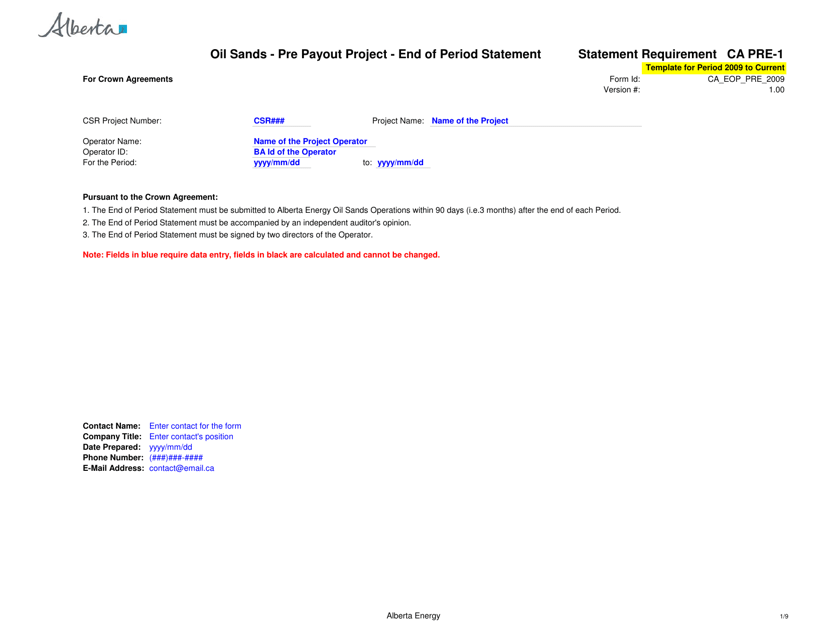

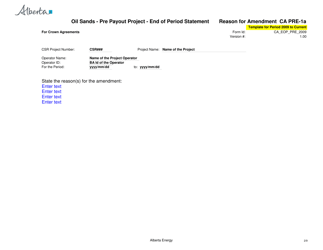

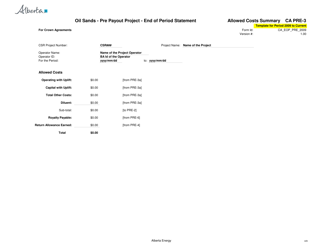

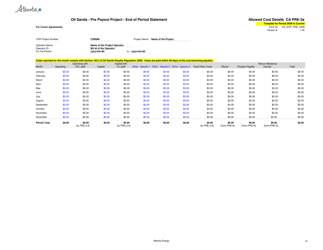

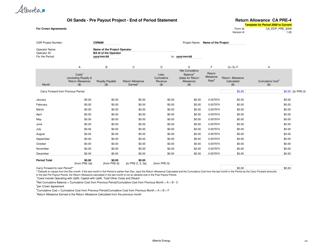

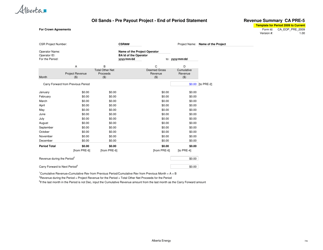

