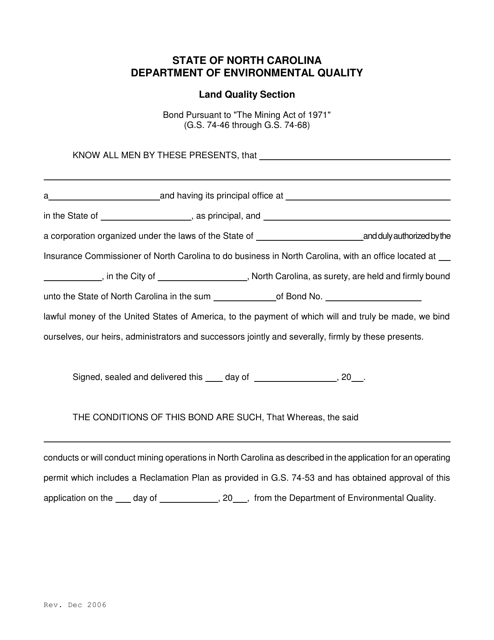

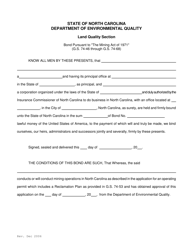

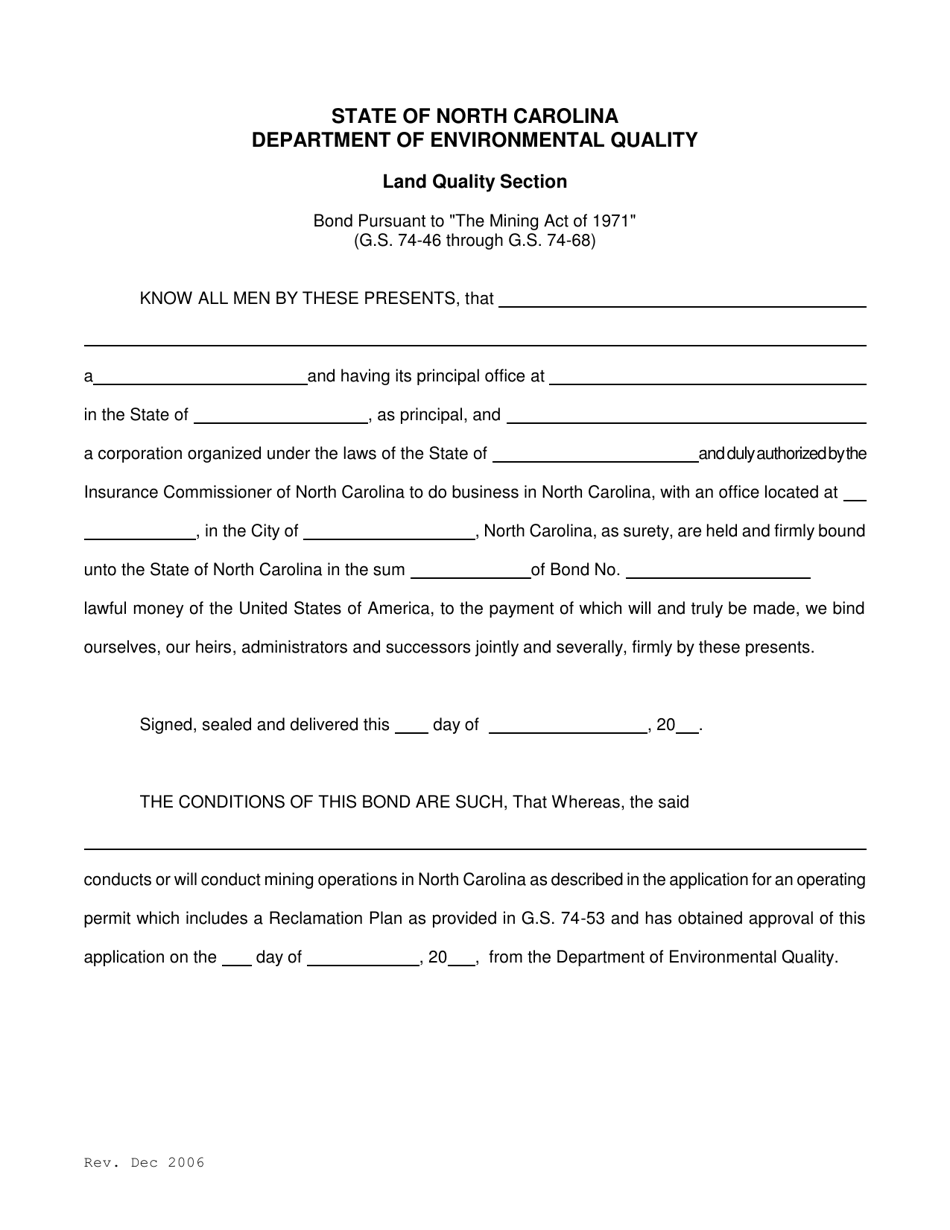

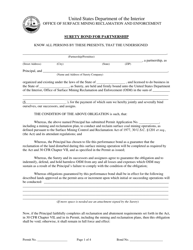

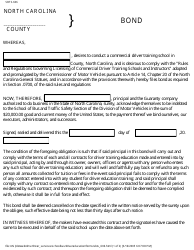

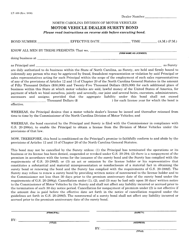

Surety Bond - North Carolina

Surety Bond is a legal document that was released by the North Carolina Department of Environmental Quality - a government authority operating within North Carolina.

FAQ

Q: What is a surety bond?

A: A surety bond is a legally binding agreement between three parties: the principal, the obligee, and the surety. It provides financial protection to the obligee in case the principal fails to fulfill their obligations.

Q: Do I need a surety bond in North Carolina?

A: The need for a surety bond in North Carolina depends on the specific industry or profession you are involved in. Certain occupations, such as contractors and notary publics, are typically required to obtain a surety bond.

Q: How do I obtain a surety bond in North Carolina?

A: To obtain a surety bond in North Carolina, you will need to contact a licensed surety bond provider. They will evaluate your eligibility and financial standing before issuing the bond.

Q: How much does a surety bond cost in North Carolina?

A: The cost of a surety bond in North Carolina can vary depending on factors such as the bond amount, the type of bond, and the applicant's credit history. It is best to contact a surety bond provider for an accurate quote.

Q: What happens if I fail to fulfill my obligations under a surety bond?

A: If a principal fails to fulfill their obligations under a surety bond, the obligee can make a claim against the bond. The surety will then investigate the claim and may be obligated to compensate the obligee up to the bond amount.

Q: Can I get a surety bond with bad credit in North Carolina?

A: Yes, it is possible to obtain a surety bond with bad credit in North Carolina. However, applicants with bad credit may be subject to higher premium rates or additional requirements.

Q: How long does a surety bond last in North Carolina?

A: The duration of a surety bond in North Carolina varies depending on the specific bond. Some bonds may be required for a specific project or time period, while others may be continuous until cancelled.

Q: Are there alternatives to surety bonds in North Carolina?

A: Yes, there are alternative forms of financial security that can be used instead of surety bonds in North Carolina. These may include cash deposits, letters of credit, or self-insurance, depending on the specific requirement.

Q: Can I cancel a surety bond in North Carolina?

A: Yes, a surety bond can be cancelled in North Carolina. However, the exact process and requirements for cancellation may vary depending on the type of bond and the issuing surety.

Form Details:

- Released on December 1, 2006;

- The latest edition currently provided by the North Carolina Department of Environmental Quality;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the North Carolina Department of Environmental Quality.