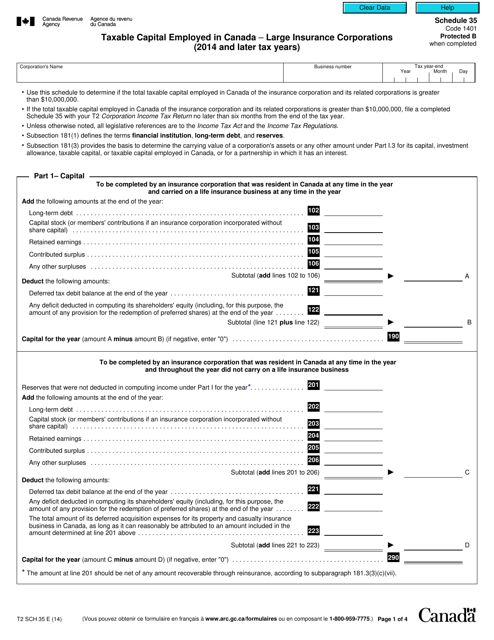

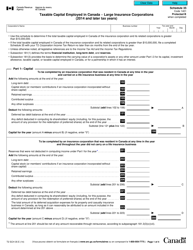

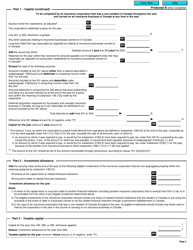

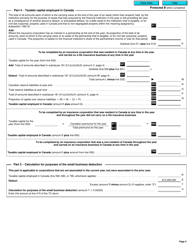

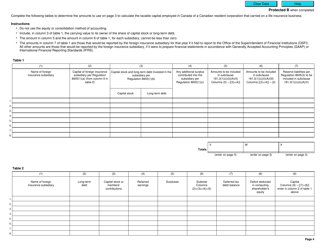

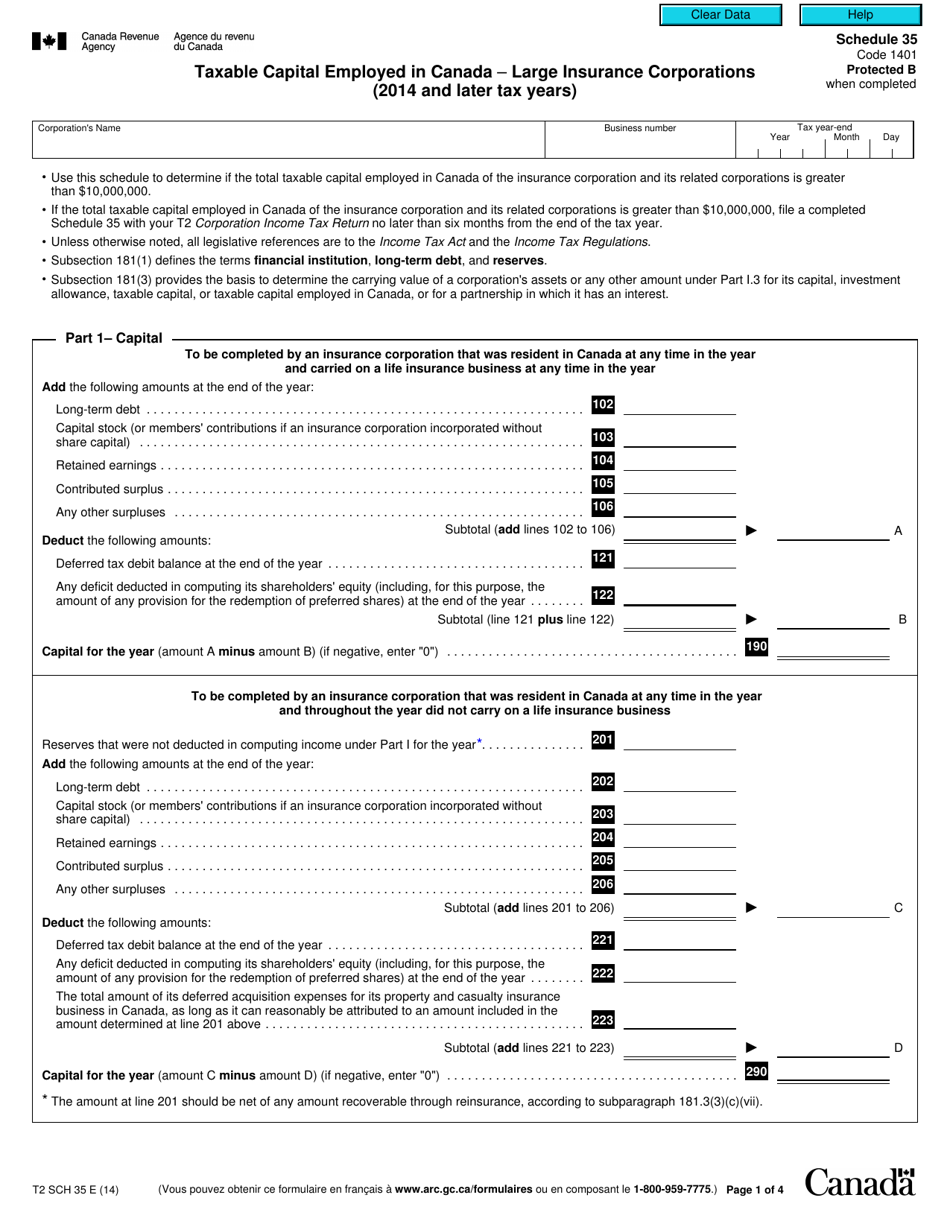

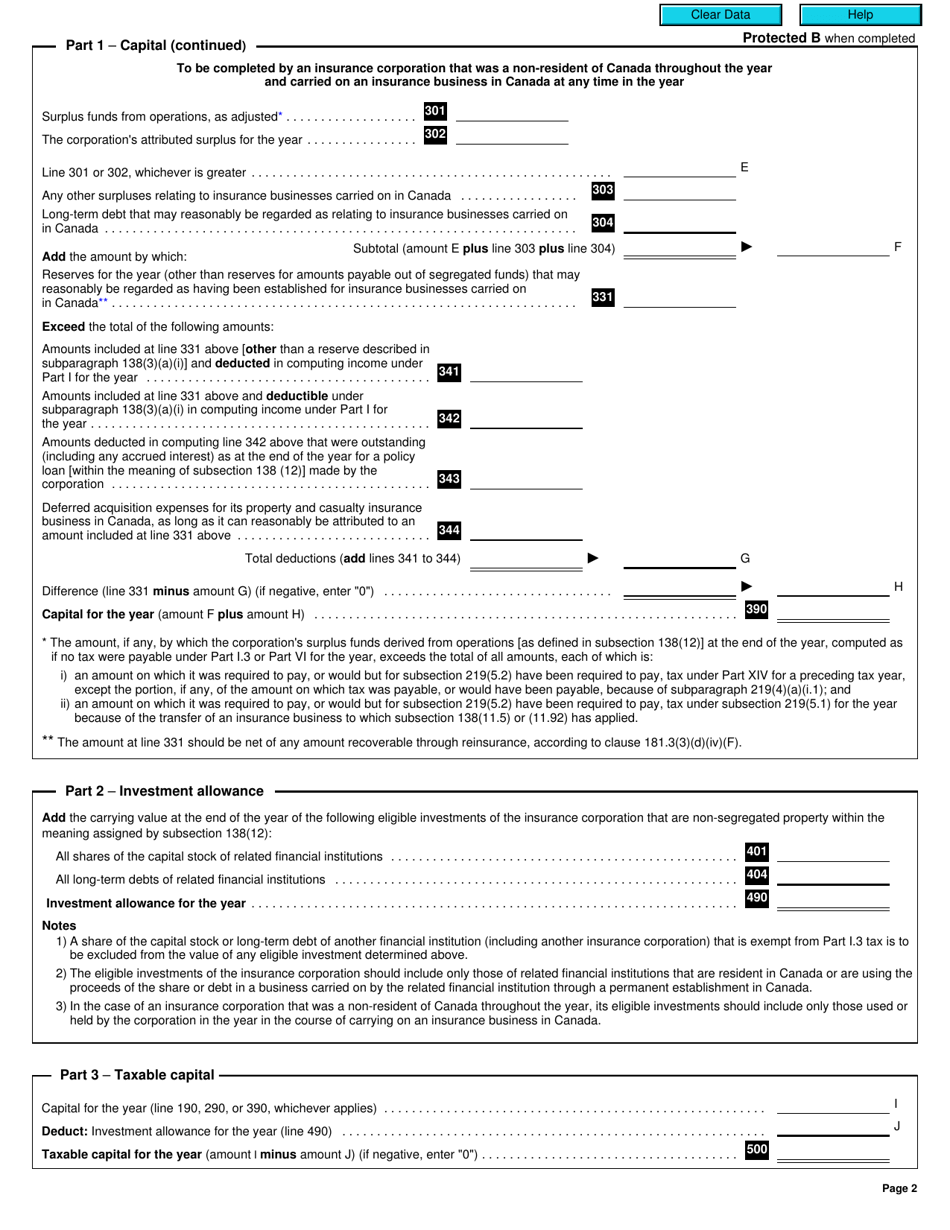

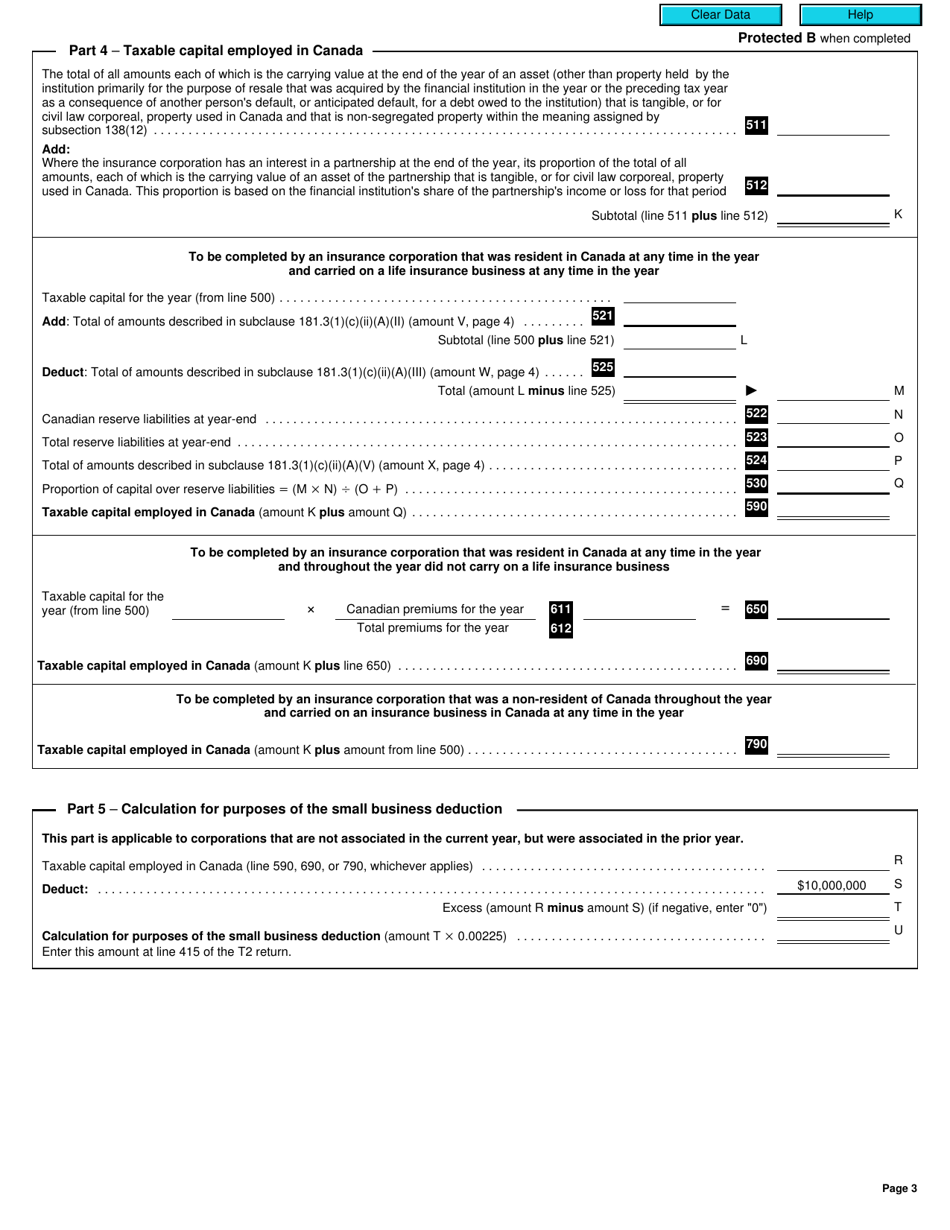

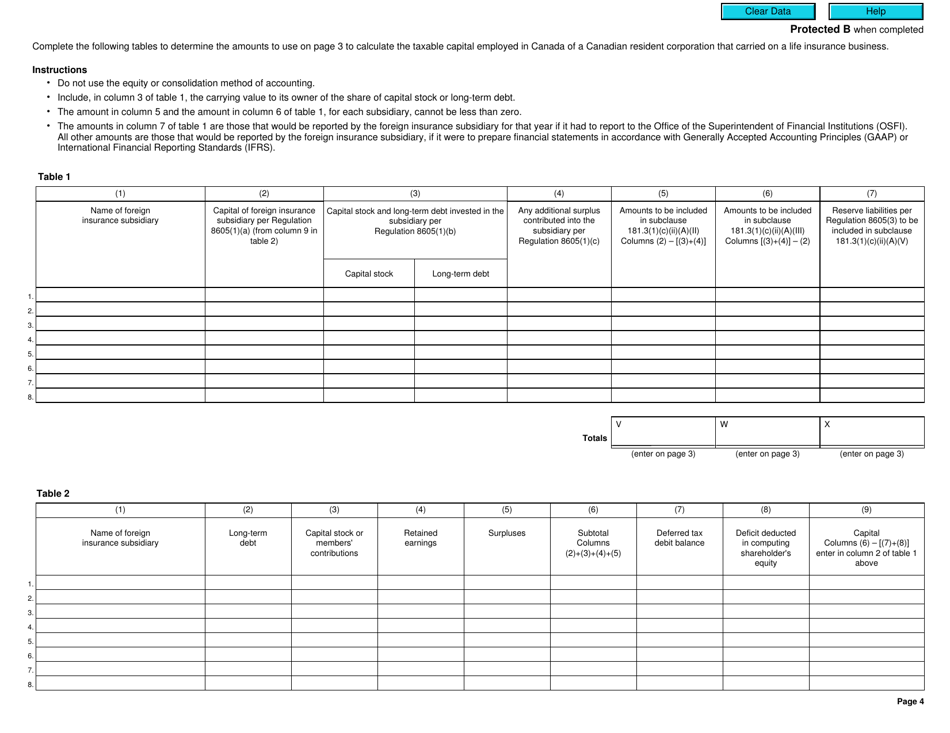

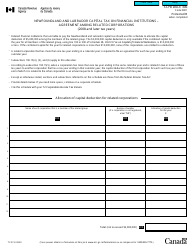

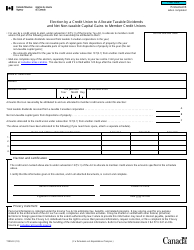

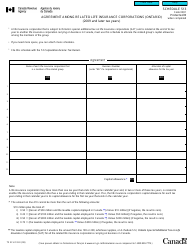

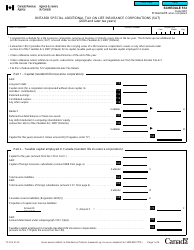

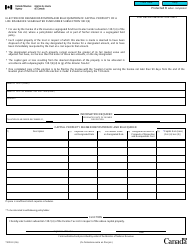

Form T2 Schedule 35 Taxable Capital Employed in Canada - Large Insurance Corporations (2014 and Later Tax Years) - Canada

Form T2 Schedule 35 is used by large insurance corporations in Canada to calculate the taxable capital employed for the purpose of taxation. It is specifically applicable for the tax years 2014 and later.

Large insurance corporations in Canada file the Form T2 Schedule 35 for taxable capital employed.

FAQ

Q: What is T2 Schedule 35?

A: T2 Schedule 35 is a form used by large insurance corporations in Canada to report their taxable capital employed.

Q: Who needs to fill out T2 Schedule 35?

A: Large insurance corporations in Canada need to fill out T2 Schedule 35.

Q: What is taxable capital employed?

A: Taxable capital employed is the amount of capital used by the insurance corporation in its Canadian operations that is subject to taxation.

Q: Which tax years does T2 Schedule 35 apply to?

A: T2 Schedule 35 applies to tax years starting in 2014 and later.

Q: Are small insurance corporations required to fill out T2 Schedule 35?

A: No, T2 Schedule 35 is only applicable to large insurance corporations in Canada.