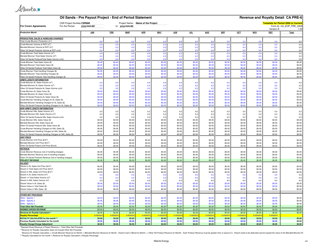

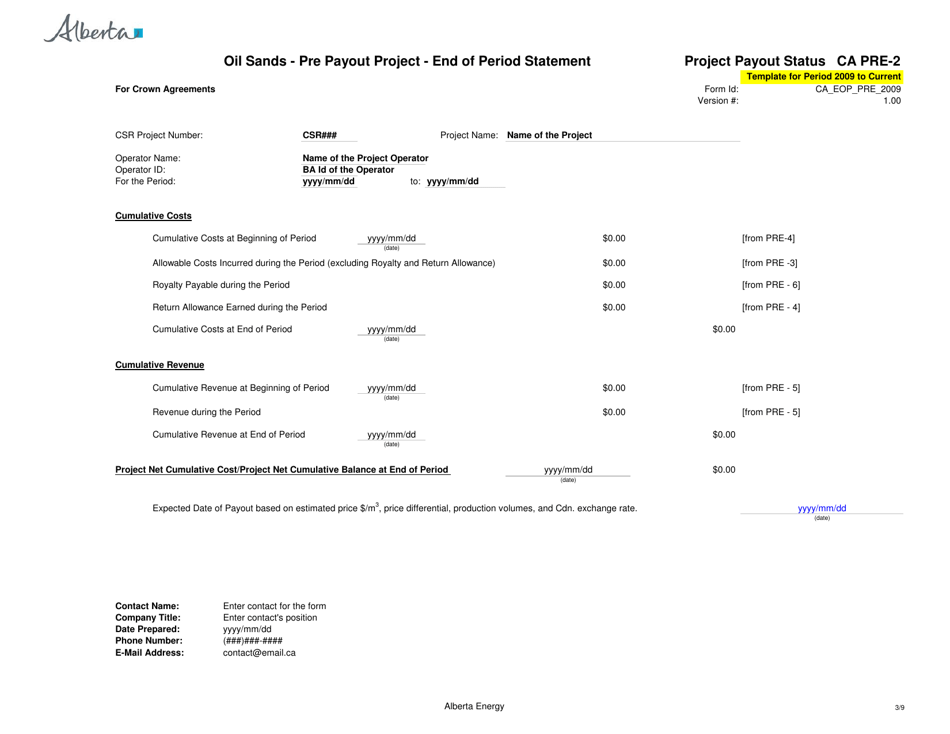

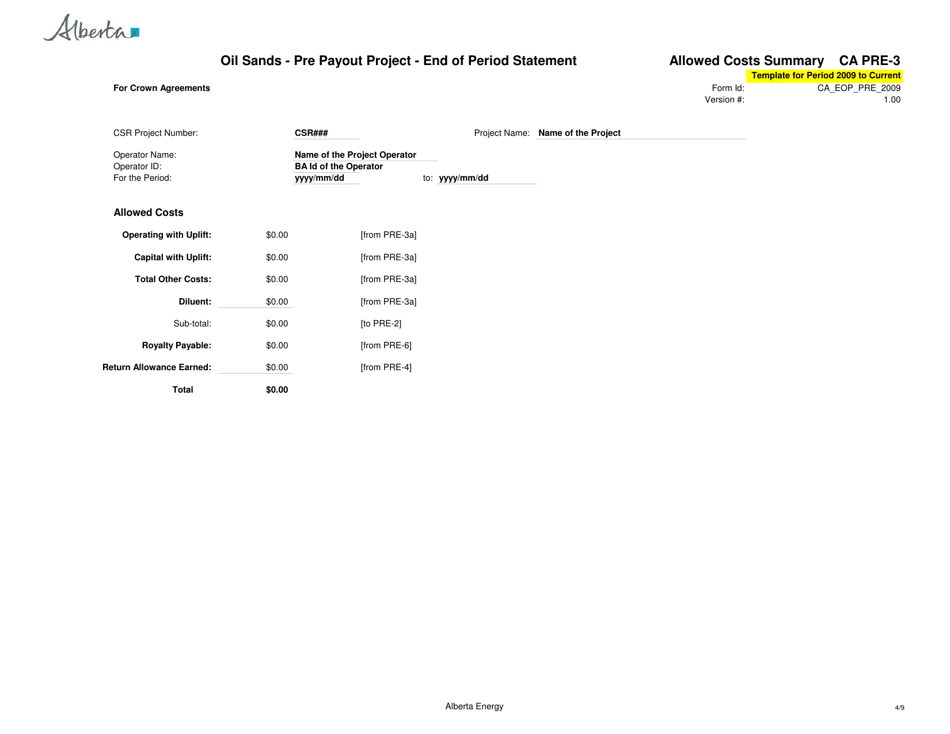

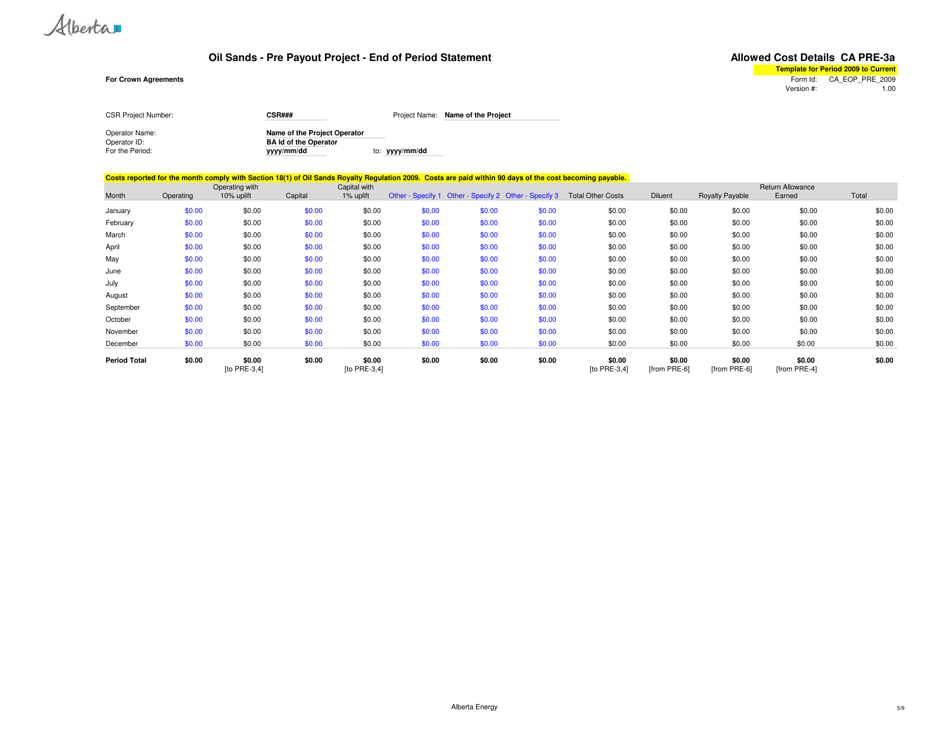

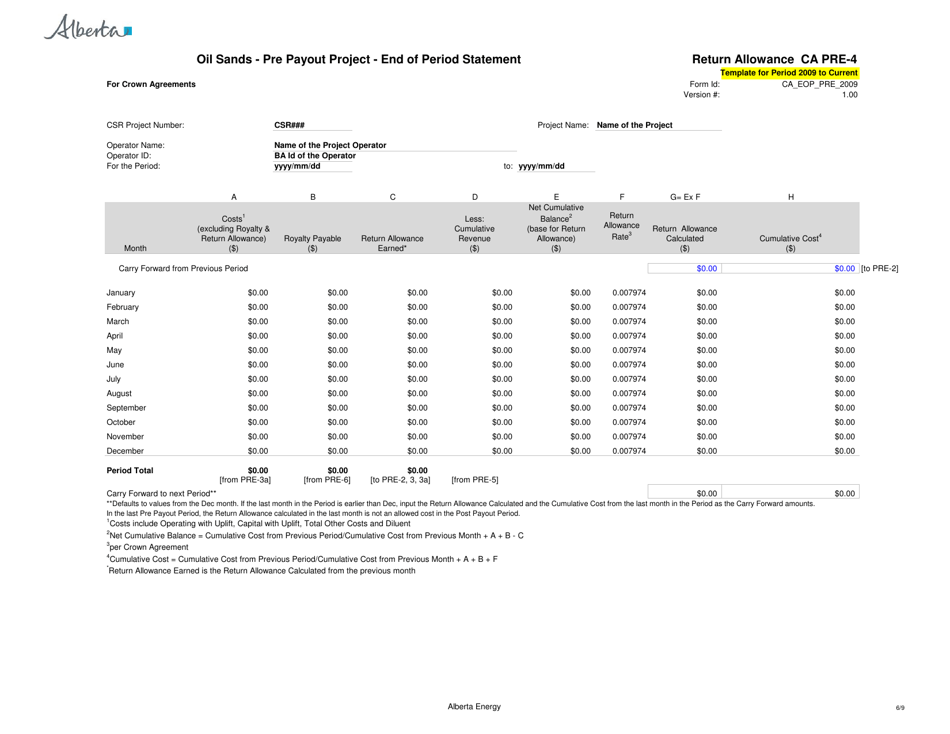

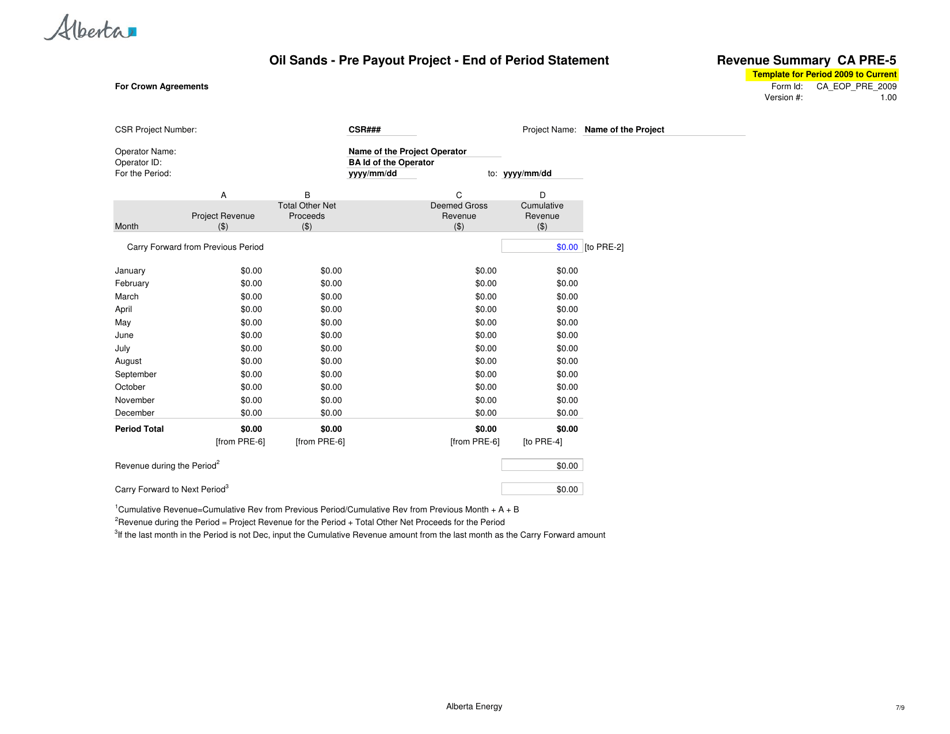

