This version of the form is not currently in use and is provided for reference only. Download this version of

Form NC-478G

for the current year.

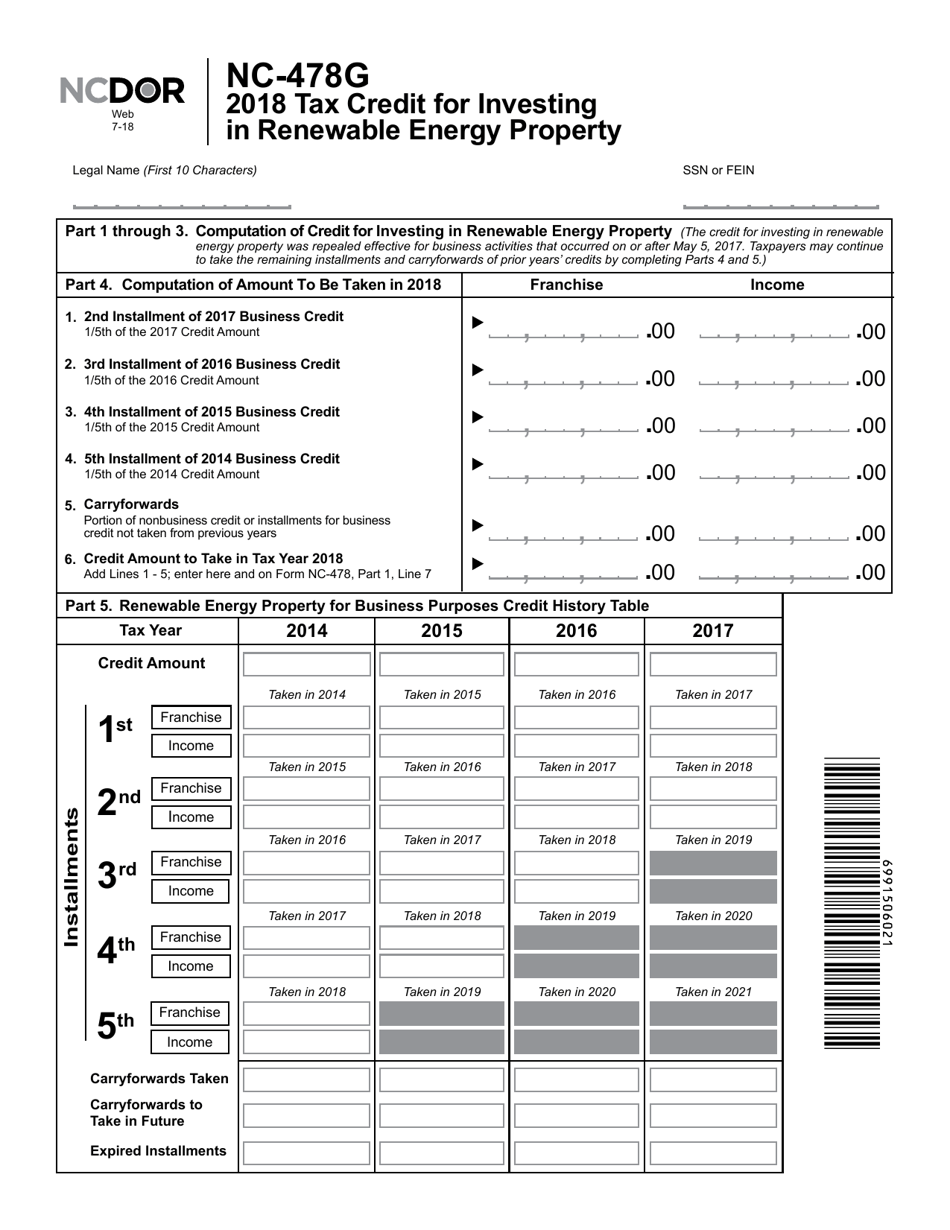

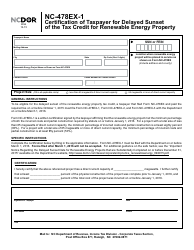

Form NC-478G Tax Credit for Investingin Renewable Energy Property - North Carolina

What Is Form NC-478G?

This is a legal form that was released by the North Carolina Department of Revenue - a government authority operating within North Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form NC-478G?

A: Form NC-478G is a tax form used in North Carolina for claiming tax credits for investing in renewable energy property.

Q: What is the purpose of Form NC-478G?

A: The purpose of Form NC-478G is to provide taxpayers in North Carolina with a means of claiming tax credits for investments made in renewable energy property.

Q: Who is eligible to use Form NC-478G?

A: Taxpayers in North Carolina who have made investments in renewable energy property may be eligible to use Form NC-478G to claim tax credits.

Q: What qualifies as renewable energy property?

A: Renewable energy property can include solar energy systems, wind energy systems, geothermal energy systems, and biomass energy systems, among others.

Q: How do I claim tax credits using Form NC-478G?

