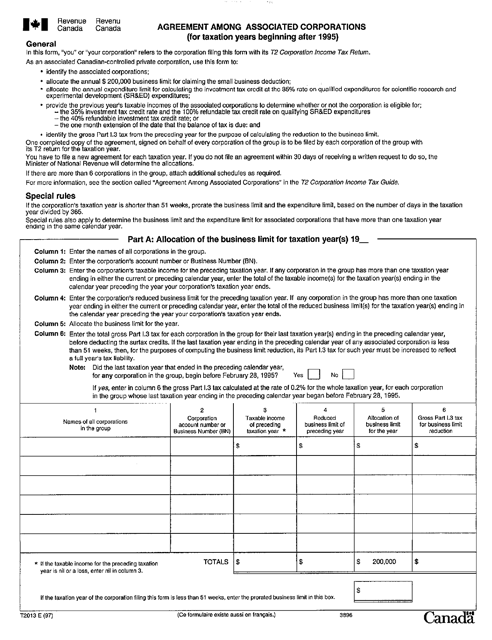

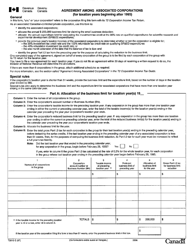

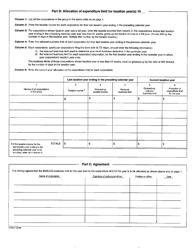

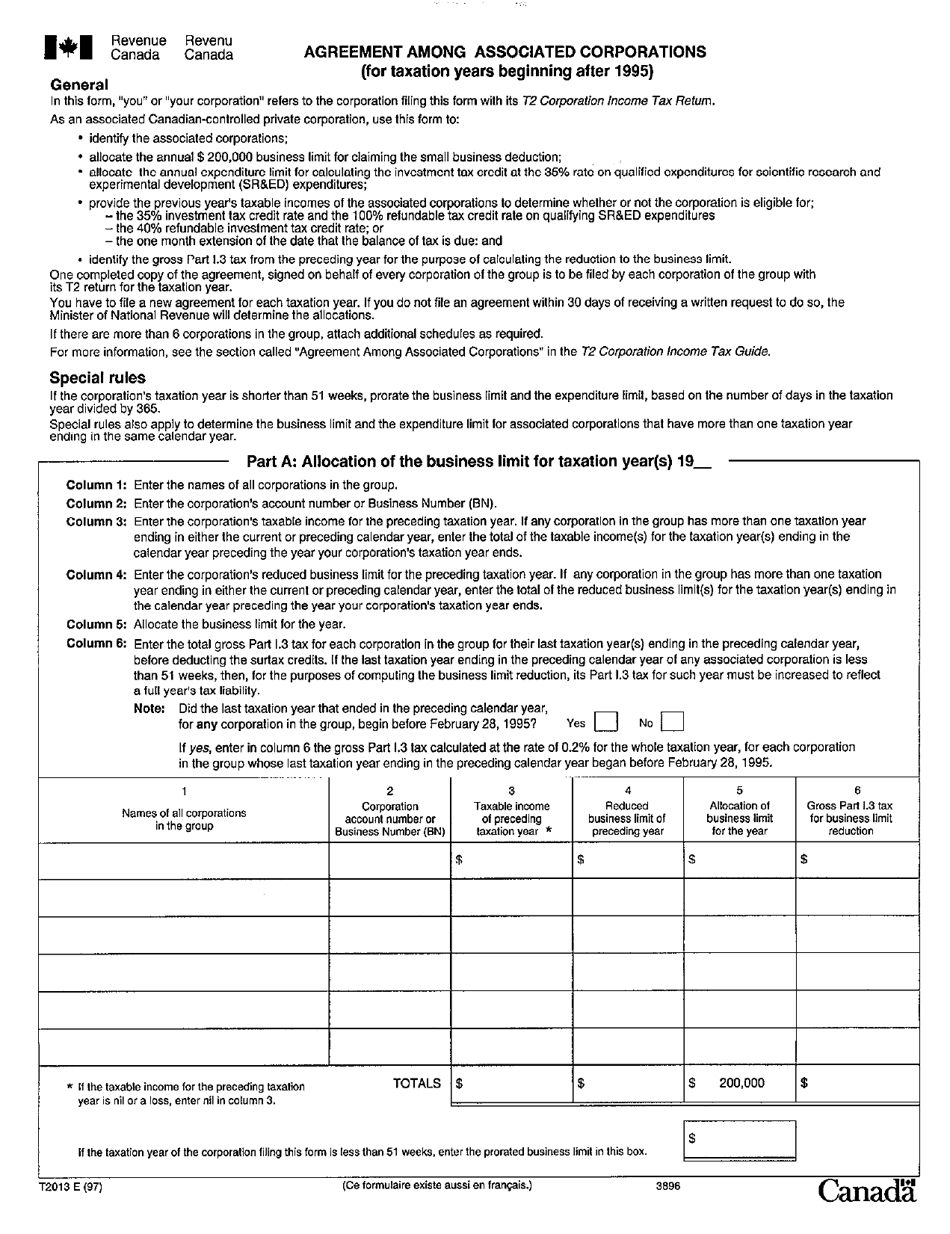

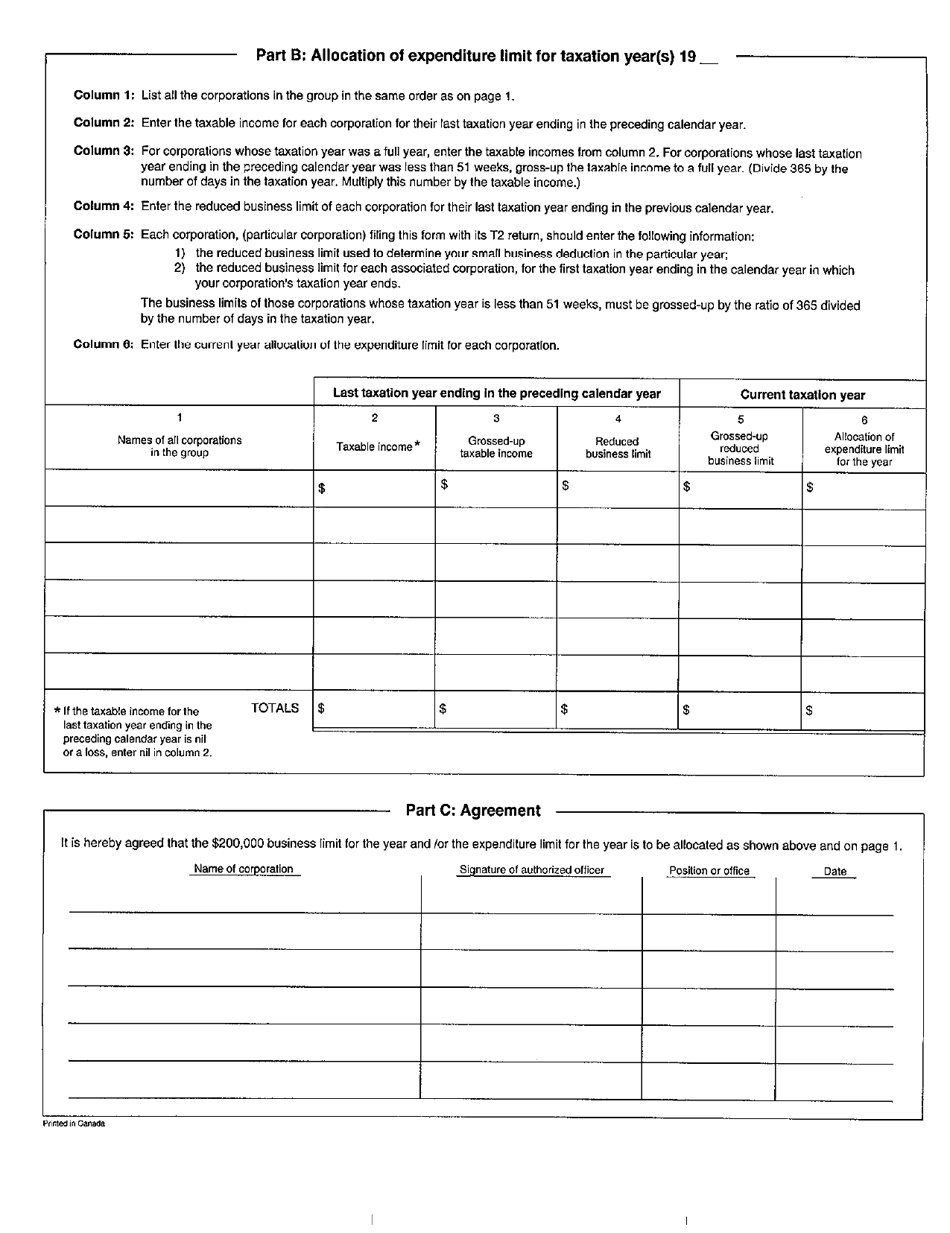

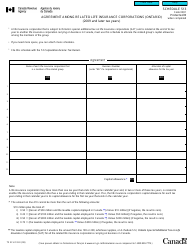

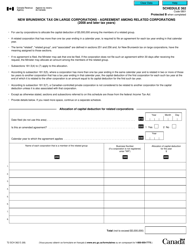

Form T2013 Agreement Among Associated Corporations (For Taxation Years Beginning After 1995) - Canada

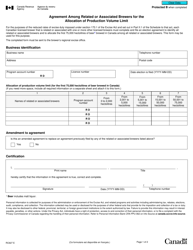

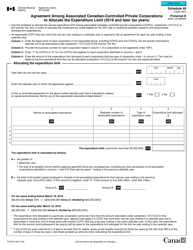

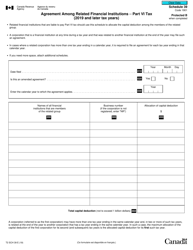

Form T2013 Agreement Among Associated Corporations is used in Canada for reporting the allocation and transfer of taxable income among associated