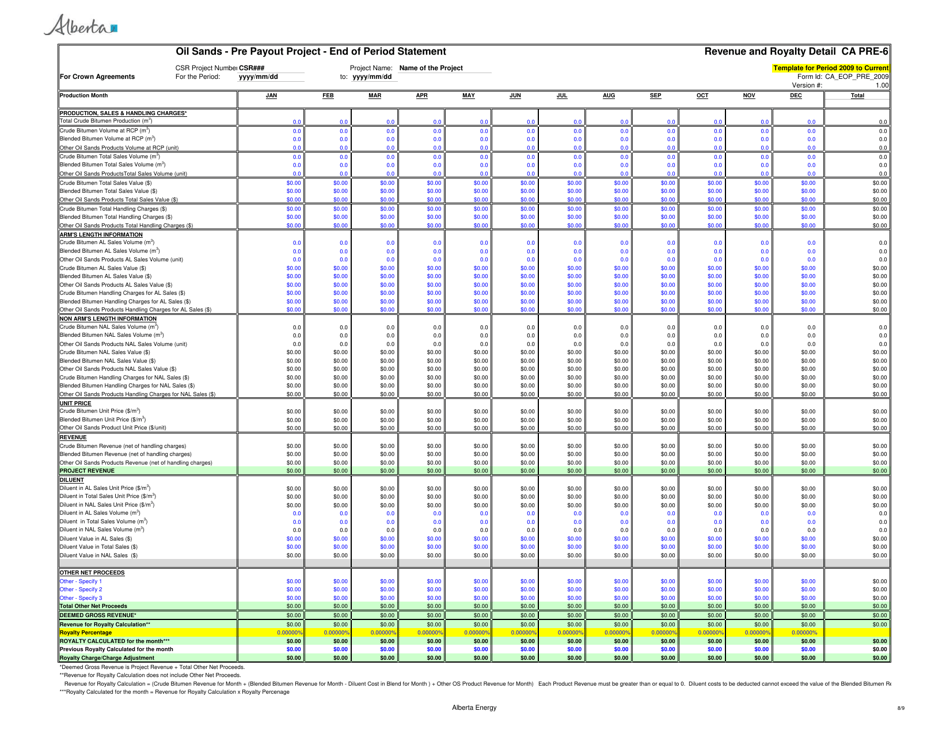

Form CA PRE-1 Oil Sands - Pre Payout Project - End of Period Statement - Alberta, Canada

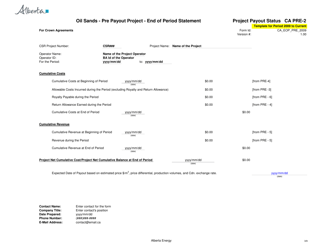

Form CA PRE-1 Oil Sands - Pre Payout Project - End of Period Statement is used for reporting the financial and operational status of pre-payout oil sands projects in Alberta, Canada. It provides information on the project's production, expenses, and revenues at the end of a specific reporting period.

