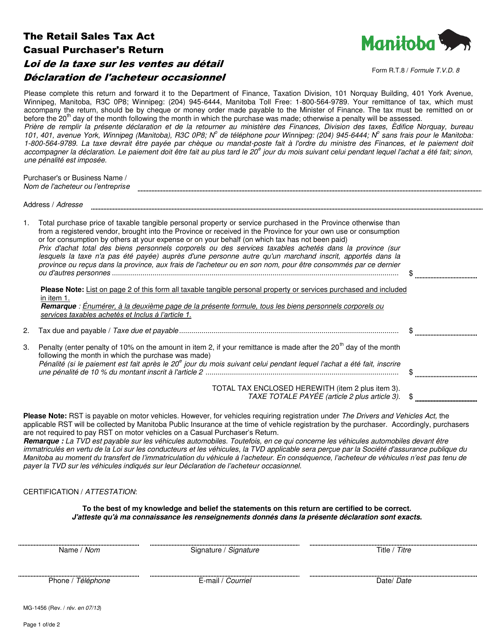

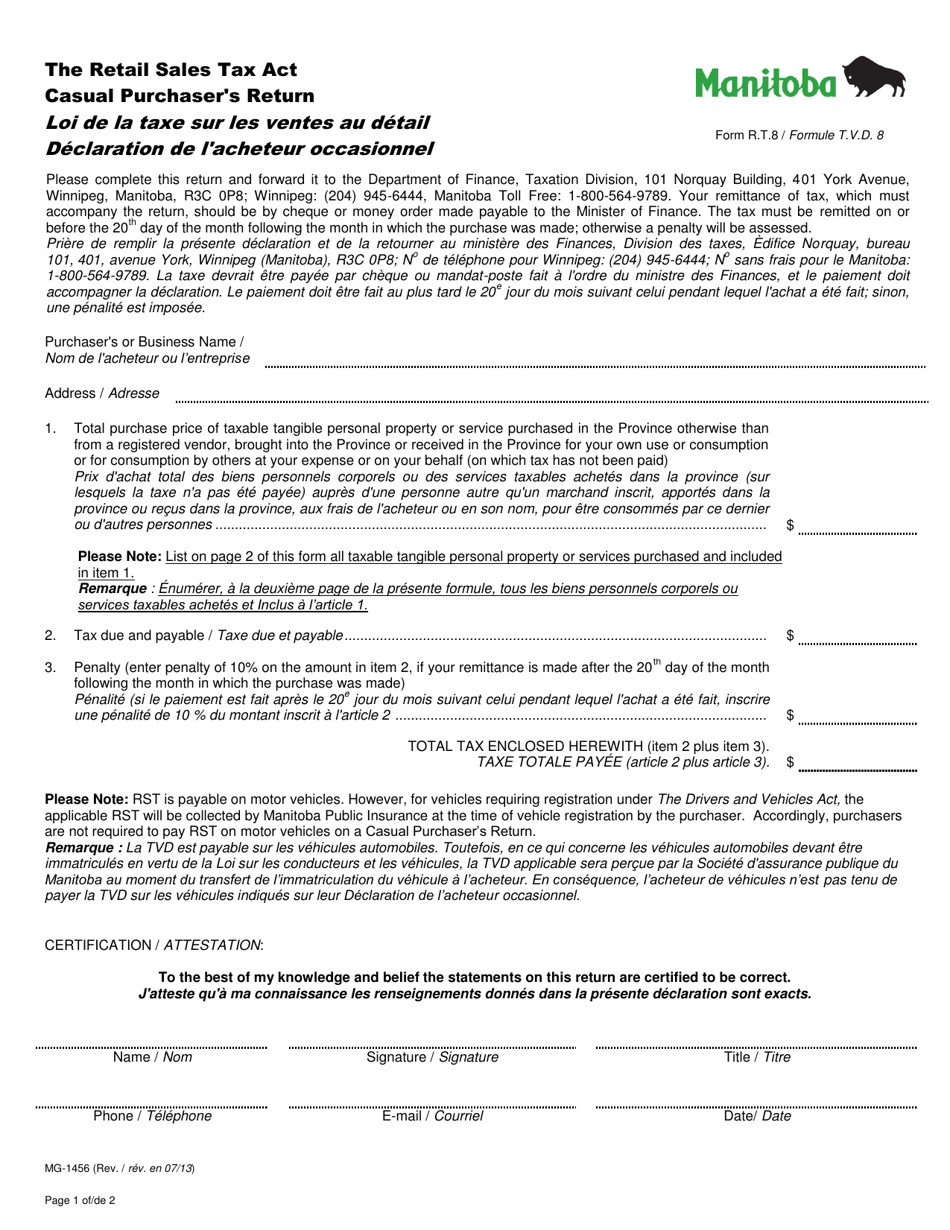

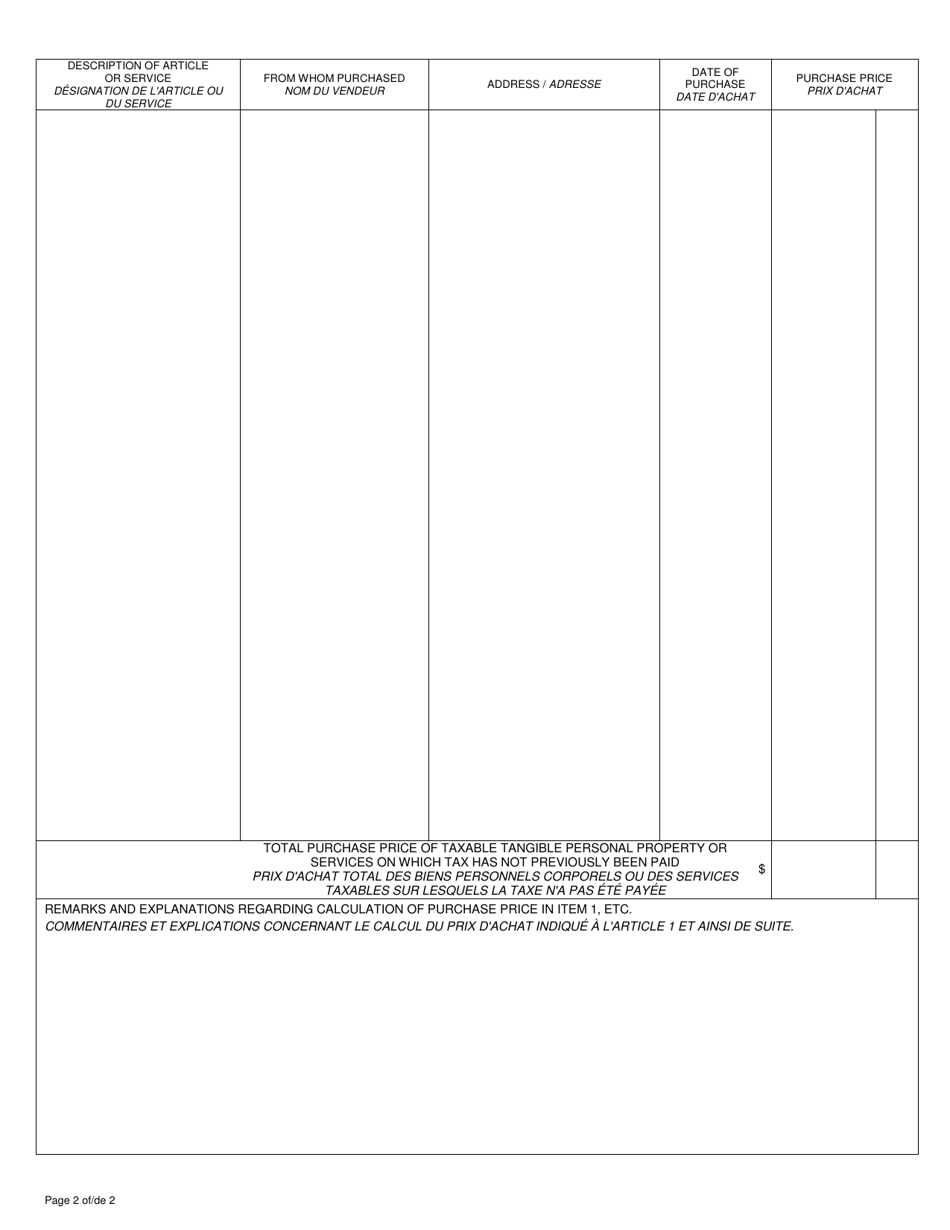

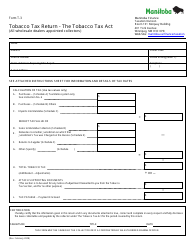

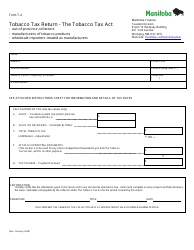

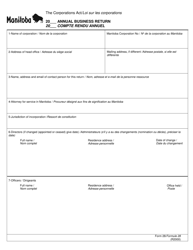

Form R.T.8 (MG-1456) Casual Purchaser's Return - Manitoba, Canada (English / French)

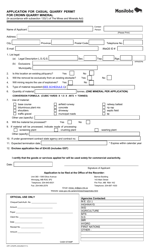

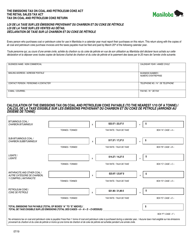

Form R.T.8 (MG-1456) Casual Purchaser's Return is used in Manitoba, Canada for reporting and remitting the Retail Sales Tax (RST) on purchases made by individuals who are not registered for RST. It is specifically designed for casual purchasers who are not engaged in regular business activities or registered as vendors. The form is available in both English and French.

The Form R.T.8 (MG-1456) Casual Purchaser's Return in Manitoba, Canada can be filed by individuals who make purchases from out-of-province suppliers and do not have a valid Canadian Goods and Services Tax (GST) number. This form is available in English and French.

FAQ

Q: What is Form R.T.8 (MG-1456)?

A: Form R.T.8 (MG-1456) is the Casual Purchaser's Return form used in Manitoba, Canada.

Q: What is the purpose of Form R.T.8 (MG-1456)?

A: The purpose of Form R.T.8 (MG-1456) is to report and remit the retail sales tax on purchases made by casual purchasers in Manitoba.

Q: Who needs to use Form R.T.8 (MG-1456)?

A: Any casual purchaser who is not registered for retail sales tax in Manitoba needs to use Form R.T.8 (MG-1456).

Q: What information is required on Form R.T.8 (MG-1456)?

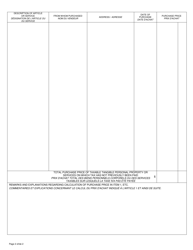

A: Form R.T.8 (MG-1456) requires information about the purchaser, the vendor, and the details of the purchases made.

Q: Is Form R.T.8 (MG-1456) available in both English and French?

A: Yes, Form R.T.8 (MG-1456) is available in both English and French.