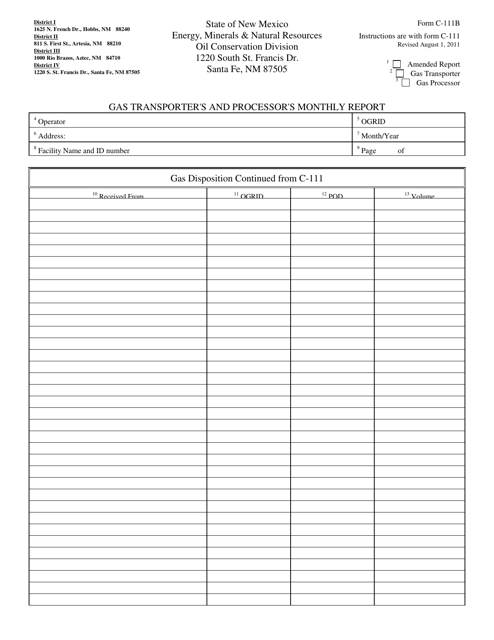

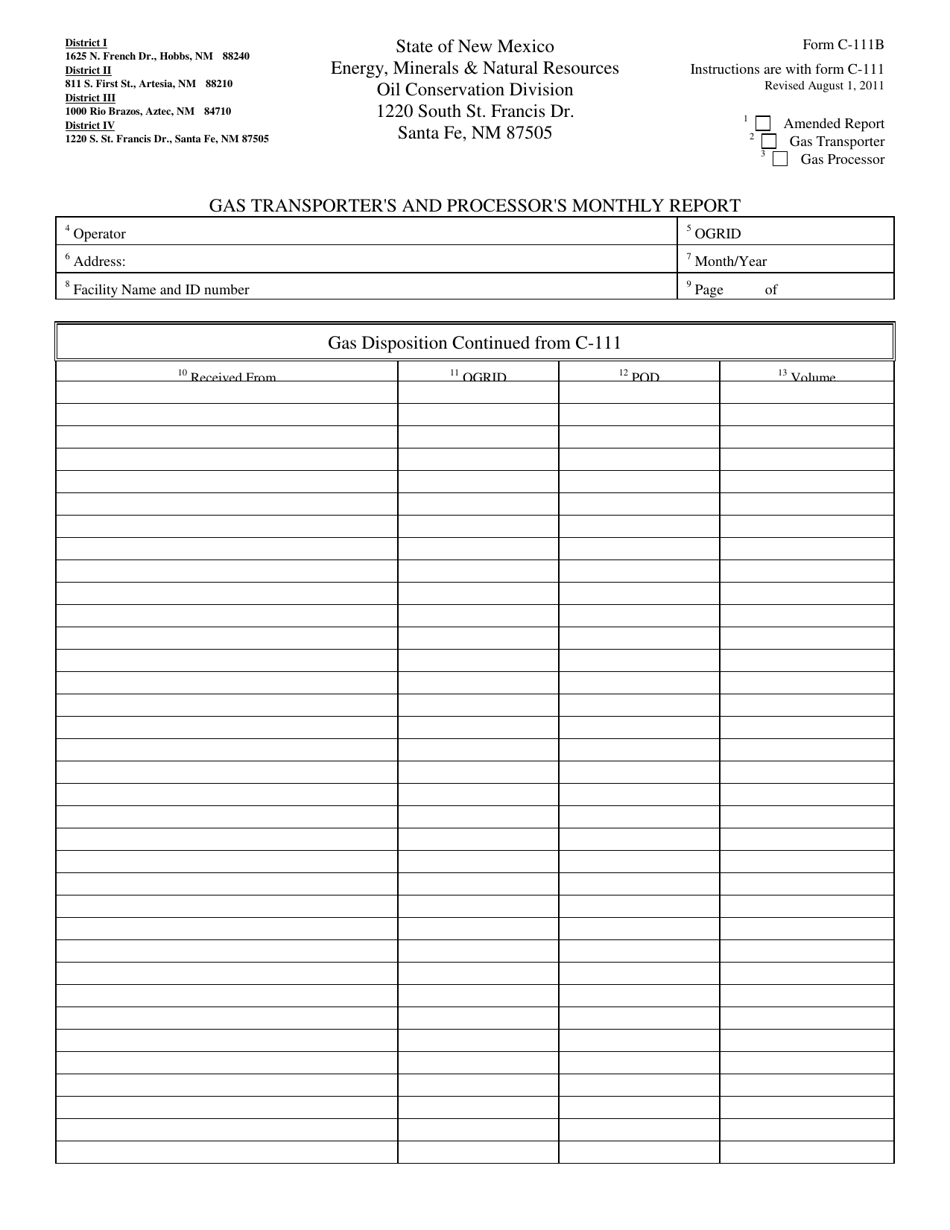

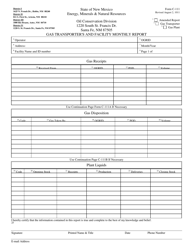

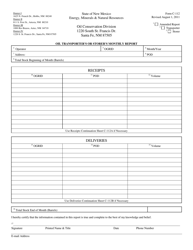

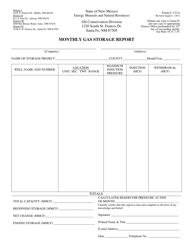

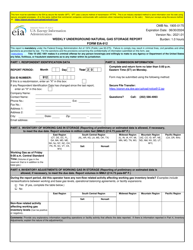

Form C-111B Gas Transporter's and Processor's Monthly Report - New Mexico

What Is Form C-111B?

This is a legal form that was released by the New Mexico Energy, Minerals and Natural Resources Department - a government authority operating within New Mexico. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form C-111B?

A: The Form C-111B is a Gas Transporter's and Processor's Monthly Report.

Q: Who needs to file the Form C-111B?

A: Gas transporters and processors in New Mexico need to file the Form C-111B.

Q: What is the purpose of the Form C-111B?

A: The purpose of the Form C-111B is to report monthly gas transportation and processing activities.

Q: When is the Form C-111B due?

A: The Form C-111B is due on or before the 25th day of the following month.

Q: Are there any penalties for late filing of the Form C-111B?

A: Yes, there are penalties for late filing of the Form C-111B. The penalty is $250 for each day the report is late, up to a maximum of $5,000.

Q: Is the Form C-111B only for gas transporters and processors in New Mexico?

A: Yes, the Form C-111B is specifically for gas transporters and processors in New Mexico.

Q: What information is required on the Form C-111B?

A: The Form C-111B requires information such as volumes of gas transported and processed, as well as financial information.

Q: Can the Form C-111B be filed electronically?

A: Yes, the Form C-111B can be filed electronically through the New Mexico Taxpayer Access Point (TAP) system.

Q: Is there any fee associated with filing the Form C-111B?

A: No, there is no fee associated with filing the Form C-111B.

Form Details:

- Released on August 1, 2011;

- The latest edition provided by the New Mexico Energy, Minerals and Natural Resources Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form C-111B by clicking the link below or browse more documents and templates provided by the New Mexico Energy, Minerals and Natural Resources Department.