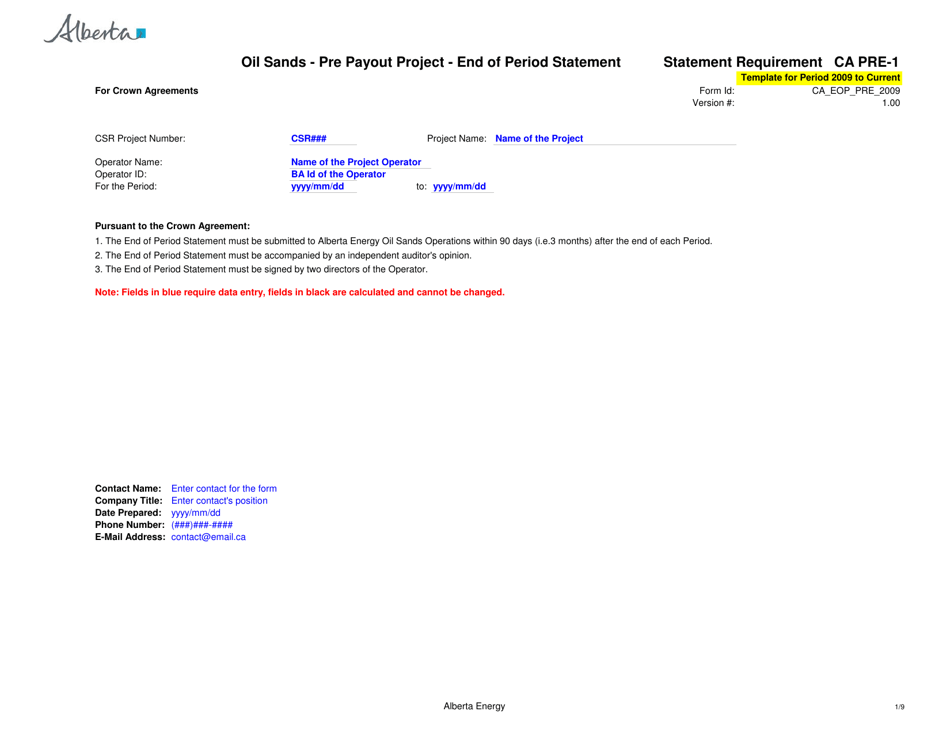

The Form CA PRE-1 for the Oil Sands - Pre Payout Project - End of Period Statement in Alberta, Canada is filed by the project operator or the authorized representative.

FAQ

Q: What is Form CA PRE-1?

A: Form CA PRE-1 is a form used to report the financial statement for oil sands pre-payout projects in Alberta, Canada.

Q: What does the form cover?

A: The form covers the end-of-period statement for oil sands pre-payout projects.

Q: What is an oil sands pre-payout project?

A: An oil sands pre-payout project refers to a project where the operator is in the pre-payout phase and has not yet recovered its costs.

Q: Who is required to file Form CA PRE-1?

A: Operators of oil sands pre-payout projects in Alberta are required to file Form CA PRE-1.

Q: What information does Form CA PRE-1 require?

A: Form CA PRE-1 requires information such as the project name, financial statement data, and details of the operator.

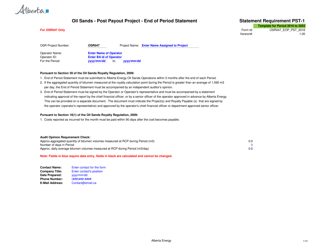

Q: When is Form CA PRE-1 due?

A: Form CA PRE-1 is typically due within 90 days after the end of the reporting period.

Q: Are there any penalties for not filing Form CA PRE-1?

A: Yes, there may be penalties for late or non-filing of Form CA PRE-1, as specified by the Alberta Energy Regulator.

Q: Can Form CA PRE-1 be filed electronically?

A: Yes, Form CA PRE-1 can be filed electronically through the AER's Digital Data Submission (DDS) system.