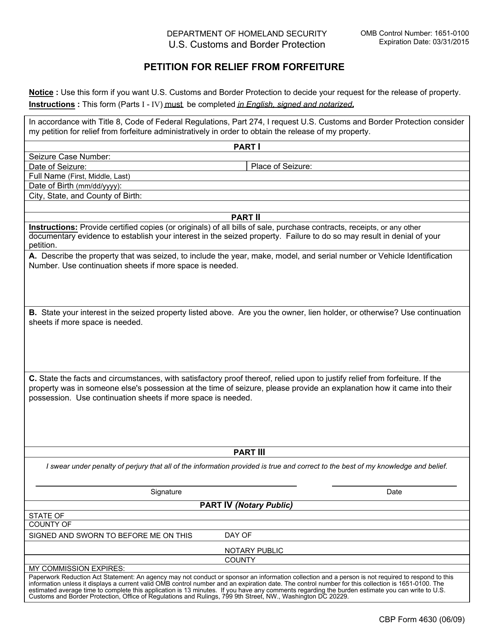

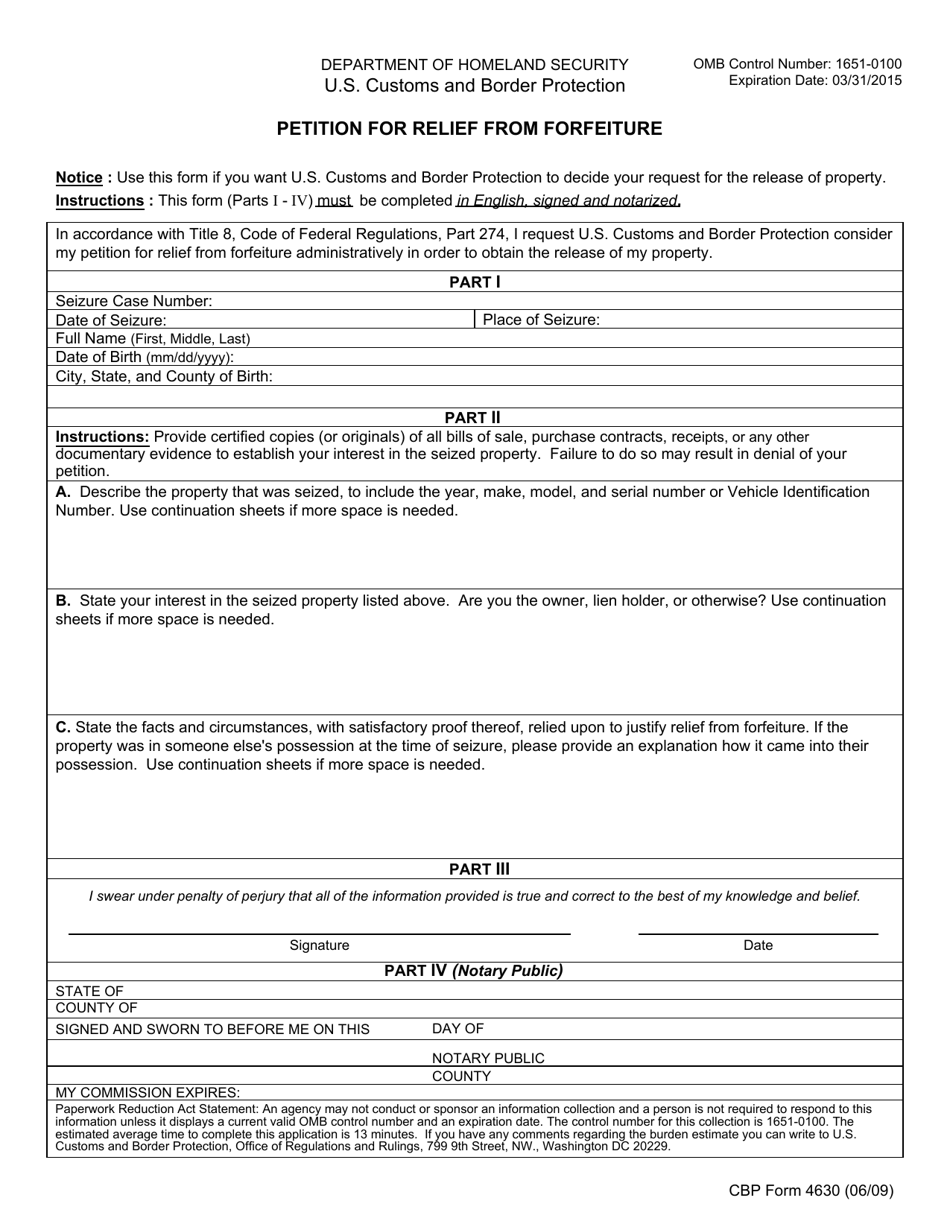

CBP Form 4630 Petition for Relief From Forfeiture

What Is CBP Form 4630?

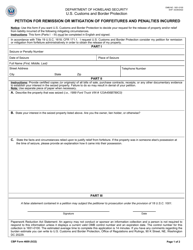

This is a legal form that was released by the U.S. Department of Homeland Security - Customs and Border Protection on June 1, 2009 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is CBP Form 4630?

A: CBP Form 4630 is a form used to file a Petition for Relief From Forfeiture.

Q: What is a Petition for Relief From Forfeiture?

