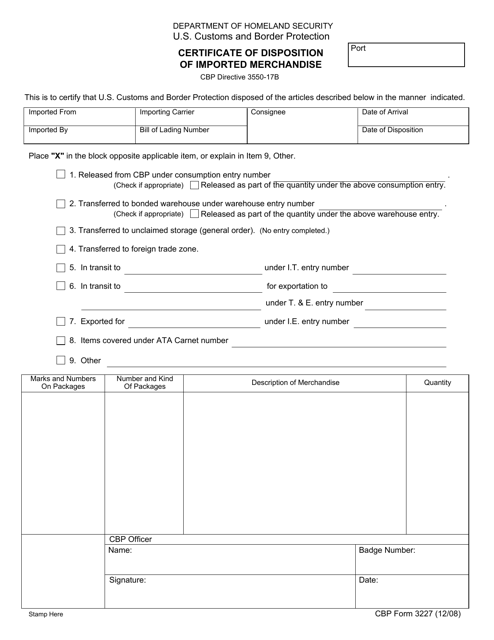

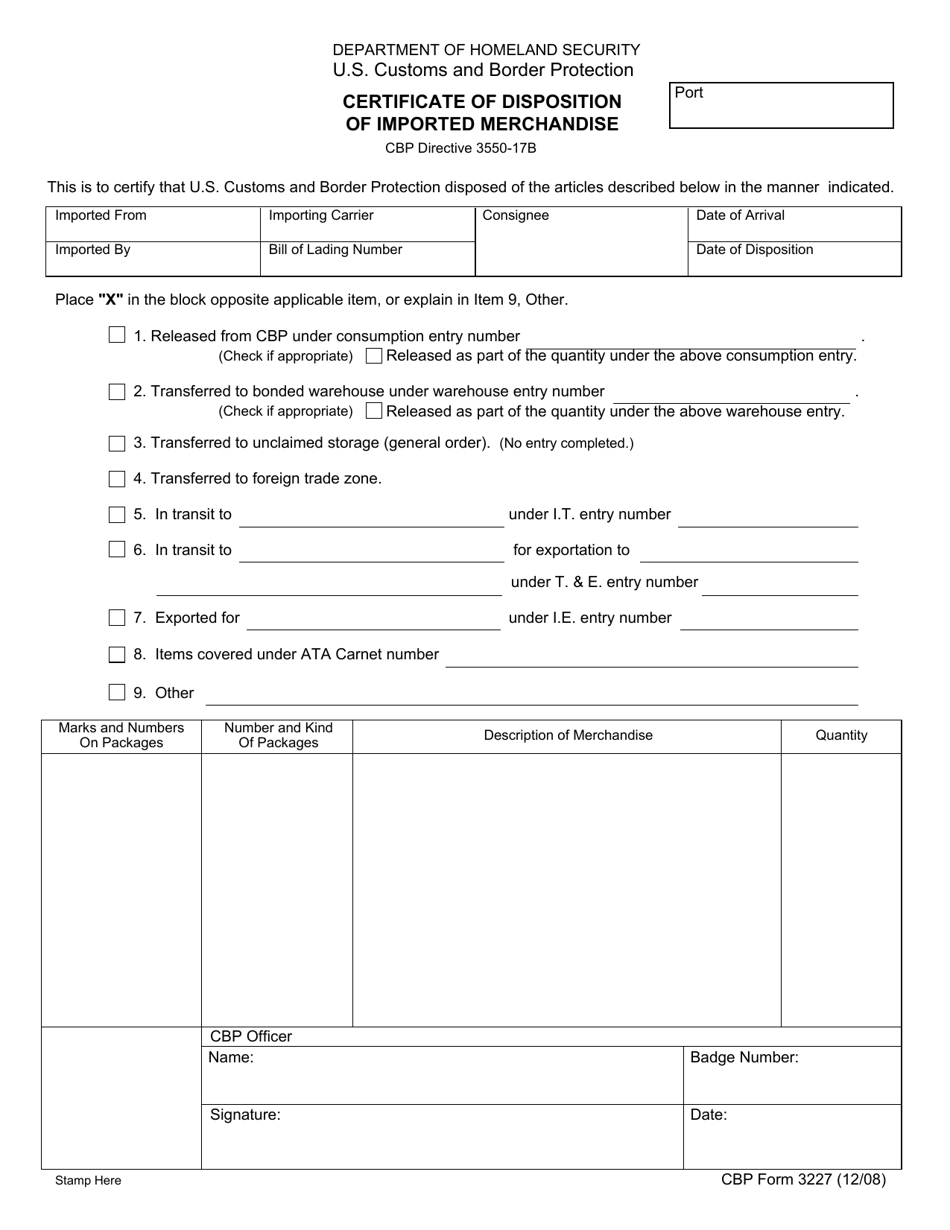

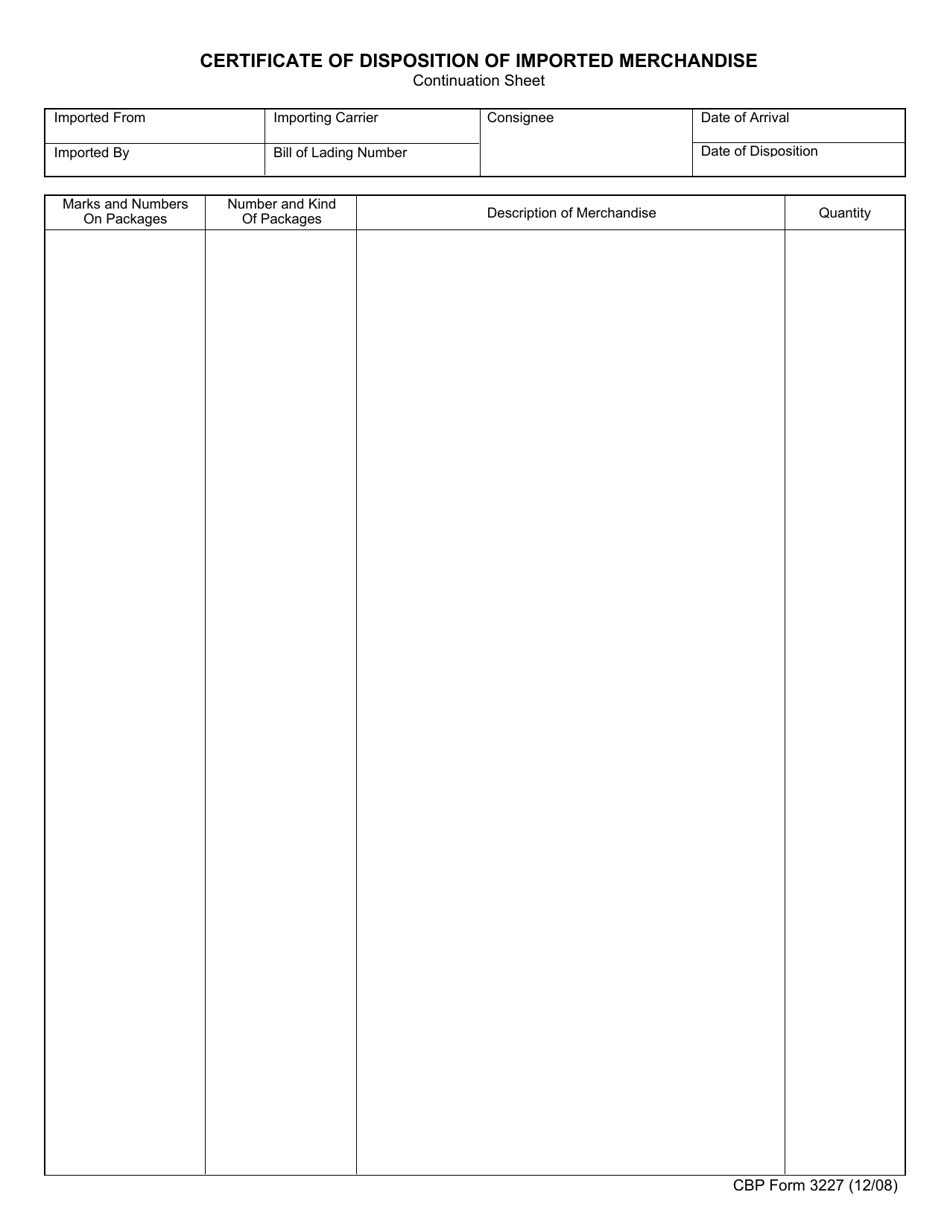

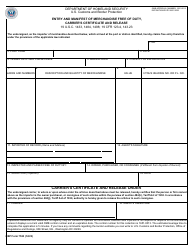

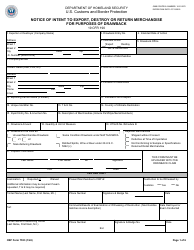

CBP Form 3227 Certificate of Disposition of Imported Merchandise

What Is CBP Form 3227?

This is a legal form that was released by the U.S. Department of Homeland Security - Customs and Border Protection on December 1, 2008 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is CBP Form 3227?

A: CBP Form 3227 is the Certificate of Disposition of Imported Merchandise.

Q: What is the purpose of CBP Form 3227?

A: The purpose of CBP Form 3227 is to certify the disposition of imported merchandise.

Q: When is CBP Form 3227 required?

A: CBP Form 3227 is required when there is a change in the status or condition of imported merchandise, such as abandonment, destruction, or exportation.

Q: Who needs to fill out CBP Form 3227?

A: Importers or their authorized agents need to fill out CBP Form 3227.

Q: How should CBP Form 3227 be submitted?

A: CBP Form 3227 should be submitted to the CBP office having jurisdiction over the port of entry or other designated location.

Q: Is there a fee for filing CBP Form 3227?

A: No, there is no fee for filing CBP Form 3227.

Q: Are there any penalties for not filing CBP Form 3227?

A: Failure to file CBP Form 3227 may result in penalties, including fines and detention of the merchandise.

Form Details:

- Released on December 1, 2008;

- The latest available edition released by the U.S. Department of Homeland Security - Customs and Border Protection;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of CBP Form 3227 by clicking the link below or browse more documents and templates provided by the U.S. Department of Homeland Security - Customs and Border Protection.