Investor Bulletin: Accredited Investors

Investor Bulletin: Accredited Investors is a 3-page legal document that was released by the U.S. Securities and Exchange Commission on September 1, 2013 and used nation-wide.

FAQ

Q: Who is considered an accredited investor?

A: An accredited investor is typically an individual or entity that meets certain financial criteria and is therefore allowed to participate in certain types of private investment opportunities.

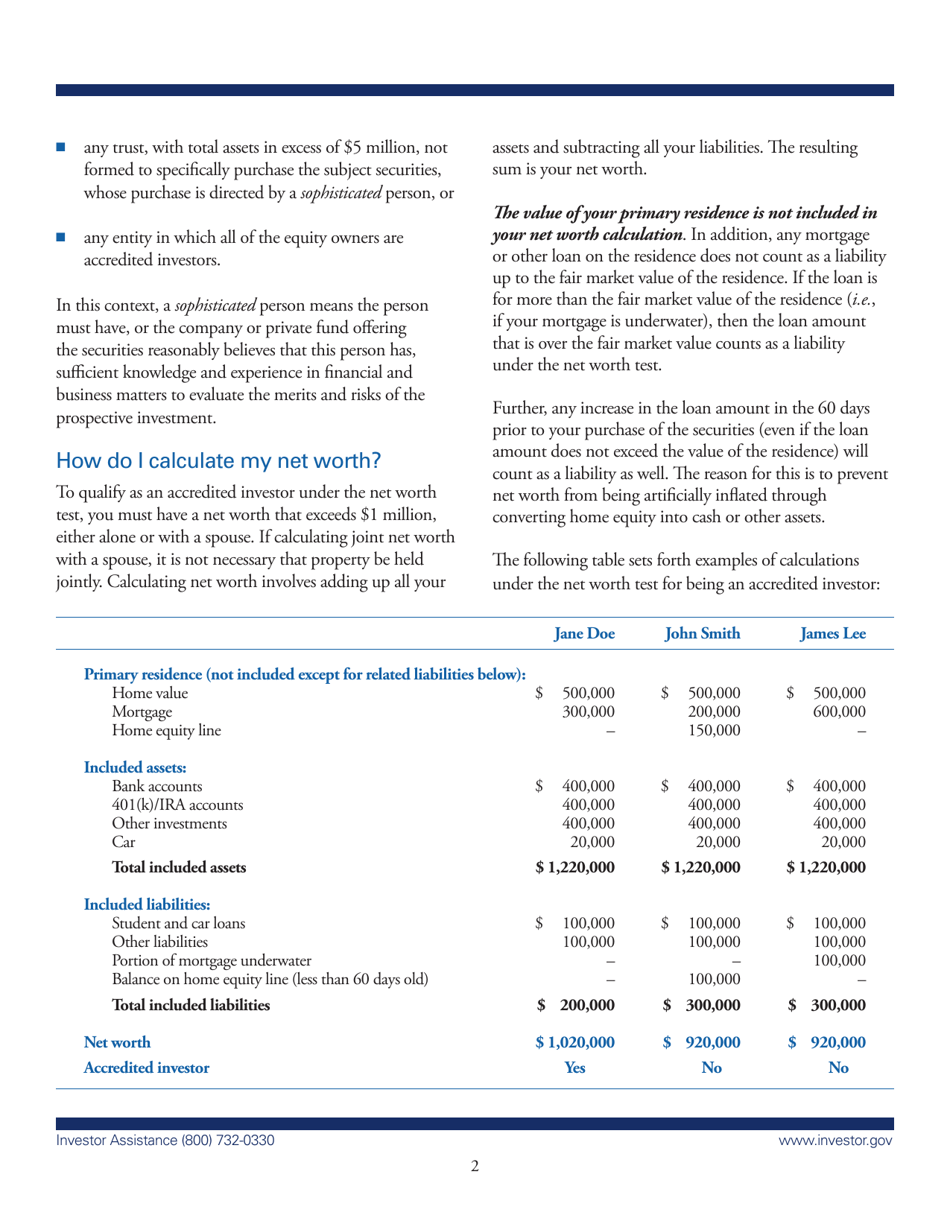

Q: What are the financial criteria for being an accredited investor?

A: The financial criteria for being an accredited investor generally include having a high net worth or a high income.

Q: Why are accredited investors given special opportunities?

A: Accredited investors are given special opportunities because they are presumed to have a certain level of financial sophistication and can bear the risks associated with certain private investments.

Q: What types of private investment opportunities are available to accredited investors?

A: Accredited investors may have access to offerings such as private placements, hedge funds, and certain types of crowdfunding opportunities.

Q: How can an individual or entity become an accredited investor?

A: An individual or entity can become an accredited investor by meeting the financial criteria set forth by the Securities and Exchange Commission (SEC).

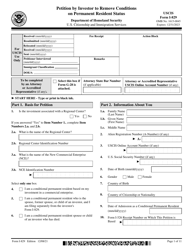

Form Details:

- The latest edition currently provided by the U.S. Securities and Exchange Commission;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more legal forms and templates provided by the issuing department.