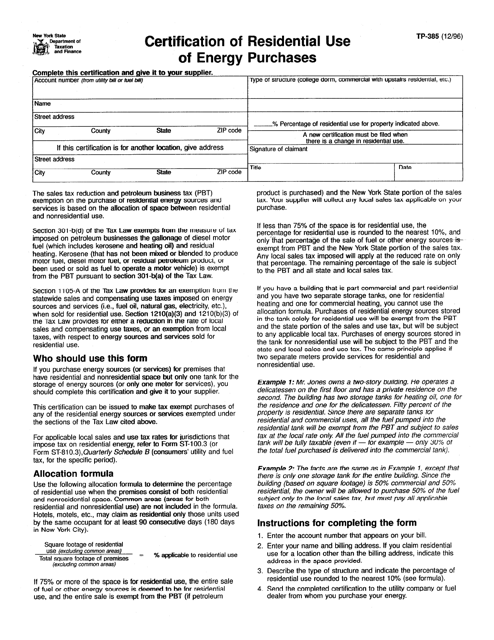

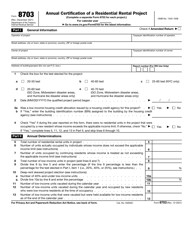

Form TP-385 Certification of Residential Use of Energy Purchases - New York

What Is Form TP-385?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form TP-385?

A: Form TP-385 is a Certification of Residential Use of Energy Purchases.

Q: Who needs to file Form TP-385?

A: Residents in New York who use energy for residential purposes need to file Form TP-385.

Q: What is the purpose of Form TP-385?

A: The purpose of Form TP-385 is to certify that energy purchases are used for residential purposes in order to claim an exemption from sales tax.

Q: How do I file Form TP-385?

A: Form TP-385 can be filed electronically or by mail.

Q: When is Form TP-385 due?

A: Form TP-385 is due annually on or before March 1st.

Q: What information is required on Form TP-385?

A: Form TP-385 requires information such as the residential address, utility account number, and the percentage of energy used for residential purposes.

Q: Are there any penalties for not filing Form TP-385?

A: Yes, failure to file Form TP-385 may result in the loss of the sales tax exemption and potential penalties.

Form Details:

- Released on December 1, 1996;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form TP-385 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.