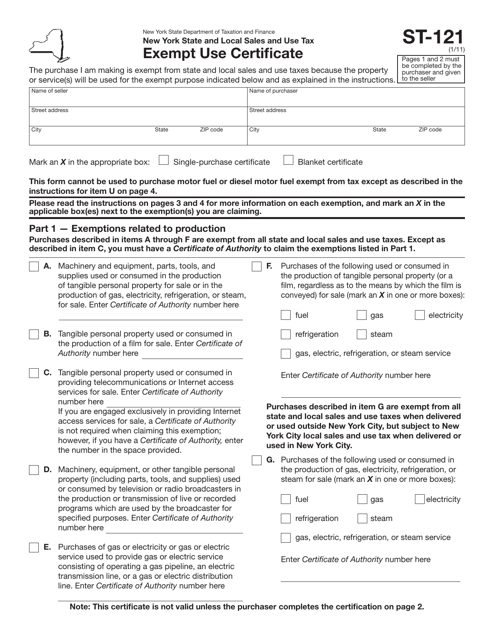

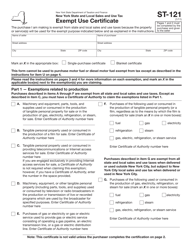

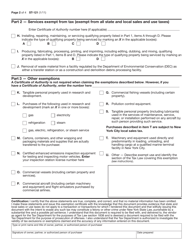

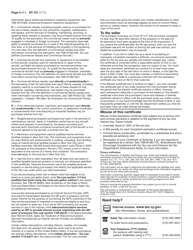

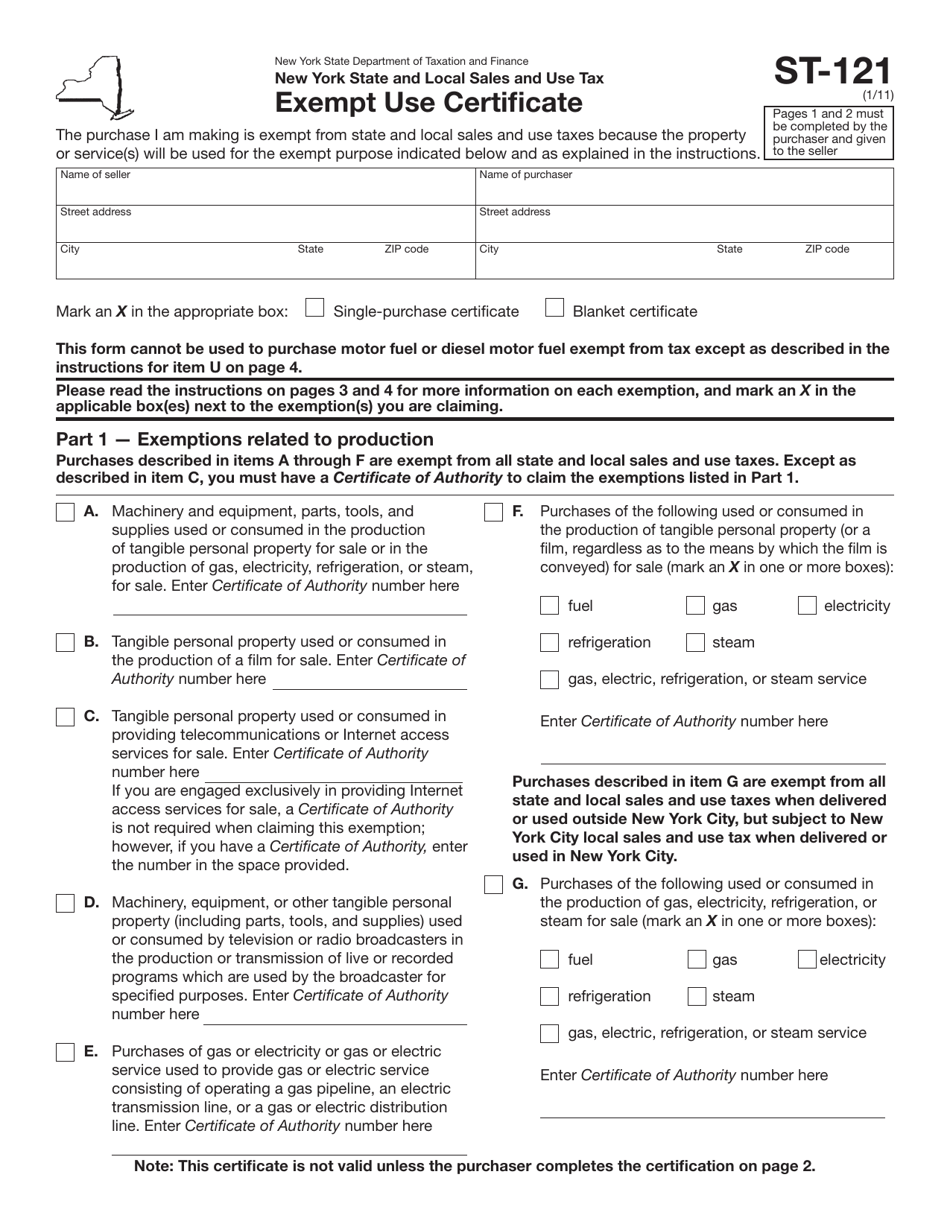

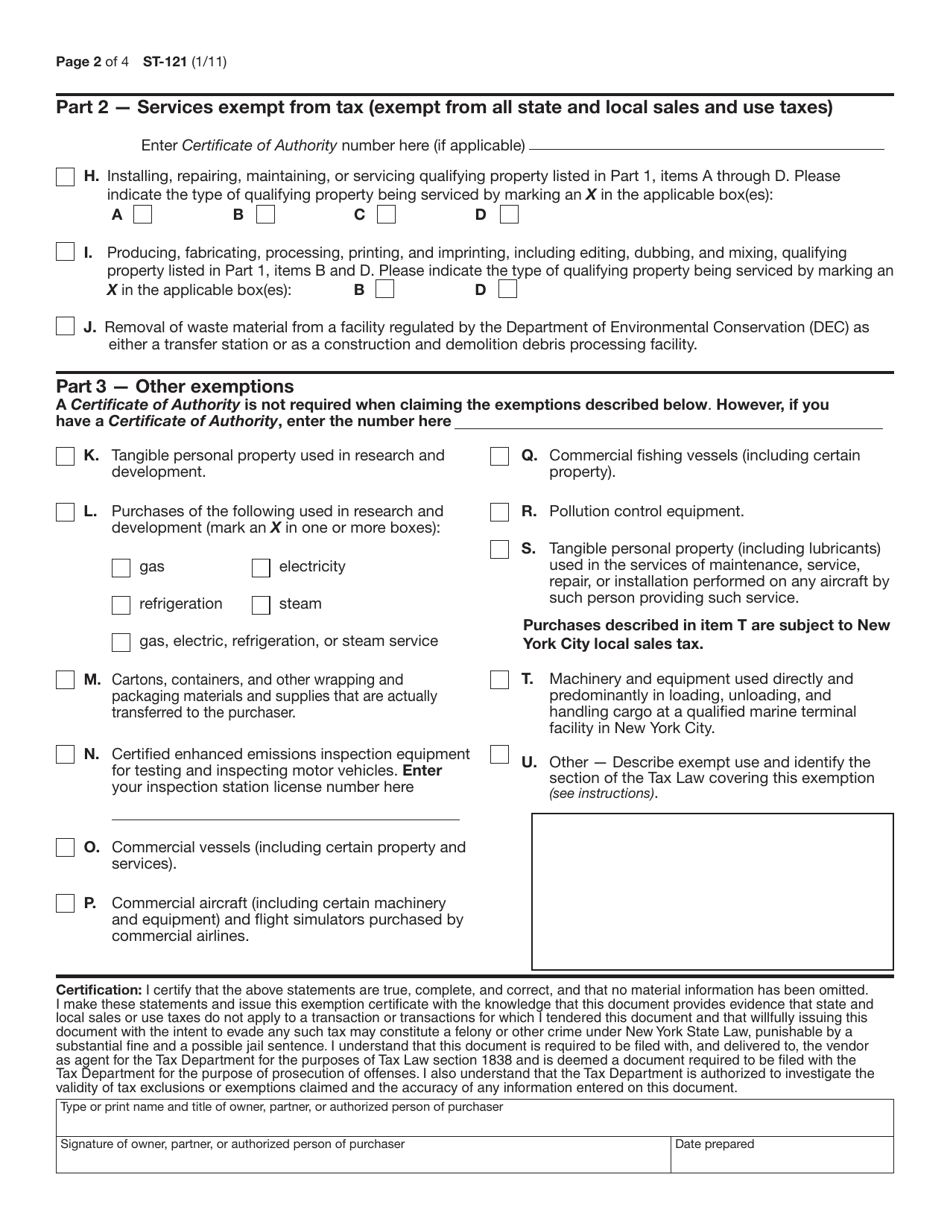

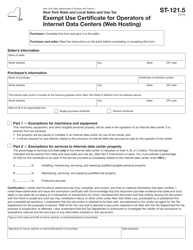

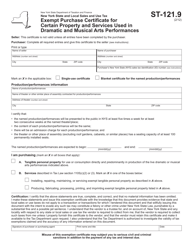

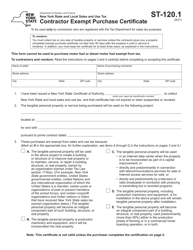

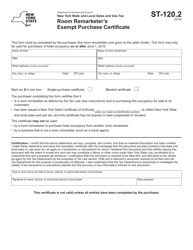

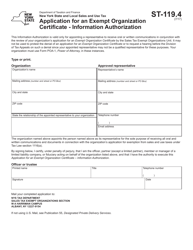

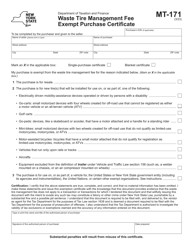

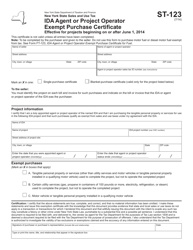

Form ST-121 Exempt Use Certificate - New York

What Is Form ST-121?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ST-121?

A: Form ST-121 is the Exempt Use Certificate that is used in the state of New York.

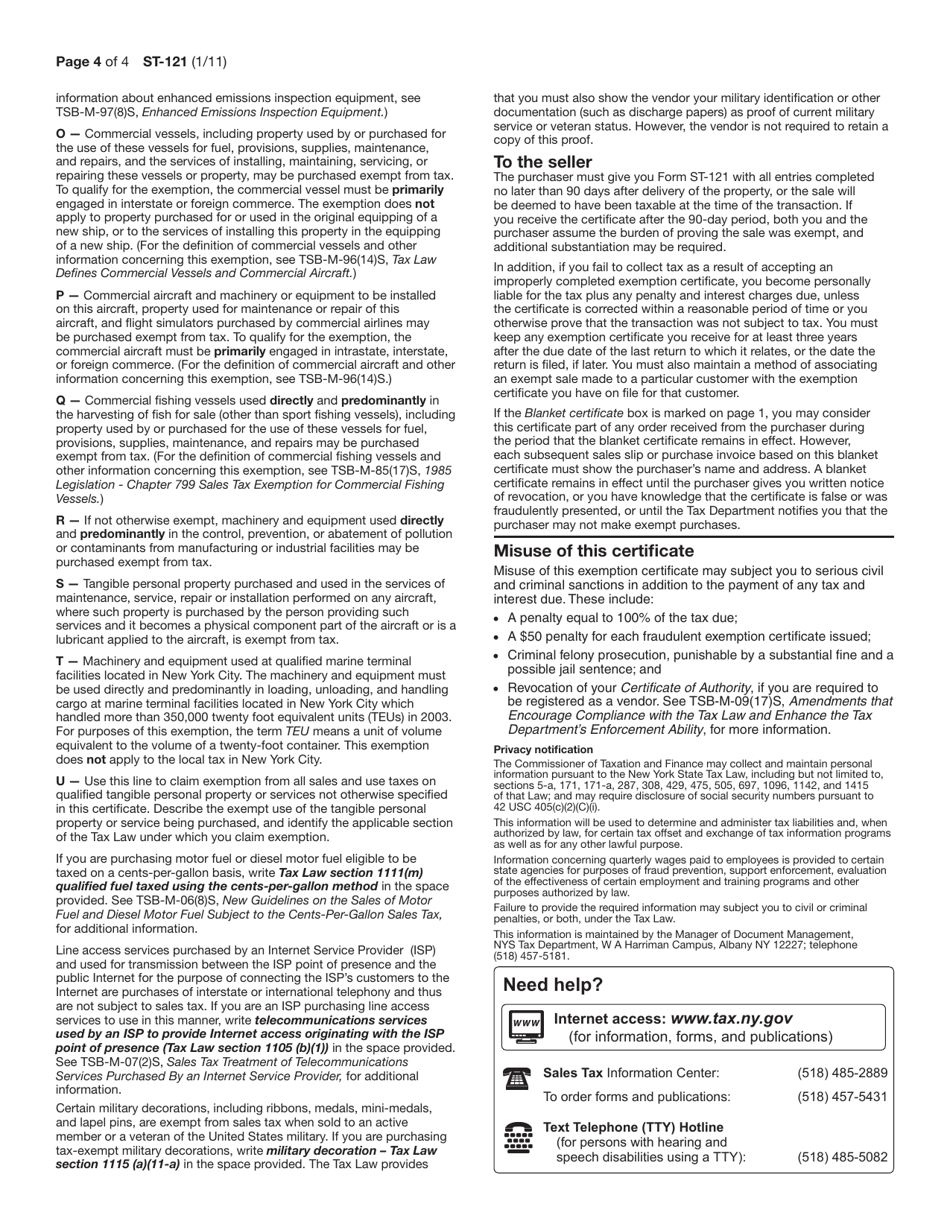

Q: What is the purpose of Form ST-121?

A: The purpose of Form ST-121 is to certify that a purchase is exempt from sales tax because it will be used in a specific exempt manner.

Q: Who should use Form ST-121?

A: Form ST-121 should be used by individuals or businesses in New York who are making purchases that qualify for a sales tax exemption.

Q: How do I fill out Form ST-121?

A: You should fill out Form ST-121 by providing your name, address, taxpayer identification number, and detailed information about the exempt use of the purchased item.

Q: How long is Form ST-121 valid?

A: Form ST-121 is typically valid for three years from the date it is signed.

Q: Can I use Form ST-121 for all purchases?

A: No, Form ST-121 can only be used for purchases that meet specific exemption criteria set by the state of New York.

Q: What happens if I use Form ST-121 improperly?

A: If Form ST-121 is used improperly, you may be subject to penalties and have to pay the sales tax that was originally exempted.

Q: Do I need to keep a copy of Form ST-121?

A: Yes, you should keep a copy of Form ST-121 for your records in case of an audit by the New York State Department of Taxation and Finance.

Form Details:

- Released on January 1, 2011;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ST-121 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.