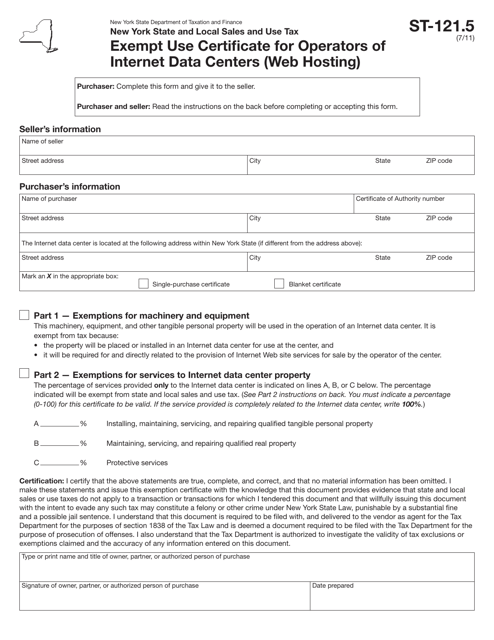

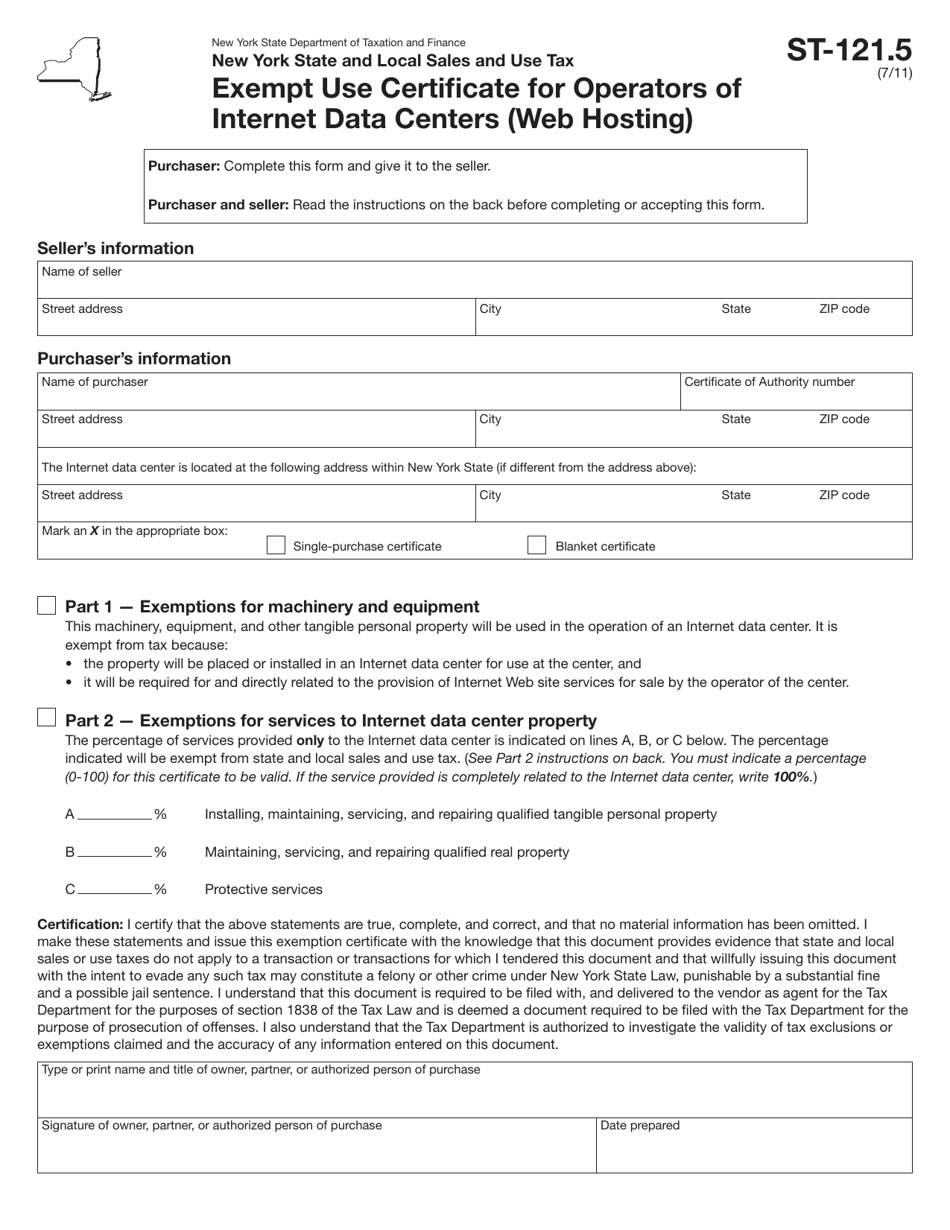

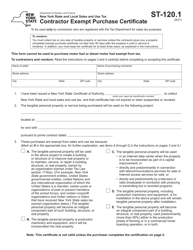

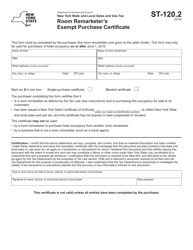

Form ST-121.5 Exempt Use Certificate for Operators of Internet Data Centers (Web Hosting) - New York

What Is Form ST-121.5?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ST-121.5?

