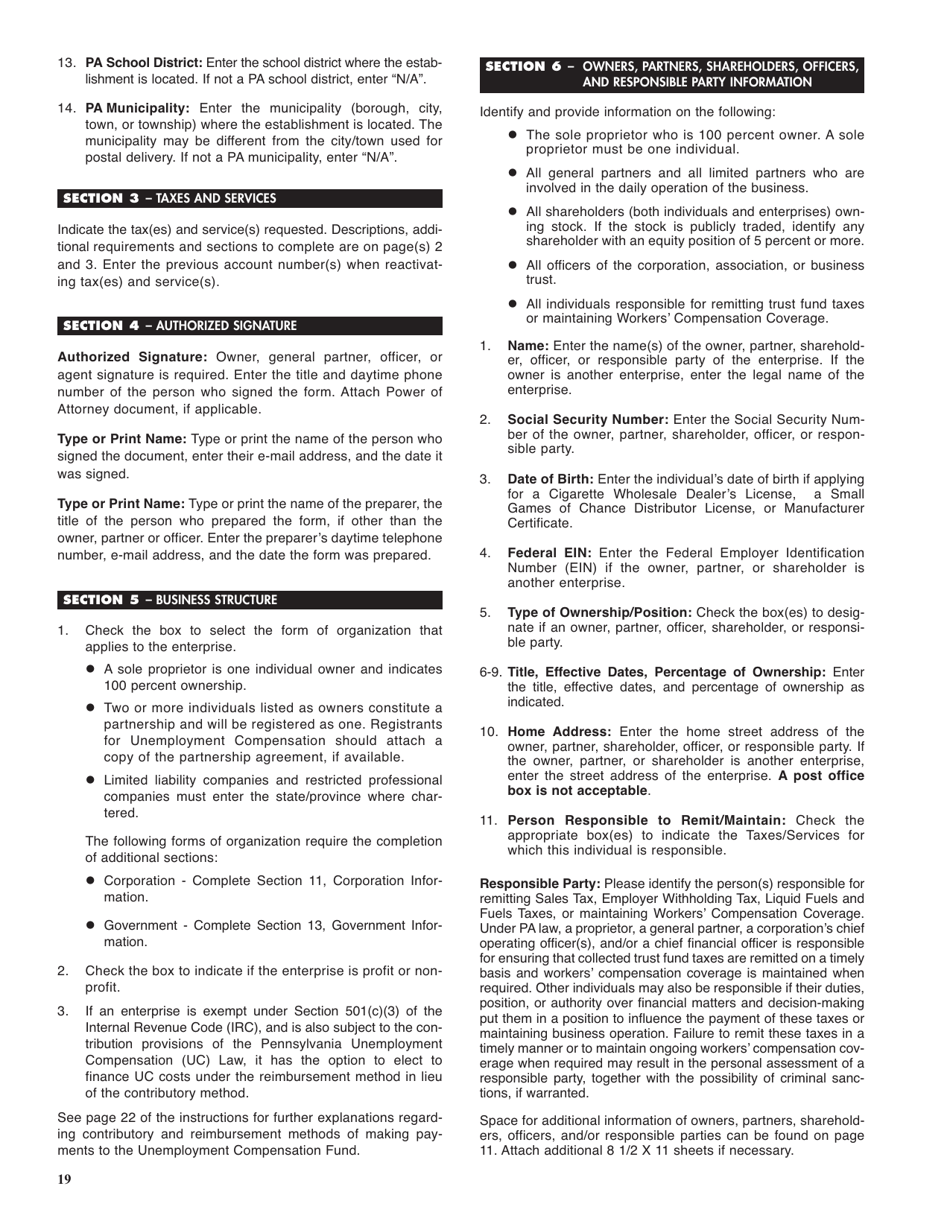

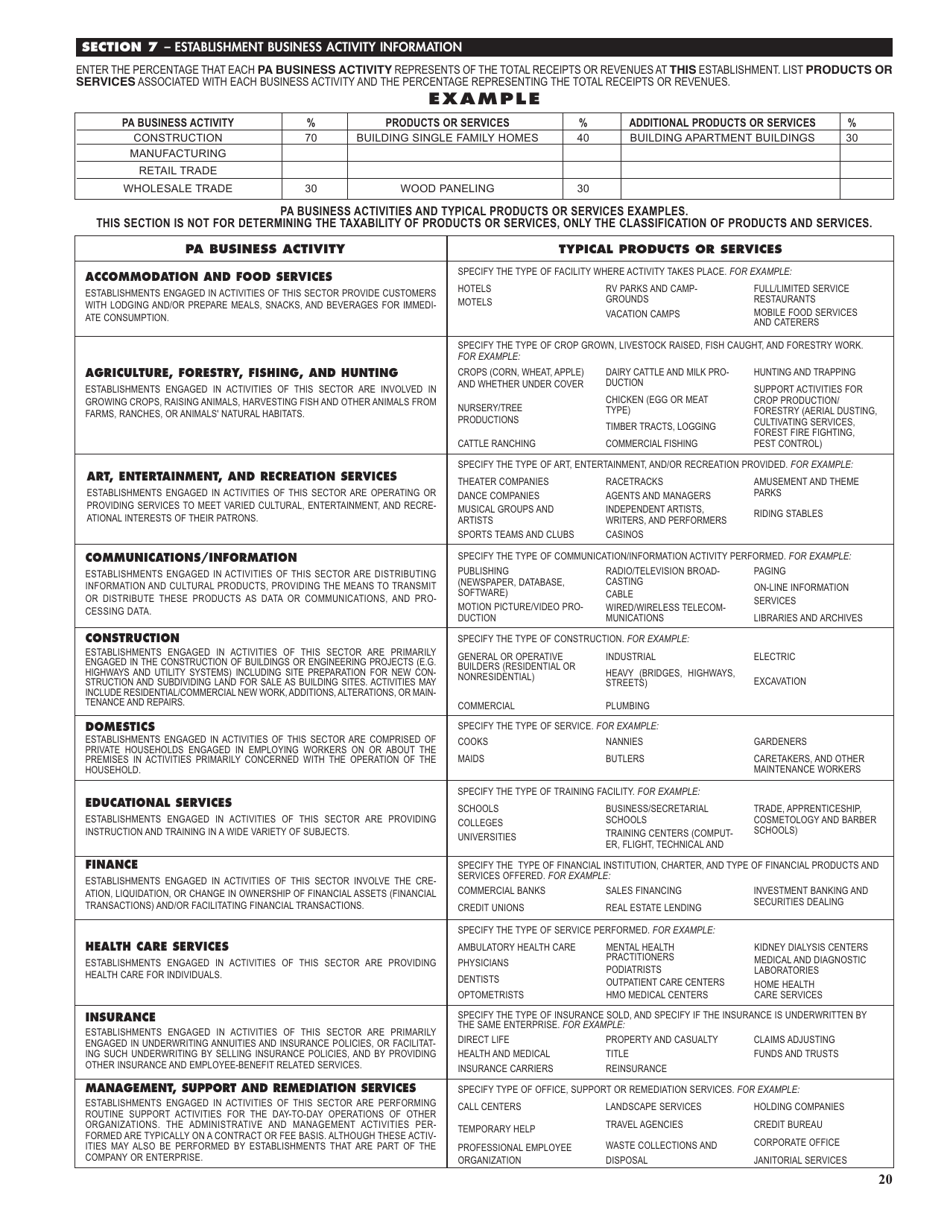

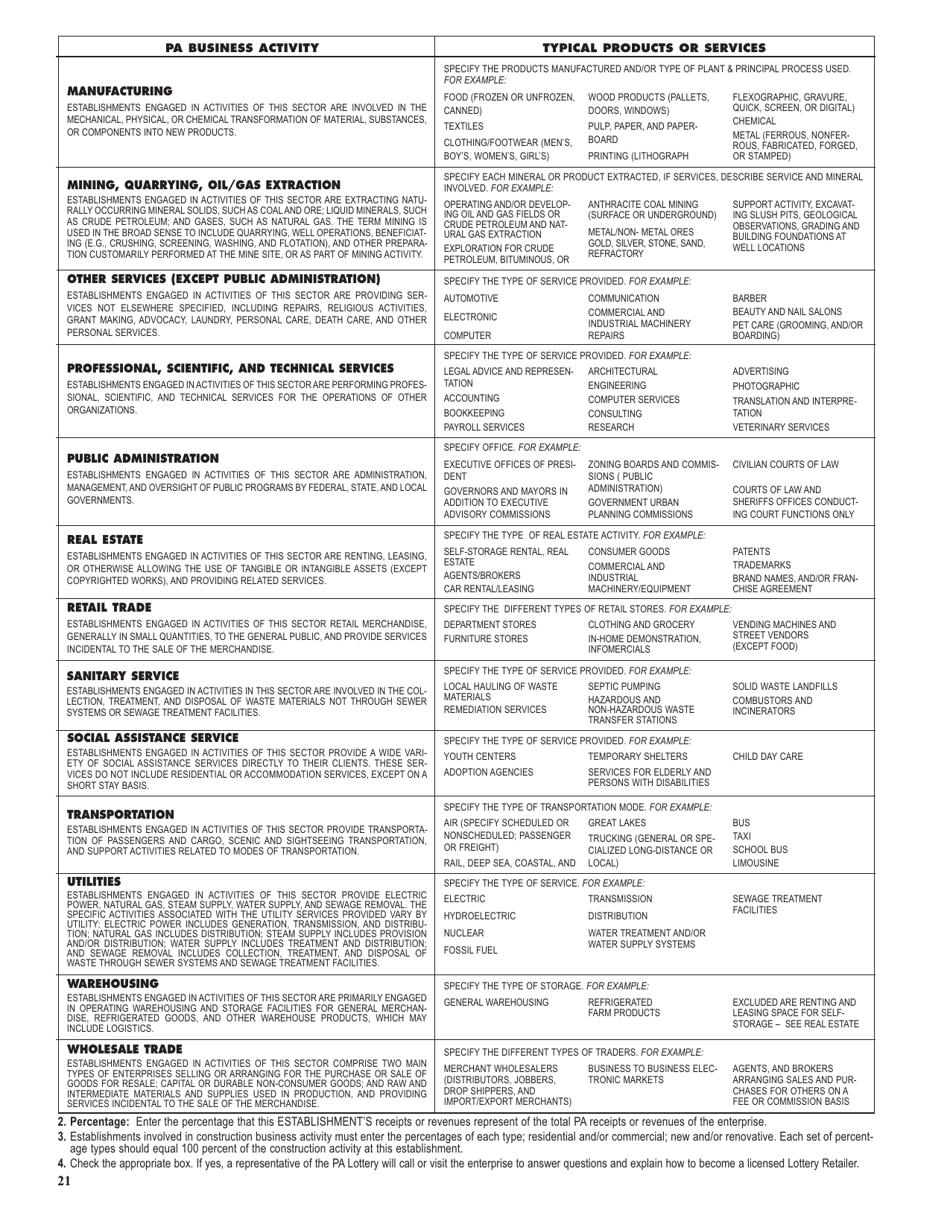

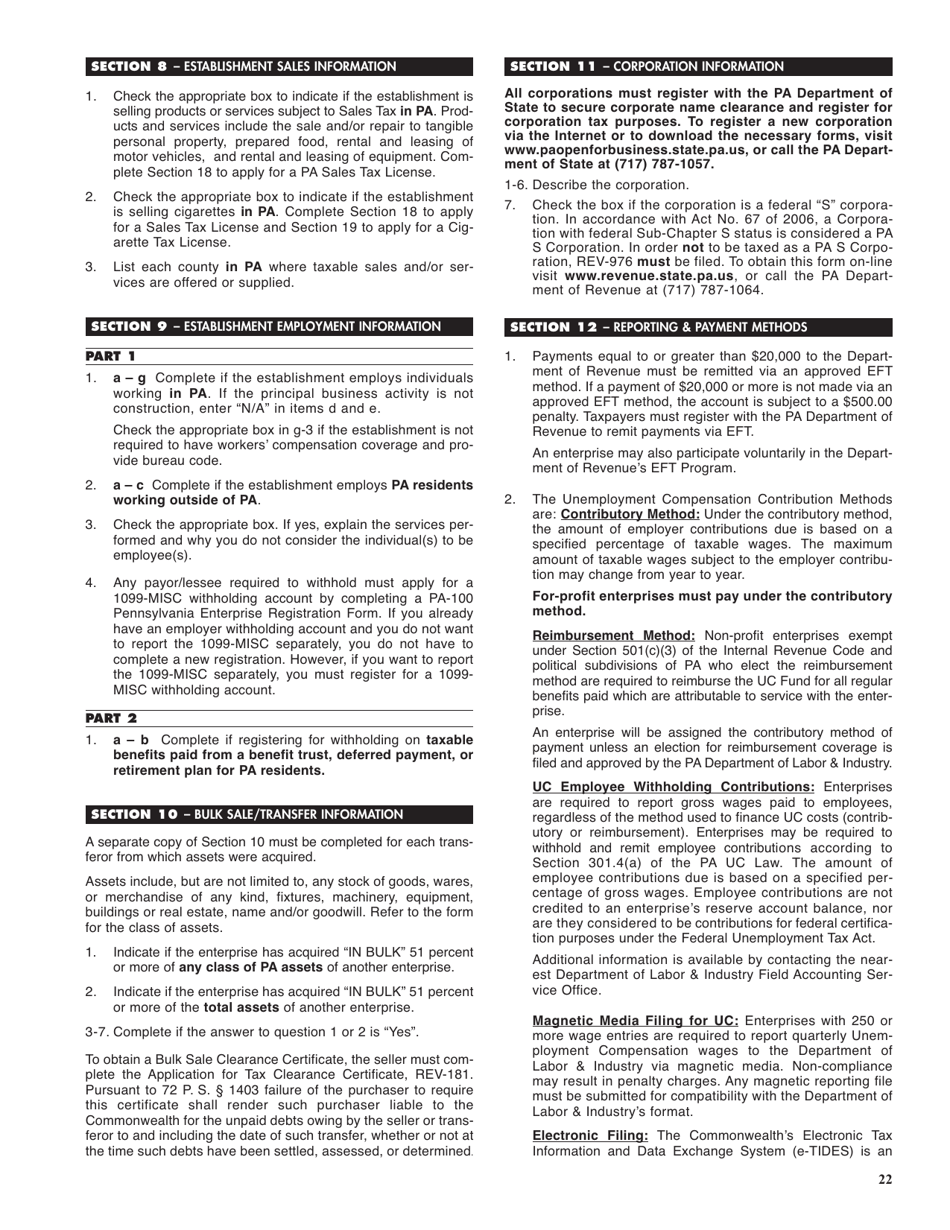

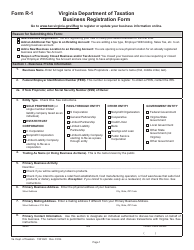

Q: What information is required on Form PA-100?

A: Form PA-100 requires information about the business entity, including its