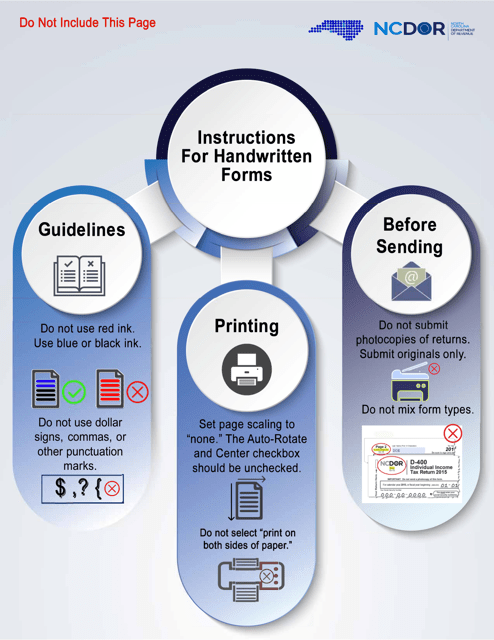

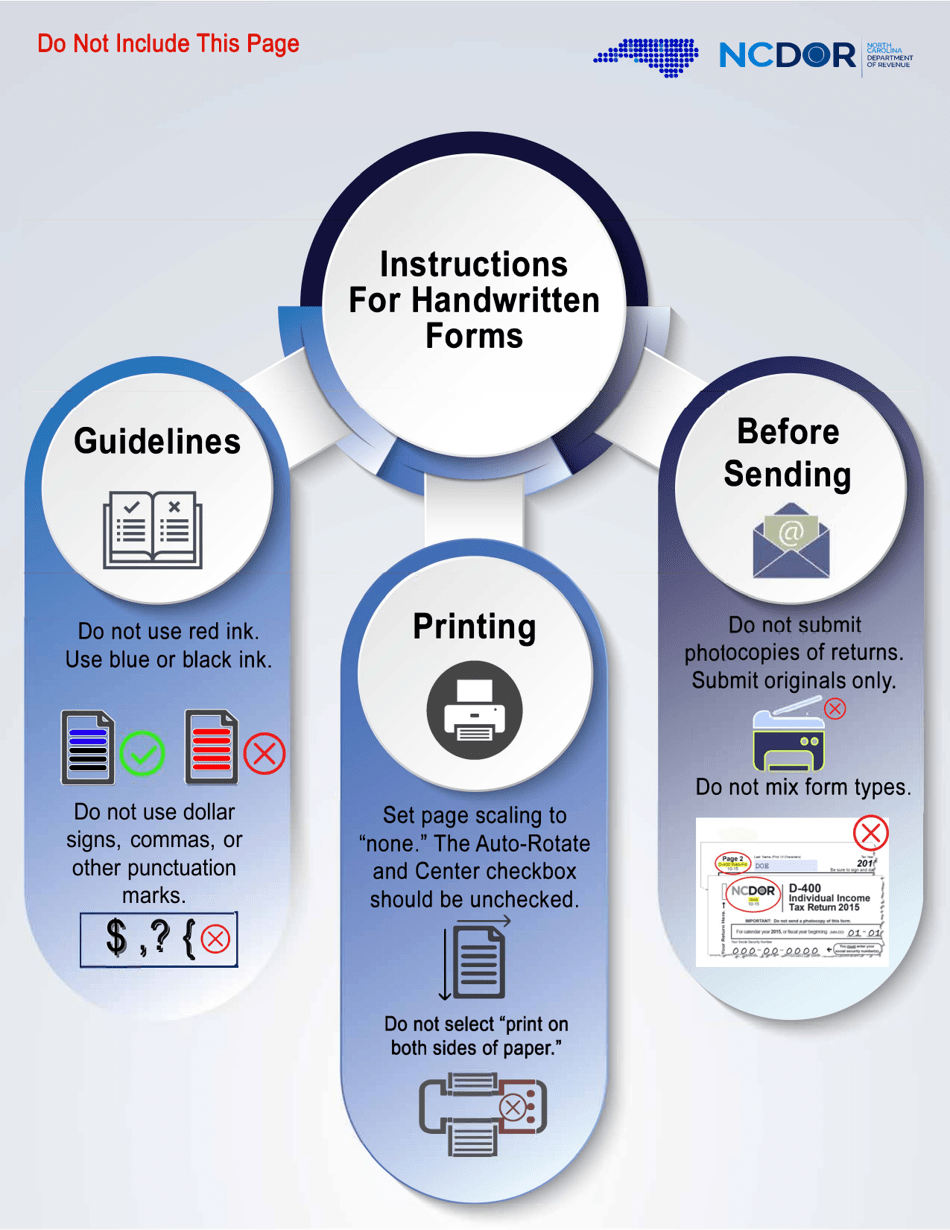

A: To claim tax credits using Form NC-478G, taxpayers should fill out the form accurately and provide all required documentation and supporting evidence.

Q: Are there any limitations or restrictions on the tax credits claimed using Form NC-478G?

A: Yes, there may be limitations or restrictions on the tax credits claimed using Form NC-478G, including maximum credit amounts and eligibility criteria.

Form Details:

- Released on July 1, 2018;

- The latest edition provided by the North Carolina Department of Revenue;

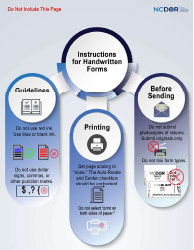

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form NC-478G by clicking the link below or browse more documents and templates provided by the North Carolina Department of Revenue.