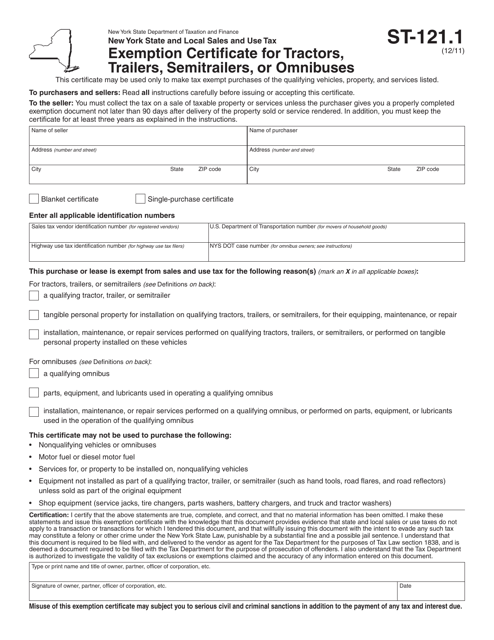

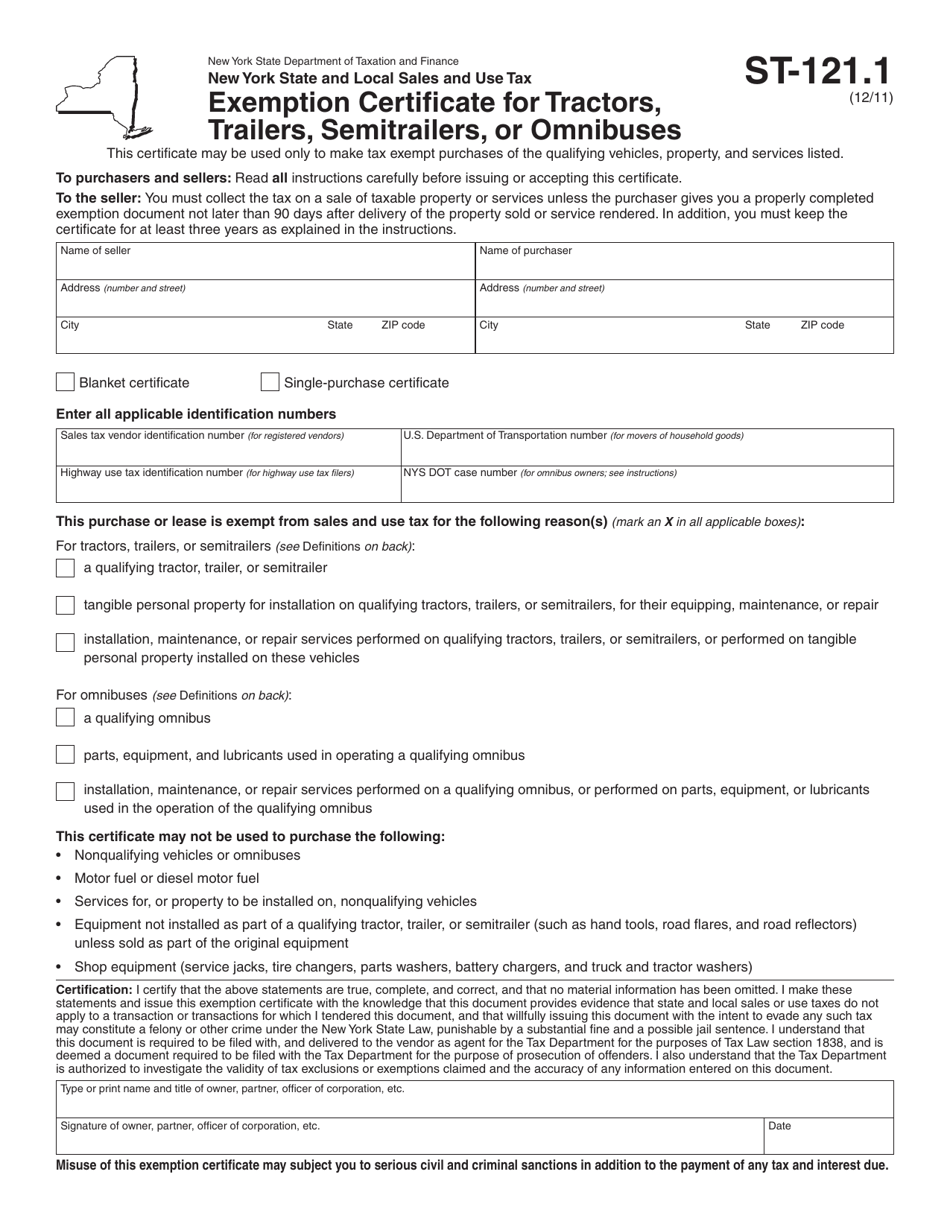

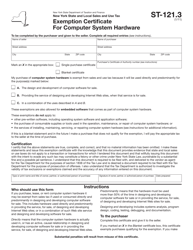

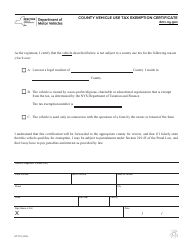

Form ST-121.1 Exemption Certificate for Tractors, Trailers, Semitrailers, or Omnibuses - New York