name, address, type of entity, and taxpayer identification number.

Q: Are there any fees for filing Form PA-100?

A: There is no fee for filing Form PA-100.

Q: When should Form PA-100 be filed?

A: Form PA-100 should be filed before the business entity starts operations in Pennsylvania.

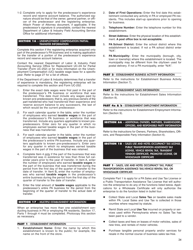

Q: Are there any penalties for not filing Form PA-100?

A: Yes, there may be penalties for not filing Form PA-100, including late filing penalties and loss of certain tax benefits.

Q: Can I make changes to my Form PA-100 after it has been filed?

A: Yes, you can make changes to your Form PA-100 by notifying the Pennsylvania Department of Revenue.

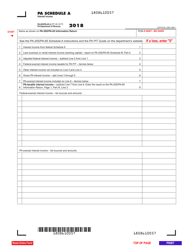

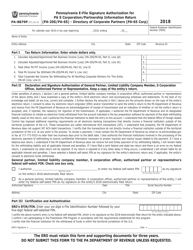

Form Details:

- Released on March 1, 2018;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

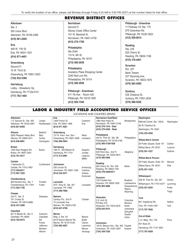

Download a printable version of Form PA-100 by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.