A: Form ST-121.5 is the Exempt Use Certificate for Operators of Internet Data Centers (Web Hosting) in New York.

Q: Who needs to use Form ST-121.5?

A: Operators of Internet Data Centers (Web Hosting) in New York need to use Form ST-121.5.

Q: What is the purpose of Form ST-121.5?

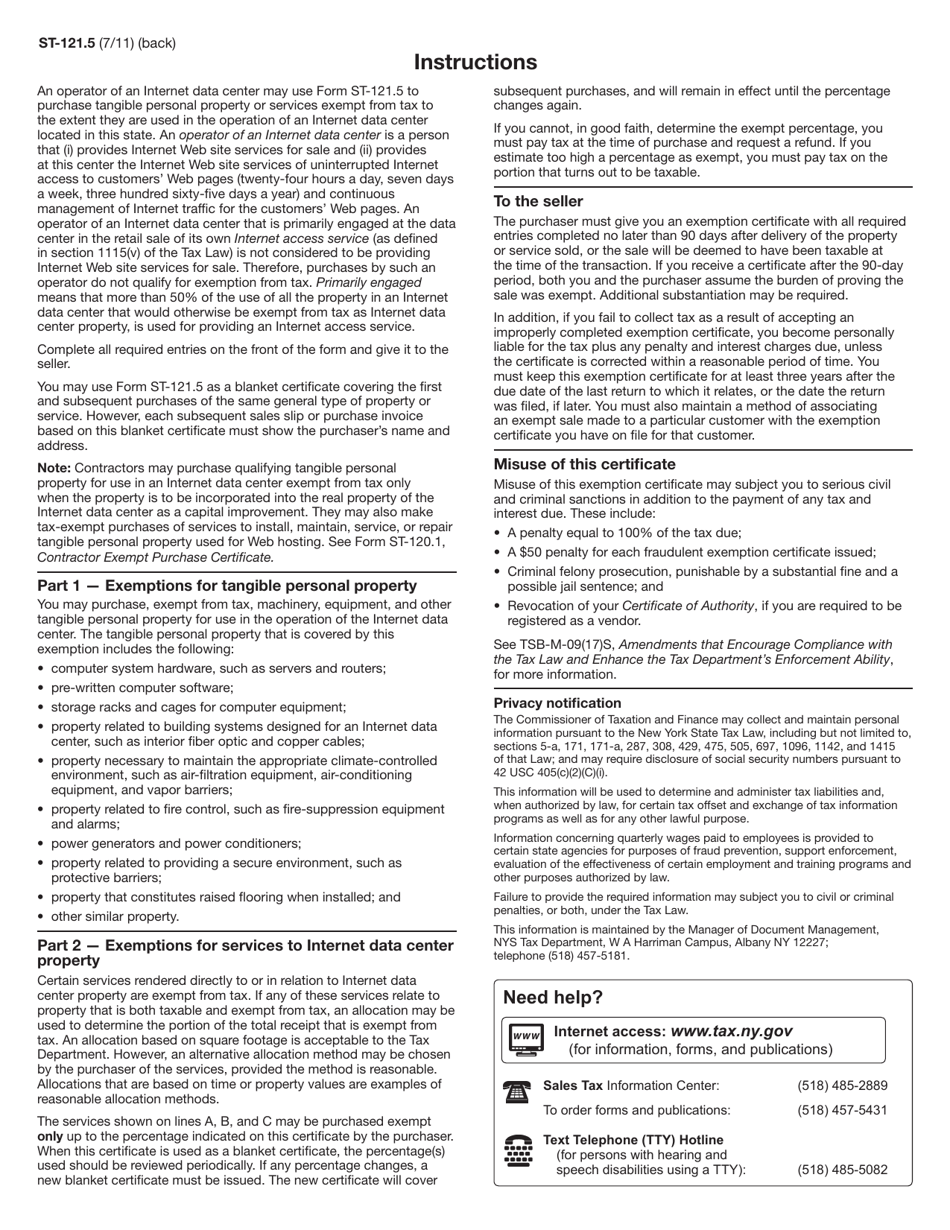

A: The purpose of Form ST-121.5 is to certify that certain purchases made by operators of Internet Data Centers (Web Hosting) are exempt from sales tax.

Q: What is an exempt use certificate?

A: An exempt use certificate is a document that allows certain purchases to be exempt from sales tax.

Q: What is an Internet Data Center?

A: An Internet Data Center is a facility where servers and other networking equipment are housed and managed.

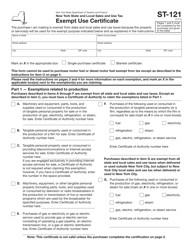

Q: What purchases can be exempt with Form ST-121.5?

A: Purchases of tangible personal property or services directly used in an Internet Data Center operation can be exempt with Form ST-121.5.

Q: Do I need to renew Form ST-121.5?

A: No, Form ST-121.5 does not need to be renewed. It is effective until revoked.

Q: Are there any penalties for incorrect use of Form ST-121.5?

A: Yes, there can be penalties for incorrect or fraudulent use of Form ST-121.5. It is important to use the form appropriately and accurately.

Form Details:

- Released on July 1, 2011;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ST-121.5 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.