This version of the form is not currently in use and is provided for reference only. Download this version of

Form T2 Schedule 402

for the current year.

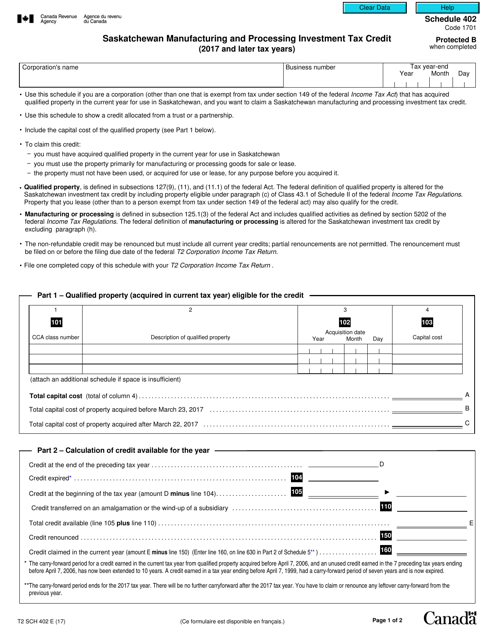

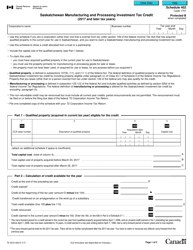

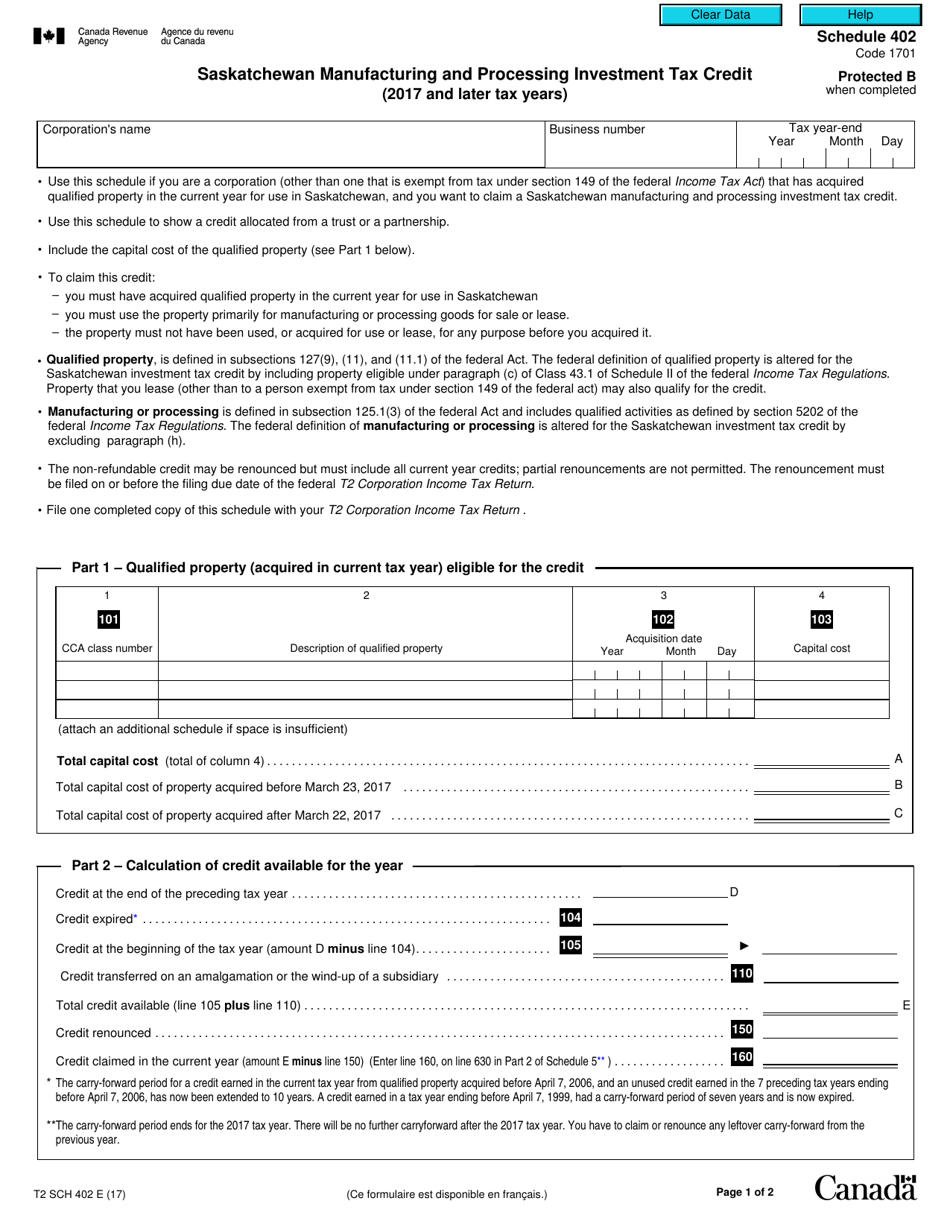

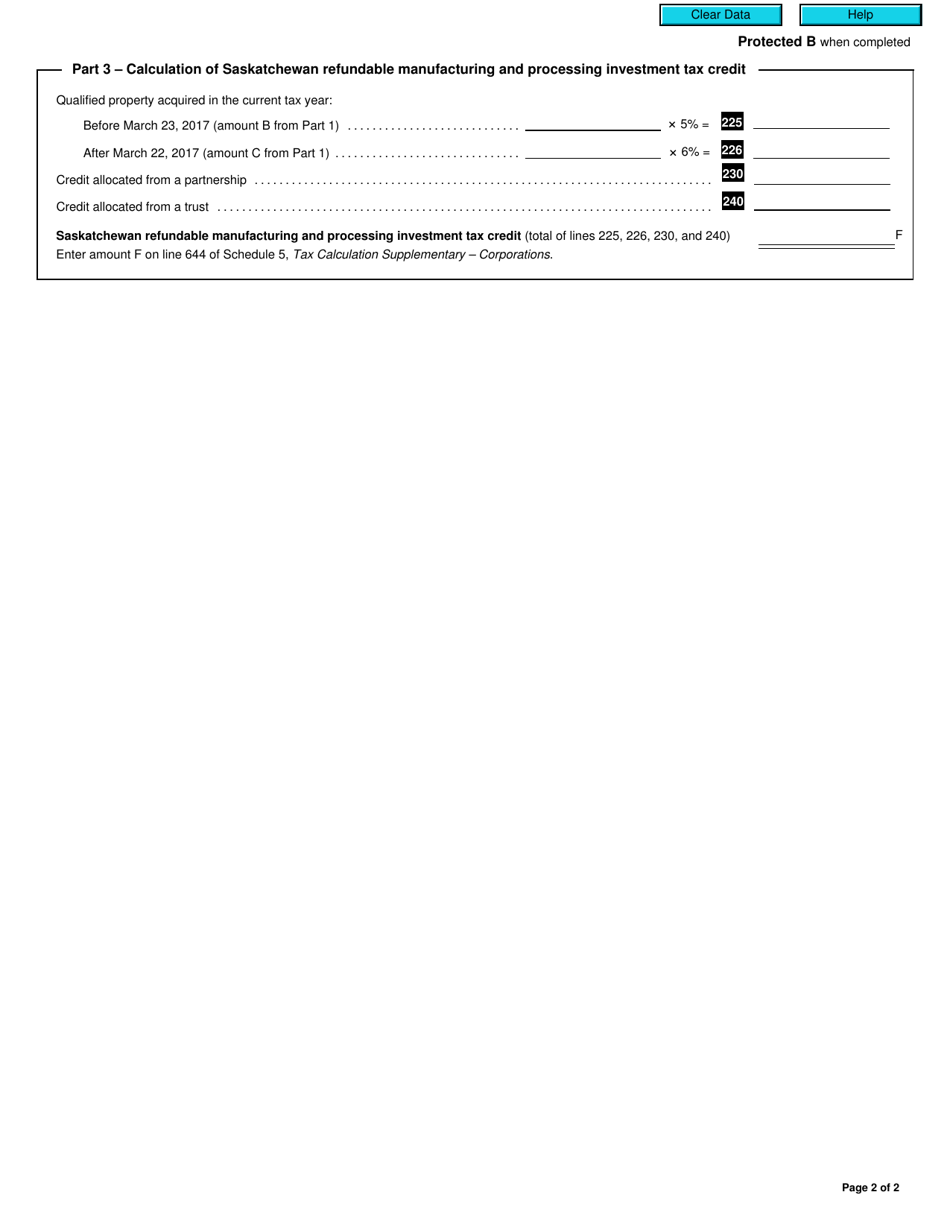

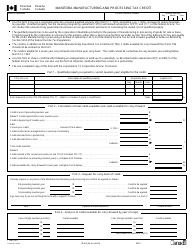

Form T2 Schedule 402 Saskatchewan Manufacturing and Processing Investment Tax Credit (2017 and Later Taxation Years) - Canada

Form T2 Schedule 402 is used in Canada for claiming the Saskatchewan Manufacturing and Processing Investment Tax Credit for the tax years 2017 and later. This tax credit is available for companies engaged in manufacturing and processing activities in Saskatchewan.

The Form T2 Schedule 402 Saskatchewan Manufacturing and Processing Investment Tax Credit in Canada is typically filed by corporations that qualify for this tax credit in Saskatchewan.

FAQ

Q: What is Form T2 Schedule 402?

A: Form T2 Schedule 402 is a tax form in Canada.

Q: What is the purpose of Form T2 Schedule 402?

A: The purpose of Form T2 Schedule 402 is to claim the Saskatchewan Manufacturing and Processing Investment Tax Credit for tax years 2017 and later.

Q: Who is eligible to use Form T2 Schedule 402?

A: Businesses in Saskatchewan engaged in manufacturing and processing activities may be eligible to use Form T2 Schedule 402 to claim the investment tax credit.

Q: What is the Saskatchewan Manufacturing and Processing Investment Tax Credit?

A: The Saskatchewan Manufacturing and Processing Investment Tax Credit is a tax credit that businesses in the manufacturing and processing sector in Saskatchewan can claim.

Q: What is the benefit of claiming the Saskatchewan Manufacturing and Processing Investment Tax Credit?

A: Claiming the tax credit can reduce a business's tax liability and provide financial support for investments in the manufacturing and processing sector in Saskatchewan.

Q: What are the requirements for claiming the Saskatchewan Manufacturing and Processing Investment Tax Credit?

A: To claim the tax credit, businesses must meet certain eligibility criteria, such as being engaged in manufacturing and processing activities in Saskatchewan and meeting the investment thresholds outlined in the tax credit guidelines.