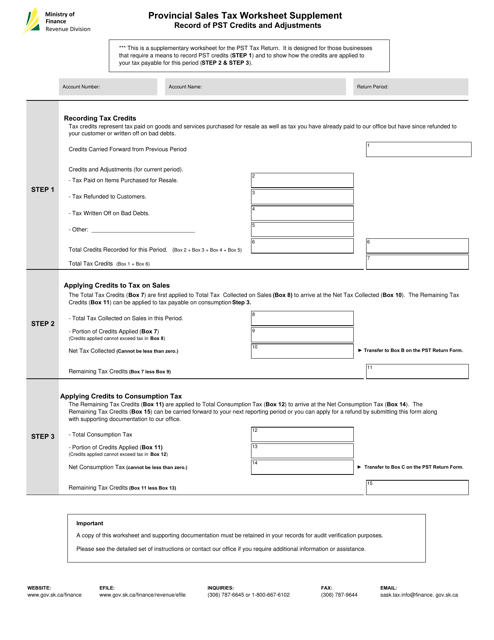

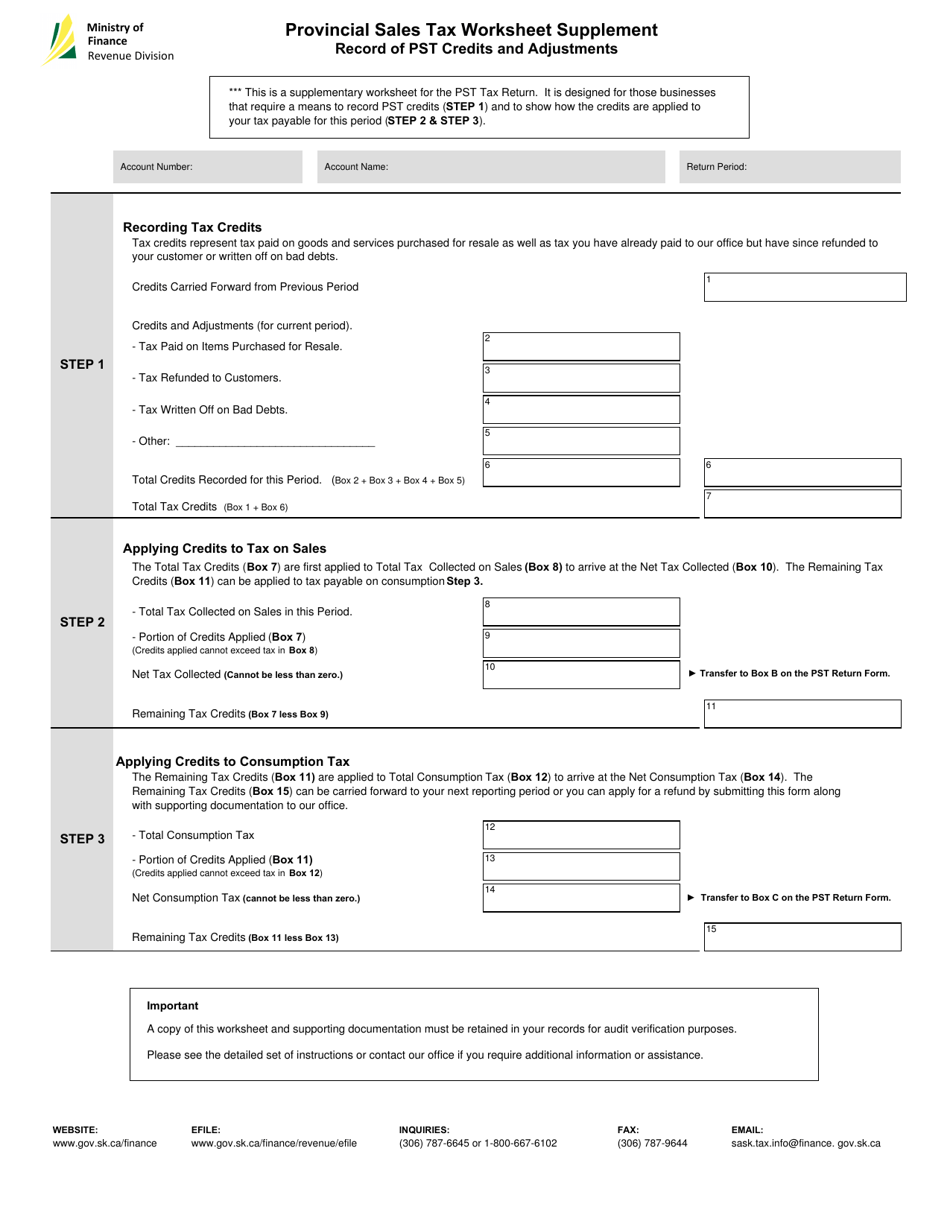

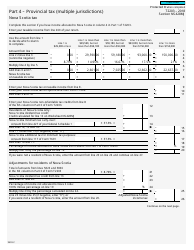

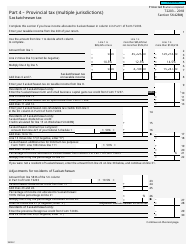

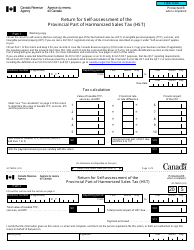

Provincial Sales Tax Worksheet Supplement - Saskatchewan, Canada

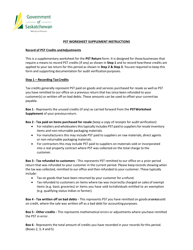

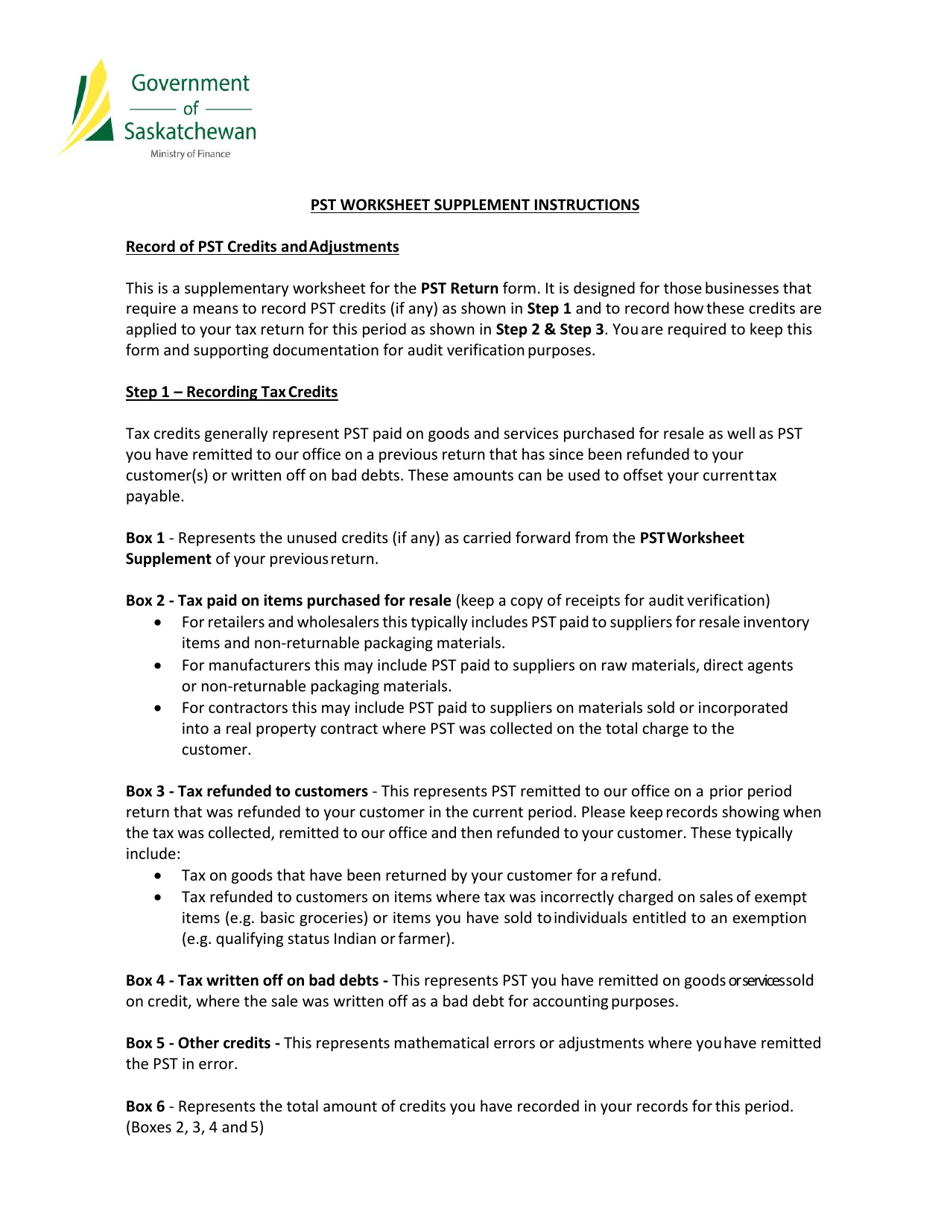

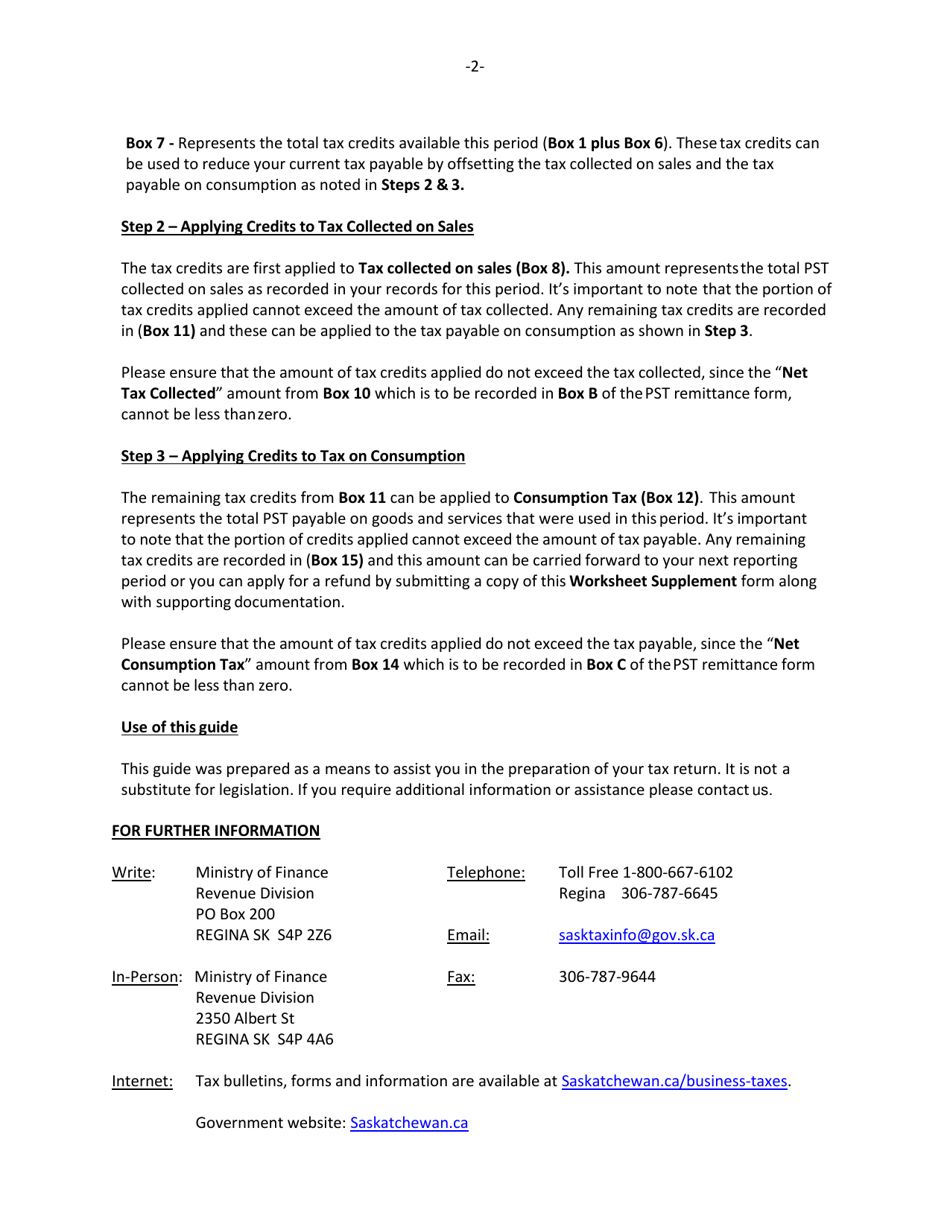

The Provincial Sales Tax Worksheet Supplement in Saskatchewan, Canada is used for calculating and reporting the provincial sales tax owed by individuals or businesses in the province. It helps track sales and purchases subject to provincial sales tax and determine the amount of tax owed.

