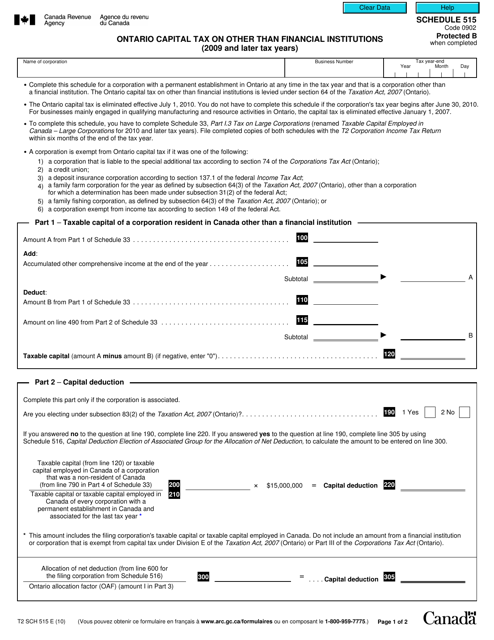

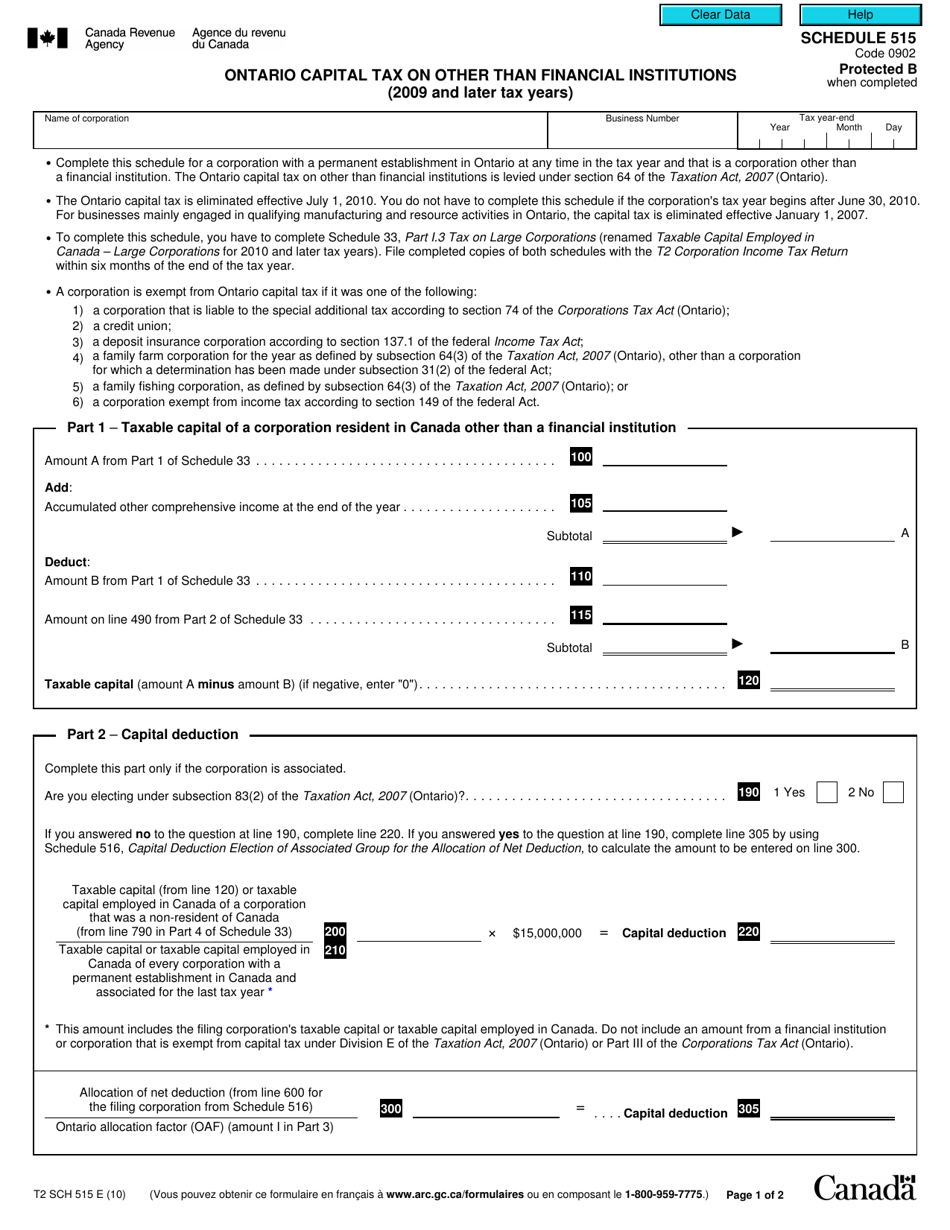

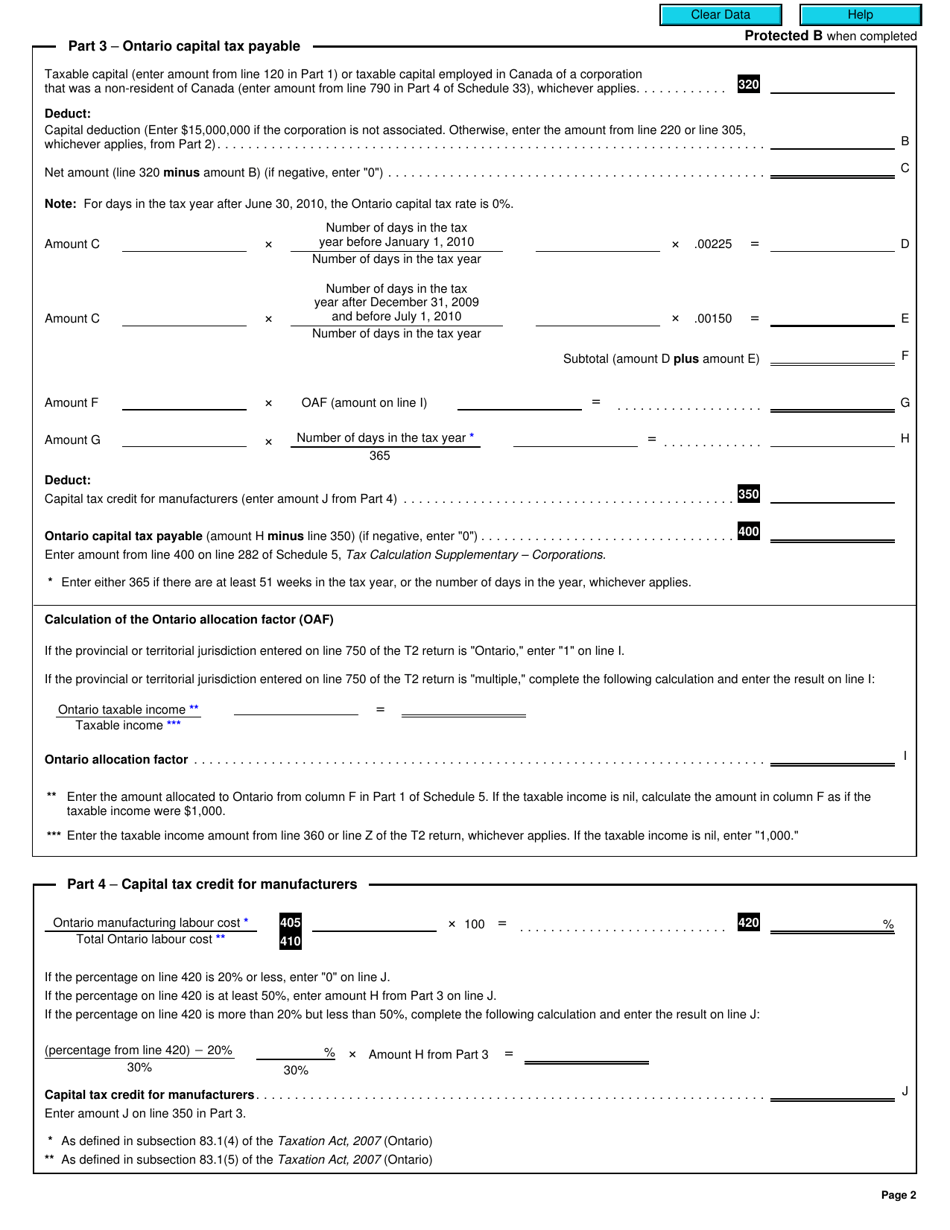

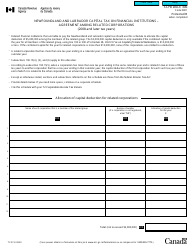

Form T2 Schedule 515 Ontario Capital Tax on Other Than Financial Institutions (2009 and Later Tax Years) - Canada

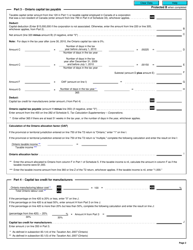

Form T2 Schedule 515 is used to calculate the Ontario Capital Tax for corporations in Canada, excluding financial institutions, for the tax years 2009 and later.

The Form T2 Schedule 515 Ontario Capital Tax on Other Than Financial Institutions (2009 and Later Tax Years) - Canada is filed by corporations that are subject to capital tax in the province of Ontario.

FAQ

Q: What is Form T2 Schedule 515?

A: Form T2 Schedule 515 is a tax form used in Canada for reporting Ontario Capital Tax on entities other than financial institutions.

Q: What tax years does Form T2 Schedule 515 apply to?

A: Form T2 Schedule 515 applies to tax years 2009 and later.

Q: What is Ontario Capital Tax?

A: Ontario Capital Tax is a tax imposed on certain corporations in Ontario, Canada. It is separate from other taxes such as income tax.

Q: Who needs to file Form T2 Schedule 515?

A: Entities other than financial institutions in Ontario may need to file Form T2 Schedule 515 if they owe Ontario Capital Tax.

Q: Is Form T2 Schedule 515 only for Ontario residents?

A: No, Form T2 Schedule 515 is applicable to entities in Ontario, regardless of their residency.