This version of the form is not currently in use and is provided for reference only. Download this version of

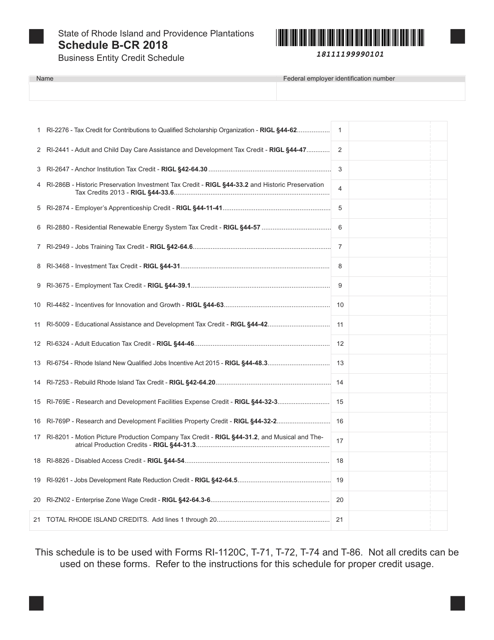

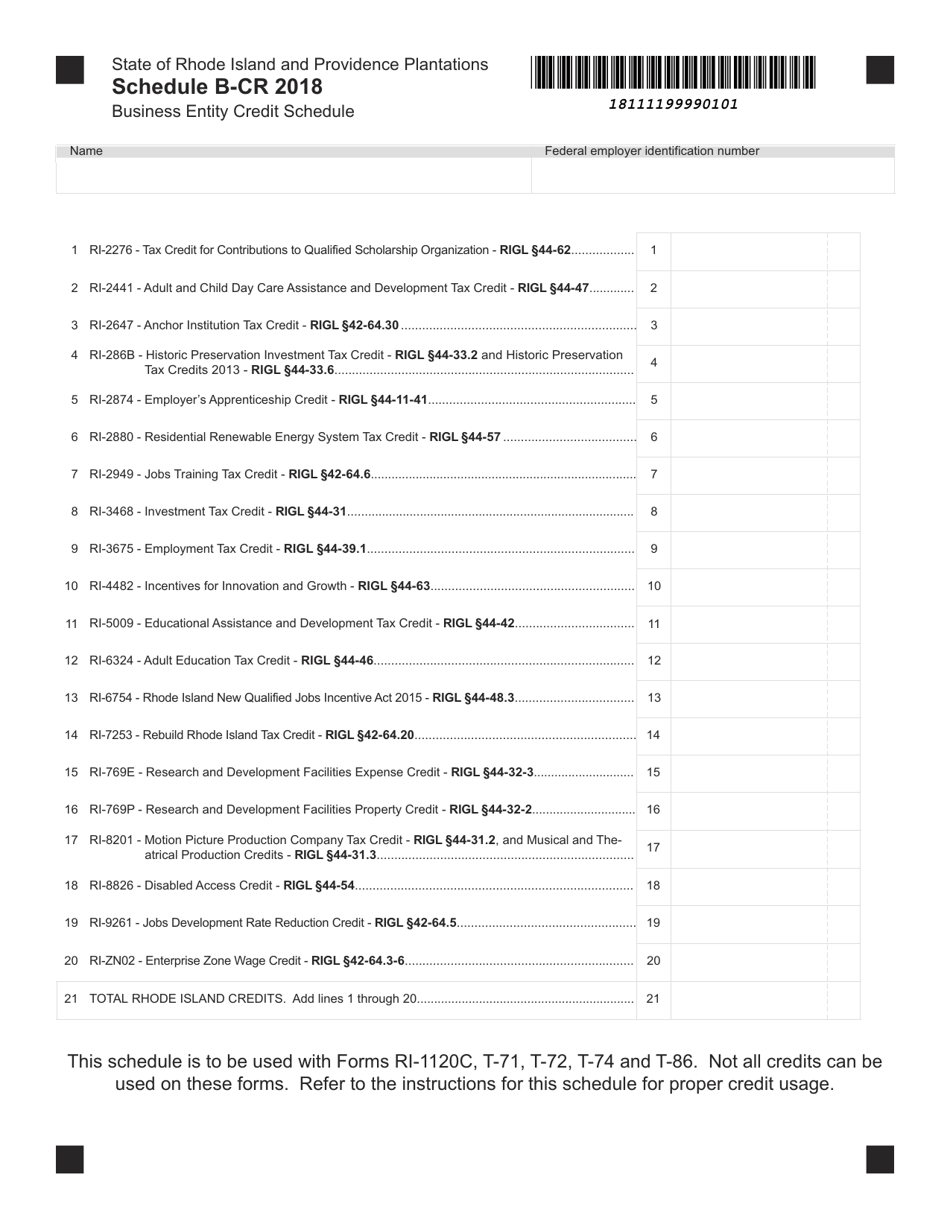

Schedule B-CR

for the current year.

Schedule B-CR Business Entity Credit Schedule - Rhode Island

What Is Schedule B-CR?

This is a legal form that was released by the Rhode Island Department of Revenue - a government authority operating within Rhode Island. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Schedule B-CR Business Entity Credit Schedule?

A: The Schedule B-CR Business Entity Credit Schedule is a form used by businesses in Rhode Island to claim tax credits.

Q: What is the purpose of the Schedule B-CR?

A: The purpose of the Schedule B-CR is to allow businesses to claim tax credits for certain activities or investments.

Q: Who needs to fill out the Schedule B-CR?

A: Businesses in Rhode Island that are eligible for tax credits need to fill out the Schedule B-CR.

Q: What type of tax credits can be claimed on the Schedule B-CR?

A: The Schedule B-CR allows for the claiming of various tax credits, including the Job Creation Guaranty Program Credit, the Small Business Assistance Program Credit, and others.

Q: Are there instructions available for filling out the Schedule B-CR?

A: Yes, the Rhode Island Division of Taxation provides instructions for filling out the Schedule B-CR form.

Q: When is the deadline for filing the Schedule B-CR?

A: The deadline for filing the Schedule B-CR is typically the same as the deadline for filing the Rhode Island business tax return, which is usually April 15th.

Q: Can I claim multiple tax credits on the Schedule B-CR?

A: Yes, the Schedule B-CR allows for the claiming of multiple tax credits, as long as the business meets the eligibility requirements for each credit.

Q: What supporting documentation is required for the Schedule B-CR?

A: Businesses may be required to provide supporting documentation, such as proof of eligible investments or job creation, when filing the Schedule B-CR.

Form Details:

- The latest edition provided by the Rhode Island Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Schedule B-CR by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue.