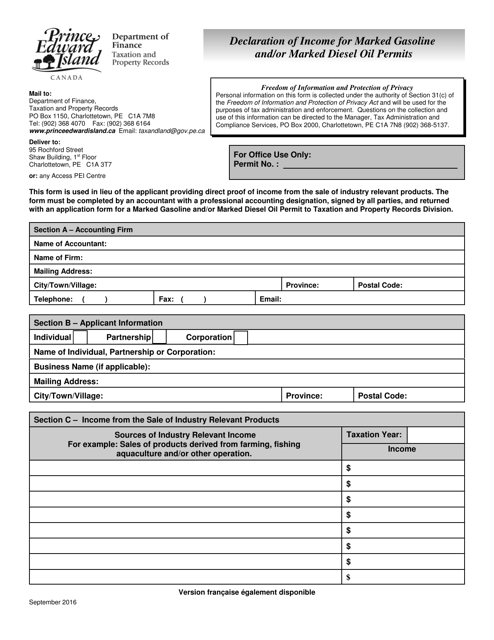

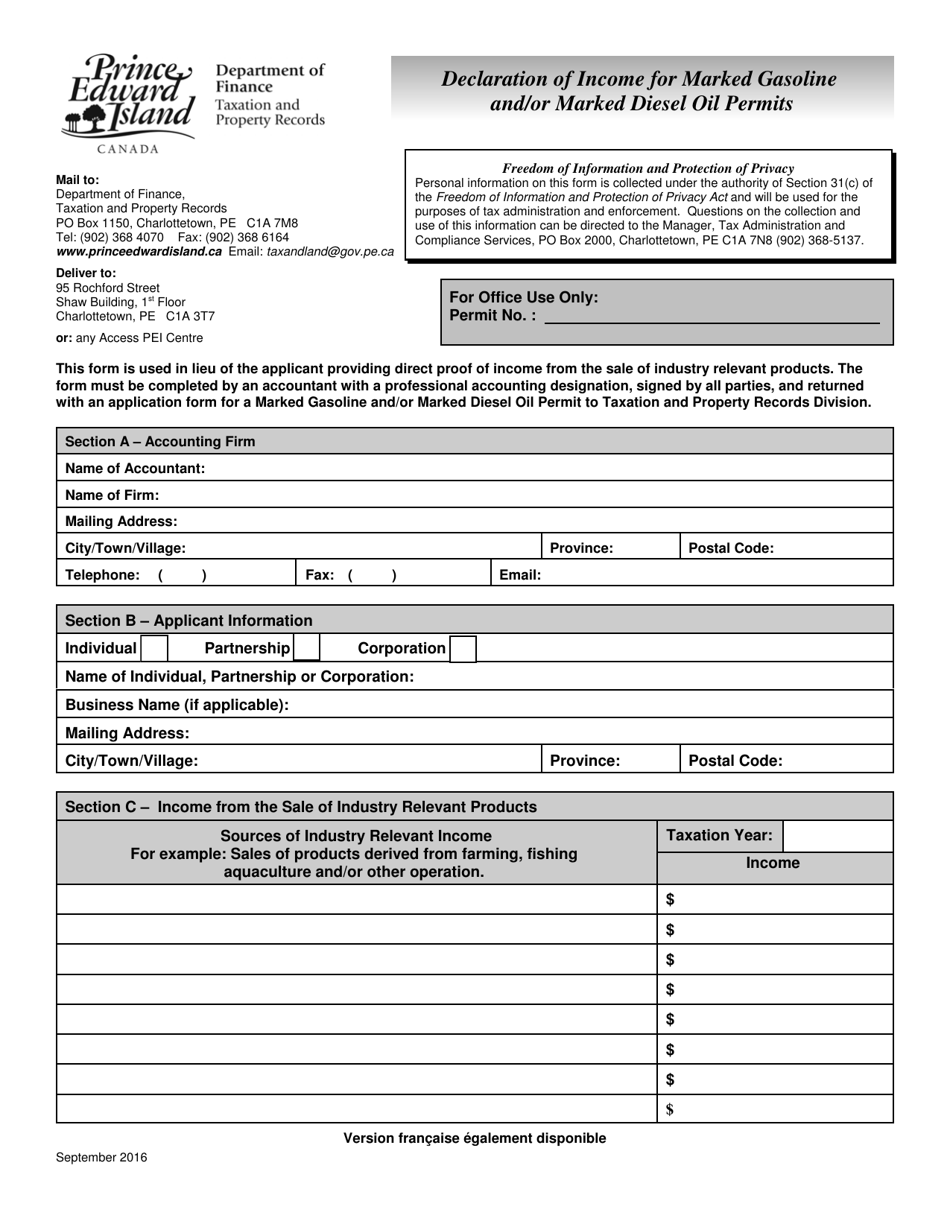

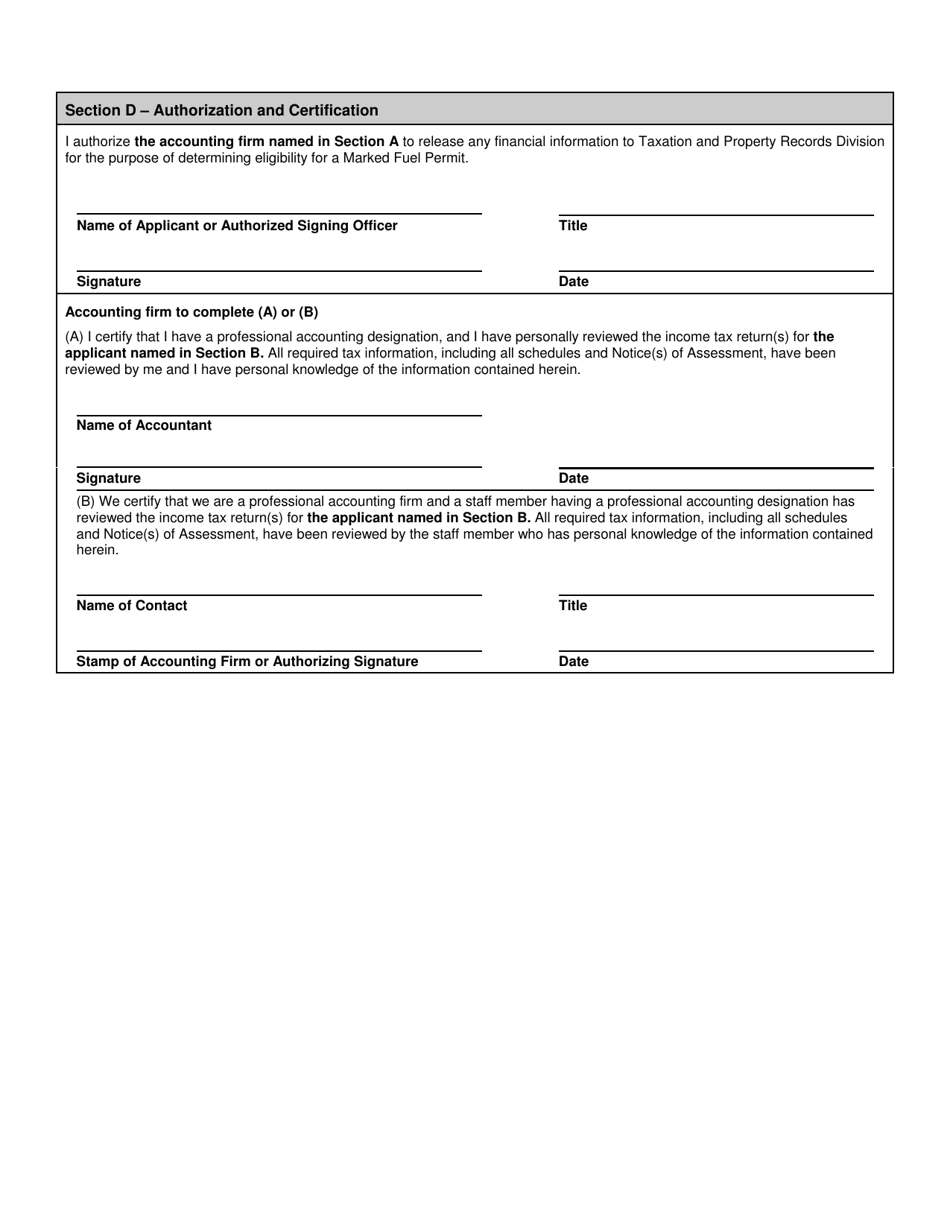

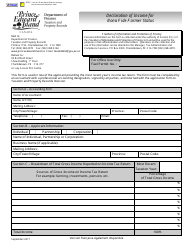

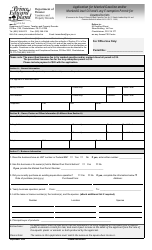

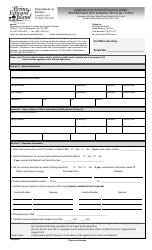

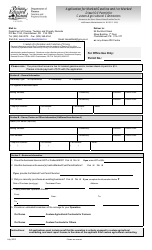

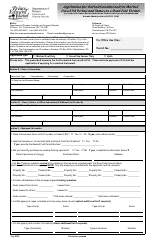

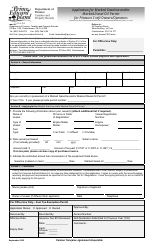

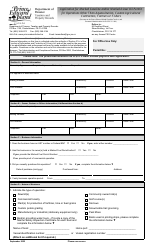

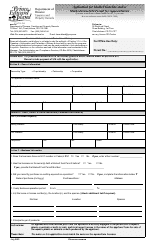

Declaration of Income for Marked Gasoline and / or Marked Diesel Oil Permits - Prince Edward Island, Canada

The Declaration of Income for Marked Gasoline and/or Marked Diesel Oil Permits in Prince Edward Island, Canada is used for reporting the income earned from the sale of marked gasoline and/or marked diesel oil. It is a requirement for individuals or businesses who hold permits to sell these fuels.

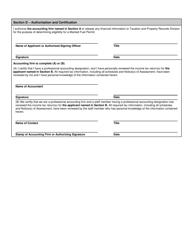

The declaration of income for marked gasoline and/or marked diesel oil permits in Prince Edward Island, Canada is filed by the permit holder or the authorized representative.

FAQ

Q: What is the Declaration of Income for Marked Gasoline and/or Marked Diesel Oil Permits?

A: The Declaration of Income for Marked Gasoline and/or Marked Diesel Oil Permits is a form that needs to be filled out by individuals who hold permits for marked gasoline and/or marked diesel oil in Prince Edward Island, Canada.

Q: Who needs to fill out the Declaration of Income for Marked Gasoline and/or Marked Diesel Oil Permits?

A: Individuals who hold permits for marked gasoline and/or marked diesel oil in Prince Edward Island, Canada, need to fill out the Declaration of Income for Marked Gasoline and/or Marked Diesel Oil Permits.

Q: What is marked gasoline and marked diesel oil?

A: Marked gasoline and marked diesel oil are fuels that have a special dye added to them to indicate that they are not meant for general use and are subject to specific regulations and taxes.

Q: Why do individuals need to declare their income for marked gasoline and/or marked diesel oil permits?

A: Individuals need to declare their income for marked gasoline and/or marked diesel oil permits to ensure compliance with taxation and regulatory requirements.

Q: When is the deadline for submitting the Declaration of Income for Marked Gasoline and/or Marked Diesel Oil Permits?

A: The deadline for submitting the Declaration of Income for Marked Gasoline and/or Marked Diesel Oil Permits may vary, and individuals should check with the relevant authorities for specific deadlines.

Q: What happens if individuals fail to submit the Declaration of Income for Marked Gasoline and/or Marked Diesel Oil Permits?

A: Failure to submit the Declaration of Income for Marked Gasoline and/or Marked Diesel Oil Permits may result in penalties or legal consequences.

Q: Can individuals claim deductions or credits related to marked gasoline and/or marked diesel oil?

A: Specific deductions or credits related to marked gasoline and/or marked diesel oil may be available, and individuals should consult tax professionals or the relevant government agencies for guidance.