A: A Petition for Relief From Forfeiture is a legal process to request the return of seized property by U.S. Customs and Border Protection (CBP).

Q: Who can file CBP Form 4630?

A: Anyone who has had their property seized by CBP can file CBP Form 4630.

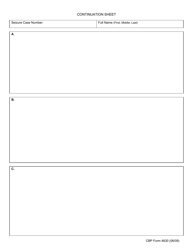

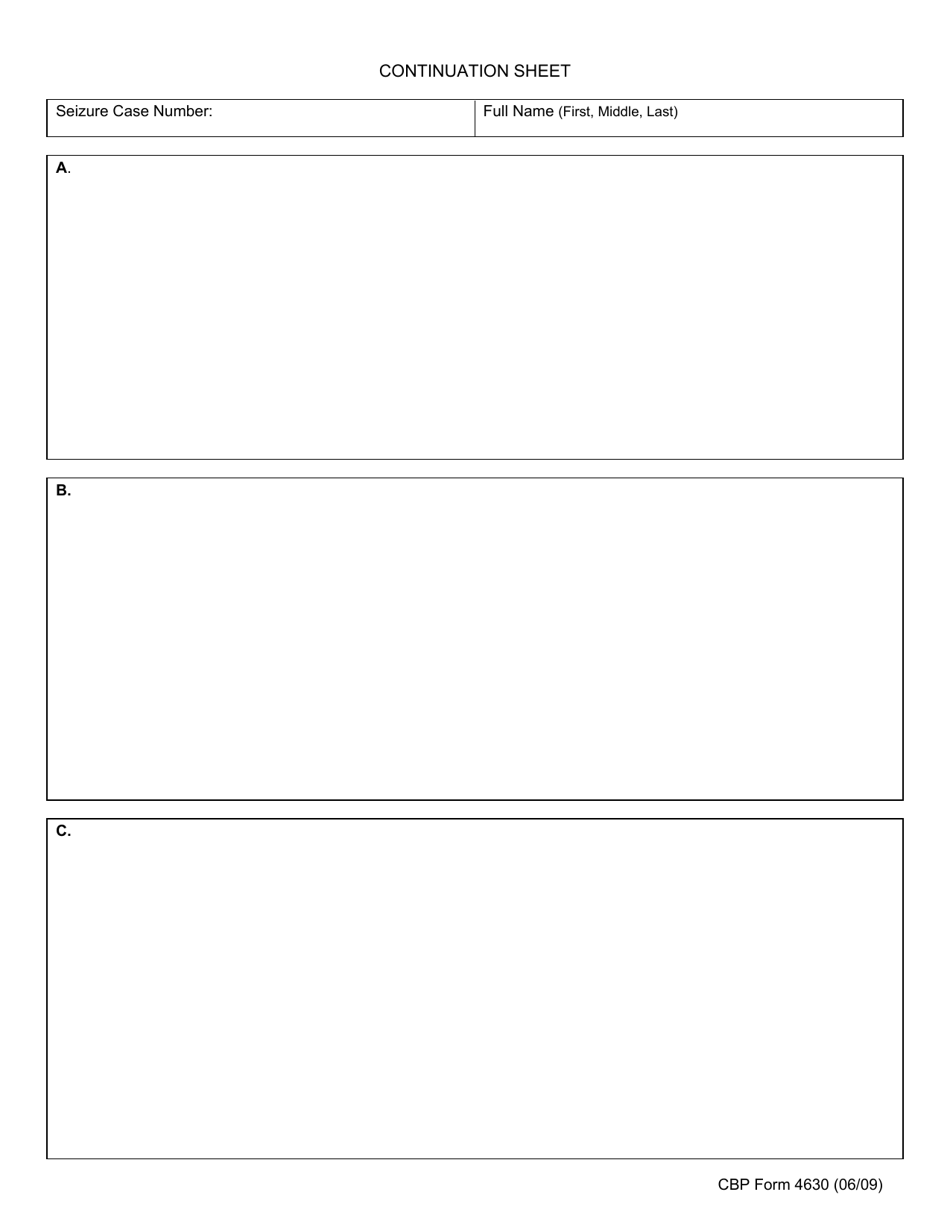

Q: What information is required in CBP Form 4630?

A: CBP Form 4630 requires detailed information about the seized property, the circumstances of the seizure, and the reasons for requesting relief from forfeiture.

Q: Is there a deadline for filing CBP Form 4630?

A: Yes, there is a deadline for filing CBP Form 4630. It is important to consult with an attorney or CBP for specific deadlines and instructions.

Q: What happens after filing CBP Form 4630?

A: After filing CBP Form 4630, the petition will be reviewed by CBP and a decision will be made regarding the relief from forfeiture.

Q: Can I appeal a decision made on my Petition for Relief From Forfeiture?

A: Yes, there is an appeals process available if you are not satisfied with the decision made on your Petition for Relief From Forfeiture. Consult with an attorney for guidance on the appeals process.

Q: Are there any fees associated with filing CBP Form 4630?

A: There may be fees associated with filing CBP Form 4630. Consult with an attorney or CBP for information on applicable fees.

Form Details:

- Released on June 1, 2009;

- The latest available edition released by the U.S. Department of Homeland Security - Customs and Border Protection;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of CBP Form 4630 by clicking the link below or browse more documents and templates provided by the U.S. Department of Homeland Security - Customs and Border Protection.