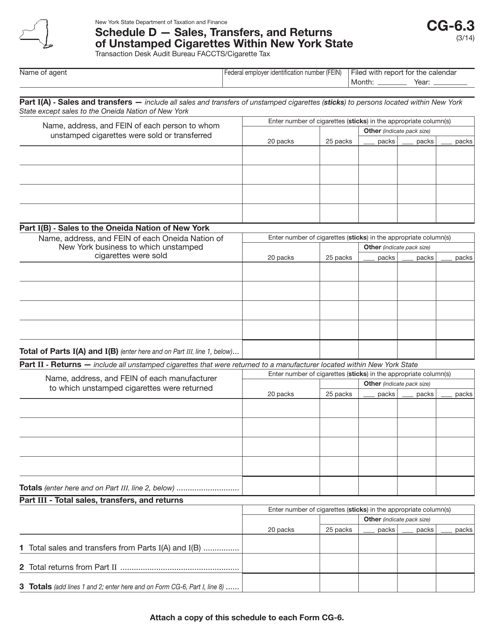

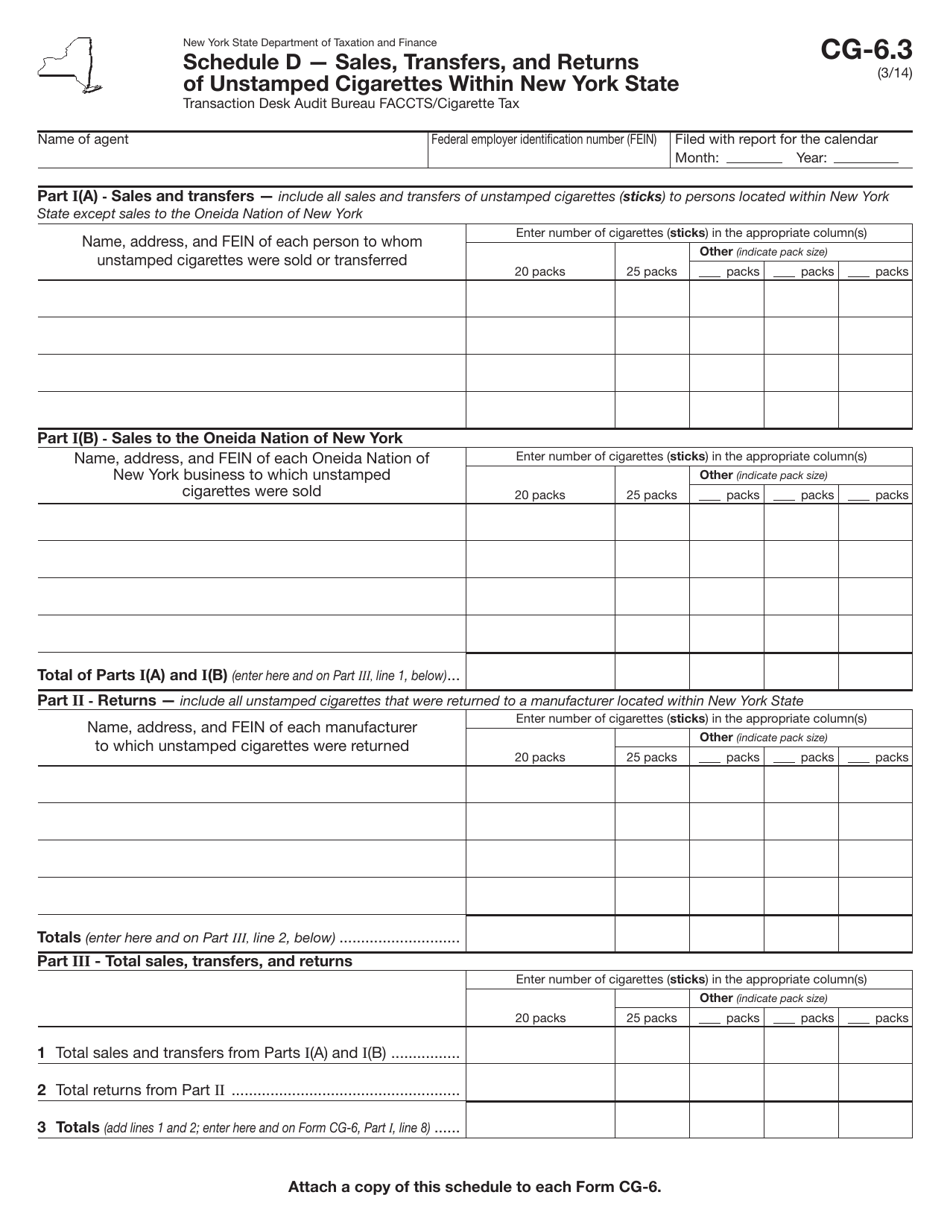

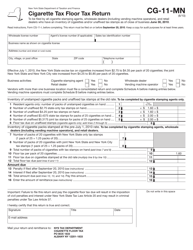

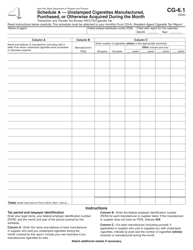

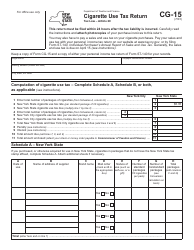

Form CG-6.3 Schedule D Sales, Transfers, and Returns of Unstamped Cigarettes Within New York State - New York

What Is Form CG-6.3 Schedule D?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CG-6.3 Schedule D?

