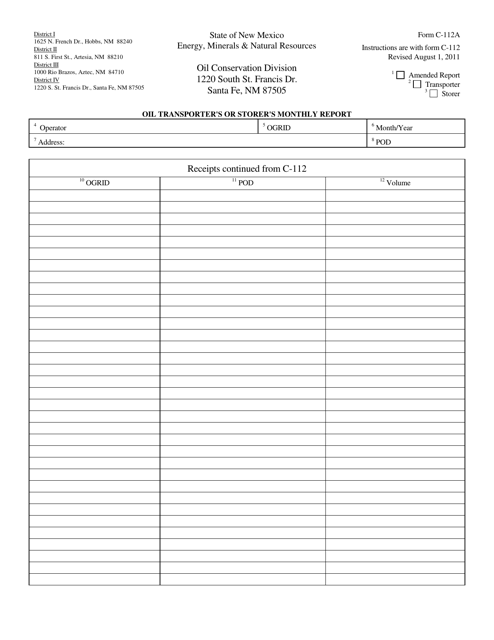

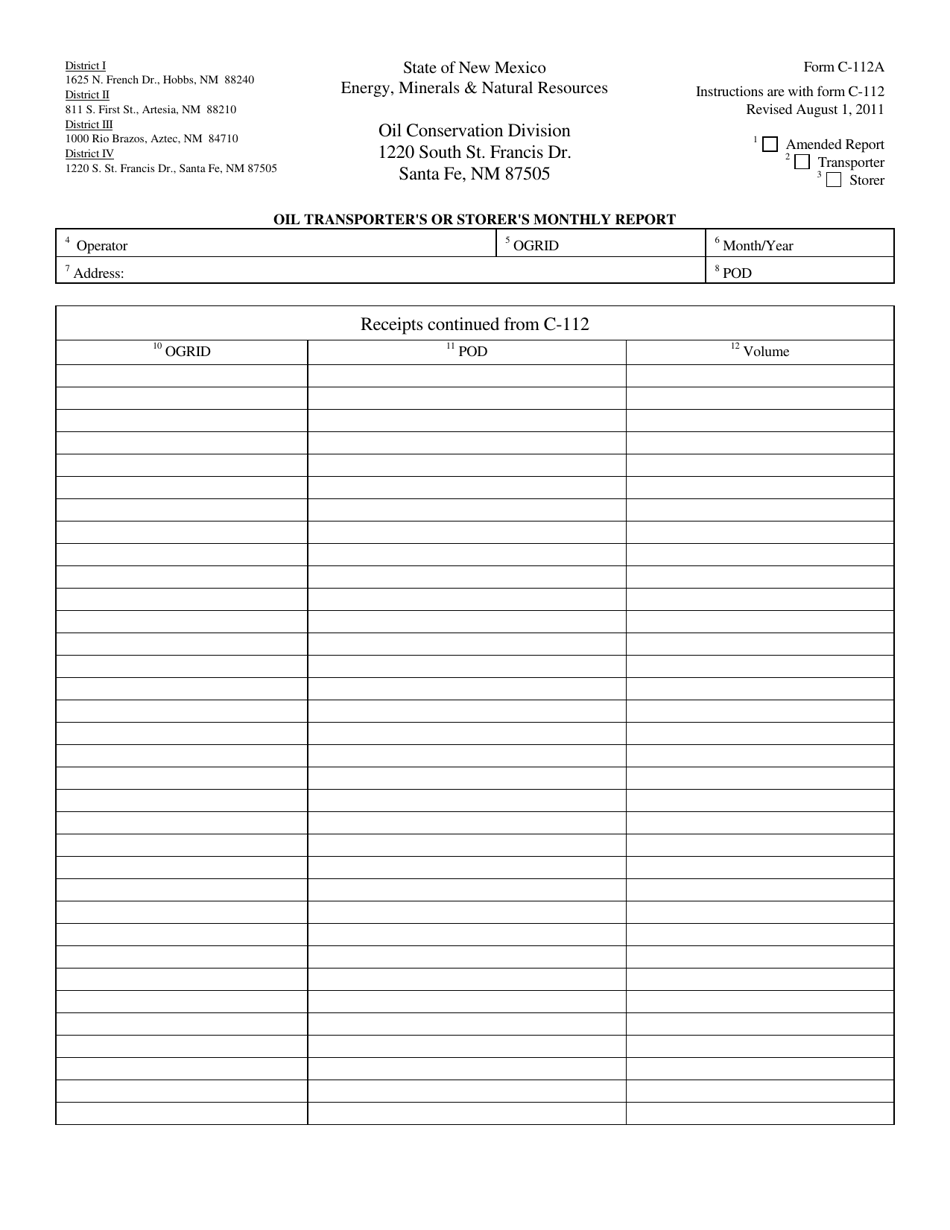

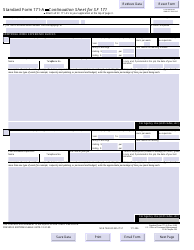

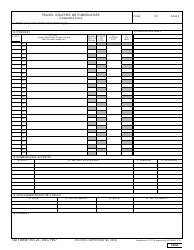

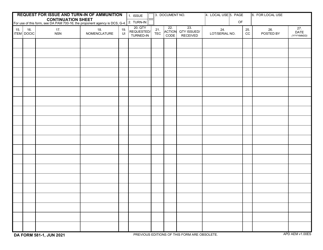

Form C-112A Receipts Continuation Sheet - New Mexico

What Is Form C-112A?

This is a legal form that was released by the New Mexico Energy, Minerals and Natural Resources Department - a government authority operating within New Mexico. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form C-112A?

A: Form C-112A is the Receipts Continuation Sheet specifically designed for use in New Mexico.

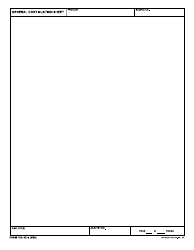

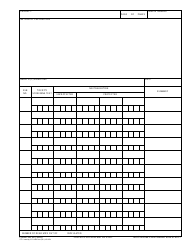

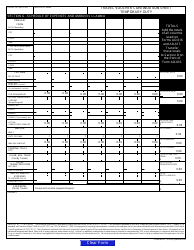

Q: What is the purpose of Form C-112A?

A: The purpose of Form C-112A is to provide additional space for documenting receipts in addition to the main tax form.

Q: Who needs to file Form C-112A?

A: Individuals or businesses residing or operating in New Mexico who need additional space to report their receipts for tax purposes.

Q: When should Form C-112A be filed?

A: Form C-112A should be filed along with the corresponding tax form, when additional space is required to report receipts.

Form Details:

- Released on August 1, 2011;

- The latest edition provided by the New Mexico Energy, Minerals and Natural Resources Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form C-112A by clicking the link below or browse more documents and templates provided by the New Mexico Energy, Minerals and Natural Resources Department.