corporations for taxation years beginning after 1995. It helps ensure that the income is properly distributed among related companies according to the tax rules.

In Canada, the Form T2013 Agreement Among Associated Corporations is filed by associated corporations for taxation years beginning after 1995.

FAQ

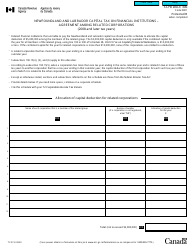

Q: What is a T2013 Agreement?

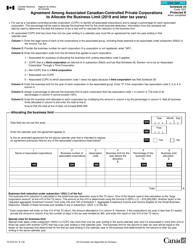

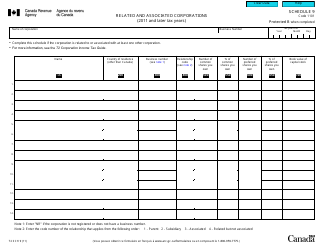

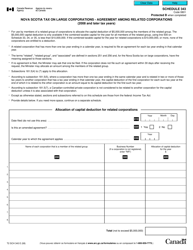

A: A T2013 Agreement is an agreement among associated corporations in Canada for tax purposes.

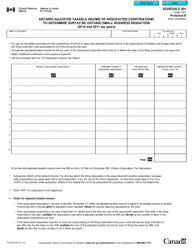

Q: What is the purpose of a T2013 Agreement?

A: The purpose of a T2013 Agreement is to determine the allocation of taxable income among associated corporations.

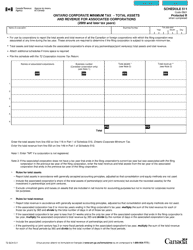

Q: Who are considered associated corporations?

A: Associated corporations are corporations that are related through control or ownership.

Q: When does a T2013 Agreement apply?

A: A T2013 Agreement applies to taxation years beginning after 1995.

Q: What information is required in a T2013 Agreement?

A: A T2013 Agreement must include the names and tax identification numbers of the associated corporations, the allocation formula, and the terms and conditions of the agreement.