A: Form CG-6.3 Schedule D is a document used to report sales, transfers, and returns of unstamped cigarettes within New York State.

Q: Who needs to file Form CG-6.3 Schedule D?

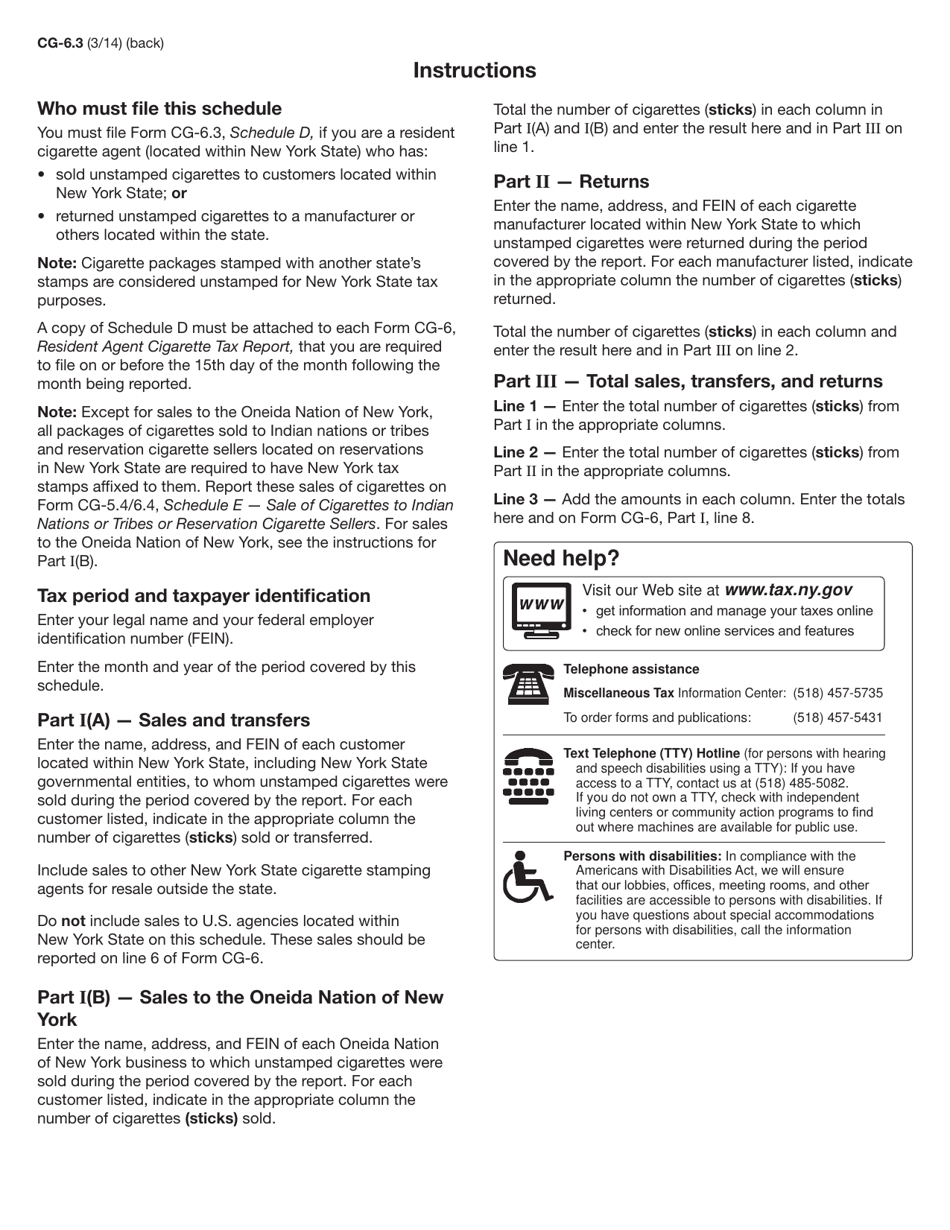

A: Any person or business engaged in the sale, transfer, or return of unstamped cigarettes within New York State needs to file this form.

Q: What information is required on Form CG-6.3 Schedule D?

A: Form CG-6.3 Schedule D requires information such as the quantity of cigarettes, the name of the seller or transferor, the name of the purchaser or transferee, and the date of the transaction.

Q: When is Form CG-6.3 Schedule D due?

A: Form CG-6.3 Schedule D is due on a monthly basis and must be filed by the 20th day of the month following the reporting period.

Form Details:

- Released on March 1, 2014;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CG-6.3 Schedule D by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.