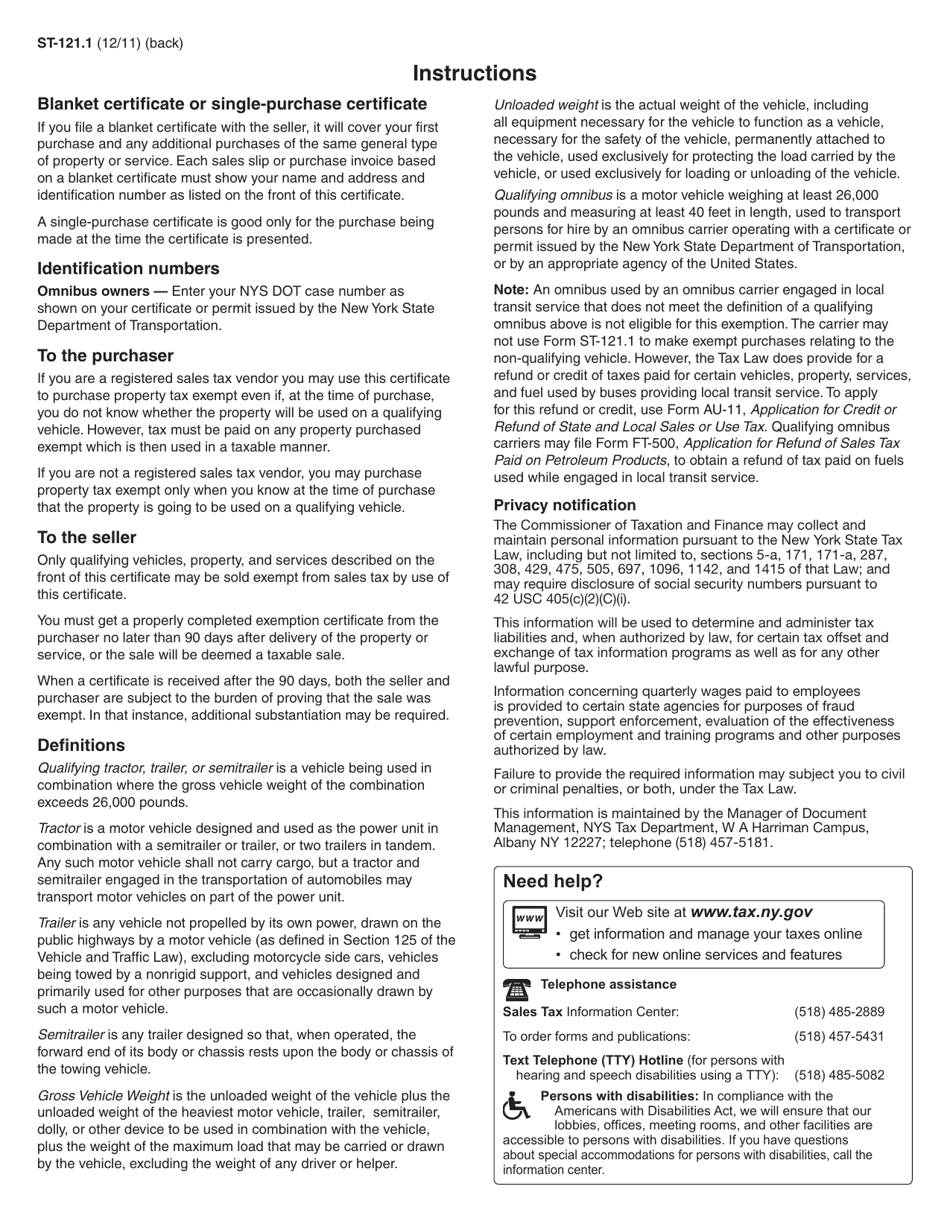

What Is Form ST-121.1?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ST-121.1 used for?

A: Form ST-121.1 is an exemption certificate used for tractors, trailers, semitrailers, or omnibuses in New York.

Q: Who should use Form ST-121.1?

A: This form should be used by individuals or businesses in New York who are purchasing or leasing tractors, trailers, semitrailers, or omnibuses.

Q: What is the purpose of this exemption certificate?

A: The purpose of this exemption certificate is to claim an exemption from sales and use tax for qualifying vehicles.

Q: What information is required on Form ST-121.1?

A: The form requires the buyer's information, seller's information, vehicle details, and a statement of qualification for the exemption.

Q: When should Form ST-121.1 be submitted?

A: Form ST-121.1 should be completed and submitted to the seller at the time of purchasing or leasing the qualifying vehicle.

Q: Are there any exceptions to using Form ST-121.1?

A: Yes, this form cannot be used for vehicles used in interstate commerce or for certain leased vehicles. Additional requirements may apply.

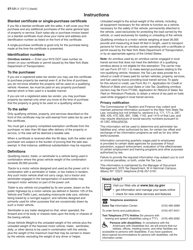

Q: What should I do if I have questions or need assistance with Form ST-121.1?

A: You can contact the New York State Department of Taxation and Finance for assistance with any questions or concerns regarding this form.

Form Details:

- Released on December 1, 2011;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ST-121.1 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.