The Provincial Sales Tax Worksheet Supplement in Saskatchewan, Canada is filed by businesses and individuals who are required to collect and remit the Provincial Sales Tax to the Saskatchewan Ministry of Finance.

FAQ

Q: What is the Provincial Sales Tax (PST)?

A: The Provincial Sales Tax (PST) is a tax imposed on the retail sale or lease of taxable goods and services in Saskatchewan.

Q: Who is required to pay PST?

A: Businesses that sell or lease taxable goods or services in Saskatchewan are required to collect and remit PST.

Q: What items are subject to PST?

A: Most goods and services are subject to PST, including clothing, furniture, electronics, and professional services.

Q: What is the current PST rate in Saskatchewan?

A: The current PST rate in Saskatchewan is 6%. However, some specific goods and services may have different tax rates.

Q: Are there any exemptions or exemptions from PST?

A: Yes, there are certain exemptions and exemptions from PST, such as certain groceries, prescription drugs, and agricultural products.

Q: How do businesses calculate and remit PST?

A: Businesses must calculate PST based on the selling price of taxable goods or services and remit the tax to the Saskatchewan Ministry of Finance.

Q: Is PST the same as Goods and Services Tax (GST)?

A: No, PST and GST are two separate taxes. GST is a federal tax imposed on most goods and services in Canada, while PST is a provincial tax specific to Saskatchewan.