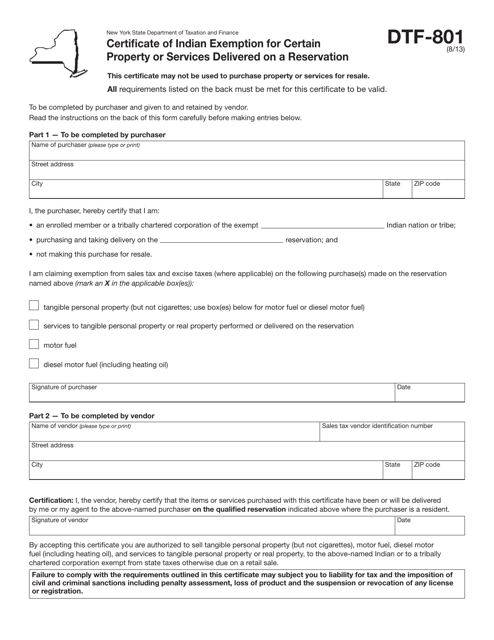

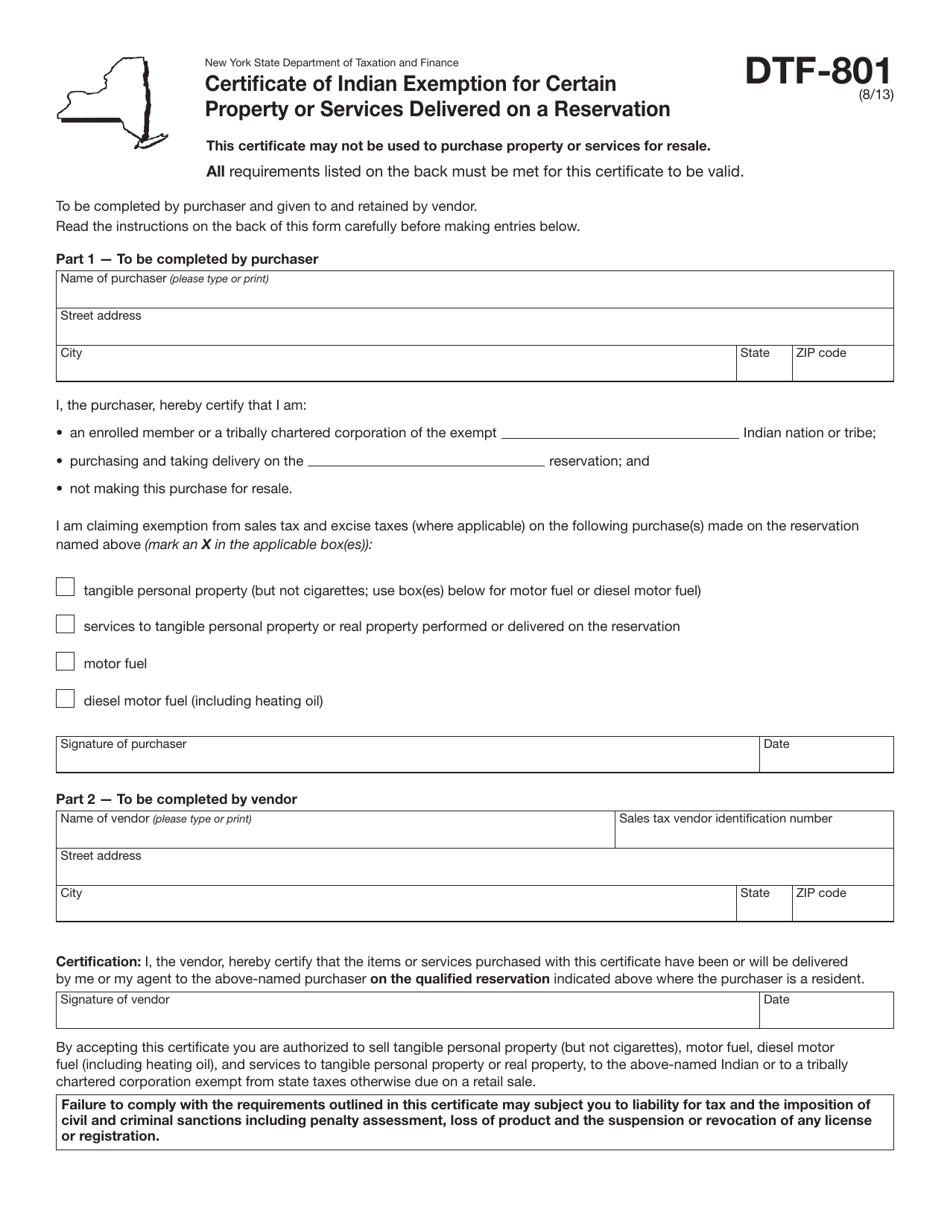

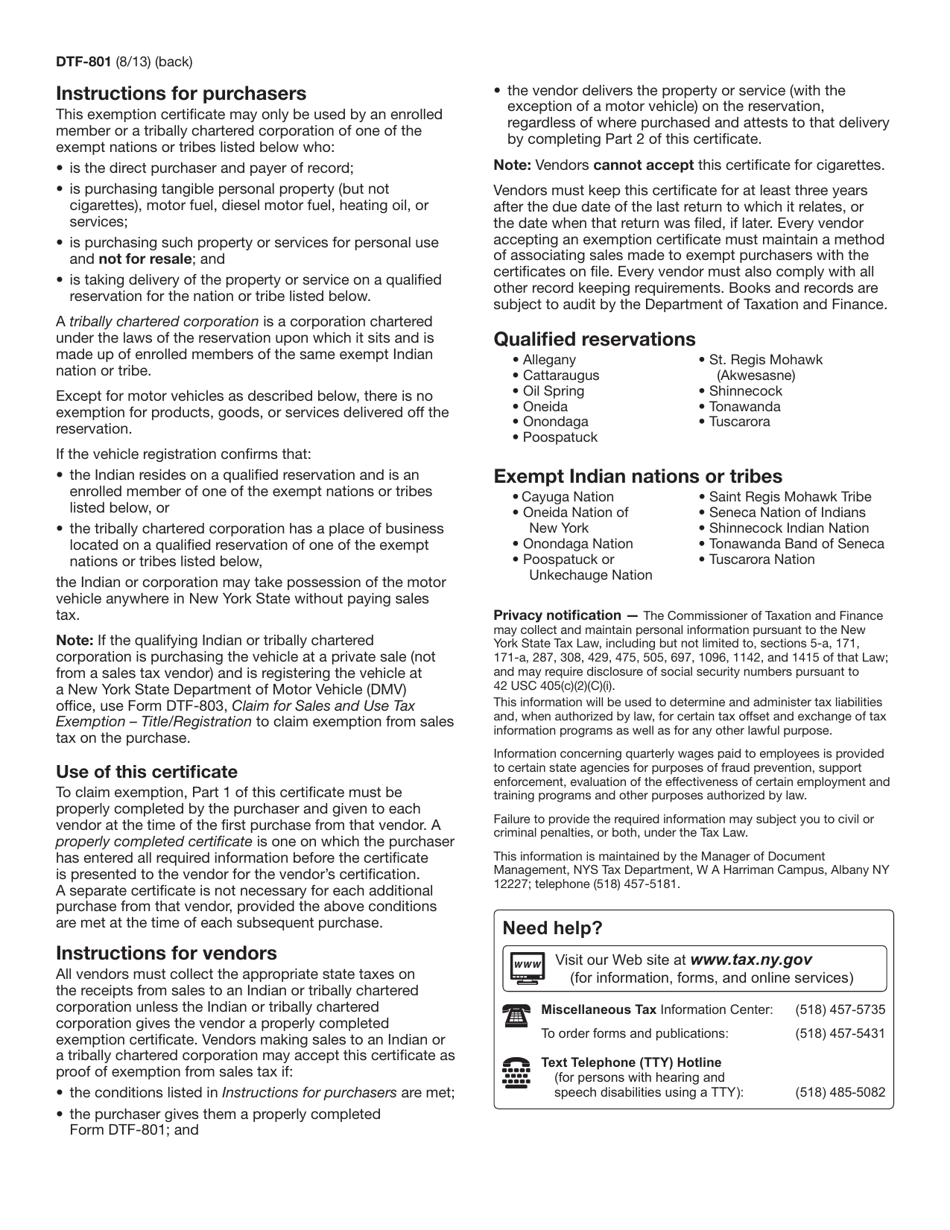

Form DTF-801 Certificate of Indian Exemption for Certain Property or Services Delivered on a Reservation - New York

What Is Form DTF-801?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DTF-801?

A: Form DTF-801 is the Certificate of Indian Exemption for Certain Property or Services Delivered on a Reservation in New York.

Q: Who needs to file Form DTF-801?

A: Businesses or individuals who are eligible for the Indian exemption on property or services delivered on a reservation in New York need to file Form DTF-801.

Q: What is the purpose of Form DTF-801?

A: The purpose of Form DTF-801 is to claim exemption from certain taxes for property or services delivered on a reservation in New York.

Q: What taxes are exempted with Form DTF-801?

A: Form DTF-801 exempts certain taxes, such as sales tax and compensating use tax, for property or services delivered on a reservation in New York.

Q: Are there any eligibility requirements for the Indian exemption?

A: Yes, there are eligibility requirements to claim the Indian exemption. These requirements include being a member of a tribe and using the property or services for tribal purposes.

Q: When should I file Form DTF-801?

A: Form DTF-801 should be filed before or at the time of the transaction that qualifies for the Indian exemption.

Q: Are there any penalties for filing Form DTF-801 incorrectly?

A: Yes, there may be penalties for filing Form DTF-801 incorrectly. It is important to accurately complete the form to avoid any penalties or additional taxes.

Q: Can I use Form DTF-801 for all types of property or services?

A: No, Form DTF-801 can only be used for property or services delivered on a reservation in New York.

Form Details:

- Released on August 1, 2013;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form DTF-801 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.